New Jersey Succession Form

What is the New Jersey Succession?

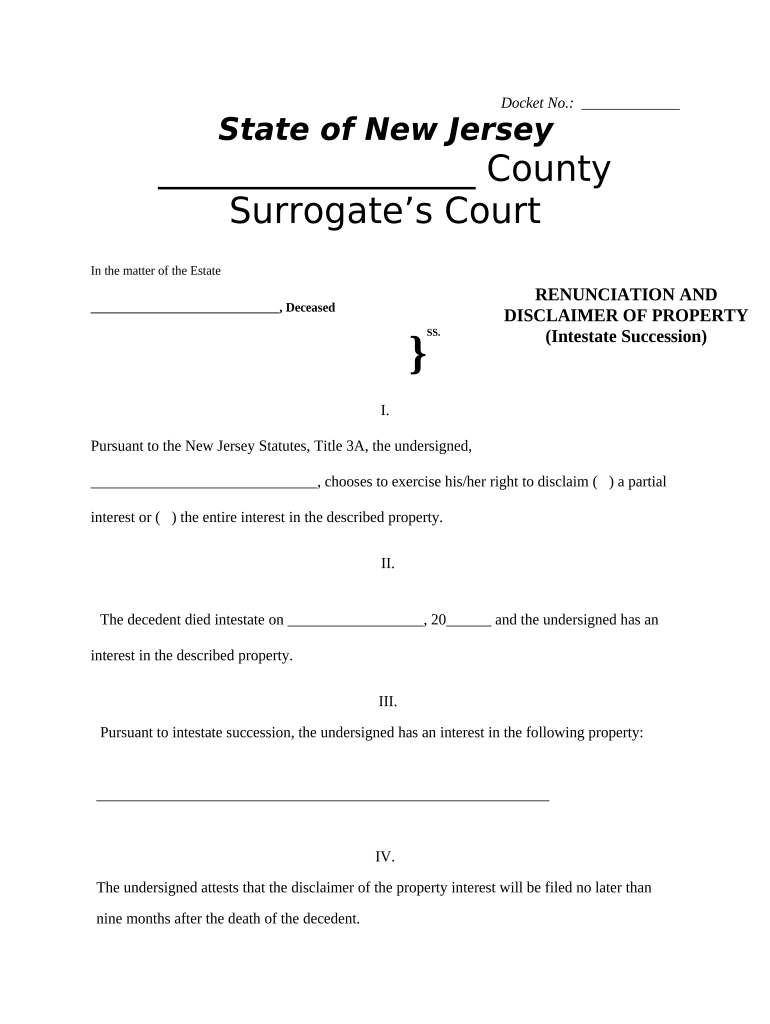

The New Jersey succession form is a legal document used to manage the distribution of a deceased person's estate when they have not left a will, also known as intestate succession. This form outlines how the deceased's assets will be allocated among their heirs according to New Jersey state laws. Understanding this process is essential for those involved in estate management, as it ensures that the deceased's wishes are honored, even in the absence of a written will.

Steps to Complete the New Jersey Succession

Completing the New Jersey succession form involves several key steps:

- Gather necessary information about the deceased, including their full name, date of death, and last known address.

- Identify the heirs according to New Jersey intestate laws, which dictate how assets are divided among family members.

- Fill out the succession form accurately, ensuring all details are correct and complete.

- Obtain signatures from all heirs, confirming their agreement with the distribution of assets as outlined in the form.

- Submit the completed form to the appropriate county surrogate court for processing.

Key Elements of the New Jersey Succession

Several important elements must be included in the New Jersey succession form to ensure its validity:

- The full name and details of the deceased, including identification numbers if applicable.

- A detailed list of the deceased's assets, including real estate, bank accounts, and personal property.

- The names and relationships of all heirs, along with their contact information.

- Signatures of all heirs, indicating their consent to the proposed distribution of assets.

- Any relevant documentation that supports the claims made in the form, such as death certificates or property deeds.

Legal Use of the New Jersey Succession

The legal use of the New Jersey succession form is crucial for ensuring that the estate is settled in accordance with state laws. When properly completed and submitted, this form acts as a legal declaration of how the deceased's assets should be distributed. It is essential to adhere to all legal requirements, as failure to do so may result in disputes among heirs or complications in the probate process.

Required Documents for the New Jersey Succession

To successfully complete the New Jersey succession form, several documents are typically required:

- A certified copy of the death certificate of the deceased.

- Identification documents for the heirs, such as driver's licenses or Social Security cards.

- Any existing financial documents that detail the deceased's assets, such as bank statements or property deeds.

- Documentation that verifies the relationship of the heirs to the deceased, if necessary.

Form Submission Methods

The New Jersey succession form can be submitted through various methods:

- Online submission via the county surrogate court's website, if available.

- Mailing the completed form and required documents to the appropriate county surrogate court.

- In-person submission at the county surrogate court, where you can also ask questions and receive assistance.

Quick guide on how to complete new jersey succession

Effortlessly set up New Jersey Succession on any gadget

Digital document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, since you can easily find the appropriate template and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage New Jersey Succession on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The simplest way to modify and eSign New Jersey Succession with ease

- Find New Jersey Succession and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign New Jersey Succession and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is new jersey succession and how does it work?

New Jersey succession refers to the legal process of transferring ownership of a deceased person's assets according to their will or state laws. Utilizing airSlate SignNow simplifies this process by enabling the secure electronic signing of documents necessary for succession. With easy-to-use features, you can efficiently manage the documentation required for new jersey succession.

-

How does airSlate SignNow support new jersey succession processes?

airSlate SignNow streamlines new jersey succession by providing an intuitive platform for eSigning essential legal documents. It allows users to collect signatures from all parties quickly and securely, ensuring compliance with state regulations. This service also helps reduce delays typically associated with traditional paper methods.

-

What are the pricing options for using airSlate SignNow for new jersey succession?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different users involved in new jersey succession. Whether you are an individual, a small business, or a larger enterprise, you will find a plan that fits your budget. Additionally, there are cost-saving features that can make the process even more economical.

-

Can I integrate airSlate SignNow with other tools for new jersey succession?

Yes, airSlate SignNow supports seamless integration with various third-party applications, enhancing your new jersey succession process. You can connect it with CRM systems, cloud storage, and other tools to create an efficient workflow. This integration allows for automated document management and signature collection.

-

What features does airSlate SignNow offer for new jersey succession?

The features of airSlate SignNow include secure eSigning, document templates, advanced authentication, and tracking capabilities, all tailored for new jersey succession needs. These tools help ensure that your documents are legally binding and easily verifiable. Additionally, you can set reminders and automate workflows to keep the succession process on track.

-

Is airSlate SignNow compliant with New Jersey laws for succession?

Yes, airSlate SignNow complies with New Jersey laws regarding eSignatures and document handling, making it suitable for new jersey succession. The platform adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act, which ensures your documents are legally valid. This compliance gives users peace of mind when carrying out their succession planning.

-

What are the benefits of using airSlate SignNow for new jersey succession?

Using airSlate SignNow for new jersey succession offers numerous benefits, including time savings, improved accuracy, and reduced paper usage. The platform allows for convenient access to documents from anywhere, enabling quicker decisions and actions. Additionally, the tracking features provide transparency throughout the succession process.

Get more for New Jersey Succession

- Wine donation form

- Individualized family service plan ifsp s3 amazonaws com form

- T 207t rev 11 16 04 english translation of a foreign registration certificate form

- Financial responsibility form noorani medical center

- Dyskinesia identification form

- Authorization to treat a minor everett clinic form

- Www uslegalforms comform library379890 spousalget spousal health care eligibility affidavit us legal forms

- Awv personalized action plan guide to action plan for spe wehealny form

Find out other New Jersey Succession

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy