Living Trust for Husband and Wife with No Children New Mexico Form

What is the Living Trust For Husband And Wife With No Children New Mexico

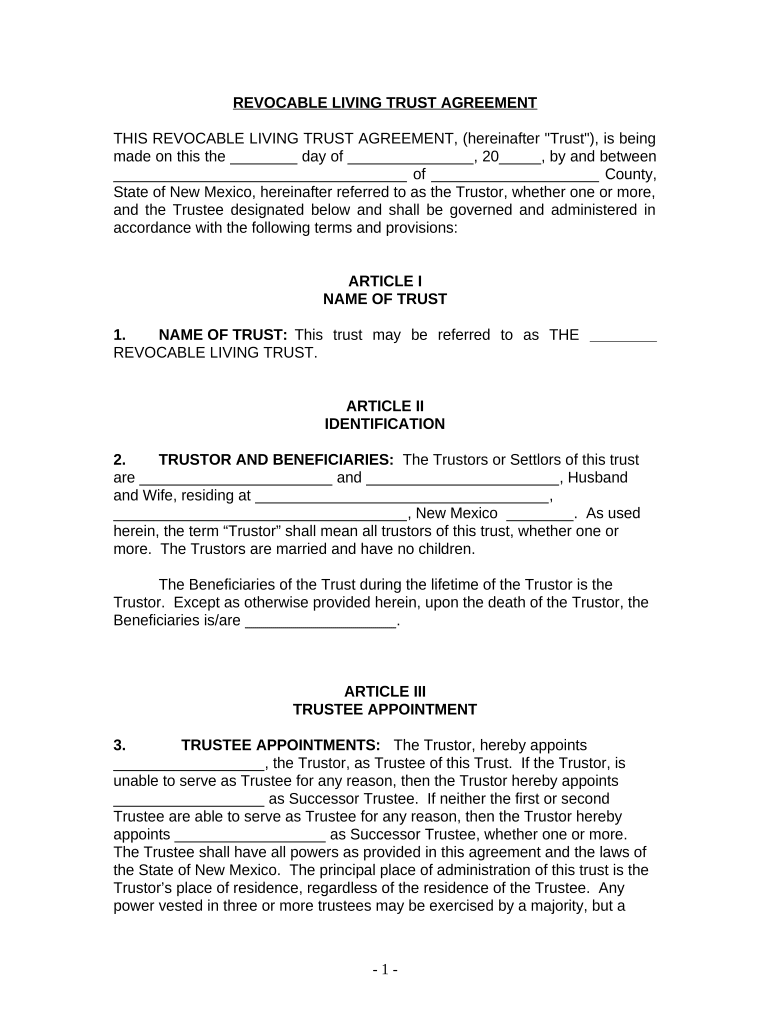

A living trust for husband and wife with no children in New Mexico is a legal arrangement that allows a couple to manage their assets during their lifetime and specify how those assets will be distributed after their passing. This type of trust is particularly beneficial for couples without children, as it simplifies the transfer of property and can help avoid probate, ensuring a smoother transition of assets to designated beneficiaries. The trust can be revocable, meaning the couple can alter its terms or dissolve it at any time, providing flexibility in managing their estate.

Steps to Complete the Living Trust For Husband And Wife With No Children New Mexico

Completing a living trust for husband and wife with no children in New Mexico involves several key steps:

- Gather necessary information: Collect details about all assets, including property, bank accounts, and investments.

- Choose a trustee: Decide who will manage the trust. This could be one or both spouses or a trusted third party.

- Draft the trust document: Outline the terms, including how assets will be managed and distributed. It is advisable to consult with an attorney to ensure compliance with New Mexico laws.

- Sign the document: Both spouses must sign the trust in the presence of a notary public to make it legally binding.

- Fund the trust: Transfer ownership of assets into the trust to ensure they are managed according to the trust's terms.

Legal Use of the Living Trust For Husband And Wife With No Children New Mexico

The legal use of a living trust for husband and wife with no children in New Mexico serves several purposes. It allows couples to maintain control over their assets while providing clear instructions for distribution after death. This trust can also help avoid the lengthy and costly probate process, ensuring that assets are transferred smoothly to beneficiaries. Additionally, it can provide privacy, as trusts do not become public records like wills do. Couples can also use this trust to manage assets in the event of incapacity, ensuring that their financial affairs are handled according to their wishes.

State-Specific Rules for the Living Trust For Husband And Wife With No Children New Mexico

New Mexico has specific rules governing living trusts that couples should be aware of. The trust must be in writing and signed by both spouses in the presence of a notary public. New Mexico law allows for the creation of revocable trusts, which can be modified or revoked at any time by the creators. It is important to ensure that the trust document complies with state laws to be considered valid. Additionally, couples should be aware of any tax implications associated with transferring assets into the trust, as New Mexico has its own regulations regarding estate and inheritance taxes.

Key Elements of the Living Trust For Husband And Wife With No Children New Mexico

Key elements of a living trust for husband and wife with no children in New Mexico include:

- Trustees: The couple can act as co-trustees, managing the trust together.

- Beneficiaries: The trust should clearly define who will inherit the assets, which can include family members, friends, or charities.

- Asset management: The trust document should outline how assets will be managed and any specific instructions for their use.

- Revocation clause: A provision that allows the couple to change or revoke the trust at any time.

How to Obtain the Living Trust For Husband And Wife With No Children New Mexico

To obtain a living trust for husband and wife with no children in New Mexico, couples can follow these steps:

- Consult an attorney: It is advisable to seek legal assistance to ensure the trust meets all legal requirements and adequately reflects the couple's wishes.

- Use online resources: Many legal websites offer templates and guides for creating a living trust. However, ensure these resources comply with New Mexico laws.

- Visit local legal aid offices: Couples may find assistance through local legal aid organizations that can provide guidance on creating a trust.

Quick guide on how to complete living trust for husband and wife with no children new mexico

Complete Living Trust For Husband And Wife With No Children New Mexico effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents promptly without delays. Manage Living Trust For Husband And Wife With No Children New Mexico on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign Living Trust For Husband And Wife With No Children New Mexico with ease

- Find Living Trust For Husband And Wife With No Children New Mexico and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your adjustments.

- Select how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Living Trust For Husband And Wife With No Children New Mexico and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children in New Mexico?

A Living Trust For Husband And Wife With No Children in New Mexico is a legal arrangement that allows couples to manage their assets during their lifetime and automatically transfer them upon death without the need for probate. This type of trust is particularly beneficial for married couples without children, as it simplifies the estate planning process.

-

What are the primary benefits of a Living Trust For Husband And Wife With No Children in New Mexico?

The primary benefits of a Living Trust For Husband And Wife With No Children in New Mexico include avoiding probate, maintaining privacy for your estate, and providing clear instructions on asset distribution. This trust can also help manage your assets if one spouse becomes incapacitated.

-

How does a Living Trust for Husband And Wife With No Children differ from a Will in New Mexico?

A Living Trust For Husband And Wife With No Children in New Mexico avoids probate, meaning your assets can be distributed more quickly and privately compared to a Will, which must go through the probate process. Additionally, a trust can provide ongoing management of assets if needed.

-

What does it cost to create a Living Trust For Husband And Wife With No Children in New Mexico?

The cost to create a Living Trust For Husband And Wife With No Children in New Mexico can vary signNowly based on the complexity of your assets and whether you choose to work with an attorney or use an online service. Generally, costs can range from a few hundred to a couple of thousand dollars, but the long-term savings from avoiding probate can make it a worthwhile investment.

-

Can I customize my Living Trust For Husband And Wife With No Children in New Mexico?

Yes, a Living Trust For Husband And Wife With No Children in New Mexico can be customized to suit your specific wishes and needs. You can specify how assets should be managed and distributed, as well as designate a successor trustee to manage the trust if both spouses are no longer able.

-

Does a Living Trust For Husband And Wife With No Children in New Mexico offer tax benefits?

While a Living Trust For Husband And Wife With No Children in New Mexico does not directly provide tax benefits, it can streamline the transfer of assets upon death, potentially minimizing estate taxes. It's important to consult a tax advisor to understand the overall impact on your specific situation.

-

How can airSlate SignNow assist with creating a Living Trust For Husband And Wife With No Children in New Mexico?

airSlate SignNow provides an easy-to-use, cost-effective solution for managing the documentation related to a Living Trust For Husband And Wife With No Children in New Mexico. Our eSign services can streamline the signing process, making it convenient for couples to finalize their estate planning documents electronically.

Get more for Living Trust For Husband And Wife With No Children New Mexico

- Child welfare case compendium unc school of government form

- Florida form death

- Print secretary of statedealer recovery trust fun form

- Green certification form template

- Patient information request for access to phi

- Online m ed in health and wellness educationace form

- Ameren aims grant application pdf peoria county form

- The praxis tests information bulletin 202223 ets

Find out other Living Trust For Husband And Wife With No Children New Mexico

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy