Revocation of Living Trust New Hampshire Form

What is the Revocation Of Living Trust New Hampshire

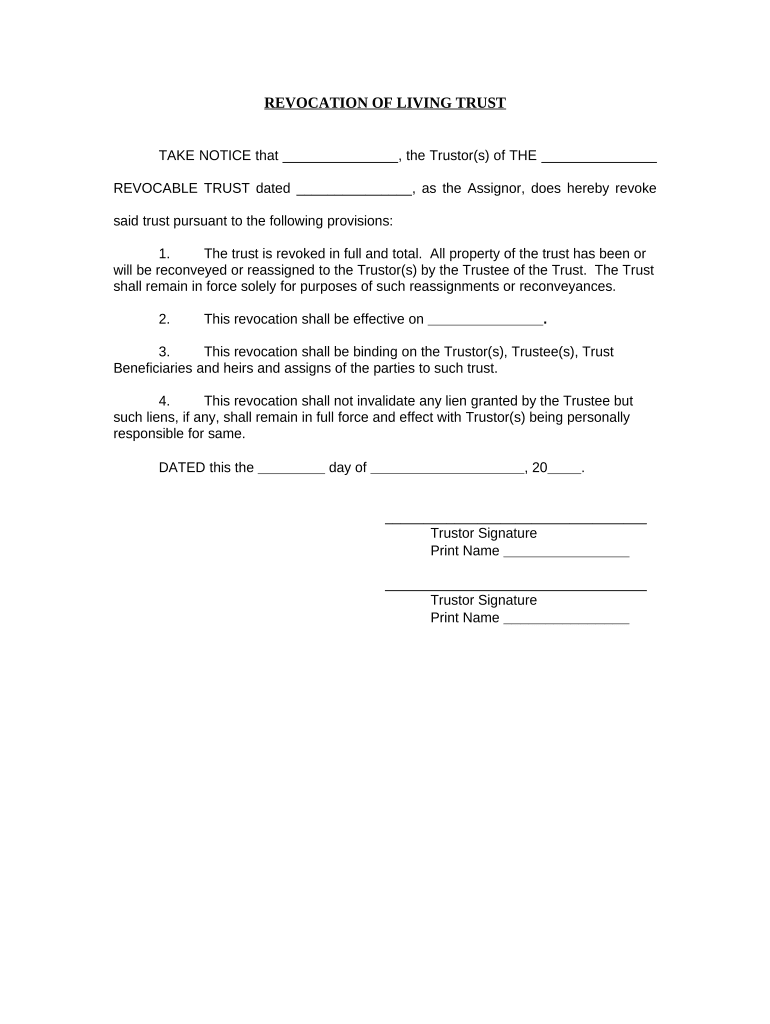

The Revocation of Living Trust in New Hampshire is a legal document that allows an individual to formally cancel or revoke a previously established living trust. This process is essential for individuals who wish to change their estate planning arrangements, ensuring that their assets are managed according to their current wishes. The revocation document must clearly state the intent to revoke the trust and should be signed by the grantor, the person who created the trust. It is crucial to ensure that the revocation complies with New Hampshire state laws to be considered valid.

Steps to complete the Revocation Of Living Trust New Hampshire

Completing the Revocation of Living Trust in New Hampshire involves a series of straightforward steps:

- Review the original trust document to confirm the details that need to be revoked.

- Draft the revocation document, clearly stating the intent to revoke the trust.

- Sign the revocation document in the presence of a notary public to ensure its legality.

- Distribute copies of the signed revocation to relevant parties, including beneficiaries and financial institutions.

- Store the original revocation document in a safe place for future reference.

Legal use of the Revocation Of Living Trust New Hampshire

The legal use of the Revocation of Living Trust in New Hampshire is governed by state laws that dictate how trusts can be created and revoked. It is important to ensure that the revocation is executed in accordance with these laws to avoid potential disputes. The revocation must be in writing and signed by the grantor, and it may require notarization to enhance its legal standing. Additionally, notifying all interested parties about the revocation is a prudent practice to prevent misunderstandings.

State-specific rules for the Revocation Of Living Trust New Hampshire

New Hampshire has specific rules regarding the revocation of living trusts. The revocation document must comply with the Uniform Trust Code, which outlines the requirements for trust modifications and revocations. It is essential to include the trust's name, the date it was created, and a statement indicating that the trust is being revoked. Furthermore, the revocation should be signed and dated by the grantor, and it is advisable to have it notarized to ensure its enforceability.

Key elements of the Revocation Of Living Trust New Hampshire

Key elements of the Revocation of Living Trust in New Hampshire include:

- Identification of the Trust: Clearly state the name and date of the original living trust.

- Intent to Revoke: Include a clear statement expressing the intent to revoke the trust.

- Signature of the Grantor: The document must be signed by the individual who created the trust.

- Notarization: While not always required, notarization adds an extra layer of legal protection.

How to use the Revocation Of Living Trust New Hampshire

Using the Revocation of Living Trust in New Hampshire involves following the established legal process to ensure that the revocation is recognized. After drafting and signing the revocation document, it should be distributed to all relevant parties, including banks, financial institutions, and beneficiaries. This ensures that everyone is aware of the change in the trust's status. Additionally, it is advisable to keep a copy of the revocation document in a secure location for future reference.

Quick guide on how to complete revocation of living trust new hampshire

Easily prepare Revocation Of Living Trust New Hampshire on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Revocation Of Living Trust New Hampshire on any device using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign Revocation Of Living Trust New Hampshire effortlessly

- Find Revocation Of Living Trust New Hampshire and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Select how you want to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Revocation Of Living Trust New Hampshire and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for Revocation Of Living Trust in New Hampshire?

The process for Revocation Of Living Trust in New Hampshire typically involves creating a formal written document stating your intent to revoke the trust. It’s advisable to include specific details about the original trust, such as its name and date. Additionally, having this document signNowd can provide further legal affirmation of your wishes.

-

Are there any fees associated with Revocation Of Living Trust in New Hampshire?

Fees for Revocation Of Living Trust in New Hampshire may vary depending on whether you hire a legal professional or handle it yourself. While you can create a revocation document using airSlate SignNow at a minimal cost, consulting an attorney may incur additional legal fees. It’s essential to weigh these options according to your needs.

-

How does airSlate SignNow assist with the Revocation Of Living Trust in New Hampshire?

airSlate SignNow simplifies the Revocation Of Living Trust process in New Hampshire by offering easy-to-use electronic signatures and templates. Our platform allows users to create, edit, and sign necessary documents from anywhere, ensuring a smooth experience. With affordable pricing plans, you’ll find a solution that fits your budget.

-

What are the benefits of using airSlate SignNow for Revocation Of Living Trust?

Using airSlate SignNow for the Revocation Of Living Trust in New Hampshire provides several benefits, including convenience and security. Our platform allows users to execute and store documents securely online, reducing paper clutter. Additionally, you have instant access to your documents whenever needed.

-

Is it necessary to notify beneficiaries about the Revocation Of Living Trust in New Hampshire?

While it’s not legally mandatory to notify beneficiaries about the Revocation Of Living Trust in New Hampshire, it is generally a good practice to do so. Keeping heirs informed can prevent confusion or disputes later. Transparency during this process can foster better relationships among family members and beneficiaries.

-

Can I revoke a living trust without a lawyer in New Hampshire?

Yes, you can revoke a living trust without a lawyer in New Hampshire by creating a written revocation document. However, if your trust is complex or involves signNow assets, consulting a legal professional is recommended. airSlate SignNow provides the tools needed to draft the necessary documents easily.

-

What integrations does airSlate SignNow offer that can help with Revocation Of Living Trust?

airSlate SignNow integrates seamlessly with various platforms, enhancing the Revocation Of Living Trust process in New Hampshire. These integrations allow for easy document sharing and management across email, cloud storage, and project management tools. This connectivity ensures that your revocation documents are streamlined and accessible.

Get more for Revocation Of Living Trust New Hampshire

Find out other Revocation Of Living Trust New Hampshire

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation