Living Trust for Husband and Wife with One Child Nevada Form

What is the Living Trust For Husband And Wife With One Child Nevada

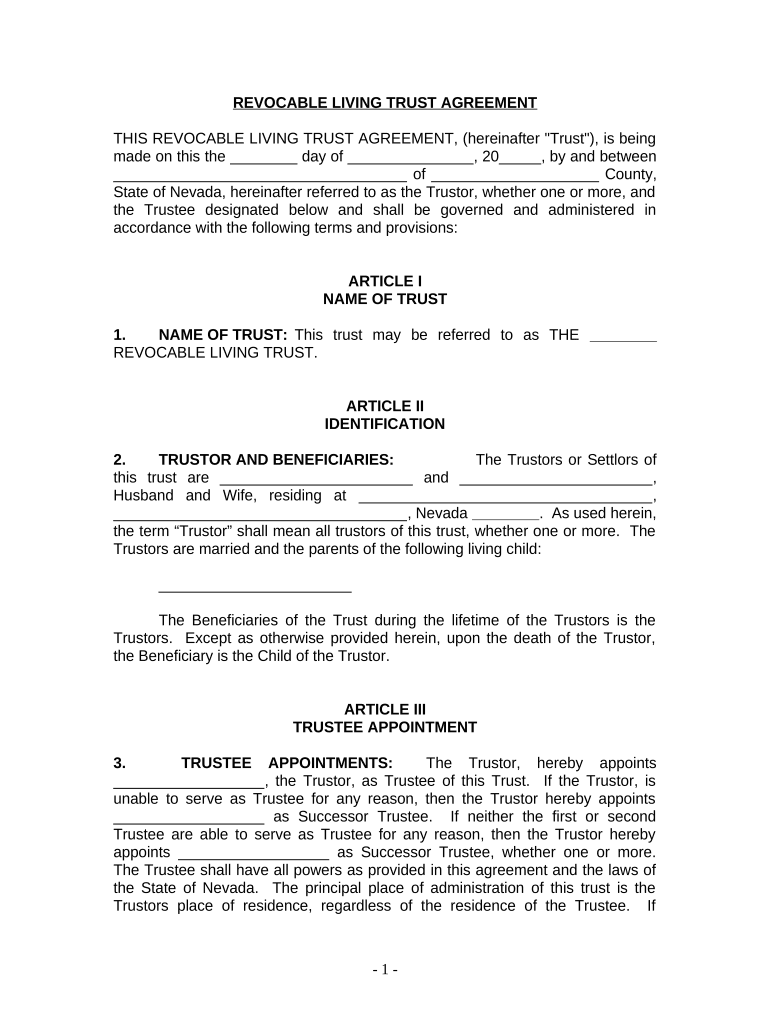

A living trust for husband and wife with one child in Nevada is a legal document that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed after their passing. This type of trust can help avoid probate, streamline the transfer of assets, and provide for the couple's child in a structured manner. It is particularly beneficial for ensuring that both spouses' wishes are honored regarding asset distribution, while also considering the child's future needs.

Key Elements of the Living Trust For Husband And Wife With One Child Nevada

Several essential components define a living trust for husband and wife with one child in Nevada:

- Grantors: The couple creating the trust, who will also typically be the initial trustees.

- Trustee: The individual or entity responsible for managing the trust assets. In many cases, the couple serves as their own trustees.

- Beneficiaries: The child is usually the primary beneficiary, with provisions for the couple or other family members as needed.

- Assets: The trust document should list all assets included in the trust, such as real estate, bank accounts, and investments.

- Distribution Instructions: Clear guidelines on how assets should be distributed upon the death of the grantors or under specific circumstances.

Steps to Complete the Living Trust For Husband And Wife With One Child Nevada

Creating a living trust involves several important steps:

- Identify Assets: Compile a comprehensive list of all assets to be included in the trust.

- Choose a Trustee: Decide whether the couple will act as trustees or appoint someone else.

- Draft the Trust Document: Create the trust document, detailing the terms and conditions of the trust.

- Sign and Notarize: Both spouses must sign the trust document in the presence of a notary public to validate it.

- Fund the Trust: Transfer ownership of the identified assets into the trust to ensure they are covered by the trust provisions.

Legal Use of the Living Trust For Husband And Wife With One Child Nevada

The legal use of a living trust in Nevada is recognized under state law, allowing couples to manage their assets effectively. This trust can be utilized for various purposes, including estate planning, asset protection, and tax management. It is essential to ensure that the trust complies with Nevada laws and regulations to maintain its validity and effectiveness.

State-Specific Rules for the Living Trust For Husband And Wife With One Child Nevada

Nevada has specific laws governing living trusts that couples should be aware of:

- Trust Creation: The trust must be created while both spouses are alive and competent.

- Revocability: Most living trusts in Nevada are revocable, meaning the grantors can modify or dissolve the trust at any time.

- Asset Protection: Nevada offers strong asset protection laws, making living trusts an effective tool for safeguarding assets from creditors.

- No State Income Tax: Nevada's lack of state income tax can benefit couples when planning their estate.

How to Obtain the Living Trust For Husband And Wife With One Child Nevada

Obtaining a living trust in Nevada can be accomplished through various methods:

- Legal Assistance: Consulting with an estate planning attorney can provide personalized guidance and ensure compliance with state laws.

- Online Resources: There are reputable online platforms that offer templates and tools for creating a living trust.

- DIY Approach: Couples can draft their own trust document using available resources, but this method requires careful attention to legal requirements.

Quick guide on how to complete living trust for husband and wife with one child nevada

Complete Living Trust For Husband And Wife With One Child Nevada with ease on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily access the needed form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Living Trust For Husband And Wife With One Child Nevada on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Living Trust For Husband And Wife With One Child Nevada effortlessly

- Find Living Trust For Husband And Wife With One Child Nevada and click on Get Form to begin.

- Use the tools available to complete your form.

- Mark important sections of your documents or redact sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Living Trust For Husband And Wife With One Child Nevada to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child in Nevada?

A Living Trust For Husband And Wife With One Child in Nevada is a legal document that allows couples to manage their assets and allocate them to their child without going through probate. This type of trust provides greater control over how and when assets are distributed, ensuring your child's financial security. It helps streamline estate planning in Nevada, making the transition smoother for your loved ones.

-

What are the benefits of creating a Living Trust For Husband And Wife With One Child in Nevada?

Creating a Living Trust For Husband And Wife With One Child in Nevada offers numerous benefits, including avoiding probate, maintaining privacy, and ensuring swift asset distribution. It allows couples to specify terms that align with their family’s needs, which can safeguard the interests of their child. Additionally, it can reduce the overall costs associated with estate administration.

-

How cost-effective is a Living Trust For Husband And Wife With One Child in Nevada?

The pricing for a Living Trust For Husband And Wife With One Child in Nevada can vary depending on complexity and the professional services used. airSlate SignNow provides an affordable solution, enabling families to create trusts without the high fees typically associated with estate planning. Investing in a trust can save families time and money in the long run by avoiding probate costs.

-

What features does airSlate SignNow offer for creating Living Trusts in Nevada?

airSlate SignNow offers streamlined document creation, electronic signing, and secure storage options for your Living Trust For Husband And Wife With One Child in Nevada. Its user-friendly platform allows couples to customize their trust easily, ensuring all necessary provisions are included. Moreover, the platform supports collaboration with legal advisors to finalize your trust effectively.

-

Can I update my Living Trust For Husband And Wife With One Child in Nevada after it's created?

Yes, a Living Trust For Husband And Wife With One Child in Nevada can be updated or amended as needed. Changes in your family situation, financial status, or wishes can prompt the need for updates. airSlate SignNow makes it simple to modify your trust documents, ensuring they reflect your current intentions and circumstances.

-

Is my information secure when using airSlate SignNow for a Living Trust?

Absolutely! airSlate SignNow employs advanced security measures to protect your sensitive information while creating a Living Trust For Husband And Wife With One Child in Nevada. Your documents are encrypted, and strict access controls are in place, ensuring that only authorized individuals can view or modify your trust documents.

-

Are there integrations available for managing my Living Trust For Husband And Wife With One Child in Nevada?

Yes, airSlate SignNow integrates seamlessly with various platforms to help you manage your Living Trust For Husband And Wife With One Child in Nevada effectively. You can connect it with cloud storage solutions, CRM systems, and other tools to streamline your document management and ensure easy access to your trust at any time. This interoperability enhances your experience and eases the management of your estate planning.

Get more for Living Trust For Husband And Wife With One Child Nevada

- Ucvbheadstart org wp content uploadsa d d e n d u m t o e n rol l m e n t f or m f or c h i l d c form

- The strikeover on the assignment of the attached manufacturers certificate of origin or certificate form

- New mexico livestock bill sale form

- First state commander custer post 46 form

- Www homes comproperty4216 s butler st atmore4216 s butler st atmore al 36502 homes com form

- Transportation department parent or guardian consent form auburnschools

- Permit application for waste form

- Concealed handgun permitsnebraska state patrol form

Find out other Living Trust For Husband And Wife With One Child Nevada

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple