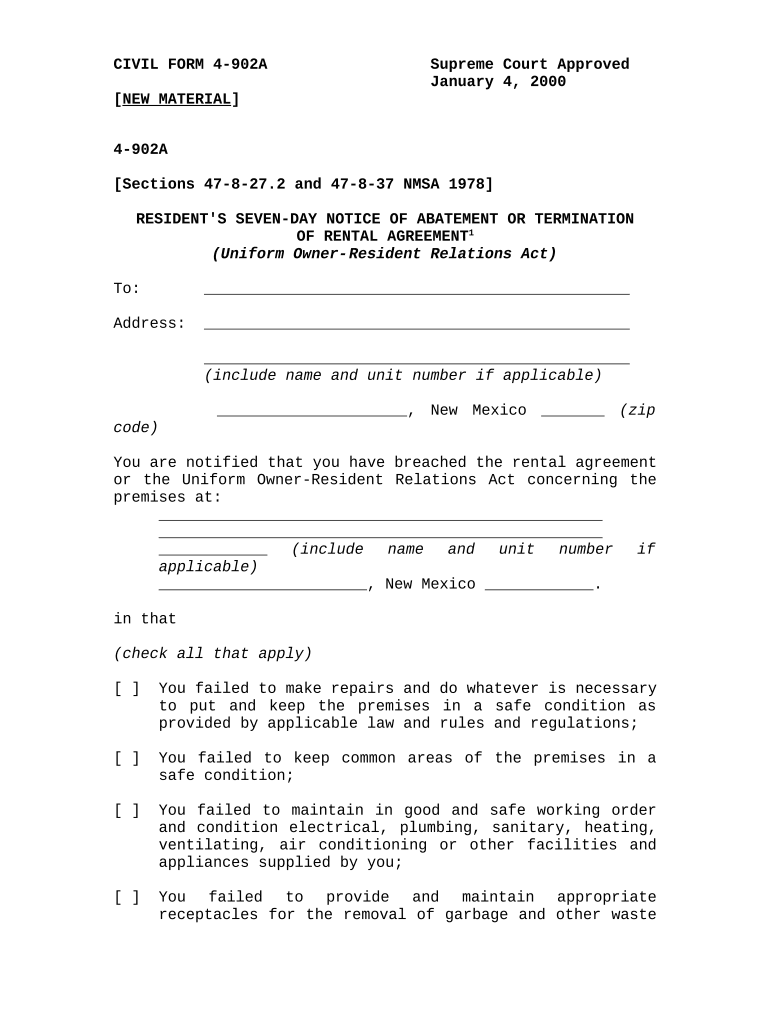

New Mexico Abatement Form

What is the New Mexico Abatement

The New Mexico Abatement refers to a legal process that allows for the reduction or elimination of certain taxes, penalties, or fees owed by individuals or businesses in the state. This process is often utilized in various contexts, including property tax relief and environmental remediation. Understanding the specific provisions of the New Mexico Abatement is essential for taxpayers seeking financial relief or compliance with state regulations.

How to use the New Mexico Abatement

Utilizing the New Mexico Abatement involves a series of steps that ensure compliance with state laws. First, individuals or businesses must determine their eligibility based on the specific criteria outlined by the state. Next, applicants should gather all necessary documentation, including proof of income and tax records. Once the required forms are completed, they can be submitted through the appropriate channels, either online or via mail. It is important to follow the guidelines carefully to ensure the application is processed smoothly.

Steps to complete the New Mexico Abatement

Completing the New Mexico Abatement requires a systematic approach. Here are the essential steps:

- Review eligibility criteria to confirm qualification for the abatement.

- Gather necessary documents, such as tax returns and identification.

- Complete the required forms accurately, ensuring all information is correct.

- Submit the application through the designated method, whether online, by mail, or in person.

- Keep copies of all submitted documents for your records.

Legal use of the New Mexico Abatement

The legal use of the New Mexico Abatement is governed by state laws and regulations. It is crucial for applicants to understand the legal framework surrounding the abatement process to ensure compliance. This includes being aware of deadlines for submission, required documentation, and any specific legal stipulations that apply to their situation. Failure to adhere to these guidelines may result in denial of the abatement request.

Eligibility Criteria

Eligibility for the New Mexico Abatement varies depending on the type of abatement being sought. Generally, criteria may include factors such as income level, property ownership status, and specific circumstances related to the taxpayer's situation. For example, certain abatements may be available for low-income households, while others might apply to businesses engaged in environmental remediation. It is important to review the specific eligibility requirements for the type of abatement being pursued.

Required Documents

When applying for the New Mexico Abatement, applicants must prepare a set of required documents to support their application. Commonly required documents may include:

- Proof of income, such as recent pay stubs or tax returns.

- Identification documents, such as a driver's license or state ID.

- Property ownership records, if applicable.

- Any additional documentation specified by the state for the specific abatement type.

Form Submission Methods

Applicants for the New Mexico Abatement have several options for submitting their forms. These methods include:

- Online submission through the state’s official website, which is often the fastest option.

- Mailing the completed forms to the appropriate state department.

- In-person submission at designated state offices, which may provide immediate assistance.

Quick guide on how to complete new mexico abatement 497320064

Manage New Mexico Abatement effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary for crafting, modifying, and electronically signing your documents swiftly and without delays. Handle New Mexico Abatement on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to adjust and electronically sign New Mexico Abatement easily

- Locate New Mexico Abatement and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize crucial sections of the documents or redact sensitive data with the tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and possesses the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign New Mexico Abatement to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is new mexico abatement and how can airSlate SignNow help?

New Mexico abatement refers to the reduction or elimination of certain taxes or fees for businesses operating in New Mexico. airSlate SignNow streamlines the document processes related to new mexico abatement by enabling businesses to send and eSign important forms quickly and securely, ensuring compliance with state regulations.

-

How much does airSlate SignNow cost for new mexico abatement processes?

airSlate SignNow offers competitive pricing plans that suit various business needs, making it a cost-effective solution for new mexico abatement documentation. You can choose from several subscription options tailored to your requirements, ensuring you only pay for what you need.

-

What features does airSlate SignNow provide for handling new mexico abatement documents?

With airSlate SignNow, you get features like customizable templates, in-app editing, and advanced security options that are essential for new mexico abatement documentation. These tools make it easy to create, send, and manage documents effortlessly while ensuring they remain legally binding.

-

Is airSlate SignNow suitable for small businesses in relation to new mexico abatement?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses looking to navigate new mexico abatement. Its user-friendly interface and affordable pricing make it an ideal choice for smaller enterprises focused on efficient document management.

-

Can airSlate SignNow integrate with other tools for easier management of new mexico abatement?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems and project management tools. This integration capability enhances workflow efficiency and simplifies the management of new mexico abatement processes.

-

What are the benefits of using airSlate SignNow for new mexico abatement?

Using airSlate SignNow for new mexico abatement offers numerous benefits, including faster document turnaround times, reducing paper waste, and ensuring secure storage of sensitive information. These advantages allow businesses to focus on growth while managing their documentation efficiently.

-

How secure is airSlate SignNow when dealing with new mexico abatement forms?

airSlate SignNow employs advanced security measures, including encryption and secure access protocols, to protect sensitive information related to new mexico abatement forms. This commitment to security ensures that your documents are safe from unauthorized access while remaining compliant with legal standards.

Get more for New Mexico Abatement

- Child and adolescent psychiatric evaluation template form

- Conference template form

- Healthy habits questionnaire form

- Tenancy application form downer co uk

- Application to upgrade to a full cpcs competent operator form

- Exclusive holidays ltd booking form

- Domestic renewable heat incentive hiversion 1 2 form

- Dhs 2114 eng mdhs request for medical opinion form

Find out other New Mexico Abatement

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors