Non Foreign Affidavit under IRC 1445 Nevada Form

What is the Non Foreign Affidavit Under IRC 1445 Nevada

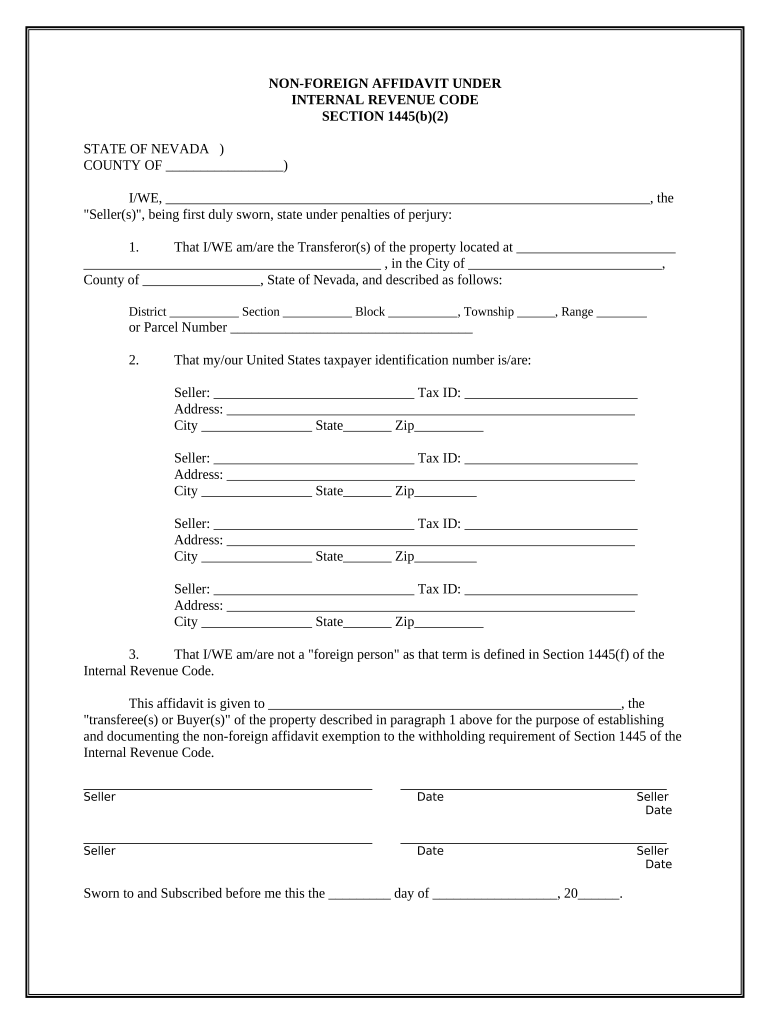

The Non Foreign Affidavit Under IRC 1445 is a legal document used in Nevada to certify that a seller of real property is not a foreign person, as defined by the Internal Revenue Code (IRC) Section 1445. This affidavit is crucial for buyers and sellers involved in real estate transactions, as it helps to ensure compliance with U.S. tax laws. By submitting this affidavit, the seller confirms their status, which can exempt the buyer from withholding taxes that might otherwise apply to foreign sellers. This form is essential in facilitating smooth real estate transactions while adhering to federal regulations.

How to use the Non Foreign Affidavit Under IRC 1445 Nevada

Using the Non Foreign Affidavit Under IRC 1445 in Nevada involves several steps to ensure proper completion and submission. First, the seller must accurately fill out the affidavit, providing all required information, including their name, address, and tax identification number. Once completed, the seller must sign and date the document. The affidavit should then be submitted to the buyer or the buyer's agent as part of the closing process. It is important to retain a copy of the signed affidavit for personal records, as it may be needed for future reference or tax purposes.

Steps to complete the Non Foreign Affidavit Under IRC 1445 Nevada

Completing the Non Foreign Affidavit Under IRC 1445 involves a series of straightforward steps:

- Obtain the form from a reliable source, such as a real estate agent or legal professional.

- Fill in personal details, including the seller's name, address, and tax identification number.

- Indicate whether the seller is a foreign person or entity.

- Sign and date the affidavit to validate it.

- Provide the completed affidavit to the buyer or their representative during the closing process.

Key elements of the Non Foreign Affidavit Under IRC 1445 Nevada

The Non Foreign Affidavit Under IRC 1445 contains several key elements that must be included to ensure its validity:

- Seller Information: Full name, address, and taxpayer identification number of the seller.

- Certification Statement: A declaration confirming the seller is not a foreign person.

- Signature: The seller's signature and the date of signing.

- Notary Acknowledgment: Depending on local requirements, a notary public may need to witness the signing.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Non Foreign Affidavit Under IRC 1445 is essential for compliance. Typically, the affidavit should be submitted at the time of closing the real estate transaction. It is advisable to check with local real estate regulations or consult a legal expert to ensure that all deadlines are met, as failing to submit the affidavit on time may result in unnecessary tax withholding or complications in the property transfer process.

Legal use of the Non Foreign Affidavit Under IRC 1445 Nevada

The legal use of the Non Foreign Affidavit Under IRC 1445 is primarily to confirm the seller's status as a non-foreign person, which has significant tax implications. By providing this affidavit, sellers protect buyers from potential withholding taxes that apply to foreign sellers. This document serves as a safeguard for both parties, ensuring compliance with federal tax laws and facilitating a smoother transaction process. It is important for all parties involved to understand the legal ramifications of this affidavit to avoid any future disputes or penalties.

Quick guide on how to complete non foreign affidavit under irc 1445 nevada

Complete Non Foreign Affidavit Under IRC 1445 Nevada effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any delays. Handle Non Foreign Affidavit Under IRC 1445 Nevada on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign Non Foreign Affidavit Under IRC 1445 Nevada with ease

- Find Non Foreign Affidavit Under IRC 1445 Nevada and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to apply your changes.

- Decide how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Non Foreign Affidavit Under IRC 1445 Nevada and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Nevada?

A Non Foreign Affidavit Under IRC 1445 Nevada is a document that certifies a seller's foreign status in real estate transactions. This affidavit is essential for compliance with the Internal Revenue Code and to avoid withholding taxes during the sale of property. Understanding this affidavit helps buyers and sellers navigate tax implications effectively.

-

How can airSlate SignNow assist with creating a Non Foreign Affidavit Under IRC 1445 Nevada?

airSlate SignNow offers easy-to-use templates and tools for generating a Non Foreign Affidavit Under IRC 1445 Nevada quickly and accurately. With our platform, users can fill in required details and eSign the document online, ensuring a smooth and efficient process. This helps reduce paperwork and speeds up real estate transactions.

-

What features does airSlate SignNow provide for eSigning the Non Foreign Affidavit Under IRC 1445 Nevada?

airSlate SignNow offers features like secure eSigning, customizable templates, and mobile compatibility for the Non Foreign Affidavit Under IRC 1445 Nevada. Users can sign documents anytime, anywhere, and track the signing process in real time. These features enhance convenience and ensure compliance with legal requirements.

-

Is there a cost associated with using airSlate SignNow for the Non Foreign Affidavit Under IRC 1445 Nevada?

Yes, there is a cost associated with using airSlate SignNow, but it remains cost-effective for businesses needing to manage documents like the Non Foreign Affidavit Under IRC 1445 Nevada. We offer multiple pricing plans to suit different user needs and budgets, ensuring that you only pay for what you really need. You can start with a free trial to assess our services.

-

What are the benefits of using airSlate SignNow for real estate transactions involving a Non Foreign Affidavit Under IRC 1445 Nevada?

Using airSlate SignNow streamlines the process of handling a Non Foreign Affidavit Under IRC 1445 Nevada, minimizing errors and maximizing efficiency. The platform allows for easy collaboration between parties, reducing the time spent on document management. This translates to faster transaction times and increased satisfaction for all stakeholders.

-

Can I integrate airSlate SignNow with other applications for managing a Non Foreign Affidavit Under IRC 1445 Nevada?

Yes, airSlate SignNow supports integrations with various applications, enhancing your workflow for handling a Non Foreign Affidavit Under IRC 1445 Nevada. You can connect it with CRM systems, cloud storage solutions, and other document management tools. This capability ensures all your documents are centralized and easily accessible.

-

How secure is airSlate SignNow when handling a Non Foreign Affidavit Under IRC 1445 Nevada?

airSlate SignNow takes security seriously, employing advanced encryption and security protocols to protect your Non Foreign Affidavit Under IRC 1445 Nevada. Your documents are stored safely, and access is limited to authorized users only. Our compliance with industry standards guarantees that your data remains confidential.

Get more for Non Foreign Affidavit Under IRC 1445 Nevada

- Www mapquest comusmichiganbloomfield township police department 4200 telegraph rd form

- Michigan parenting time complaint form

- Pdf petition legal custody and physical placement douglas county wi form

- New jersey east orange form

- Earnings garnishment exemption form

- Fillable trial court of massachusetts civil action cover sheet form

- Www doj state wi usrestraining ordersrestraining orderswisconsin department of justice form

- Divorce papers hawaii form

Find out other Non Foreign Affidavit Under IRC 1445 Nevada

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online