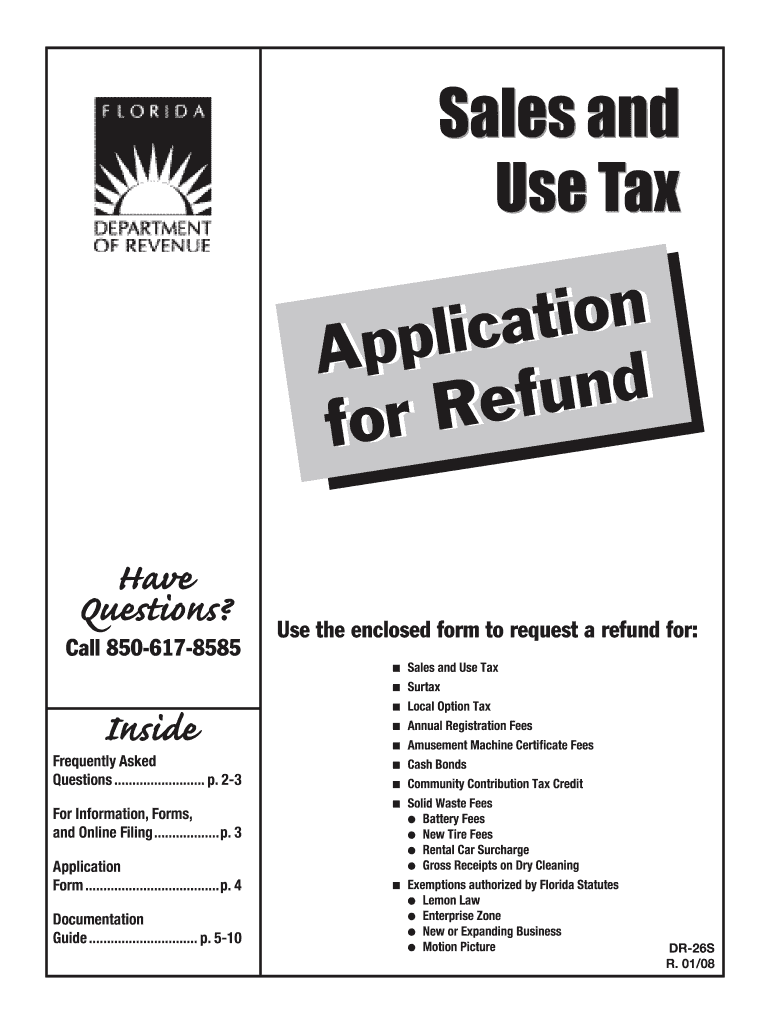

Application Refund Form 2008

What is the Application Refund Form

The Application Refund Form is a document used by individuals or businesses to request a refund for overpayments or other eligible claims. This form is essential for ensuring that taxpayers can reclaim funds they are entitled to, whether due to overpayment of taxes, fees, or other financial obligations. The form typically includes sections for personal information, the reason for the refund, and the amount being claimed. Understanding the purpose of this form is crucial for anyone looking to navigate the refund process effectively.

Steps to complete the Application Refund Form

Completing the Application Refund Form involves several key steps to ensure accuracy and compliance with IRS guidelines. Start by gathering all necessary documentation, such as proof of payment and identification. Next, fill out the form with your personal information, including your name, address, and Social Security number. Clearly state the reason for the refund and provide the amount you are requesting. Review the completed form for any errors before signing and dating it. Finally, submit the form according to the specified submission methods, ensuring you keep a copy for your records.

How to obtain the Application Refund Form

The Application Refund Form can be obtained through various channels. Most commonly, individuals can download the form directly from the IRS website or other official state tax authority websites. Additionally, many tax preparation software programs include the form as part of their offerings, allowing users to fill it out digitally. For those who prefer a physical copy, local tax offices may provide printed versions of the form. It is essential to ensure you are using the most current version of the form to avoid any processing delays.

Legal use of the Application Refund Form

The legal use of the Application Refund Form is governed by IRS regulations and state laws. It is important to ensure that the information provided is accurate and truthful, as submitting false information can result in penalties. The form must be completed in accordance with the guidelines set forth by the IRS, including any specific requirements related to signatures and documentation. Understanding these legal implications helps ensure that your refund request is processed smoothly and without complications.

Required Documents

When submitting the Application Refund Form, certain documents may be required to support your claim. Commonly required documents include proof of payment, such as receipts or bank statements, and identification documents, such as a driver's license or Social Security card. Depending on the reason for the refund, additional documentation may be necessary, such as tax returns or correspondence from the IRS. Having these documents ready can expedite the review process and increase the likelihood of a successful refund request.

Form Submission Methods

The Application Refund Form can be submitted through various methods, including online, by mail, or in person. For online submissions, many tax authorities provide secure portals where you can upload your completed form and supporting documents. If you choose to submit by mail, ensure that you send the form to the correct address specified by the IRS or your state tax authority. In-person submissions are also an option at local tax offices, where you can receive immediate assistance. Each method has its own advantages, so consider your preferences and circumstances when deciding how to submit your form.

Quick guide on how to complete application refund 2008 form

Your instructional manual on how to prepare your Application Refund Form

If you're looking to understand how to create and submit your Application Refund Form, here are a few brief recommendations on making tax processing easier.

To begin, simply register your airSlate SignNow account to change how you manage documents online. airSlate SignNow offers a very user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax documents with ease. With its editor, you can alternate between text, check boxes, and eSignatures, returning to edit responses as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to finalize your Application Refund Form in no time:

- Create your account and start editing PDFs almost immediately.

- Utilize our directory to locate any IRS tax form; browse through varieties and schedules.

- Select Get form to access your Application Refund Form in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-recognized eSignature (if required).

- Examine your document and rectify any mistakes.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes online with airSlate SignNow. Keep in mind that filing on paper can increase return inaccuracies and cause delays in reimbursements. It goes without saying, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct application refund 2008 form

FAQs

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill the JEE (Main) application form?

This is a step by step guide to help you fill your JEE (Main) application form online brought to you by Toppr. We intend to help you save time and avoid mistakes so that you can sail through this whole process rather smoothly. In case you have any doubts, please talk to our counselors by first registering at Toppr. JEE Main Application Form is completely online and there is no offline component or downloadable application form. Here are some steps you need to follow:Step 1: Fill the Application FormEnter all the details while filling the Online Application Form and choose a strong password and security question with a relevant answer.After entering the data, an application number will be generated and it will be used to complete the remaining steps. Make sure your note down this number.Once you register, you can use this number and password for further logins. Do not share the login credentials with anyone but make sure you remember them.Step 2: Upload Scanned ImagesThe scanned images of photographs, thumb impression and signature should be in JPG/JPEG format only.While uploading the photograph, signature and thumb impression, please see its preview to check if they have been uploaded correctly.You will be able to modify/correct the particulars before the payment of fees.Step 3: Make The PaymentPayment of the Application Fees for JEE (Main) is through Debit card or Credit Card or E Challan.E-challan has to be downloaded while applying and the payment has to be made in cash at Canara Bank or Syndicate Bank or ICICI bank.After successful payment, you will be able to print the acknowledgment page. In case acknowledgment page is not generated after payment, then the transaction is cancelled and amount will be refunded.Step 4: Selection of Date/SlotIf you have opted for Computer Based Examination of Paper – 1, you should select the date/slot after payment of Examination Fee.If you do not select the date/slot, you will be allotted the date/slot on random basis depending upon availability.In case you feel you are ready to get started with filling the application form, pleaseclick here. Also, if you are in the final stages of your exam preparation process, you can brush up your concepts and solve difficult problems on Toppr.com to improve your accuracy and save time.

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

Create this form in 5 minutes!

How to create an eSignature for the application refund 2008 form

How to create an eSignature for your Application Refund 2008 Form in the online mode

How to generate an eSignature for the Application Refund 2008 Form in Chrome

How to create an eSignature for signing the Application Refund 2008 Form in Gmail

How to generate an eSignature for the Application Refund 2008 Form from your smart phone

How to generate an electronic signature for the Application Refund 2008 Form on iOS devices

How to make an electronic signature for the Application Refund 2008 Form on Android

People also ask

-

What is the Application Refund Form in airSlate SignNow?

The Application Refund Form is a customizable document that allows users to request refunds efficiently. With airSlate SignNow, you can create and send this form to streamline the refund process, ensuring that all necessary information is captured accurately.

-

How can I create an Application Refund Form using airSlate SignNow?

Creating an Application Refund Form with airSlate SignNow is straightforward. Simply log into your account, select 'Create Document,' and use our intuitive template builder to customize your refund form according to your business needs.

-

What features does the Application Refund Form offer?

The Application Refund Form in airSlate SignNow includes features such as electronic signatures, customizable fields, and automated workflows. These features ensure that the refund process is not only efficient but also legally compliant.

-

Is there a cost associated with using the Application Refund Form?

Using the Application Refund Form is part of the airSlate SignNow subscription plans. We offer various pricing tiers to accommodate businesses of all sizes, allowing you to choose the plan that best fits your budget and needs.

-

Can I integrate the Application Refund Form with other software?

Yes, airSlate SignNow allows you to integrate the Application Refund Form with a variety of third-party applications. This ensures seamless data transfer and enhances your overall operational efficiency.

-

What are the benefits of using the Application Refund Form?

The Application Refund Form provides numerous benefits, including faster processing times and improved accuracy in handling refund requests. By using airSlate SignNow, businesses can enhance customer satisfaction by making the refund process simple and efficient.

-

Is the Application Refund Form secure and compliant?

Absolutely! The Application Refund Form created with airSlate SignNow adheres to strict security protocols and compliance standards, ensuring that all sensitive information is protected. This gives both businesses and customers peace of mind when handling refund requests.

Get more for Application Refund Form

- Owners or sellers affidavit of no liens colorado form

- Affidavit financial status form

- Complex will with credit shelter marital trust for large estates colorado form

- Colorado demand 497300041 form

- Will formal probate

- Colorado appointment representative form

- Determination heirs form

- Appointment special administrator form

Find out other Application Refund Form

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter