Tax Brackets & Federal Income Tax Rates 2018

Understanding Arkansas Tax Brackets

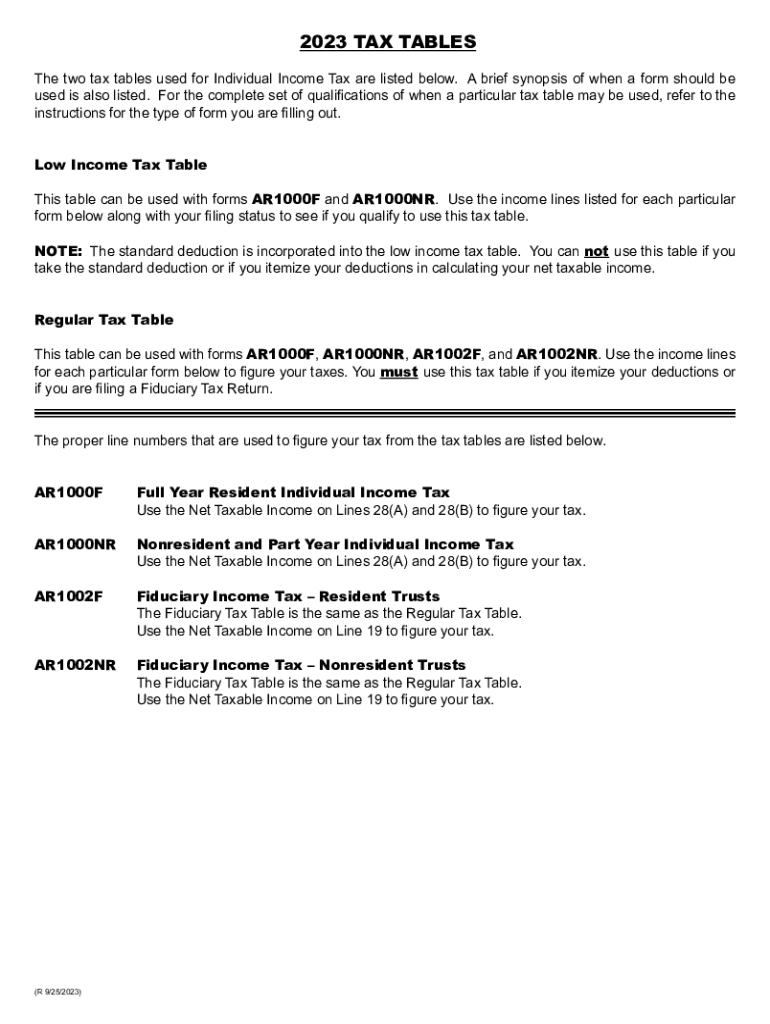

The tax brackets in Arkansas determine how much state income tax individuals owe based on their taxable income. Arkansas has a progressive income tax system, meaning that tax rates increase as income rises. As of 2022, the tax rates range from one percent to five point nine percent, divided into various income brackets. For example, individuals earning less than twenty-two thousand dollars may fall into the lowest bracket, while those earning over seventy-five thousand dollars will be taxed at the higher rates.

How to Use Arkansas Tax Tables

To utilize the Arkansas tax tables effectively, start by identifying your taxable income for the year. Once you have this figure, locate the corresponding tax bracket in the Arkansas state income tax tables. The tables provide clear guidance on the tax rate applicable to your income level. For instance, if your taxable income is fifty thousand dollars, you would refer to the specific bracket that applies to that income and calculate your tax liability accordingly.

Obtaining Arkansas Tax Tables

Arkansas tax tables can be obtained through the Arkansas Department of Finance and Administration website or by accessing the latest tax forms available for download. These tables are typically included in the annual tax guide, which outlines the current rates and brackets. For the most accurate and up-to-date information, it is advisable to refer to the official state resources or consult a tax professional.

Steps to Complete the Arkansas Tax Form

Completing the Arkansas tax form involves several key steps. First, gather all necessary documentation, including W-2 forms and any other income statements. Next, calculate your total income and determine your taxable income by subtracting any deductions. Once you have your taxable income, refer to the Arkansas tax tables to find your applicable tax rate. Finally, fill out the tax form accurately, ensuring all calculations are correct before submitting it to the state.

Legal Use of Arkansas Tax Tables

The Arkansas tax tables are legally mandated tools used to calculate state income tax obligations. They must be used in accordance with Arkansas tax laws to ensure compliance. Failing to use the correct tables or miscalculating taxes based on these tables can lead to penalties or audits. It is essential for taxpayers to familiarize themselves with these tables to avoid any legal issues related to tax reporting and payment.

Examples of Using Arkansas Tax Tables

For instance, if an individual has a taxable income of thirty thousand dollars, they would look up this amount in the Arkansas tax tables. If the corresponding tax rate is three percent, the individual would owe nine hundred dollars in state income tax. This straightforward example illustrates how to apply the tax tables to determine tax liability based on income.

Quick guide on how to complete tax brackets ampamp federal income tax rates

Effortlessly Prepare Tax Brackets & Federal Income Tax Rates on Any Device

Digital document management has surged in popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without delays. Manage Tax Brackets & Federal Income Tax Rates on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Tax Brackets & Federal Income Tax Rates with minimal effort

- Locate Tax Brackets & Federal Income Tax Rates and then click Get Form to commence.

- Utilize the available tools to finalize your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, cumbersome form searches, or errors that require new copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Tax Brackets & Federal Income Tax Rates and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax brackets ampamp federal income tax rates

Create this form in 5 minutes!

How to create an eSignature for the tax brackets ampamp federal income tax rates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are tax tables for Arkansas?

Tax tables for Arkansas are official documents that outline the income tax rates applicable to residents and businesses in the state. They provide essential information on how income is taxed, making it easier for users to calculate their tax obligations. Understanding the tax tables Arkansas provides is crucial for accurate financial planning and compliance.

-

How can airSlate SignNow help with handling tax documents in Arkansas?

airSlate SignNow simplifies the process of managing tax documents by offering a user-friendly platform for eSigning and sending important paperwork. With the ability to securely store and manage documents relevant to tax filings, businesses can streamline their compliance with Arkansas tax regulations. This makes handling documents listed in the tax tables Arkansas much more efficient.

-

What integration options does airSlate SignNow offer for tax management?

airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your document management processes related to tax payments and filings. These integrations can help you work directly with tax tables Arkansas when preparing reports and filing taxes. This ensures that all documentation is aligned with current tax regulations.

-

Is airSlate SignNow cost-effective for small businesses in Arkansas?

Yes, airSlate SignNow is a cost-effective solution for small businesses that need an efficient way to manage their tax-related documents. With pricing plans designed to fit various budgets, you can access features that simplify compliance with tax tables Arkansas without overspending. It's an investment in efficiency and accuracy.

-

What are the primary features of airSlate SignNow for tax documentation?

airSlate SignNow offers several key features, including electronic signatures, document templates, and secure cloud storage, specifically designed to simplify tax documentation processes. These features are particularly beneficial when working with tax tables Arkansas as they ensure that all transactions are legally binding and easily accessible. Users can quickly send, sign, and store tax-related documents.

-

Can airSlate SignNow help me stay updated with the latest tax table changes in Arkansas?

While airSlate SignNow does not directly provide tax tables Arkansas, it enables users to manage documents that reflect these changes efficiently. By keeping all tax documents organized and up-to-date, you can ensure that your business remains compliant with new tax regulations and rates. Regular updates to your document templates can facilitate this.

-

How does airSlate SignNow ensure the security of sensitive tax documents?

airSlate SignNow prioritizes the security of your documents by employing state-of-the-art encryption and secure cloud storage solutions. This ensures that all tax documents, including those related to the tax tables Arkansas, are protected from unauthorized access and bsignNowes. You can confidently manage your sensitive tax information knowing it’s secure.

Get more for Tax Brackets & Federal Income Tax Rates

- On this day of in the year before me 490219162 form

- Business law chapter 17 flashcardsquizlet form

- Heshethey executed the same form

- County state of south dakota and described as follows form

- State of south dakota and being described as follows form

- Deed of trust fill out and sign printable pdf template form

- And the board of directors of a south form

- Sd inc cr form

Find out other Tax Brackets & Federal Income Tax Rates

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document