CHAPTER 12 26 2024-2026

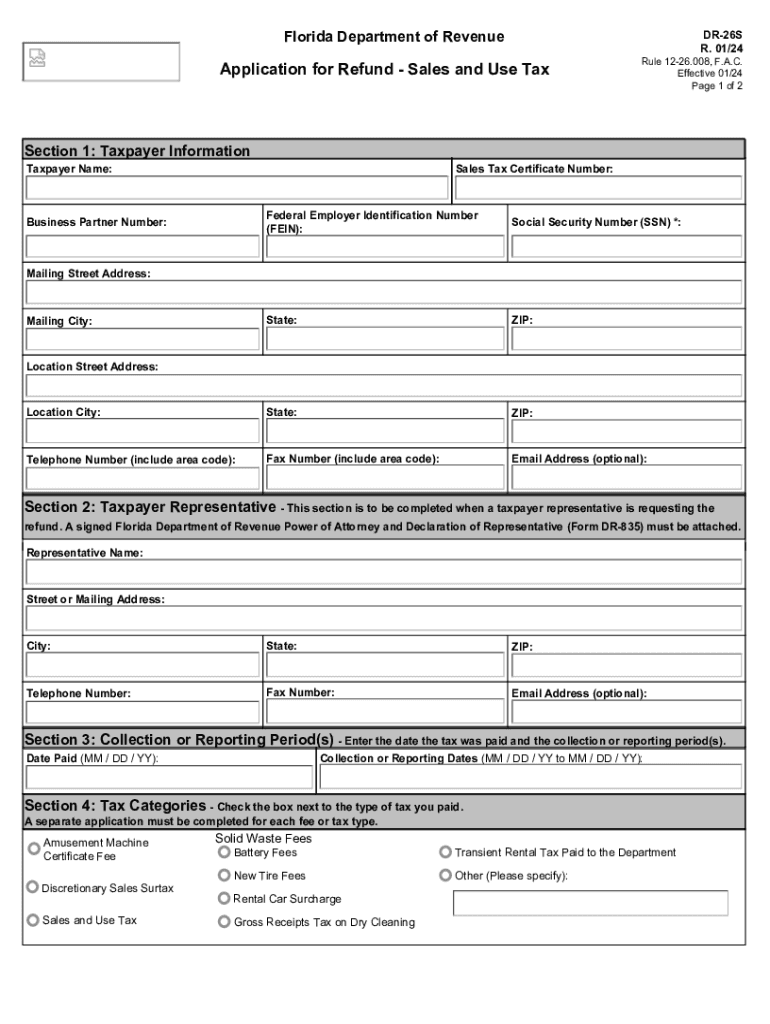

What is the Florida Department of Revenue Form DR-26S?

The Florida Department of Revenue Form DR-26S is a key document used for requesting a sales tax refund in Florida. This form is specifically designed for businesses and individuals who have overpaid sales tax or have had sales tax incorrectly charged. Understanding the purpose of this form is essential for ensuring that you receive any eligible refunds in a timely manner.

Eligibility Criteria for Form DR-26S

To qualify for a refund using Form DR-26S, applicants must meet specific eligibility criteria. Generally, the following conditions apply:

- The applicant must have paid sales tax on eligible purchases.

- The overpayment must be documented with receipts or invoices.

- The request must be made within the stipulated time frame set by the Florida Department of Revenue.

It is important to review these criteria carefully before submitting the form to ensure compliance and increase the chances of a successful refund.

Steps to Complete Form DR-26S

Completing Form DR-26S involves several important steps. Here is a concise guide:

- Gather all necessary documentation, including proof of payment and any relevant receipts.

- Fill out the form accurately, providing all required information such as your name, address, and details of the overpaid tax.

- Double-check the information for accuracy to avoid delays in processing.

- Submit the completed form along with the required documentation to the Florida Department of Revenue.

Following these steps can help ensure a smooth refund process.

Required Documents for Form DR-26S Submission

When submitting Form DR-26S, it is essential to include all required documents to support your claim. The following documents are typically needed:

- Proof of sales tax payment, such as receipts or invoices.

- A copy of the completed Form DR-26S.

- Any additional documentation requested by the Florida Department of Revenue.

Providing comprehensive documentation can help expedite the review process and increase the likelihood of receiving your refund.

Form Submission Methods for DR-26S

Form DR-26S can be submitted through various methods, allowing flexibility for applicants. The available submission methods include:

- Online submission through the Florida Department of Revenue's official website.

- Mailing the completed form and supporting documents to the designated address.

- In-person submission at local Florida Department of Revenue offices.

Choosing the most convenient method for your situation can help ensure that your refund request is processed efficiently.

Filing Deadlines for Form DR-26S

It is crucial to be aware of the filing deadlines associated with Form DR-26S to avoid missing out on potential refunds. Generally, the deadline for submitting the form is within three years from the date of the overpayment. Keeping track of these deadlines ensures that you can submit your claim in a timely manner.

Quick guide on how to complete chapter 12 26

Complete CHAPTER 12 26 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly and seamlessly. Manage CHAPTER 12 26 on any device with airSlate SignNow's Android or iOS applications and simplify your document-based tasks today.

The easiest way to modify and eSign CHAPTER 12 26 without hassle

- Locate CHAPTER 12 26 and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign CHAPTER 12 26 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct chapter 12 26

Create this form in 5 minutes!

How to create an eSignature for the chapter 12 26

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing my fl tax refund with airSlate SignNow?

Filing your fl tax refund with airSlate SignNow is straightforward. First, you can upload your tax documents directly into our platform. Then, simply eSign the forms and submit them, ensuring that you're compliant with all necessary regulations for a smooth refund process.

-

How does airSlate SignNow ensure the security of my fl tax refund documents?

Your security is our top priority at airSlate SignNow. We use advanced encryption protocols and secure cloud storage to protect your fl tax refund documents from unauthorized access. Additionally, our platform is compliant with industry standards to keep your sensitive information safe.

-

What are the costs associated with using airSlate SignNow for my fl tax refund?

airSlate SignNow offers competitive pricing to make it accessible for everyone. Our plans are structured to provide excellent value, particularly for businesses looking to streamline their processes, including managing fl tax refunds. You can choose a plan that fits your needs without compromising on features.

-

Can I integrate airSlate SignNow with other financial software for my fl tax refund?

Yes, airSlate SignNow seamlessly integrates with various financial and accounting software, allowing you to manage your fl tax refund efficiently. This integration ensures that all your data is synchronized, making it easier for you to keep track of your finances and taxes in one place.

-

What features does airSlate SignNow offer for handling fl tax refunds?

airSlate SignNow provides a suite of features tailored for managing fl tax refunds, including document templates, secure eSignatures, and automated workflows. These tools enable you to process your refunds quickly and efficiently, reducing the time spent on paperwork.

-

How can airSlate SignNow help me track the status of my fl tax refund?

With airSlate SignNow, you can easily track the status of your fl tax refund through our dashboard. The platform provides updates on document submissions and notifications if any actions are required from you, ensuring you're always informed about your refund process.

-

Is customer support available if I have questions about my fl tax refund?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any questions regarding your fl tax refund. Our knowledgeable team is available via chat, email, or phone to provide timely and helpful responses to your inquiries.

Get more for CHAPTER 12 26

- This agreement made and entered into this by and between form

- Bill of sale form kansas dmv bill of sale templates fillable

- Texas promissory note in connection with sale of vehicle form

- Free kansas bill of sale templates pdf ampamp docxformswift

- Quotcont form

- Materials to construct erect alter or repair all types of fences corrals runs railings form

- Heat pumpair conditioner brand name model size form

- Time of completion contractor shall commence the work to be performed under this

Find out other CHAPTER 12 26

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors