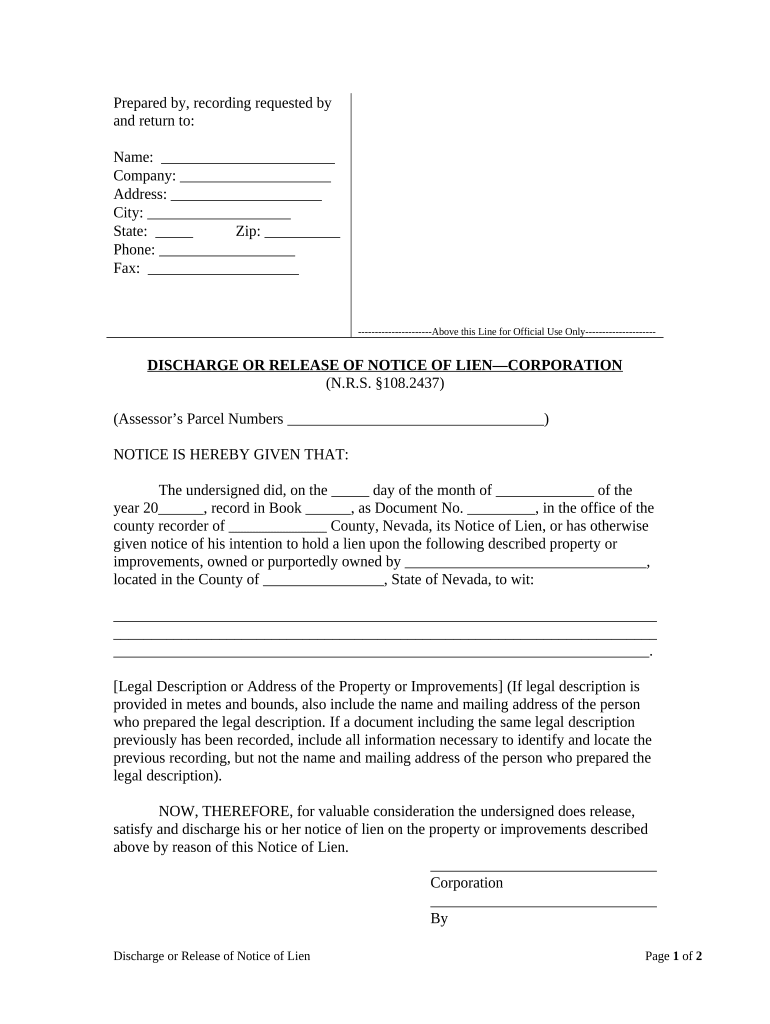

Nevada Lien Form

What is the Nevada Lien

The Nevada lien is a legal claim against a property or asset that serves as security for a debt or obligation. This type of lien can arise from various situations, such as unpaid taxes, loans, or contractor services. When a lien is placed on a property, it indicates that the property owner owes a certain amount to a creditor. In Nevada, liens can be classified into several categories, including mechanic's liens, tax liens, and judgment liens. Understanding the nature of the lien is crucial for both property owners and creditors to ensure compliance with state laws and regulations.

Steps to Complete the Nevada Lien

Completing the Nevada lien form involves several important steps to ensure that the document is valid and legally binding. Here’s a brief overview of the process:

- Gather Required Information: Collect all necessary details, including the debtor's name, property description, and the amount owed.

- Fill Out the Form: Accurately complete the Nevada lien form, ensuring that all information is correct and legible.

- Obtain Signatures: Depending on the type of lien, signatures from relevant parties may be required to validate the document.

- File the Form: Submit the completed form to the appropriate county recorder's office in Nevada, either in person or online.

- Pay Filing Fees: Ensure that any required fees are paid at the time of filing to avoid delays.

Legal Use of the Nevada Lien

The legal use of a Nevada lien is governed by state laws that dictate how and when liens can be placed on properties. A lien must be filed correctly to be enforceable, and it must be based on a legitimate debt or obligation. For instance, a mechanic's lien can be placed when a contractor has not been paid for services rendered. It is essential to follow all legal requirements, including filing deadlines and proper documentation, to protect the rights of both the creditor and the property owner.

Required Documents

When filing a Nevada lien, certain documents are necessary to support the claim. These documents may include:

- Proof of Debt: Documentation showing the amount owed, such as invoices or contracts.

- Property Description: A detailed description of the property subject to the lien, including its address and parcel number.

- Affidavit: A sworn statement affirming the validity of the debt and the lien.

- Filing Form: The official Nevada lien form that must be completed and submitted.

Who Issues the Form

The Nevada lien form is typically issued by the county recorder's office in the jurisdiction where the property is located. Each county may have its own specific requirements and procedures for filing liens, so it is important to check with the local office for any additional forms or information needed. In some cases, legal professionals may assist in preparing and filing the lien to ensure compliance with all state regulations.

Examples of Using the Nevada Lien

There are several scenarios where a Nevada lien may be utilized, including:

- Mechanic's Lien: A contractor who completes work on a property but is not paid can file a mechanic's lien to secure payment.

- Tax Lien: The state may place a lien on a property for unpaid property taxes, giving the government a claim to the property until the taxes are settled.

- Judgment Lien: A creditor may file a lien after winning a court judgment against a debtor, allowing them to claim the debtor's property if the debt remains unpaid.

Quick guide on how to complete nevada lien 497320630

Finalize Nevada Lien seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to draft, modify, and eSign your documents swiftly without delays. Manage Nevada Lien on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest method to modify and eSign Nevada Lien effortlessly

- Obtain Nevada Lien and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or hide sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and eSign Nevada Lien while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the NV lien form and its purpose?

The NV lien form is a legal document used in Nevada to establish a lien on a property. It serves to protect the interests of creditors and ensure that they are compensated in case of default. Properly filling out this form is crucial for securing your claim.

-

How can airSlate SignNow help with the NV lien form?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing and signing the NV lien form. With our eSignature solution, you can quickly fill out the form, send it for signatures, and store it securely—all in one place.

-

What features are available for managing the NV lien form with airSlate SignNow?

With airSlate SignNow, you can easily create, fill out, and track the NV lien form. Key features include template creation, automated reminders for signers, secure cloud storage, and the ability to integrate with various applications to streamline your workflow.

-

Is there a cost associated with using airSlate SignNow for the NV lien form?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. Depending on the plan you choose, you can access features specifically designed for managing documents like the NV lien form, providing a cost-effective solution for your eSigning needs.

-

Can I integrate airSlate SignNow with other software for NV lien form management?

Absolutely! airSlate SignNow supports integrations with various third-party applications, making it easy to incorporate the NV lien form into your existing workflows. This enhances productivity and ensures seamless document management.

-

What are the benefits of using airSlate SignNow for the NV lien form?

Using airSlate SignNow for the NV lien form offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform ensures that your documents are signed and processed quickly while maintaining compliance with legal requirements.

-

How secure is my NV lien form when using airSlate SignNow?

airSlate SignNow prioritizes your document security. Your NV lien form and other sensitive information are protected with advanced encryption, secure data storage, and comprehensive compliance with industry regulations. This ensures that your documents remain safe and confidential.

Get more for Nevada Lien

- 2nd grade homophones worksheet form

- State of delaware division of motor vehicles perso form

- Care coordination request form

- Download sonic job application form fillable pdf wikidownload

- Securities and futures licensing and conduct of form

- Fillable online refund request form simply energy fax

- Cherokee county school district athletic parental form

- Pur 102 form

Find out other Nevada Lien

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter