North Dakota Installments Fixed Rate Promissory Note Secured by Commercial Real Estate North Dakota Form

What is the North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota

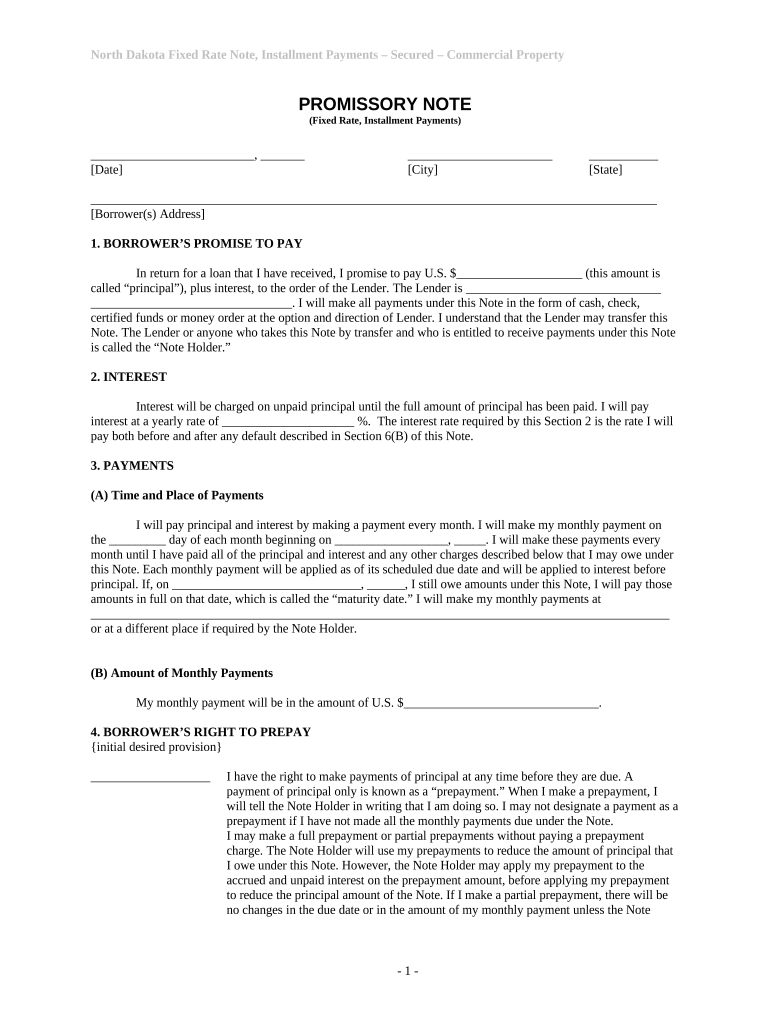

The North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate is a legal document that outlines the terms under which a borrower agrees to repay a loan secured by commercial real estate. This form specifies the fixed interest rate, repayment schedule, and the collateral involved, ensuring that both the lender and borrower understand their obligations. It serves as a binding agreement that protects the interests of all parties involved, particularly in the context of commercial real estate transactions in North Dakota.

Key elements of the North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota

Several key elements are essential to the North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate. These include:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the principal amount.

- Repayment Schedule: The timeline for payments, including the frequency and due dates.

- Collateral Description: Detailed information about the commercial real estate securing the loan.

- Default Conditions: Circumstances under which the borrower would be considered in default.

- Governing Law: Specification that North Dakota law governs the agreement.

Steps to complete the North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota

Completing the North Dakota Installments Fixed Rate Promissory Note involves several steps:

- Gather necessary information about the loan, including the principal amount and interest rate.

- Clearly describe the collateral, ensuring all details about the commercial real estate are included.

- Outline the repayment schedule, specifying how often payments will be made.

- Include any additional terms or conditions that both parties have agreed upon.

- Review the document for accuracy and completeness before signing.

Legal use of the North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota

The legal use of the North Dakota Installments Fixed Rate Promissory Note is crucial for ensuring that the agreement is enforceable in a court of law. For the document to be legally binding, it must meet specific requirements, including clear identification of all parties, a defined loan amount, and a signed agreement by both the borrower and lender. Compliance with state laws and regulations is essential, as it ensures that the document adheres to North Dakota's legal standards for promissory notes.

How to use the North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota

Using the North Dakota Installments Fixed Rate Promissory Note involves several practical steps. After completing the form, both parties should sign it in the presence of a witness or notary, if required. The signed document should then be securely stored, as it serves as a record of the agreement. If any disputes arise, this document can be presented as evidence of the terms agreed upon. It is advisable to consult with a legal professional to ensure that the form is used correctly and that all legal requirements are met.

State-specific rules for the North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota

North Dakota has specific rules governing promissory notes, which must be adhered to for the document to be valid. These rules include requirements for the format of the note, the necessity of clear terms, and the need for both parties to sign the document. Additionally, the state may have regulations regarding interest rates and repayment terms that must be followed. Understanding these state-specific rules is essential for ensuring the legality and enforceability of the promissory note.

Quick guide on how to complete north dakota installments fixed rate promissory note secured by commercial real estate north dakota

Effortlessly Prepare North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota on Any Device

Web-based document handling has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely preserve it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without any holdups. Manage North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota on any device using airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

How to Modify and Electronically Sign North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota with Ease

- Find North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight key sections of your documents or obscure sensitive information with specific tools provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota?

A North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota is a financial instrument that outlines a borrower’s commitment to repay a loan through fixed installment payments, with the loan secured by commercial real estate property. This product provides predictability in payment amounts and schedules, making it easier for borrowers to manage their finances.

-

What are the benefits of using a North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota?

The benefits include fixed payment terms, which help in budgeting, and the security provided by commercial real estate collateral, reducing risk for lenders. Borrowers also enjoy potential tax benefits associated with secured loans and the ability to leverage real estate assets for funding.

-

How does the pricing work for the North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota?

Pricing for the North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota typically involves interest rates that are fixed over the life of the loan. Costs may also involve origination fees or closing costs, which can vary based on the lender's policies and the specifics of the commercial property.

-

What features should I look for in a North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota?

Essential features include clearly defined payment schedules, detailed terms regarding interest rates, and provisions related to collateral. Additionally, an effective note should contain clauses that handle potential defaults and outline the process for foreclosure if necessary.

-

Are there any integrations available with the North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota?

Yes, many providers of the North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota offer integrations with document management and eSigning solutions, like airSlate SignNow. This enables seamless handling of documentation and streamlines the signing process for all parties involved.

-

How quickly can I get a North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota?

The timeline for obtaining a North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota can vary based on the lender and the complexity of the transaction. Generally, once the application is submitted and all documents are provided, approvals can take anywhere from a few days to several weeks.

-

What should I prepare to apply for a North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota?

Applicants should prepare financial statements, tax returns, and details about the commercial real estate being used as collateral. Additionally, a business plan and credit history may also be required to assess eligibility for the North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota.

Get more for North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota

- Letter of closure idaho central credit union form

- Authorization to quit form

- Gapsc pre service certificate application form

- Rhinoplasty surgical consent form new

- Icivics executive command mini quiz answers form

- Form disclosure of lobbying activities acf hhs

- Chet advisor broker dealer change form hartford funds

- Items to convey at no value form

Find out other North Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate North Dakota

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer