Non Foreign Affidavit under IRC 1445 New Mexico Form

What is the Non Foreign Affidavit Under IRC 1445 New Mexico

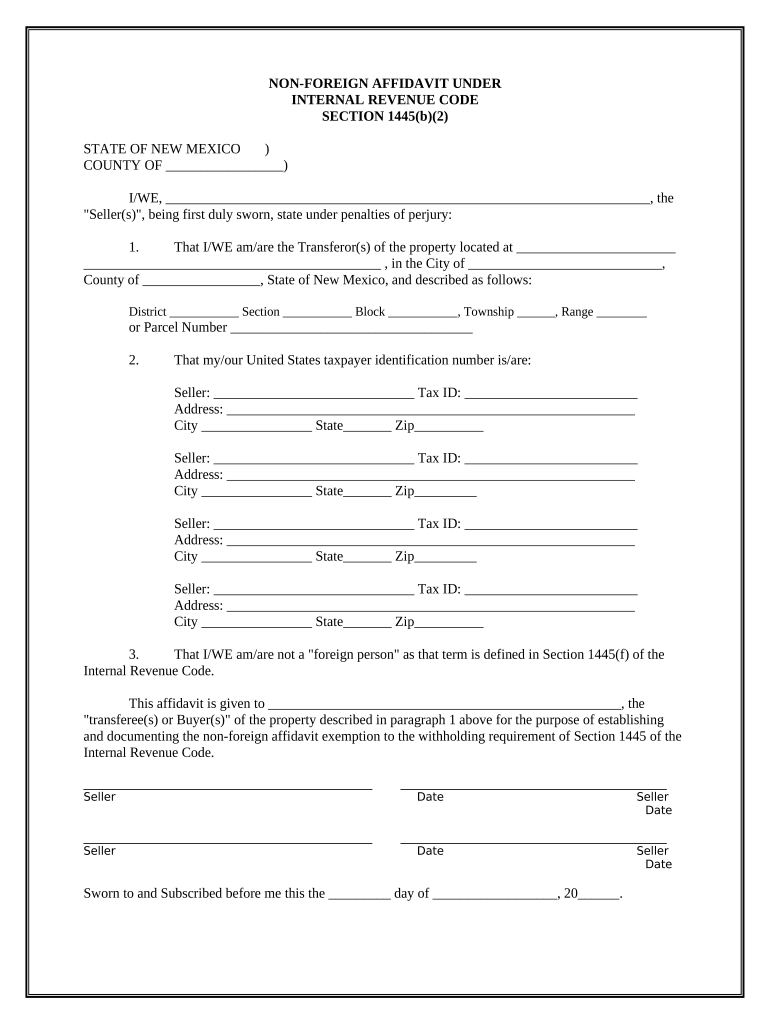

The Non Foreign Affidavit Under IRC 1445 is a legal document required in New Mexico for individuals or entities that are not classified as foreign persons under the Internal Revenue Code. This affidavit serves to certify that the seller of a property is not a foreign entity, thereby exempting the buyer from withholding taxes that would otherwise apply to foreign sellers. It is essential for real estate transactions to ensure compliance with federal tax regulations.

Steps to Complete the Non Foreign Affidavit Under IRC 1445 New Mexico

Completing the Non Foreign Affidavit involves several important steps to ensure accuracy and compliance:

- Gather necessary information, including the seller's name, address, and taxpayer identification number.

- Confirm that the seller qualifies as a non-foreign person under the IRC guidelines.

- Fill out the affidavit form with the required details, ensuring all information is accurate.

- Sign the affidavit in the presence of a notary public to validate the document.

- Submit the completed affidavit to the appropriate parties involved in the real estate transaction.

Legal Use of the Non Foreign Affidavit Under IRC 1445 New Mexico

The legal use of the Non Foreign Affidavit is crucial in real estate transactions to prevent unnecessary tax withholding. By providing this affidavit, the seller affirms their non-foreign status, allowing the buyer to proceed without the obligation to withhold taxes. This document is legally binding and must be executed correctly to hold up in legal or tax-related matters.

Key Elements of the Non Foreign Affidavit Under IRC 1445 New Mexico

Several key elements must be included in the Non Foreign Affidavit to ensure its validity:

- The full legal name and address of the seller.

- The seller's taxpayer identification number, such as a Social Security number or Employer Identification Number.

- A statement confirming the seller's non-foreign status.

- The signature of the seller, along with the date of signing.

- Notary acknowledgment to verify the authenticity of the signature.

How to Obtain the Non Foreign Affidavit Under IRC 1445 New Mexico

The Non Foreign Affidavit can be obtained through various means. It is often available from real estate professionals, attorneys, or online legal resources. Additionally, the form may be accessible through state tax authority websites or local government offices that handle property transactions. Ensuring you have the correct and most current version of the affidavit is essential for compliance.

Filing Deadlines / Important Dates

When dealing with the Non Foreign Affidavit, it is important to be aware of specific filing deadlines. Generally, the affidavit should be completed and submitted at the time of closing a real estate transaction. Failure to provide the affidavit on time may result in tax withholding obligations for the buyer. It is advisable to consult with a tax professional or real estate attorney for guidance on any specific deadlines that may apply.

Quick guide on how to complete non foreign affidavit under irc 1445 new mexico

Complete Non Foreign Affidavit Under IRC 1445 New Mexico seamlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Non Foreign Affidavit Under IRC 1445 New Mexico on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign Non Foreign Affidavit Under IRC 1445 New Mexico effortlessly

- Find Non Foreign Affidavit Under IRC 1445 New Mexico and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Non Foreign Affidavit Under IRC 1445 New Mexico to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 in New Mexico?

A Non Foreign Affidavit Under IRC 1445 in New Mexico is a legal document that certifies the seller of a property is not a foreign person for tax purposes. This affidavit helps buyers avoid withholding taxes on the sale of real estate. Understanding this document is crucial to ensure compliance with tax regulations in New Mexico.

-

How can airSlate SignNow help me with Non Foreign Affidavit Under IRC 1445 in New Mexico?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning your Non Foreign Affidavit Under IRC 1445 in New Mexico. Our digital tools streamline the document process, ensuring your affidavit is compliant and securely stored. With our solution, you can finalize important real estate transactions efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet different business needs, including options for single users and teams. Our plans are designed to be cost-effective while providing all the necessary features for handling documents like the Non Foreign Affidavit Under IRC 1445 in New Mexico. You can choose a plan that fits your budget and needs.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with numerous applications, including CRMs, cloud storage, and productivity tools. This functionality enhances your workflow when handling the Non Foreign Affidavit Under IRC 1445 in New Mexico and other important documents. Its versatility means you can manage your documents within your preferred software environment.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features like customizable templates, electronic signatures, and secure cloud storage to manage your documents effectively. These tools can simplify the process of preparing a Non Foreign Affidavit Under IRC 1445 in New Mexico, ensuring accuracy and security. Our platform is designed to make document management straightforward for every user.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your documents, including the Non Foreign Affidavit Under IRC 1445 in New Mexico. Our platform complies with legal standards, ensuring that your sensitive information remains confidential and secure throughout the signing process.

-

How long does it take to complete a Non Foreign Affidavit Under IRC 1445 in New Mexico using airSlate SignNow?

Using airSlate SignNow, completing a Non Foreign Affidavit Under IRC 1445 in New Mexico can be done within minutes. The platform simplifies the process, allowing you to fill out the necessary fields and get signatures quickly. Our intuitive interface ensures that both buyers and sellers can complete their documents efficiently.

Get more for Non Foreign Affidavit Under IRC 1445 New Mexico

Find out other Non Foreign Affidavit Under IRC 1445 New Mexico

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy