Vesco Foods Application Form 2009-2026

What is the Vesco Foods Application Form

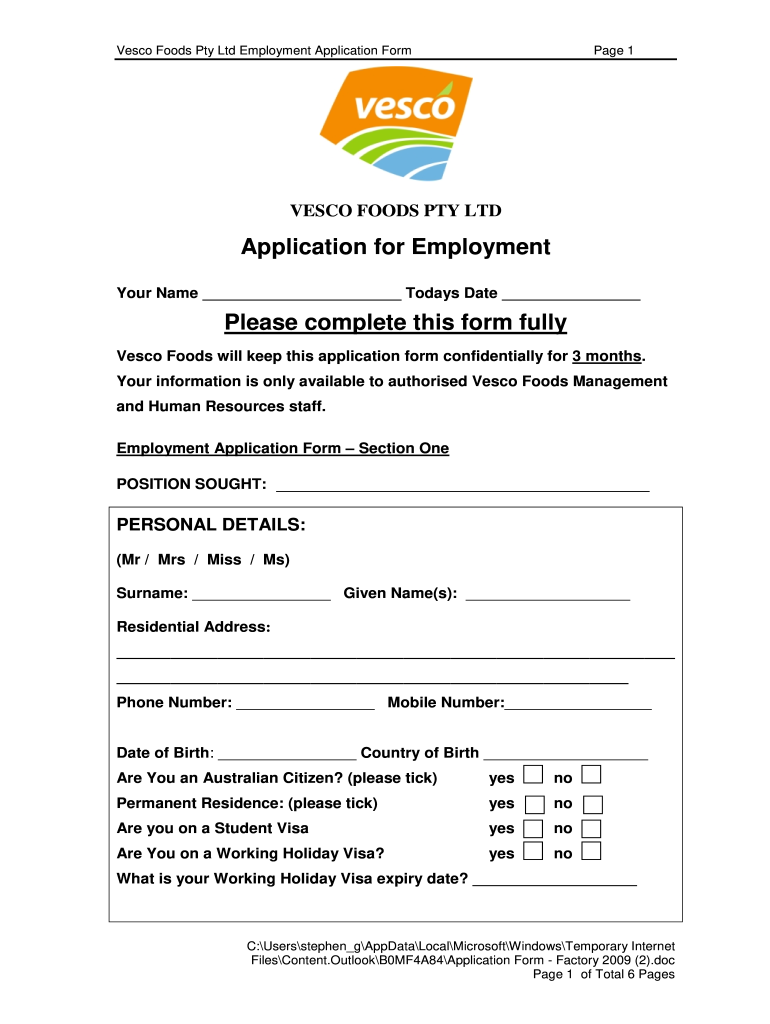

The Vesco Foods Application Form is a crucial document for individuals seeking employment with Vesco Foods, a prominent company in the food industry. This form collects essential information about applicants, including personal details, work history, and qualifications. It serves as the first step in the hiring process, allowing Vesco Foods to assess candidates for various job roles within the organization.

How to use the Vesco Foods Application Form

Using the Vesco Foods Application Form involves several straightforward steps. Applicants should first download the form from the official Vesco Foods website or obtain a physical copy from a local branch. Once in possession of the form, individuals need to fill it out completely and accurately, ensuring that all required fields are addressed. After completing the form, applicants should review their entries for any errors before submitting it either online or in person, depending on the submission guidelines provided by Vesco Foods.

Steps to complete the Vesco Foods Application Form

Completing the Vesco Foods Application Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary personal information, including your full name, address, and contact details.

- List your employment history, including previous job titles, employers, and dates of employment.

- Detail your educational background, including degrees earned and institutions attended.

- Provide references who can vouch for your qualifications and character.

- Review the form for accuracy and completeness before submitting.

Legal use of the Vesco Foods Application Form

The Vesco Foods Application Form must be used in accordance with legal guidelines to ensure compliance with employment laws. This includes adhering to anti-discrimination laws and ensuring that the information collected is used solely for the purpose of evaluating candidates for employment. Additionally, applicants should be aware that providing false information on the application can result in disqualification from the hiring process or termination if discovered after employment begins.

Eligibility Criteria

To be eligible for employment with Vesco Foods, applicants must meet specific criteria outlined in the application form. This typically includes being of legal working age, possessing the necessary qualifications for the desired position, and having the right to work in the United States. Some positions may also require specific certifications or experience in the food industry, which should be clearly indicated on the application form.

Form Submission Methods

Applicants can submit the Vesco Foods Application Form through various methods. The most common methods include:

- Online submission via the Vesco Foods careers portal.

- Mailing a printed copy of the application to the designated human resources address.

- Delivering the application in person to a local Vesco Foods branch.

Key elements of the Vesco Foods Application Form

The Vesco Foods Application Form includes several key elements that are essential for a complete application. These elements typically consist of:

- Personal information: Name, address, phone number, and email.

- Employment history: Previous jobs, responsibilities, and duration of employment.

- Education: Schools attended, degrees earned, and relevant coursework.

- References: Contact information for individuals who can provide professional recommendations.

- Signature: A declaration confirming the accuracy of the information provided.

Quick guide on how to complete bapplicationb for employment please complete this bb vesco foods

The optimal method to locate and sign Vesco Foods Application Form

On the scale of an entire organization, ineffective workflows surrounding document approval can consume signNow working hours. Signing documents like Vesco Foods Application Form is an inherent aspect of operations across all sectors, which is why the effectiveness of each agreement’s lifecycle heavily impacts the company’s overall productivity. With airSlate SignNow, signing your Vesco Foods Application Form can be both simple and swift. You will discover with this platform the latest version of nearly any form. Even better, you can sign it immediately without needing to install external applications on your computer or printing hard copies.

Steps to obtain and sign your Vesco Foods Application Form

- Browse our collection by category or utilize the search bar to identify the form you require.

- View the form preview by clicking on Learn more to confirm it’s the correct one.

- Click Get form to begin editing right away.

- Fill out your form and include any necessary information using the toolbar.

- Once completed, click the Sign tool to authenticate your Vesco Foods Application Form.

- Select the signature method that is most suitable for you: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to conclude editing and proceed to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to manage your documentation effectively. You can find, complete, modify, and even send your Vesco Foods Application Form within one tab without any complications. Optimize your workflows with a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

-

I'm the founder of a new startup and recently I heard that when I employ someone, I need to fill out form I-9 for them. The employee needs to fill it out, but I also need to check their identity and status. Is it true that I am required to do that? Is it true that all companies, even big companies that employ thousands of people, do this?

In addition to both you and the employee filling out the form, you need to do it within a certain time period, usually the first day of work for the employee. And as mentioned, you do need to keep them on file in case of an audit. You need to examine their eligibility documents (most often their passport, or their driver's license and social security card, and the list of acceptable documents is included on the form). You just need to make sure it looks like it's the same person and that they aren't obvious fakes.You can find the forms as well as instructions on how to fill them out here: Employment Eligibility Verification | USCIS On the plus side, I-9's aren't hard or time-consuming to do. Once you get the hang of it, it only takes a few minutes.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

I am being made redundant and my employer want me to help them fill out tax forms after I leave, can I charge them a consultancy fee for this?

You are not obligated to do work for an employer after your last date of employment. Generally, if you are asked to do work for them after you leave, you should:determine if you are interested since this will impact time you can give to a job searchbe polite however you answer because being asked to do additional work for them does reflect well on your work with themhave some idea of what you would do the work for. Unless you have access to medical or other lost benefits, you would typically expect to be paid somewhat more than you were paid in salary (because you now have to provide your own benefits). ask them to make you an offer and put it in writing including what the responsibilities will be, the dates they anticipate you will be needed, will you have to work through a contract provider, etc. Be sure this documentation includes how and on what timing you will be paid (do you have to invoice them, etc.) Once you are doing this job, work hard specifically on your responsibilities. If they ask for additional types of work, remind them politely of what your documentation requested, but indicate you'll be glad to do it as long as a change in documentation is promptly done (and you should take responsibility to make sure that happens).So, bottom line, negotiate the fee or payment and complete all the documentation before you do the work, so that everythi is clear to you and your former employer.Thanks for the A2A.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

I have a class lesson assessment form that I need to have filled out for 75 lessons. The form will be exactly the same except for the course number. How would you do this?

Another way would be to use the option of getting pre-filled answers with the course numbers entered. A custom URL is created and the form would collect the answers for all of the courses in the same spreadsheet. Not sure if that creates another problem for you, but you could sort OR filter the sheet once all the forms had been submitted. This is what the URL would look like for a Text Box https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048=COURSE+NUMBER+75 The nice thing about this is you can just change the part of the URL that Contains "COURSE+NUMBER+75" to a different number...SO for course number 1 it would be https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048=COURSE+NUMBER+1This is what the URL would look like for a Text Box radio button, same concept. https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048&entry.1934317001=Option+1 OR https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048&entry.1934317001=Option+6The Google Doc would look like this Quora pre-filled form I'm not sure if this helps at all or makes too complicated and prone to mistakes.

Create this form in 5 minutes!

How to create an eSignature for the bapplicationb for employment please complete this bb vesco foods

How to generate an eSignature for your Bapplicationb For Employment Please Complete This Bb Vesco Foods in the online mode

How to make an electronic signature for the Bapplicationb For Employment Please Complete This Bb Vesco Foods in Google Chrome

How to create an eSignature for putting it on the Bapplicationb For Employment Please Complete This Bb Vesco Foods in Gmail

How to generate an eSignature for the Bapplicationb For Employment Please Complete This Bb Vesco Foods right from your smart phone

How to make an eSignature for the Bapplicationb For Employment Please Complete This Bb Vesco Foods on iOS

How to create an electronic signature for the Bapplicationb For Employment Please Complete This Bb Vesco Foods on Android

People also ask

-

What types of jobs are available at Vesco Foods?

Vesco Foods jobs range from warehouse positions to management roles, catering to various skill sets and experience levels. Our career opportunities are designed to help individuals grow in a dynamic work environment, focusing on the food distribution sector.

-

How can I apply for Vesco Foods jobs?

To apply for Vesco Foods jobs, you can visit our careers page where all current openings are listed. Interested applicants can submit their resumes online, making the application process quick and straightforward.

-

What benefits do Vesco Foods jobs offer?

Vesco Foods jobs come with a comprehensive benefits package that includes health insurance, retirement plans, and paid time off. We believe in supporting our employees, ensuring they have access to resources that promote both personal and professional wellbeing.

-

Are there opportunities for career advancement in Vesco Foods jobs?

Yes, Vesco Foods emphasizes professional growth, offering various training programs and mentorship opportunities. Employees are encouraged to pursue promotions and develop their skills internally, fostering a culture of growth.

-

What is the work environment like for Vesco Foods jobs?

The work environment for Vesco Foods jobs is collaborative and supportive, prioritizing teamwork and respect. We foster an inclusive atmosphere where employees can thrive and contribute to the company's success.

-

How does Vesco Foods ensure employee safety?

Employee safety is a top priority at Vesco Foods. We implement strict safety protocols and provide regular training to ensure that all employees understand and comply with workplace safety standards.

-

What qualifications are required for Vesco Foods jobs?

Qualifications for Vesco Foods jobs vary depending on the position. Basic requirements typically include a high school diploma or equivalent, while specialized roles may require specific experience or certifications to ensure the best fit for the job.

Get more for Vesco Foods Application Form

- Dc notice 497301526 form

- Deed of distribution personal representative to an individual district of columbia form

- District of columbia llc form

- Demand for notice of satisfaction individual district of columbia form

- Dc corporation search form

- Dc law case form

- Dc judgment form

- Letter from landlord to tenant as notice to remove wild animals in premises district of columbia form

Find out other Vesco Foods Application Form

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now