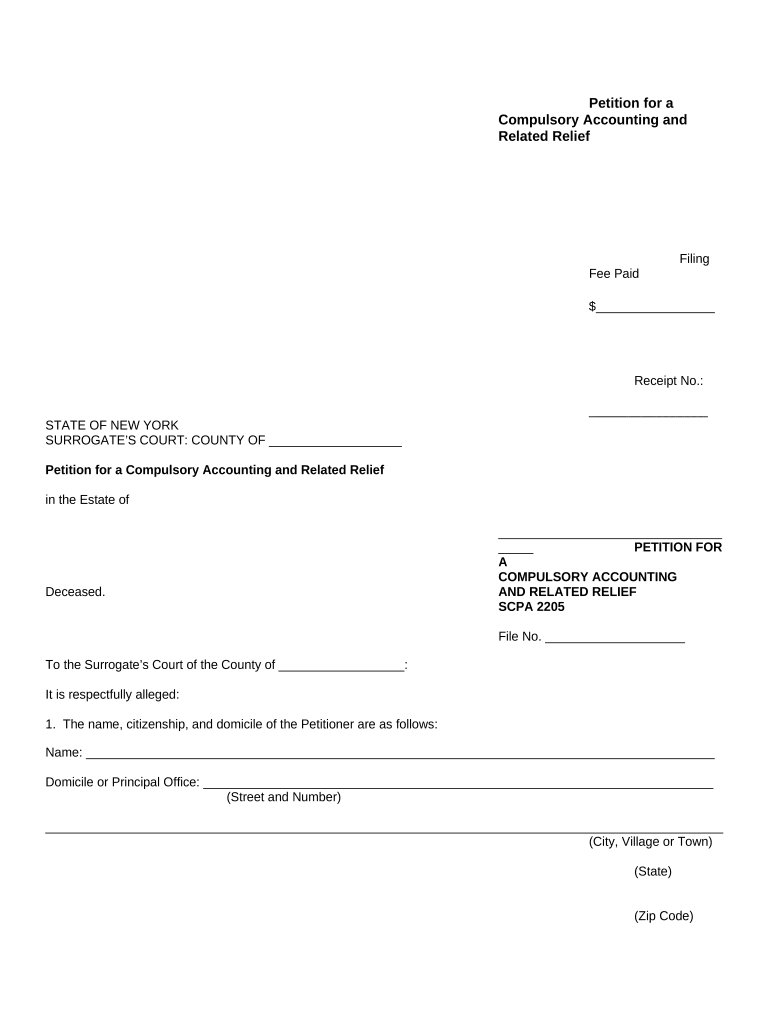

Compulsory Accounting Form

What is compulsory accounting?

Compulsory accounting refers to the mandatory financial reporting and record-keeping practices required by law for certain entities. This system ensures transparency and accountability in financial operations, particularly for businesses and organizations that must adhere to specific regulatory standards. In the United States, compulsory accounting is often associated with tax compliance and the accurate reporting of income, expenses, and financial positions.

Entities required to follow compulsory accounting include corporations, partnerships, and sometimes sole proprietorships, depending on their revenue thresholds and business structure. The primary goal is to provide a clear picture of financial health, which is essential for stakeholders, including investors, creditors, and regulatory bodies.

Steps to complete compulsory accounting

Completing compulsory accounting involves a series of structured steps to ensure compliance with applicable laws and regulations. Here are the key steps:

- Identify applicable regulations: Understand the specific accounting standards and legal requirements relevant to your business type and location.

- Gather financial data: Collect all necessary financial documents, including receipts, invoices, and bank statements, to ensure accurate reporting.

- Select an accounting method: Choose between cash or accrual accounting methods based on your business needs and regulatory requirements.

- Record transactions: Maintain detailed records of all financial transactions in a systematic manner, ensuring accuracy and completeness.

- Prepare financial statements: Generate essential financial documents, such as income statements, balance sheets, and cash flow statements, to reflect your financial position.

- Review and audit: Conduct regular reviews and audits to identify discrepancies and ensure compliance with accounting standards.

- Submit required reports: File all necessary reports and documents with relevant authorities by the specified deadlines.

Legal use of compulsory accounting

The legal use of compulsory accounting is rooted in compliance with federal and state regulations. Businesses must adhere to the Generally Accepted Accounting Principles (GAAP) or other relevant standards, depending on their jurisdiction and industry. Failure to comply can result in penalties, fines, or legal repercussions.

In the U.S., the Internal Revenue Service (IRS) requires businesses to maintain accurate financial records to ensure proper tax reporting and compliance. This legal framework aims to prevent fraud and promote transparency in financial dealings. Companies should also be aware of any state-specific regulations that may impose additional requirements for compulsory accounting.

Required documents for compulsory accounting

To effectively manage compulsory accounting, businesses must maintain a comprehensive set of documents that support their financial activities. Key required documents include:

- Invoices and receipts for all sales and purchases

- Bank statements and reconciliations

- Payroll records and employee compensation details

- Tax returns and supporting documentation

- Financial statements, including income statements and balance sheets

- Contracts and agreements related to business transactions

Maintaining these documents not only supports compliance but also aids in financial analysis and decision-making.

IRS guidelines for compulsory accounting

The IRS provides specific guidelines for businesses regarding compulsory accounting practices. These guidelines outline the necessary steps for maintaining accurate financial records and reporting income. Key points include:

- Choosing the appropriate accounting method (cash or accrual) based on business size and structure.

- Keeping detailed records of all income and expenses to ensure accurate tax reporting.

- Filing tax returns by the established deadlines to avoid penalties.

- Utilizing available resources, such as IRS publications and online tools, for guidance on compliance.

Following IRS guidelines helps businesses avoid legal issues and ensures proper financial management.

Quick guide on how to complete compulsory accounting

Prepare Compulsory Accounting effortlessly on any device

Digital document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without complications. Manage Compulsory Accounting on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Compulsory Accounting without hassle

- Find Compulsory Accounting and then click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Compulsory Accounting and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for creating a petition compulsory document with airSlate SignNow?

Creating a petition compulsory document with airSlate SignNow is straightforward. Simply upload your document, add signature fields where needed, and customize the content to suit your requirements. Our intuitive interface ensures that you can manage your documents efficiently and effectively.

-

Are there any costs associated with using airSlate SignNow for petition compulsory documents?

airSlate SignNow offers competitive pricing for businesses looking to manage petition compulsory documents. We provide a range of subscription plans that cater to various needs and budgets, ensuring you can find an option that suits your organization's size and document management requirements.

-

What features does airSlate SignNow offer for managing petition compulsory documents?

airSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage, all vital for managing petition compulsory documents. Our platform also allows for real-time collaboration and tracking, ensuring that every stakeholder is updated and involved throughout the signing process.

-

Can I integrate airSlate SignNow with other tools when handling petition compulsory documents?

Yes, you can seamlessly integrate airSlate SignNow with various third-party applications, enhancing your workflow for petition compulsory documents. Popular integrations include CRM software, project management tools, and cloud storage services. This flexibility ensures that you can utilize existing systems effectively.

-

What are the benefits of using airSlate SignNow for petition compulsory processes?

Using airSlate SignNow for petition compulsory processes streamlines the document management workflow, saving time and reducing errors. The user-friendly interface facilitates quick document setup, while eSigning ensures that approvals are obtained faster. Additionally, our secure platform keeps your documents safe and accessible.

-

Is airSlate SignNow compliant with legal regulations for petition compulsory documents?

Absolutely, airSlate SignNow complies with legal standards like ESIGN and UETA, ensuring that all petition compulsory documents signed on our platform hold legal validity. Our commitment to security means you can trust that your documents are handled with the utmost professionalism and in accordance with applicable laws.

-

How does airSlate SignNow ensure the security of my petition compulsory documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and robust access controls to protect your petition compulsory documents. Additionally, regular security audits and compliance with industry standards further safeguard your sensitive information.

Get more for Compulsory Accounting

- Yacht food preference sheet form

- Energy star qualified homes version 3 inspection form

- F104 proficiency testing data submission form

- Divisional science olympiad ru ac form

- Riding lawn mower maintenance log form

- Jdf1111ss pdf form

- Puppy for breeders contract template form

- Puppy health contract template form

Find out other Compulsory Accounting

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document