Nv Lien Form

What is the nv lien?

The nv lien is a legal document that establishes a claim against property or assets. It is often used in financial transactions to secure a loan or credit by providing assurance to the lender that they have a right to the property in case of default. This form is particularly relevant in the context of real estate and personal property, as it helps protect the interests of creditors while also providing a clear record of obligations. Understanding the nv lien is essential for both borrowers and lenders to navigate the complexities of secured financing.

How to obtain the nv lien

Obtaining the nv lien typically involves a few straightforward steps. First, you need to identify the appropriate state agency or office that handles lien filings. In many cases, this is the Secretary of State or a similar governmental body. Next, you will need to complete the necessary application form and provide any required documentation, such as proof of the underlying obligation. After submitting the application, there may be a processing fee. Once approved, the nv lien will be recorded and made part of the public record, ensuring that it is enforceable against the property in question.

Steps to complete the nv lien

Completing the nv lien involves several key steps to ensure that the document is legally binding and correctly filed. Begin by gathering all necessary information, including details about the borrower, lender, and the property involved. Next, accurately fill out the nv lien form, ensuring that all fields are completed without errors. Once the form is filled, review it for accuracy and completeness. After verifying the information, submit the form to the appropriate state office along with any required fees. Finally, keep a copy of the submitted form for your records, as it serves as proof of the lien's existence.

Legal use of the nv lien

The legal use of the nv lien is crucial for protecting the rights of creditors. When properly executed, it provides a legal claim against the property, allowing the lender to recover their investment in the event of default. It is essential to comply with state laws and regulations regarding lien filings, as improper execution can render the lien invalid. Additionally, understanding the implications of the nv lien can help both lenders and borrowers navigate their rights and obligations, ensuring that all parties are aware of the potential consequences of default.

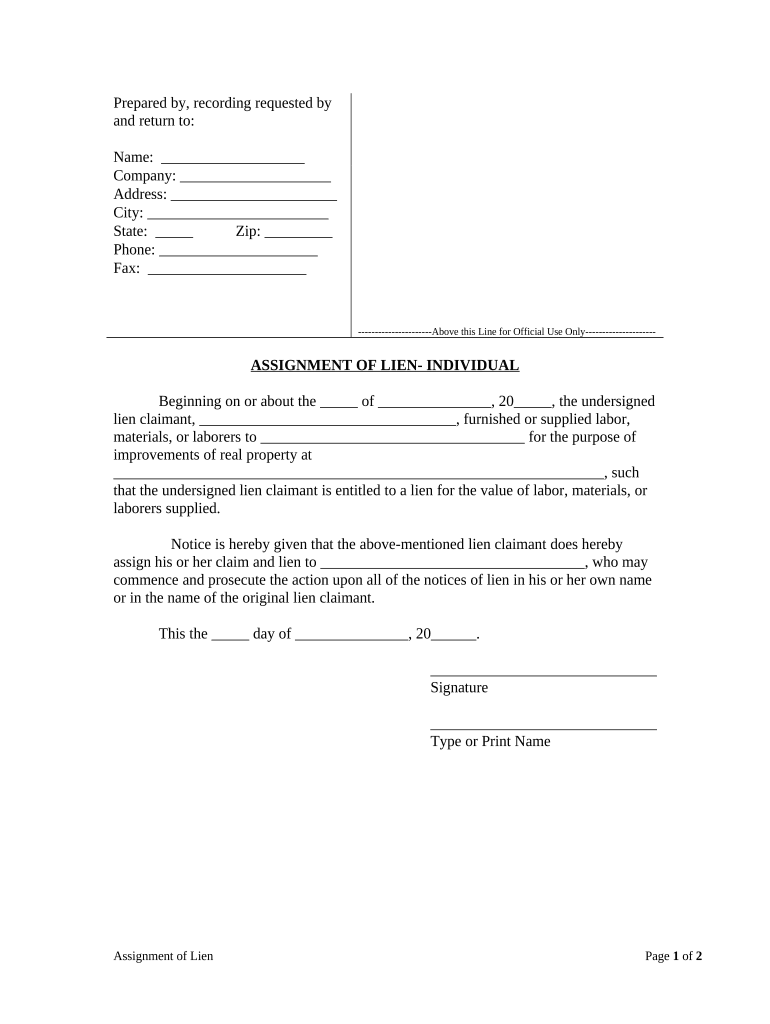

Key elements of the nv lien

Several key elements must be included in the nv lien to ensure its validity. These elements typically include:

- The names and addresses of the borrower and lender

- A clear description of the property subject to the lien

- The amount secured by the lien

- The date of the agreement

- Signatures of both parties involved

Including these elements helps establish a clear and enforceable claim against the property, protecting the interests of the lender while also informing the borrower of their obligations.

State-specific rules for the nv lien

Each state has its own rules and regulations governing the nv lien, which can affect how the form is completed and filed. It is important to familiarize yourself with the specific requirements in your state, as these can include variations in the filing process, required documentation, and fees. Some states may also have additional provisions regarding the enforcement of liens, such as timelines for filing or specific disclosures that must be made to the borrower. Consulting with a legal professional or the appropriate state office can provide clarity on these state-specific rules.

Quick guide on how to complete nv lien 497320699

Complete Nv Lien effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed materials, as you can acquire the necessary form and securely keep it online. airSlate SignNow furnishes you with all the resources required to create, alter, and electronically sign your documents swiftly without delays. Manage Nv Lien on any platform using airSlate SignNow Android or iOS applications and streamline any document-based procedure today.

How to modify and eSign Nv Lien with ease

- Locate Nv Lien and then click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Modify and eSign Nv Lien and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an NV lien and how does it work?

An NV lien is a legal claim placed on property in Nevada, ensuring that the debt is secured. When you use airSlate SignNow to manage documents, you can easily incorporate and track NV liens, ensuring all necessary signatures are obtained efficiently.

-

How can airSlate SignNow help with NV lien documentation?

With airSlate SignNow, you can seamlessly create, send, and eSign NV lien documents. Our platform ensures a smooth workflow, allowing you to manage your lien documents with confidence and ease.

-

What are the costs associated with using airSlate SignNow for NV lien processing?

airSlate SignNow offers a cost-effective solution for NV lien processing with flexible pricing plans. Whether you’re a small business or a large enterprise, you will find a package that suits your needs and budget perfectly.

-

Are there features specifically for managing NV liens in airSlate SignNow?

Yes, airSlate SignNow offers features tailored for NV lien management, such as customizable templates and automated reminders. These features enhance efficiency, allowing you to focus on other important aspects of your business.

-

Can I integrate airSlate SignNow with other tools for NV lien management?

Absolutely! airSlate SignNow integrates easily with popular CRMs and document management systems. This means you can enhance your NV lien management process while maintaining your preferred tools and workflows.

-

What are the benefits of using airSlate SignNow for NV lien contracts?

Using airSlate SignNow for NV lien contracts improves efficiency and compliance. The ability to track the status of your documents in real-time ensures that you can manage your agreements effectively, reducing the risk of delays.

-

Is it safe to store NV lien documents on airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your NV lien documents. Our platform employs advanced encryption and security measures to keep your sensitive information safe from unauthorized access.

Get more for Nv Lien

- Form wv dfa lieap 1 fill online printable

- Certificate contract template form

- Request for statement of qualifications rfsq no 606 sh form

- Ps 3150 tangible capital assets summary of key form

- Faqshow do i apply for medicaid form

- Dhhs form 3218 d

- Arizona department of health services revised statutes form

- Sd form 827 quotconfirmation of request for reasonable

Find out other Nv Lien

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors