Business Credit Application Nebraska Form

What is the Business Credit Application Nebraska

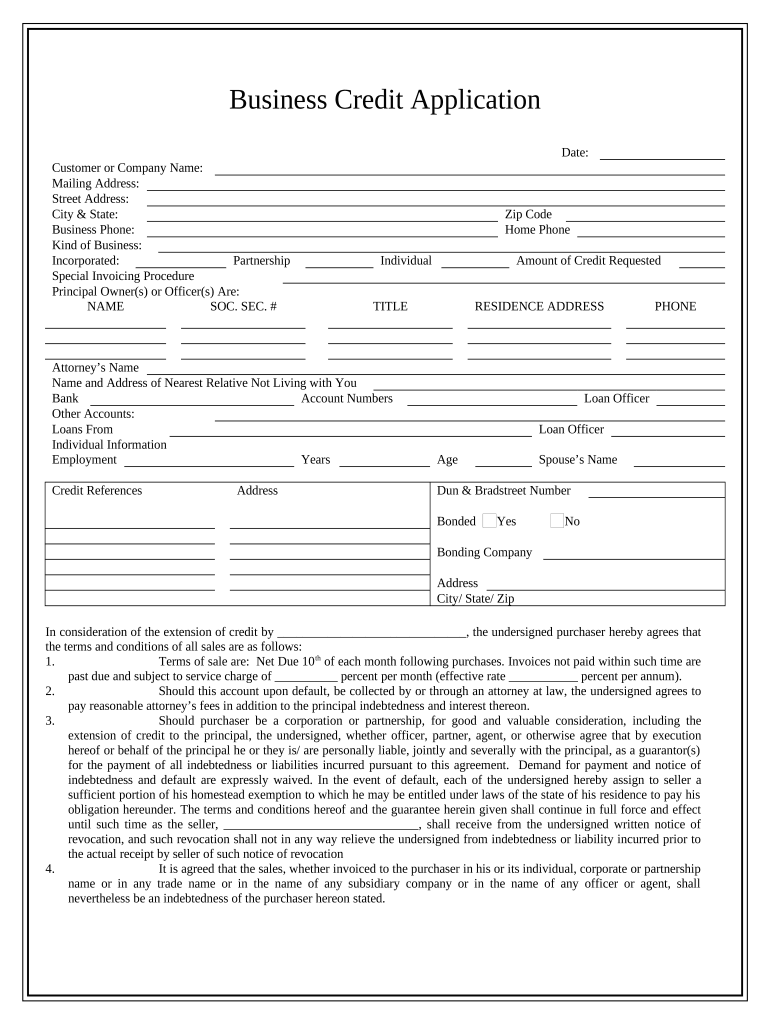

The Business Credit Application Nebraska is a formal document that businesses in Nebraska use to apply for credit from financial institutions or suppliers. This application collects essential information about the business, such as its legal structure, financial status, and credit history. By providing this information, businesses can demonstrate their creditworthiness and secure funding or credit lines necessary for operations.

Steps to complete the Business Credit Application Nebraska

Completing the Business Credit Application Nebraska involves several key steps to ensure accuracy and completeness. First, gather necessary documentation, including financial statements, tax returns, and business identification. Next, fill out the application form with precise information regarding your business structure, ownership, and financial details. Be sure to review the application for any errors or omissions before submission. Finally, sign the application electronically or manually, depending on the submission method chosen.

Legal use of the Business Credit Application Nebraska

The Business Credit Application Nebraska is legally binding when completed correctly and submitted through appropriate channels. To ensure its legality, the application must comply with state and federal regulations regarding business credit. This includes providing truthful and accurate information, as any discrepancies may lead to legal repercussions or denial of credit. Utilizing an electronic signature platform, like signNow, can enhance the legal standing of the application by ensuring compliance with eSignature laws.

Required Documents

When applying for credit using the Business Credit Application Nebraska, certain documents are typically required to support your application. These may include:

- Business financial statements (profit and loss statements, balance sheets)

- Tax returns for the past two to three years

- Business licenses and permits

- Personal financial information of business owners

- Credit history reports

Having these documents ready can expedite the application process and improve your chances of approval.

Eligibility Criteria

Eligibility for the Business Credit Application Nebraska varies based on the lender or supplier's requirements. Generally, businesses must meet specific criteria, such as:

- Being a registered business entity in Nebraska

- Demonstrating a stable financial history

- Providing a personal guarantee from business owners

- Meeting minimum revenue thresholds set by the lender

Understanding these criteria can help businesses prepare a strong application that meets the expectations of potential creditors.

Application Process & Approval Time

The application process for the Business Credit Application Nebraska typically involves submitting the completed form along with required documents to the lender or supplier. After submission, the review process begins, which may take anywhere from a few days to several weeks, depending on the institution's policies and the complexity of the application. During this time, lenders may contact the business for additional information or clarification. Promptly responding to such inquiries can help speed up the approval process.

Quick guide on how to complete business credit application nebraska

Effortlessly Prepare Business Credit Application Nebraska on Any Device

Managing documents online has gained traction among organizations and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Handle Business Credit Application Nebraska on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Business Credit Application Nebraska with Ease

- Locate Business Credit Application Nebraska and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you prefer to send your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Business Credit Application Nebraska to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application in Nebraska?

A Business Credit Application in Nebraska is a formal request for credit made by a business seeking financial assistance or credit lines. This application typically requires documentation of the business's financial health, including credit history and revenue projections. Understanding this process is essential for businesses looking to secure credit efficiently in Nebraska.

-

How can airSlate SignNow help with my Business Credit Application in Nebraska?

airSlate SignNow facilitates the business credit application process by allowing businesses to easily create, send, and eSign documents online. This streamlines the application workflow and enhances efficiency, ensuring that you can focus on managing your finances rather than getting bogged down in paperwork. Using airSlate SignNow means less time spent on the credit application process in Nebraska.

-

What are the costs associated with using airSlate SignNow for a Business Credit Application in Nebraska?

airSlate SignNow offers competitive pricing options tailored to accommodate businesses of various sizes. By choosing our service, you can eliminate the high costs often associated with traditional document handling and management. This makes submitting your Business Credit Application in Nebraska more budget-friendly.

-

What features does airSlate SignNow provide for Business Credit Applications in Nebraska?

airSlate SignNow includes numerous features such as customizable templates, automated workflows, and secure eSigning capabilities, all designed to simplify the Business Credit Application process in Nebraska. These tools ensure that the application can be completed quickly and securely, making it easier for businesses to apply for credit on their terms.

-

Are there any integrations available with airSlate SignNow for Business Credit Applications in Nebraska?

Yes, airSlate SignNow seamlessly integrates with a variety of business tools such as CRM systems and cloud storage services. This allows for easy access to your documents and enhances collaboration among team members during the Business Credit Application process in Nebraska. These integrations ensure a smooth flow of information and functionality.

-

What are the benefits of using airSlate SignNow for Business Credit Applications in Nebraska?

The primary benefits of using airSlate SignNow for Business Credit Applications in Nebraska include faster processing times, improved accuracy, and increased security. By digitizing the traditional credit application approach, businesses can expedite their applications while ensuring compliance and safeguarding sensitive data.

-

How secure is the Business Credit Application process with airSlate SignNow in Nebraska?

airSlate SignNow prioritizes security in the Business Credit Application process by employing encryption and secure access protocols. We ensure that all documents are stored safely and that signatures are verified to prevent unauthorized access. This allows businesses in Nebraska to confidently manage their credit applications with peace of mind.

Get more for Business Credit Application Nebraska

- Auction script example form

- Fill in blank resignation letter form

- Pleading sample 76647076 form

- Edexcel epq project proposal form example

- Participants must sign and submit a waiver before barclays center form

- Walgreenshealthcom registration and order form

- Soonercare 12 month profit amp loss worksheet form

- Application for contractors prequalification certificate city of okc form

Find out other Business Credit Application Nebraska

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF