Nj Financing Statement Form

What is the NJ Financing Statement

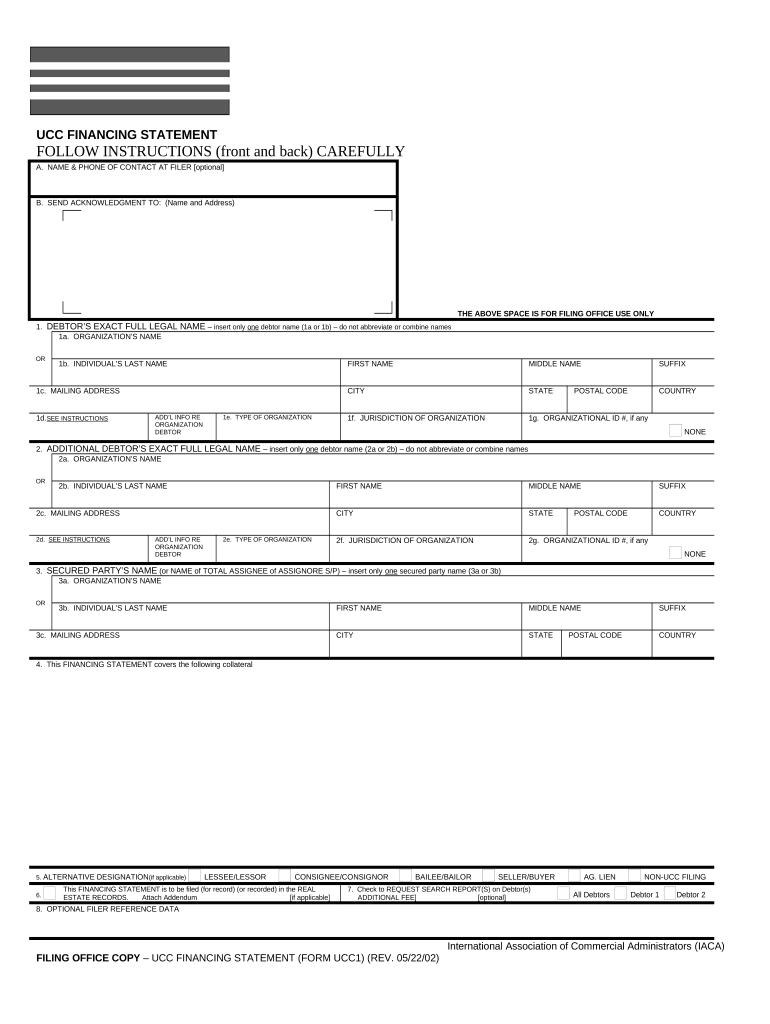

The NJ financing statement, often referred to as the NJ UCC1, is a legal document used to secure a creditor's interest in a debtor's personal property. This form is essential for establishing a security interest under the Uniform Commercial Code (UCC) in New Jersey. By filing this statement, creditors can protect their rights to the collateral if the debtor defaults on their obligations. The NJ financing statement serves as public notice of the secured party's interest and is crucial for both lenders and borrowers in various financial transactions.

How to Use the NJ Financing Statement

Using the NJ financing statement involves several key steps. First, identify the debtor and the secured party, ensuring all names are accurate and complete. Next, provide a detailed description of the collateral being secured. This description must be specific enough to allow for identification of the property. After completing the form, it must be filed with the New Jersey Division of Revenue and Enterprise Services. This filing can be done online or by mail. Once filed, the financing statement becomes part of the public record, providing notice to other creditors regarding the secured interest.

Key Elements of the NJ Financing Statement

The NJ financing statement includes several critical components that must be completed accurately. These elements are:

- Debtor Information: Full legal name and address of the debtor.

- Secured Party Information: Full legal name and address of the secured party.

- Collateral Description: A clear and specific description of the collateral being secured.

- Filing Information: Date of filing and any additional information required by the state.

Completing these elements correctly is vital for the enforceability of the financing statement and the protection of the secured party's interests.

