Supplemental Wage Schedule New Hampshire Form

What is the Supplemental Wage Schedule New Hampshire

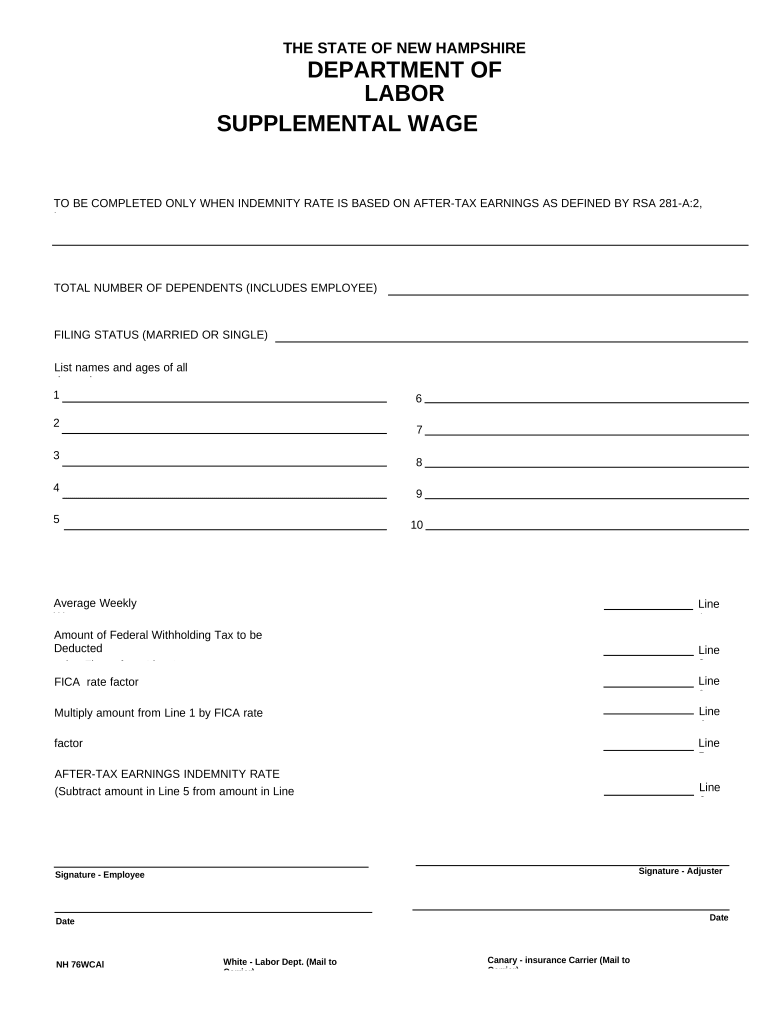

The Supplemental Wage Schedule New Hampshire is a specific form used for reporting additional wages that are not part of regular income. This form is essential for employers who need to report supplemental wages, such as bonuses, commissions, or overtime pay, to ensure accurate tax withholding. Understanding this form is crucial for both employers and employees to comply with state tax regulations and to manage tax liabilities effectively.

How to use the Supplemental Wage Schedule New Hampshire

Using the Supplemental Wage Schedule New Hampshire involves several steps. First, employers should gather all relevant payroll information, including the total amount of supplemental wages paid during the reporting period. Next, they must accurately fill out the form, ensuring that all figures align with their payroll records. Once completed, the form should be submitted to the New Hampshire Department of Revenue Administration along with any required tax payments. Proper use of this form helps maintain compliance with state tax laws.

Steps to complete the Supplemental Wage Schedule New Hampshire

Completing the Supplemental Wage Schedule New Hampshire requires careful attention to detail. Follow these steps for accurate completion:

- Gather payroll data for the reporting period, including total supplemental wages.

- Obtain the latest version of the Supplemental Wage Schedule form from the New Hampshire Department of Revenue Administration.

- Fill in the employee details, including name, Social Security number, and the total amount of supplemental wages paid.

- Calculate the appropriate tax withholding based on the current state tax rates.

- Review the completed form for accuracy before submission.

- Submit the form by the designated deadline to ensure compliance.

Legal use of the Supplemental Wage Schedule New Hampshire

The legal use of the Supplemental Wage Schedule New Hampshire is governed by state tax laws. Employers are required to use this form to report supplemental wages accurately, which ensures that the correct amount of state income tax is withheld. Failure to use the form properly can result in penalties, including fines or audits by the New Hampshire Department of Revenue Administration. It is important for employers to stay informed about any changes in tax laws that may affect the use of this form.

Key elements of the Supplemental Wage Schedule New Hampshire

Several key elements are essential for the Supplemental Wage Schedule New Hampshire. These include:

- Employee Information: Accurate details about the employee receiving supplemental wages.

- Total Supplemental Wages: The total amount paid in supplemental wages during the reporting period.

- Tax Withholding Amount: The calculated amount of state income tax to be withheld from the supplemental wages.

- Employer Information: Details about the employer, including name and tax identification number.

Filing Deadlines / Important Dates

Filing deadlines for the Supplemental Wage Schedule New Hampshire are crucial for compliance. Employers must submit the form by the end of the tax year, typically December thirty-first, to report supplemental wages for that year. Additionally, any tax payments associated with the supplemental wages should be made by the same deadline to avoid penalties. Staying aware of these dates helps ensure that employers remain compliant with state tax regulations.

Quick guide on how to complete supplemental wage schedule new hampshire

Complete Supplemental Wage Schedule New Hampshire effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Supplemental Wage Schedule New Hampshire on any device using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

How to modify and eSign Supplemental Wage Schedule New Hampshire with ease

- Obtain Supplemental Wage Schedule New Hampshire and click on Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form hunting, or errors that require printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Supplemental Wage Schedule New Hampshire to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Supplemental Wage Schedule in New Hampshire?

The Supplemental Wage Schedule in New Hampshire refers to the structured taxation rates applied to supplemental wages, such as bonuses or overtime. Understanding this schedule is essential for business compliance and accurate payroll processing. By using airSlate SignNow, you can easily manage documents related to these wages and ensure smooth operation.

-

How does airSlate SignNow assist with the Supplemental Wage Schedule in New Hampshire?

airSlate SignNow provides an efficient platform to create, send, and eSign documents related to payroll and the Supplemental Wage Schedule in New Hampshire. Our solution simplifies the documentation process, enabling businesses to stay compliant while managing payroll effectively. This saves time and reduces the risk of errors in calculating supplemental wages.

-

Are there any costs associated with using airSlate SignNow for Supplemental Wage Schedule documents?

Yes, there are flexible pricing plans available when using airSlate SignNow to manage your Supplemental Wage Schedule documents in New Hampshire. Businesses can select a plan that suits their needs, ensuring they have access to all the essential features for efficient document management and eSignature capabilities. Investing in our solution can lead to long-term savings through improved efficiency.

-

What features does airSlate SignNow offer for managing payroll documents?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure document storage specifically designed for payroll documents like the Supplemental Wage Schedule in New Hampshire. These features streamline the process, making it easier to send and eSign necessary forms and contracts, thus enhancing workplace productivity.

-

Can I integrate airSlate SignNow with other payroll systems?

Yes, airSlate SignNow can seamlessly integrate with various payroll systems, enhancing your ability to manage the Supplemental Wage Schedule in New Hampshire. This integration allows for smoother data transfer and ensures that documents are updated in real-time, keeping your payroll process efficient and organized.

-

How secure is airSlate SignNow for managing sensitive payroll information?

Security is a top priority at airSlate SignNow. Our platform adheres to industry-standard security protocols to protect sensitive payroll information related to the Supplemental Wage Schedule in New Hampshire. With features like encryption, secure access, and authentication processes, you can rest assured that your data is safe and secure.

-

What benefits does airSlate SignNow provide for businesses in New Hampshire?

By using airSlate SignNow, businesses in New Hampshire can streamline their document management processes for the Supplemental Wage Schedule and other payroll-related tasks. The platform enables faster turnaround times, reduced administrative burdens, and improved compliance with state regulations, all of which contribute to enhanced operational efficiency.

Get more for Supplemental Wage Schedule New Hampshire

Find out other Supplemental Wage Schedule New Hampshire

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer