Satisfaction Release of Mortgage by Mortgagee Individual Lender or Holder New Mexico Form

What is the Satisfaction Release of Mortgage by Mortgagee Individual Lender or Holder New Mexico

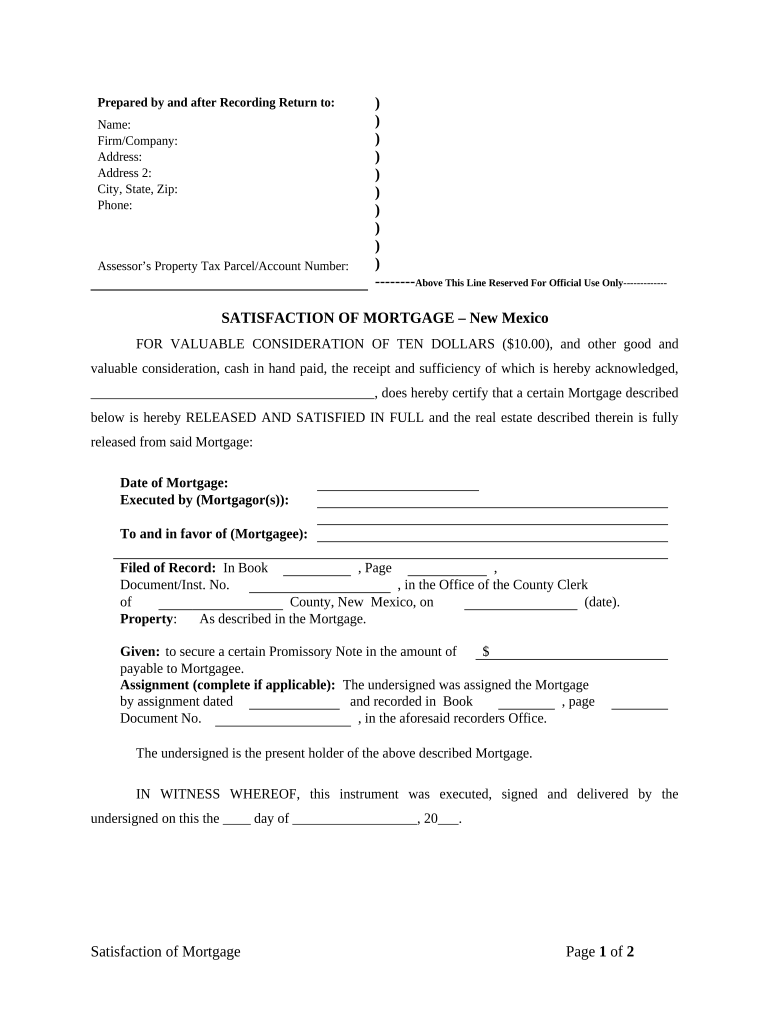

The Satisfaction Release of Mortgage by Mortgagee Individual Lender or Holder in New Mexico is a legal document that signifies the full repayment of a mortgage loan. This form is essential for homeowners who have completed their mortgage obligations, as it officially releases the lender's claim on the property. Once filed, it serves as proof that the mortgage has been satisfied, allowing the homeowner to clear their title and potentially sell or refinance the property without encumbrances.

How to Use the Satisfaction Release of Mortgage by Mortgagee Individual Lender or Holder New Mexico

Utilizing the Satisfaction Release of Mortgage by Mortgagee Individual Lender or Holder in New Mexico involves several steps. First, the lender must complete the form accurately, ensuring all required information is included, such as the borrower's details and the mortgage account number. Once the form is filled out, it should be signed by the lender or authorized representative. The completed document must then be filed with the appropriate county clerk's office to make the release official.

Steps to Complete the Satisfaction Release of Mortgage by Mortgagee Individual Lender or Holder New Mexico

Completing the Satisfaction Release of Mortgage by Mortgagee Individual Lender or Holder requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the mortgage account number, property address, and borrower details.

- Fill out the form, ensuring all fields are completed accurately.

- Sign the form in the designated area, ensuring that the signature matches the name of the lender or authorized representative.

- File the completed form with the county clerk's office where the mortgage was originally recorded.

- Keep a copy of the filed document for your records.

Key Elements of the Satisfaction Release of Mortgage by Mortgagee Individual Lender or Holder New Mexico

Several key elements must be included in the Satisfaction Release of Mortgage to ensure its validity. These elements typically include:

- The name and address of the mortgagee (lender).

- The name and address of the mortgagor (borrower).

- The legal description of the property.

- The mortgage account number.

- The date of the mortgage and the date of satisfaction.

- The signature of the mortgagee or authorized representative.

Legal Use of the Satisfaction Release of Mortgage by Mortgagee Individual Lender or Holder New Mexico

The legal use of the Satisfaction Release of Mortgage in New Mexico is crucial for protecting both the lender and the borrower. This document must be executed in accordance with state laws to ensure that it is legally binding. By filing this form, the lender officially relinquishes their claim on the property, which is vital for the homeowner to establish clear ownership. Failure to file this document may result in ongoing liabilities for the borrower, as the lender may still appear to hold a claim on the property.

State-Specific Rules for the Satisfaction Release of Mortgage by Mortgagee Individual Lender or Holder New Mexico

New Mexico has specific rules regarding the Satisfaction Release of Mortgage that must be adhered to. These rules include:

- The form must be filed within a certain timeframe after the mortgage has been paid in full.

- It must be recorded in the county where the property is located to be effective.

- Any fees associated with filing the form must be paid at the time of submission.

Quick guide on how to complete satisfaction release of mortgage by mortgagee individual lender or holder new mexico

Effortlessly Prepare Satisfaction Release Of Mortgage By Mortgagee Individual Lender Or Holder New Mexico on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage Satisfaction Release Of Mortgage By Mortgagee Individual Lender Or Holder New Mexico on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and eSign Satisfaction Release Of Mortgage By Mortgagee Individual Lender Or Holder New Mexico Seamlessly

- Locate Satisfaction Release Of Mortgage By Mortgagee Individual Lender Or Holder New Mexico and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to send your document, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Satisfaction Release Of Mortgage By Mortgagee Individual Lender Or Holder New Mexico and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Satisfaction Release of Mortgage by Mortgagee for Individual Lender or Holder in New Mexico?

A Satisfaction Release of Mortgage by Mortgagee for Individual Lender or Holder in New Mexico is a legal document that confirms the full repayment of a loan secured by a mortgage. This document releases the borrower from any further obligation and provides proof that the mortgage is no longer in effect. It is essential for property owners to obtain this document to clear their title.

-

How can airSlate SignNow help with processing a Satisfaction Release of Mortgage?

airSlate SignNow streamlines the process of creating and signing a Satisfaction Release of Mortgage by allowing users to easily draft, send, and eSign documents. Our platform simplifies the workflow, ensuring that both lenders and borrowers can execute necessary documents quickly and securely. This saves time and reduces hassle compared to traditional methods.

-

What are the pricing options for using airSlate SignNow for mortgage-related documentation?

airSlate SignNow offers flexible pricing plans to accommodate different user needs, ranging from individuals to businesses handling numerous transactions. Each plan provides various features, ensuring you get the most value while processing a Satisfaction Release of Mortgage by Mortgagee for Individual Lender or Holder in New Mexico. You can start with a free trial to assess our service.

-

What features does airSlate SignNow offer for managing mortgage documents?

airSlate SignNow provides a range of features designed to enhance document management, including customizable templates, secure eSigning, and automated workflows. Users have access to real-time tracking and notifications, making it easy to manage the Satisfaction Release of Mortgage by Mortgagee for Individual Lender or Holder in New Mexico. These features ensure a smooth and efficient document process.

-

Is airSlate SignNow compliant with New Mexico's regulations regarding mortgage documents?

Yes, airSlate SignNow is compliant with all relevant regulations in New Mexico concerning the Satisfaction Release of Mortgage by Mortgagee for Individual Lender or Holder. Our platform adheres to legal standards, ensuring that all eSigned documents are valid and enforceable in the state. We continuously update our services to meet evolving legal requirements.

-

How long does it take to complete a Satisfaction Release of Mortgage using airSlate SignNow?

Using airSlate SignNow, completing a Satisfaction Release of Mortgage can take just minutes, depending on your preparation and document readiness. Our user-friendly interface allows for quick drafting, eSigning, and sending documents, streamlining the entire process signNowly. This efficiency benefits both lenders and borrowers in New Mexico.

-

Can I integrate airSlate SignNow with other software for mortgage processing?

Yes, airSlate SignNow offers integrations with various software platforms commonly used in the mortgage industry. This includes CRM systems, document management tools, and more, allowing you to seamlessly incorporate the Satisfaction Release of Mortgage by Mortgagee for Individual Lender or Holder in New Mexico into your existing workflows. Effortless integration enhances productivity and collaboration.

Get more for Satisfaction Release Of Mortgage By Mortgagee Individual Lender Or Holder New Mexico

- Application forms bureau of internal

- What is a metlife total control account tca form

- Imm 5257 e application for visitor visa temporary resident visa imm5257e pdf form

- Vaccines for children program provider agreement nc form

- Report of divorce annulment or dissolution of marriage form 3907

- 1fdv first circuit affidavit of plaintiff form

- Www desotocountyms gov documentcenter viewcover sheet court identificationdocket desoto county ms form

- Division of liquor control 6606 tussing road p o box form

Find out other Satisfaction Release Of Mortgage By Mortgagee Individual Lender Or Holder New Mexico

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now