Steps to Complete the NJ Financing Statement

Completing the NJ financing statement involves a systematic approach:

- Gather necessary information about the debtor and the secured party.

- Draft a detailed description of the collateral.

- Fill out the NJ financing statement form accurately, ensuring all details are correct.

- Review the form for completeness and accuracy.

- File the completed form with the New Jersey Division of Revenue and Enterprise Services, either online or by mail.

- Keep a copy of the filed statement for your records.

Following these steps helps ensure that the financing statement is filed correctly and legally binding.

Legal Use of the NJ Financing Statement

The NJ financing statement is legally binding when it is filed according to the requirements set forth by New Jersey law. It provides a mechanism for creditors to secure their interests in personal property. To be enforceable, the statement must be filed in a timely manner and must meet all legal standards, including proper identification of the debtor and collateral. Failure to comply with these legal requirements may result in the loss of priority over other creditors.

Form Submission Methods

The NJ financing statement can be submitted through various methods, including:

- Online Submission: Filing electronically through the New Jersey Division of Revenue and Enterprise Services website.

- Mail Submission: Sending a completed paper form to the appropriate state office.

- In-Person Submission: Delivering the form directly to the state office during business hours.

Each method has its own processing times and fees, so it is important to choose the one that best fits your needs.

Quick guide on how to complete nj financing statement

Effortlessly Prepare Nj Financing Statement on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly, without delays. Manage Nj Financing Statement on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Easily Modify and Electronically Sign Nj Financing Statement

- Obtain Nj Financing Statement and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or obscure confidential information using tools specifically designed for that function by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which requires just seconds and has the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to apply your changes.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Nj Financing Statement to ensure excellent communication at any step of your form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an NJ financing statement and why is it important?

An NJ financing statement is a legal form used to secure a creditor's interest in a borrower’s collateral in New Jersey. This document is crucial for protecting the creditor's rights in case of bankruptcy or default by the borrower. Using an NJ financing statement can help businesses establish their security interests clearly and effectively.

-

How does airSlate SignNow streamline the NJ financing statement process?

airSlate SignNow simplifies the process of creating and filing NJ financing statements by providing an intuitive platform for eSigning and document management. With our solution, businesses can easily prepare their financing statements, obtain signatures, and submit them electronically, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for NJ financing statements?

airSlate SignNow offers various pricing plans to accommodate different business needs for managing NJ financing statements. Our plans are designed to be cost-effective, ensuring that all businesses, whether small or large, can benefit from our document signing solutions without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing NJ financing statements?

Yes, airSlate SignNow offers integrations with popular business applications, allowing you to connect seamlessly with your existing systems for managing NJ financing statements. Whether you use CRM software or accounting tools, our platform can enhance your workflow and improve efficiency.

-

What features does airSlate SignNow provide for creating an NJ financing statement?

airSlate SignNow includes features specifically designed for creating NJ financing statements, such as customizable templates, eSigning, and document tracking. These features ensure that users can produce accurate and compliant financing statements quickly and easily.

-

Is airSlate SignNow secure for filing NJ financing statements?

Absolutely. airSlate SignNow takes security seriously, employing advanced encryption and compliance measures to ensure that all your NJ financing statements are safe during creation and submission. Our platform is designed to meet high-security standards, providing peace of mind for users.

-

How can airSlate SignNow benefit small businesses with NJ financing statements?

For small businesses, airSlate SignNow offers an affordable and user-friendly solution for managing NJ financing statements. By simplifying the eSigning and filing process, small businesses can focus more on growth rather than getting bogged down with paperwork.

Get more for Nj Financing Statement

- Lake arbor foundation inc camp inspiration thelafi org form

- Senate district 3 old oksenate gov form

- Camp oasis emergency contact ampampamp health history form

- Firemarshal utah govstate boards councilsutahfire service certification councildps fire marshal form

- Smithville merit badge college fill online printable form

- Agreement telecommuting form

- Application for undergraduate admission university of maine system form

- Services office of libraries technology uofl libraries at form

Find out other Nj Financing Statement

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application