Living Trust for Husband and Wife with Minor and or Adult Children Nevada Form

What is the Living Trust For Husband And Wife With Minor And Or Adult Children Nevada

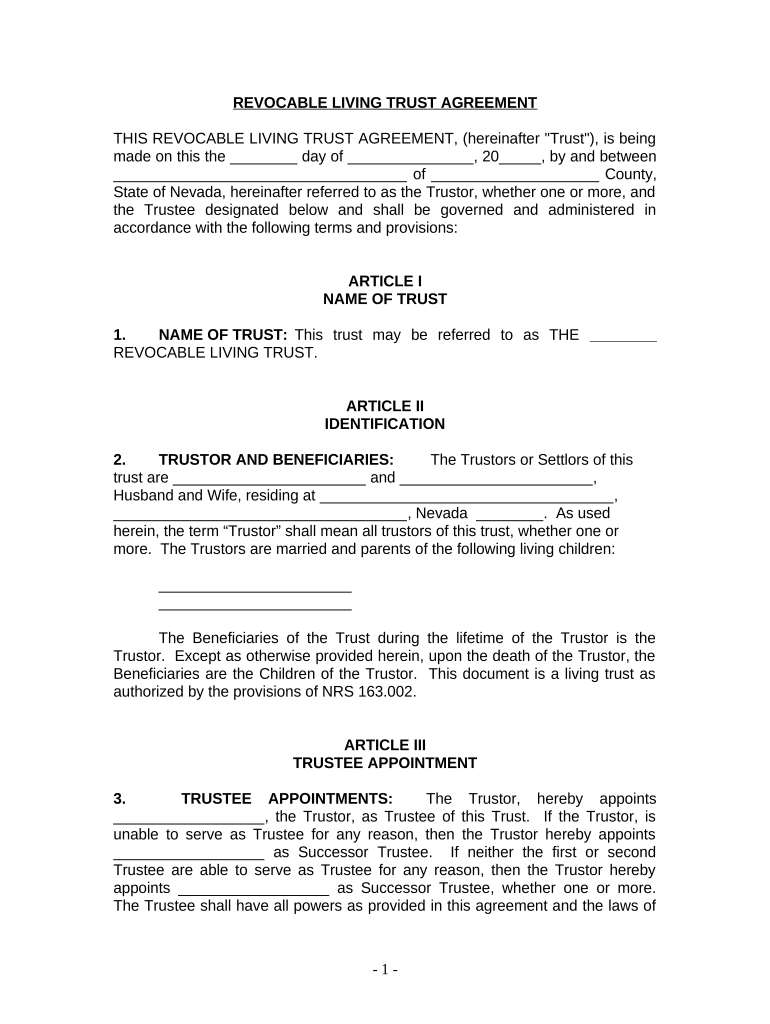

A living trust for husband and wife with minor and/or adult children in Nevada is a legal arrangement that allows couples to manage their assets during their lifetime and dictate how these assets will be distributed after their passing. This type of trust serves to protect the interests of both spouses and their children, ensuring that the family’s wealth is preserved and passed on according to the couple's wishes. It provides flexibility, allowing the trustors to modify the terms as their circumstances change, and helps avoid the lengthy and costly probate process.

Key Elements of the Living Trust For Husband And Wife With Minor And Or Adult Children Nevada

Several key elements define a living trust for husband and wife with minor and/or adult children in Nevada. These include:

- Trustees: Typically, both spouses serve as trustees, managing the trust assets while alive.

- Beneficiaries: The couple's children, both minor and adult, are usually designated as beneficiaries, ensuring they receive the trust assets upon the death of the trustors.

- Asset Protection: The trust can protect assets from creditors and ensure they are distributed according to the couple's wishes.

- Revocability: The trust can be amended or revoked by the trustors at any time during their lifetime.

Steps to Complete the Living Trust For Husband And Wife With Minor And Or Adult Children Nevada

Completing a living trust involves several steps to ensure it is legally binding and meets the needs of the family. The steps include:

- Identify Assets: List all assets to be included in the trust, such as real estate, bank accounts, and investments.

- Choose Trustees: Designate who will manage the trust, typically both spouses.

- Draft the Trust Document: Create a legal document that outlines the terms of the trust, including how assets will be managed and distributed.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public to ensure its legality.

- Fund the Trust: Transfer ownership of the identified assets into the trust to ensure they are managed according to the trust's terms.

Legal Use of the Living Trust For Husband And Wife With Minor And Or Adult Children Nevada

The legal use of a living trust in Nevada is governed by state law, which recognizes the validity of such trusts. A living trust can be used to manage assets during the lifetime of the trustors and provide for the distribution of those assets after their death. It helps avoid probate, which can be a lengthy and public process. Additionally, it allows for the management of assets in the event one spouse becomes incapacitated, ensuring that the other spouse and children are cared for without court intervention.

State-Specific Rules for the Living Trust For Husband And Wife With Minor And Or Adult Children Nevada

Nevada has specific rules regarding living trusts that couples should be aware of. These include:

- Trust Creation: A trust must be created in writing and signed by the trustors.

- Asset Transfer: To be effective, assets must be formally transferred into the trust.

- Tax Implications: Nevada does not impose a state income tax, which can be beneficial for trustors.

- Privacy: Unlike wills, living trusts do not go through probate, keeping the distribution of assets private.

How to Obtain the Living Trust For Husband And Wife With Minor And Or Adult Children Nevada

Obtaining a living trust in Nevada can be accomplished through several methods. Couples can choose to work with an attorney specializing in estate planning to draft a trust document tailored to their needs. Alternatively, there are online services that provide templates and guidance for creating a living trust. It is essential to ensure that any documents comply with Nevada state laws to be legally binding. Consulting with a professional can provide peace of mind and ensure that all legal requirements are met.

Quick guide on how to complete living trust for husband and wife with minor and or adult children nevada

Effortlessly Prepare Living Trust For Husband And Wife With Minor And Or Adult Children Nevada on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly option to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents quickly and accurately. Manage Living Trust For Husband And Wife With Minor And Or Adult Children Nevada across various platforms with airSlate SignNow’s Android or iOS applications and enhance any document-related procedure today.

How to Alter and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Nevada with Ease

- Locate Living Trust For Husband And Wife With Minor And Or Adult Children Nevada and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Nevada to ensure excellent communication throughout all stages of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With Minor And Or Adult Children Nevada?

A Living Trust For Husband And Wife With Minor And Or Adult Children Nevada is a legal arrangement that allows you and your spouse to manage and distribute your assets while you are alive and after your passing. This type of trust helps protect your children's inheritance and can ensure that your wishes are fulfilled without going through probate.

-

How much does it cost to create a Living Trust For Husband And Wife With Minor And Or Adult Children Nevada?

The cost of creating a Living Trust For Husband And Wife With Minor And Or Adult Children Nevada can vary based on complexity and whether you hire an attorney or use an online service. Generally, you can expect to pay between $1,000 and $3,000 for legal assistance, whereas a do-it-yourself option might be more cost-effective starting from around $200.

-

What are the benefits of setting up a Living Trust For Husband And Wife With Minor And Or Adult Children Nevada?

Setting up a Living Trust For Husband And Wife With Minor And Or Adult Children Nevada provides several benefits, including avoiding probate, ensuring privacy, and allowing for the seamless management of assets in case of incapacity. Additionally, this trust can specify how assets are distributed among your minor and adult children, providing peace of mind.

-

Can we amend our Living Trust For Husband And Wife With Minor And Or Adult Children Nevada?

Yes, you can amend your Living Trust For Husband And Wife With Minor And Or Adult Children Nevada as your circumstances change. It’s important to regularly review the trust to ensure it reflects your current wishes regarding the management and distribution of assets in your estate.

-

How does a Living Trust For Husband And Wife With Minor And Or Adult Children Nevada differ from a will?

A Living Trust For Husband And Wife With Minor And Or Adult Children Nevada differs from a will in that it allows your assets to avoid probate and can be effective immediately upon your incapacity, whereas a will only takes effect after death. Trusts also provide greater privacy and control over asset distribution.

-

What is included in a Living Trust For Husband And Wife With Minor And Or Adult Children Nevada?

A Living Trust For Husband And Wife With Minor And Or Adult Children Nevada typically includes real estate, bank accounts, investments, and personal property. You will need to retitle these assets in the name of the trust to ensure they are effectively managed according to the terms you set.

-

Do I need an attorney to create a Living Trust For Husband And Wife With Minor And Or Adult Children Nevada?

While it is not mandatory to have an attorney to create a Living Trust For Husband And Wife With Minor And Or Adult Children Nevada, it is often advisable, especially to handle complex situations. However, many online platforms provide templates and guidance to help you set up a trust yourself.

Get more for Living Trust For Husband And Wife With Minor And Or Adult Children Nevada

- Walk to help children with dyslexia valley of waterbury form

- Verification of licensure form

- Butch cassidy days rodeo queen pageant judges scor form

- Fillable online role in the fulfilment fax email print form

- The rl 1 slip form

- Fillable online the rl 1 slip fax email print pdffiller form

- Guide to filing the rl 1 slip employment and other income form

- Teachers choice accountability form 458202936

Find out other Living Trust For Husband And Wife With Minor And Or Adult Children Nevada

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer