Living Trust for Husband and Wife with One Child New Hampshire Form

What is the Living Trust For Husband And Wife With One Child New Hampshire

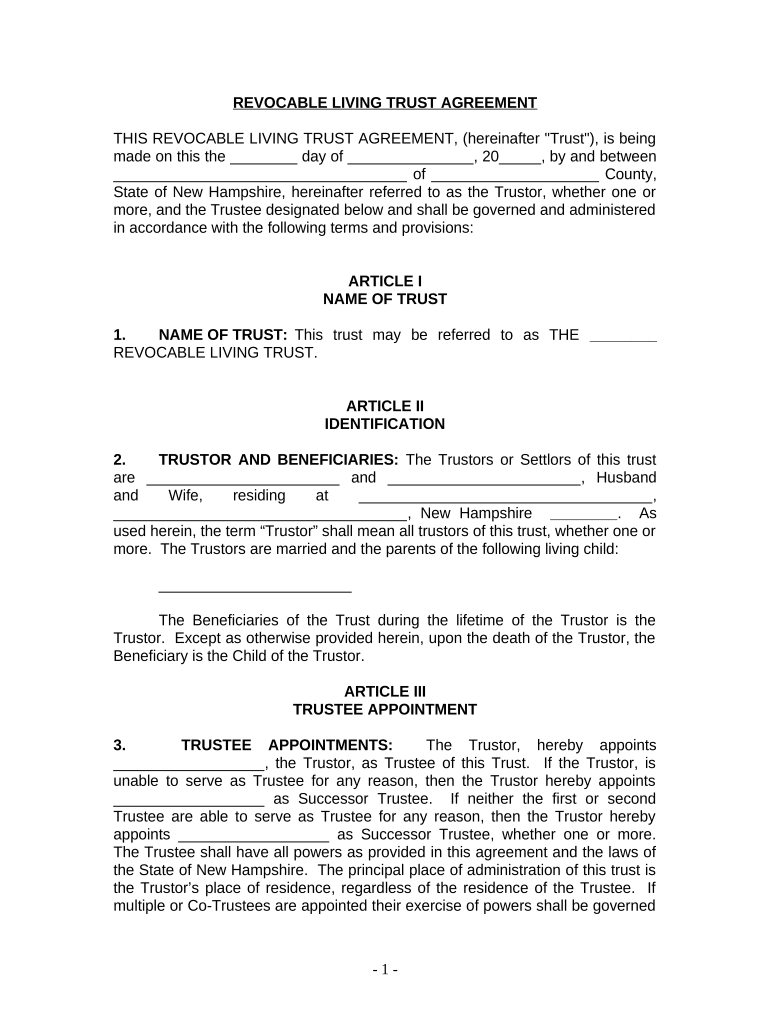

A living trust for husband and wife with one child in New Hampshire is a legal arrangement that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed after their passing. This type of trust can help avoid probate, ensuring a smoother transition of assets to the surviving spouse and child. It typically allows both partners to act as trustees, maintaining control over the trust assets while they are alive.

Key Elements of the Living Trust For Husband And Wife With One Child New Hampshire

Several key elements define this living trust:

- Trustees: Typically, both spouses serve as co-trustees, allowing them to manage the trust assets together.

- Beneficiaries: The primary beneficiaries are usually the surviving spouse and the child, ensuring that both are provided for after one partner's death.

- Revocability: Most living trusts are revocable, meaning the couple can modify or dissolve the trust as their circumstances change.

- Asset Management: The trust outlines how assets are to be managed and distributed, providing clarity and reducing potential conflicts.

Steps to Complete the Living Trust For Husband And Wife With One Child New Hampshire

Completing a living trust involves several important steps:

- Gather Information: Collect details about all assets, including real estate, bank accounts, and investments.

- Draft the Trust Document: Create a trust document that outlines the terms, including trustees, beneficiaries, and asset distribution.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public to ensure its legal validity.

- Fund the Trust: Transfer ownership of assets into the trust to ensure they are managed according to the trust's terms.

State-Specific Rules for the Living Trust For Husband And Wife With One Child New Hampshire

New Hampshire has specific regulations governing living trusts. These include:

- Trusts must comply with state laws regarding the creation and management of trusts.

- New Hampshire does not require living trusts to be recorded, but it is advisable to keep the trust document in a safe place.

- Tax implications may vary, so consulting a tax professional is recommended to understand any potential tax liabilities.

Legal Use of the Living Trust For Husband And Wife With One Child New Hampshire

The legal use of a living trust in New Hampshire includes its ability to dictate asset distribution, avoid probate, and provide for the surviving spouse and child. It is recognized by New Hampshire law, provided it meets the necessary legal requirements. The trust can also include specific provisions for the care of the child, such as educational expenses or health care needs, ensuring that their welfare is prioritized.

How to Obtain the Living Trust For Husband And Wife With One Child New Hampshire

To obtain a living trust, couples can either draft the document themselves using templates or hire an attorney specializing in estate planning. While templates can be cost-effective, legal assistance ensures that the trust complies with New Hampshire laws and meets the couple's specific needs. After drafting the trust, it must be signed and funded to be effective.

Quick guide on how to complete living trust for husband and wife with one child new hampshire

Effortlessly Prepare Living Trust For Husband And Wife With One Child New Hampshire on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Living Trust For Husband And Wife With One Child New Hampshire on any device with airSlate SignNow's Android or iOS applications, enhancing any document-driven procedure today.

The easiest method to modify and eSign Living Trust For Husband And Wife With One Child New Hampshire seamlessly

- Obtain Living Trust For Husband And Wife With One Child New Hampshire and click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Living Trust For Husband And Wife With One Child New Hampshire and ensure exceptional communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child New Hampshire?

A Living Trust For Husband And Wife With One Child New Hampshire is a legal document that allows couples to manage their assets during their lifetime and specify how their property will be distributed upon their death. This type of trust can help streamline the transfer of assets to your child, avoiding probate and ensuring their needs are met.

-

What are the benefits of establishing a Living Trust For Husband And Wife With One Child New Hampshire?

Establishing a Living Trust For Husband And Wife With One Child New Hampshire offers numerous benefits, including avoiding probate, ensuring privacy, and facilitating asset management. It provides peace of mind knowing that your child will inherit your assets according to your wishes, and it can also help in case of incapacity.

-

How much does a Living Trust For Husband And Wife With One Child New Hampshire typically cost?

The cost of setting up a Living Trust For Husband And Wife With One Child New Hampshire can vary widely based on complexity and the professionals involved. Generally, you can expect to pay between $1,000 to $3,000 for attorney fees and related expenses. However, these costs can be offset by the savings gained from avoiding probate.

-

Can I modify a Living Trust For Husband And Wife With One Child New Hampshire?

Yes, one of the key features of a Living Trust For Husband And Wife With One Child New Hampshire is that it can be amended or revoked at any time while both spouses are alive. This flexibility allows you to make changes as your family situation or financial circumstances evolve.

-

Is a Living Trust For Husband And Wife With One Child New Hampshire complex to create?

Creating a Living Trust For Husband And Wife With One Child New Hampshire can be straightforward, especially with the help of experienced legal professionals. While some details can be complex, many online platforms and services simplify the process, making it accessible to couples wanting to protect their family’s future.

-

What assets can be included in my Living Trust For Husband And Wife With One Child New Hampshire?

You can include various assets in your Living Trust For Husband And Wife With One Child New Hampshire, such as real estate, bank accounts, investments, and personal property. It’s important to identify and transfer ownership of these assets into the trust to ensure smooth management and transfer upon death.

-

How does a Living Trust For Husband And Wife With One Child New Hampshire function in estate planning?

A Living Trust For Husband And Wife With One Child New Hampshire is a crucial component of estate planning, providing a clear framework for asset distribution. It designates how your assets will be handled during your lifetime and specifies instructions for your child's inheritance after death, bypassing the lengthy probate process.

Get more for Living Trust For Husband And Wife With One Child New Hampshire

- H childs preadmission record dhr cdc 739 revised form

- Form 82003 residential green and energy efficient addendum

- Nd lease tax worksheet form

- Financial assistance program caremount medical form

- Spadi 252046683 form

- Form 4400 256a

- Rrsp withdrawal request simplii financialtm form

- Running record no grid with follow up comprehension prompts hpedsb on form

Find out other Living Trust For Husband And Wife With One Child New Hampshire

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast