Living Trust for Husband and Wife with Minor and or Adult Children Nebraska Form

What is the Living Trust For Husband And Wife With Minor And Or Adult Children Nebraska

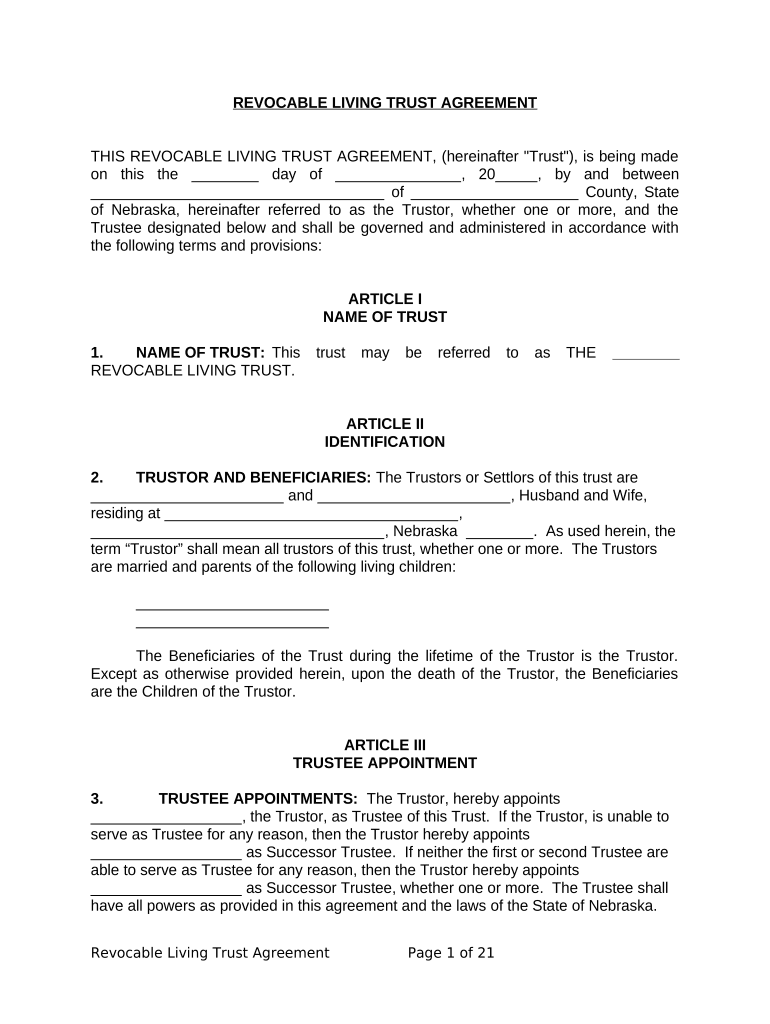

A living trust for husband and wife with minor and or adult children in Nebraska is a legal document that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed upon their passing. This type of trust can provide significant benefits, including avoiding probate, ensuring privacy, and allowing for the seamless transfer of assets to beneficiaries. It is particularly useful for couples with children, as it can outline specific provisions for the care and management of minor children's inheritance.

Key Elements of the Living Trust For Husband And Wife With Minor And Or Adult Children Nebraska

Several key elements define a living trust for husband and wife with minor and or adult children in Nebraska:

- Trustees: Typically, both spouses act as co-trustees, managing the trust during their lifetime.

- Beneficiaries: The couple's children, whether minor or adult, are designated as beneficiaries, receiving assets as specified in the trust.

- Asset Management: The trust outlines how assets are to be managed and distributed, including provisions for minor children.

- Revocability: This trust can be altered or revoked by the couple at any time while they are alive, providing flexibility.

Steps to Complete the Living Trust For Husband And Wife With Minor And Or Adult Children Nebraska

Completing a living trust involves several important steps:

- Gather Information: Collect details about all assets, including real estate, bank accounts, and personal property.

- Choose a Trustee: Decide who will manage the trust, typically both spouses.

- Draft the Trust Document: Create a legal document that outlines the terms of the trust, including beneficiaries and management instructions.

- Sign the Document: Both spouses must sign the trust in the presence of a notary public to ensure its legality.

- Fund the Trust: Transfer ownership of assets into the trust to ensure they are managed according to its terms.

Legal Use of the Living Trust For Husband And Wife With Minor And Or Adult Children Nebraska

The legal use of a living trust in Nebraska is recognized as a valid estate planning tool. It allows couples to specify how their assets should be handled during their lifetime and after their death. By properly executing the trust according to Nebraska laws, couples can ensure that their wishes are honored without the need for probate, which can be a lengthy and public process. It is advisable to consult with an estate planning attorney to ensure compliance with state laws and to address any specific legal concerns.

State-Specific Rules for the Living Trust For Husband And Wife With Minor And Or Adult Children Nebraska

Nebraska has specific rules that govern the creation and execution of living trusts. These include:

- Notarization: Trust documents must be signed in front of a notary public to be legally binding.

- Asset Transfer: Assets must be formally transferred into the trust for them to be protected under its terms.

- Revocation Procedures: The trust can be revoked or amended at any time, but this must be done in writing and usually requires notarization.

How to Obtain the Living Trust For Husband And Wife With Minor And Or Adult Children Nebraska

Obtaining a living trust for husband and wife with minor and or adult children in Nebraska can be done through several avenues:

- Legal Assistance: Consult with an estate planning attorney who can draft a trust tailored to your specific needs.

- Online Resources: Utilize reputable online legal services that offer templates and guidance for creating a living trust.

- Financial Institutions: Some banks and financial advisors provide trust services and can assist in setting up a living trust.

Quick guide on how to complete living trust for husband and wife with minor and or adult children nebraska

Manage Living Trust For Husband And Wife With Minor And Or Adult Children Nebraska effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed papers, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Living Trust For Husband And Wife With Minor And Or Adult Children Nebraska on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Nebraska with ease

- Locate Living Trust For Husband And Wife With Minor And Or Adult Children Nebraska and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or conceal sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you want to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Nebraska and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with Minor and/or Adult Children in Nebraska?

A Living Trust for Husband and Wife with Minor and/or Adult Children in Nebraska is a legal document that helps couples manage their assets and provide for their children. This trust allows for the seamless transfer of assets upon death or incapacity, avoiding probate and ensuring that both minor and adult children are adequately cared for. By establishing this type of trust, couples can outline their wishes regarding asset distribution clearly.

-

How does a Living Trust benefit my family in Nebraska?

A Living Trust for Husband and Wife with Minor and/or Adult Children in Nebraska offers several benefits, including the avoidance of probate, which can be time-consuming and costly. Additionally, it provides privacy since the trust does not become a public record. This arrangement ensures that your loved ones can access assets smoothly and efficiently during difficult times.

-

What are the costs associated with creating a Living Trust in Nebraska?

The costs for setting up a Living Trust for Husband and Wife with Minor and/or Adult Children in Nebraska can vary based on complexity and the services provided. Typically, legal fees range from a few hundred to several thousand dollars, depending on whether you choose to hire an attorney or utilize an online service. It’s important to compare options to find a cost-effective solution that meets your needs.

-

Can I modify a Living Trust after it is created in Nebraska?

Yes, a Living Trust for Husband and Wife with Minor and/or Adult Children in Nebraska can be modified or revoked at any time while both partners are alive. As your family situation and financial circumstances change, you can make adjustments to ensure the trust accurately reflects your intentions. It's advisable to work with legal professionals to ensure modifications are properly documented.

-

What assets can be placed in a Living Trust in Nebraska?

A Living Trust for Husband and Wife with Minor and/or Adult Children in Nebraska can hold various types of assets, including real estate, bank accounts, investments, and business interests. By placing these assets in the trust, you ensure seamless management and distribution according to your wishes. It's important to consult with professionals understanding the nuances of asset inclusion and management.

-

Is a Living Trust the same as a Will in Nebraska?

No, a Living Trust for Husband and Wife with Minor and/or Adult Children in Nebraska is not the same as a Will. While both documents serve the purpose of directing asset distribution after death, a Living Trust takes effect during your lifetime and avoids probate. In contrast, a Will only becomes effective upon death and may require a lengthy probate process.

-

How can I ensure my Living Trust is valid in Nebraska?

To ensure your Living Trust for Husband and Wife with Minor and/or Adult Children in Nebraska is valid, you must follow state-specific legal requirements, including proper execution and funding of the trust. It's essential to have the document signed in front of a notary public and ensure it accurately reflects your wishes. Consulting with an attorney can provide additional security and validity.

Get more for Living Trust For Husband And Wife With Minor And Or Adult Children Nebraska

- Authorization of insured contingency form

- In va 000b antragsformular juristische personen t 1 an das amtsgericht insolvenzgericht

- Majorette sign up form

- Fhcp referral form

- Rogz pet insurance form

- Template for the authorization letter form

- Federal direct plus loan application and master promissory note centenary form

- Warehous contract template form

Find out other Living Trust For Husband And Wife With Minor And Or Adult Children Nebraska

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure