How to Claim a Medical Expense Tax Deduction 2005

Understanding the Arkansas Tax AR3 Form

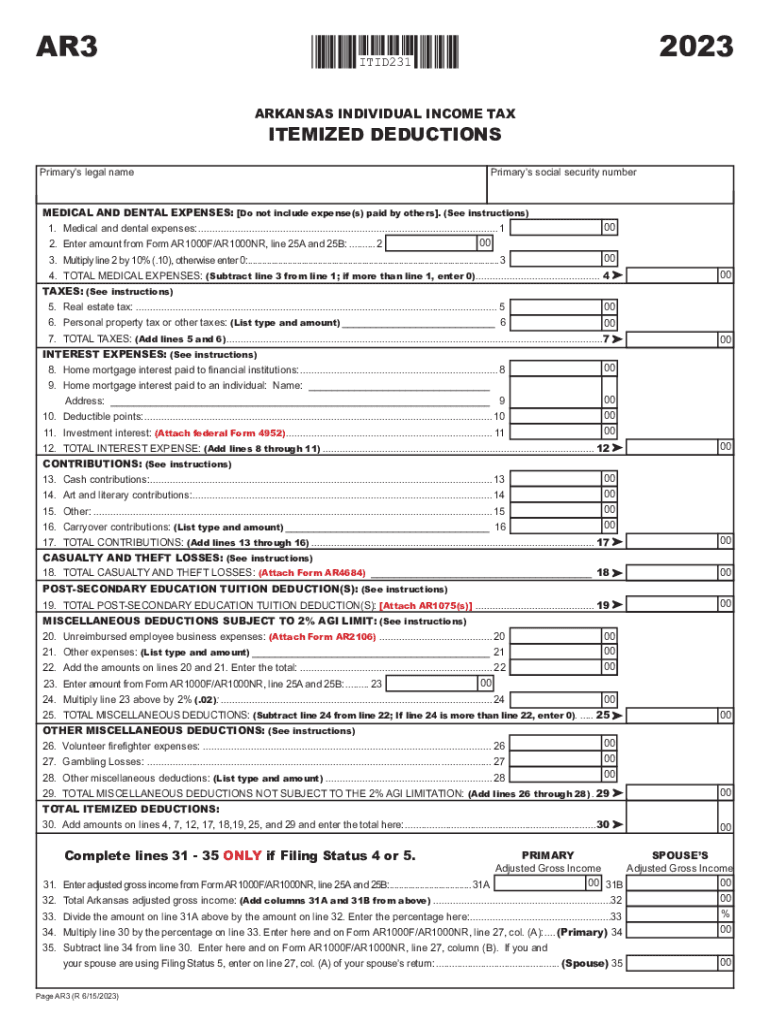

The Arkansas Tax AR3 form is essential for taxpayers who wish to claim itemized deductions on their state income tax returns. This form allows individuals to report various deductions that can reduce their taxable income, ultimately leading to potential tax savings. The AR3 form is particularly useful for those who have incurred significant medical expenses, mortgage interest, or other qualifying deductions throughout the tax year.

Key Elements of the Arkansas Tax AR3 Form

The AR3 form includes several important sections that taxpayers need to complete accurately. Key elements of the form include:

- Personal Information: This section requires basic details such as your name, address, and Social Security number.

- Itemized Deductions: Taxpayers must list and categorize their deductions, including medical expenses, state and local taxes, and charitable contributions.

- Total Deductions: This section summarizes the total amount of itemized deductions claimed, which will be used to calculate the taxable income.

Steps to Complete the Arkansas Tax AR3 Form

Filling out the Arkansas Tax AR3 form involves several straightforward steps:

- Gather all necessary documents, including receipts for medical expenses, mortgage statements, and records of charitable donations.

- Fill in your personal information accurately at the top of the form.

- List each itemized deduction in the appropriate section, ensuring that you categorize them correctly.

- Calculate your total deductions and ensure that all figures are accurate and supported by documentation.

- Review the completed form for any errors before submitting it.

Eligibility Criteria for Using the Arkansas Tax AR3 Form

To use the Arkansas Tax AR3 form, taxpayers must meet specific eligibility criteria. Generally, this form is available to individuals who choose to itemize their deductions rather than take the standard deduction. Additionally, taxpayers must have qualifying expenses that exceed the standard deduction amount, making itemization beneficial. Common qualifying expenses include:

- Medical and dental expenses that exceed a certain percentage of adjusted gross income.

- State and local taxes paid during the tax year.

- Mortgage interest on a primary residence.

Filing Deadlines for the Arkansas Tax AR3 Form

Timely submission of the Arkansas Tax AR3 form is crucial to avoid penalties. The filing deadline typically aligns with the federal tax return deadline, which is usually April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should ensure they submit their forms on time to take advantage of any deductions claimed.

Form Submission Methods for the Arkansas Tax AR3 Form

Taxpayers have several options for submitting the Arkansas Tax AR3 form. These methods include:

- Online Submission: Many taxpayers opt to file electronically through state-approved tax software, which can streamline the process and reduce errors.

- Mail: Taxpayers can print the completed form and send it via postal mail to the appropriate state tax office.

- In-Person: Individuals may also choose to submit their forms in person at designated state tax offices.

Quick guide on how to complete how to claim a medical expense tax deduction

Complete How To Claim A Medical Expense Tax Deduction effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the correct format and securely keep it online. airSlate SignNow equips you with everything necessary to create, adjust, and eSign your documents rapidly without interruptions. Manage How To Claim A Medical Expense Tax Deduction on any platform through airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign How To Claim A Medical Expense Tax Deduction without effort

- Obtain How To Claim A Medical Expense Tax Deduction and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors necessitating new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Adjust and eSign How To Claim A Medical Expense Tax Deduction while ensuring clear communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to claim a medical expense tax deduction

Create this form in 5 minutes!

How to create an eSignature for the how to claim a medical expense tax deduction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arkansas tax AR3 form?

The Arkansas tax AR3 form is a document used for reporting withholding tax for employees and other miscellaneous payments in Arkansas. Understanding how to properly fill out and submit the AR3 form is crucial for compliance and to avoid penalties. It is essential for businesses operating in Arkansas to ensure they handle the tax AR3 form correctly.

-

How can airSlate SignNow help with the Arkansas tax AR3 form?

airSlate SignNow provides a simple and efficient way to eSign and manage the Arkansas tax AR3 form. With our platform, you can easily send the AR3 form for signatures, ensuring that all necessary parties can sign electronically, streamlining your filing process. This helps you save time and increases accuracy in your tax submissions.

-

Is airSlate SignNow affordable for small businesses handling the Arkansas tax AR3 form?

Yes, airSlate SignNow offers cost-effective pricing plans that are ideal for small businesses needing to handle the Arkansas tax AR3 form. Our plans are designed to provide value without compromising essential features. You can start with a free trial to see how SignNow can fit your budget and needs.

-

What features does airSlate SignNow offer for managing the Arkansas tax AR3 form?

airSlate SignNow includes features such as customizable templates, audit trails, and easy integration with popular applications for managing the Arkansas tax AR3 form. These features enable businesses to automate their document workflow, ensuring compliance and saving time. Our platform is tailored to make the signing process seamless for you and your team.

-

Can I integrate airSlate SignNow with other tools for filing the Arkansas tax AR3 form?

Absolutely! airSlate SignNow seamlessly integrates with various tools and systems, making it easy to file the Arkansas tax AR3 form alongside your existing software. With integrations ranging from tax preparation software to CRMs, you can streamline your processes and maintain efficient workflows. This connectivity helps enhance productivity in managing your tax documents.

-

What are the benefits of using airSlate SignNow for the Arkansas tax AR3 form?

Using airSlate SignNow for the Arkansas tax AR3 form offers numerous benefits, such as improved efficiency, reduced paperwork, and easy access to signed documents. The eSigning process eliminates the hassle of printing and scanning, allowing for quicker turnaround times. Additionally, our platform enhances document security and compliance, which are vital for handling sensitive tax information.

-

Is airSlate SignNow legally binding for the Arkansas tax AR3 form?

Yes, eSignatures collected through airSlate SignNow are legally binding for the Arkansas tax AR3 form. Our platform complies with federal and state regulations, ensuring that your eSigned documents hold the same legal weight as traditional handwritten signatures. This compliance provides peace of mind when submitting your AR3 form.

Get more for How To Claim A Medical Expense Tax Deduction

Find out other How To Claim A Medical Expense Tax Deduction

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple