Grant, Bargain, Sale Deed from Corporation to Husband and Wife Nevada Form

What is the Grant, Bargain, Sale Deed From Corporation To Husband And Wife Nevada

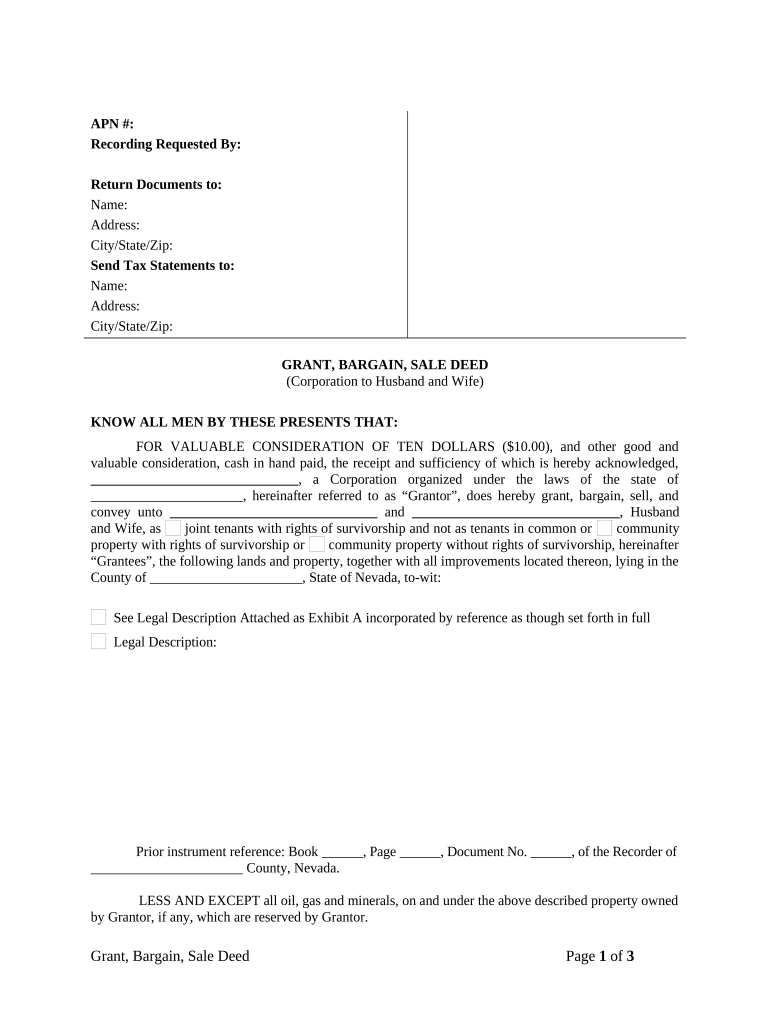

The Grant, Bargain, Sale Deed from Corporation to Husband and Wife in Nevada is a legal document that facilitates the transfer of property ownership from a corporation to a married couple. This type of deed is particularly significant in real estate transactions, as it outlines the specifics of the property being transferred, including its legal description and the parties involved. The deed serves to convey the title of the property, ensuring that the husband and wife become the rightful owners. It is important to note that this deed includes warranties from the corporation, affirming that the property is free of encumbrances, except those explicitly stated in the document.

Key Elements of the Grant, Bargain, Sale Deed From Corporation To Husband And Wife Nevada

Several key elements are essential for the validity of the Grant, Bargain, Sale Deed from Corporation to Husband and Wife in Nevada. These elements include:

- Identification of Parties: The deed must clearly identify the corporation transferring the property and the husband and wife receiving it.

- Property Description: A detailed legal description of the property must be included to avoid any ambiguity regarding what is being transferred.

- Consideration: The deed should state the consideration or price paid for the property, which can be a nominal amount in many cases.

- Signatures: The deed must be signed by authorized representatives of the corporation and both spouses, ensuring that all parties agree to the terms.

- Notarization: To enhance the deed's legal standing, it should be notarized, providing an additional layer of authenticity.

Steps to Complete the Grant, Bargain, Sale Deed From Corporation To Husband And Wife Nevada

Completing the Grant, Bargain, Sale Deed from Corporation to Husband and Wife in Nevada involves several important steps:

- Gather Information: Collect all necessary information about the property, including its legal description and the identities of the parties involved.

- Draft the Deed: Prepare the deed using a standard template or with the assistance of legal counsel to ensure compliance with Nevada laws.

- Review the Document: Carefully review the deed for accuracy and completeness, confirming that all required elements are included.

- Sign the Deed: Have the authorized representative of the corporation and both spouses sign the document in the presence of a notary public.

- File the Deed: Submit the signed and notarized deed to the county recorder's office where the property is located to officially record the transfer.

Legal Use of the Grant, Bargain, Sale Deed From Corporation To Husband And Wife Nevada

The legal use of the Grant, Bargain, Sale Deed from Corporation to Husband and Wife in Nevada is crucial for establishing ownership and protecting the rights of the new owners. This deed is recognized by the state as a legitimate means of transferring property, provided it meets all legal requirements. It serves as public notice of the transfer, which is important for future transactions involving the property. Additionally, the deed can be referenced in any legal disputes regarding property ownership, making it a vital document for the husband and wife.

How to Obtain the Grant, Bargain, Sale Deed From Corporation To Husband And Wife Nevada

Obtaining the Grant, Bargain, Sale Deed from Corporation to Husband and Wife in Nevada can be done through several avenues:

- Legal Assistance: Engaging a real estate attorney can provide guidance in drafting and executing the deed correctly.

- Online Resources: Various online legal services offer templates and guidance for creating a Grant, Bargain, Sale Deed.

- County Recorder's Office: The local county recorder's office may provide forms and information on the requirements for filing the deed.

State-Specific Rules for the Grant, Bargain, Sale Deed From Corporation To Husband And Wife Nevada

Nevada has specific rules governing the Grant, Bargain, Sale Deed from Corporation to Husband and Wife that must be adhered to for the deed to be valid. These rules include:

- Recording Requirements: The deed must be recorded with the county recorder's office within a certain timeframe to be effective against third parties.

- Notarization: The signatures on the deed must be notarized to ensure authenticity and prevent fraud.

- Tax Considerations: There may be tax implications associated with the transfer, such as transfer taxes that need to be addressed during the transaction.

Quick guide on how to complete grant bargain sale deed from corporation to husband and wife nevada

Effortlessly Prepare Grant, Bargain, Sale Deed From Corporation To Husband And Wife Nevada on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documentation, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any hold-ups. Handle Grant, Bargain, Sale Deed From Corporation To Husband And Wife Nevada on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to Edit and eSign Grant, Bargain, Sale Deed From Corporation To Husband And Wife Nevada with Ease

- Obtain Grant, Bargain, Sale Deed From Corporation To Husband And Wife Nevada and then click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of the documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your updates.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Grant, Bargain, Sale Deed From Corporation To Husband And Wife Nevada to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada?

A Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada is a legal document used to transfer property ownership from a corporation to a married couple. This type of deed ensures that both parties have clear title to the property and outlines the terms of the transfer. Utilizing airSlate SignNow can simplify the eSigning process for this deed, making transactions quicker and more efficient.

-

How much does it cost to create a Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada with airSlate SignNow?

The cost for creating a Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada using airSlate SignNow varies based on your specific needs and subscription plan. However, airSlate SignNow offers competitive pricing, ensuring a cost-effective solution for document creation and eSigning. Explore our pricing plans for detailed options tailored to your business.

-

What features does airSlate SignNow offer for creating a Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada?

airSlate SignNow provides a user-friendly interface, customizable templates, and secure eSigning capabilities for creating a Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada. Our platform also includes document tracking features and integrations with popular applications, making the process seamless and efficient. Leverage these features to streamline your document management.

-

Can I customize the Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada using airSlate SignNow?

Yes, you can easily customize your Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada using airSlate SignNow's document editor. This allows you to include specific terms and conditions relevant to your situation. With our flexible platform, you can ensure the deed meets all legal requirements and your personal preferences.

-

Is the Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada legally binding?

Yes, a Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada is legally binding once it is properly executed and signed. Using airSlate SignNow's electronic signature feature ensures compliance with Nevada laws regarding electronic documents. This provides peace of mind knowing that your transaction is valid and enforceable.

-

How does airSlate SignNow ensure the security of my Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada?

airSlate SignNow prioritizes security with data encryption, secure cloud storage, and compliance with industry standards. These measures protect your Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada from unauthorized access. You can confidently manage your documents knowing that our platform safeguards sensitive information.

-

Can I obtain support while creating my Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada?

Absolutely! airSlate SignNow offers customer support to assist you with creating your Grant, Bargain, Sale Deed From Corporation To Husband And Wife in Nevada. Our support team is available through multiple channels to answer questions, provide guidance, and help you navigate the document creation process effortlessly.

Get more for Grant, Bargain, Sale Deed From Corporation To Husband And Wife Nevada

- Any of the providers of information that appear on the web site is engaged in rendering legal accounting or other

- Conversion from one entity to another jeffreyobrienesq com form

- Acceptable distance records for audit form

- Car repair contract template form

- Controlled dangerous substance registration initial application form

- Dss 6240 form

- Asbestos accreditation application form

- Name address and telephone number of attorney or form

Find out other Grant, Bargain, Sale Deed From Corporation To Husband And Wife Nevada

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast