Business Credit Application New York Form

What is the Business Credit Application New York

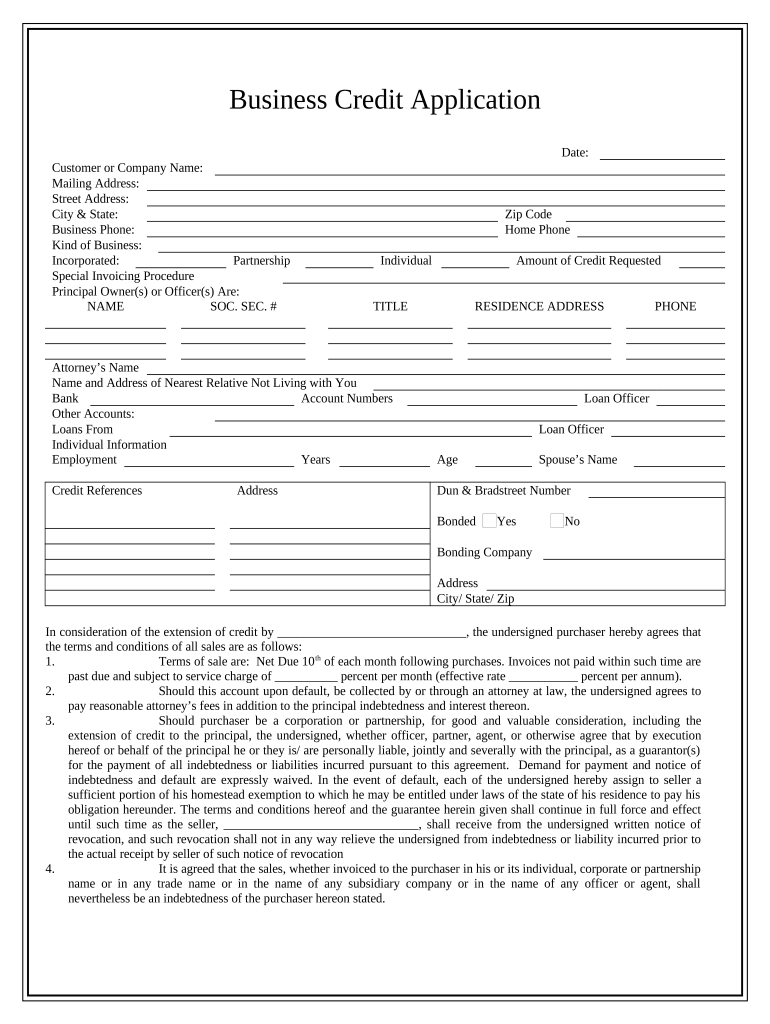

The Business Credit Application New York is a formal document that businesses in New York use to apply for credit from financial institutions or suppliers. This application typically requires detailed information about the business, including its legal structure, financial history, and creditworthiness. The purpose of this form is to assess the risk involved in extending credit to the business, allowing lenders to make informed decisions.

Key Elements of the Business Credit Application New York

When filling out the Business Credit Application New York, several key elements are essential for a successful submission:

- Business Information: This includes the legal name, address, and contact details of the business.

- Ownership Details: Information about the owners or partners, including their names and ownership percentages.

- Financial Statements: Recent financial statements, such as balance sheets and income statements, may be required to demonstrate the business's financial health.

- Credit History: A summary of the business's credit history, including any existing loans or credit lines.

- Purpose of Credit: A description of how the requested credit will be used, which helps lenders understand the business's needs.

Steps to Complete the Business Credit Application New York

Completing the Business Credit Application New York involves several steps to ensure accuracy and completeness:

- Gather Required Information: Collect all necessary documents and information, including financial statements and ownership details.

- Fill Out the Application: Carefully complete the application form, ensuring that all sections are filled out accurately.

- Review for Errors: Double-check the application for any errors or omissions that could delay processing.

- Submit the Application: Send the completed application to the financial institution or supplier, following their submission guidelines.

Legal Use of the Business Credit Application New York

The Business Credit Application New York is legally binding once signed by the authorized representatives of the business. It is crucial to understand that the information provided must be truthful and accurate, as any discrepancies can lead to legal repercussions or denial of credit. Additionally, the application must comply with federal and state laws regarding credit and lending practices.

Eligibility Criteria

To qualify for credit through the Business Credit Application New York, businesses typically must meet certain eligibility criteria, which may include:

- Operating as a registered business entity in New York.

- Demonstrating a stable financial history and creditworthiness.

- Providing sufficient documentation to support the application.

- Meeting any specific requirements set by the lender or supplier.

Form Submission Methods

The Business Credit Application New York can be submitted through various methods, depending on the preferences of the lender or supplier:

- Online Submission: Many institutions offer online portals for submitting applications electronically.

- Mail: Businesses can send a physical copy of the application through standard mail.

- In-Person: Some lenders may allow businesses to submit applications in person at their offices.

Quick guide on how to complete business credit application new york

Complete Business Credit Application New York effortlessly on any device

Online document management has gained traction among organizations and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle Business Credit Application New York on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Business Credit Application New York with ease

- Find Business Credit Application New York and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invite link, or download it to your PC.

Forget about lost or mislaid documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign Business Credit Application New York and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application New York?

A Business Credit Application New York is a formal document that allows businesses to apply for credit or loans within the state of New York. It typically requires details about the business, its financial history, and other relevant information to assess creditworthiness.

-

How can airSlate SignNow help with my Business Credit Application New York?

airSlate SignNow offers a seamless solution to create and eSign your Business Credit Application New York. With our user-friendly platform, you can easily prepare documents, manage signatures, and ensure compliance, all from one place.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow provides various pricing plans to fit different business needs. Our plans are cost-effective and designed to help you manage your Business Credit Application New York efficiently, with no hidden fees.

-

What features does airSlate SignNow offer for Business Credit Applications?

Our platform includes features like customizable templates, real-time tracking, and cloud storage, making it easy to manage your Business Credit Application New York. Additionally, you can add fields for electronic signatures, ensuring a quick and efficient application process.

-

Are there any benefits to using airSlate SignNow for Business Credit Applications in New York?

Using airSlate SignNow for Business Credit Applications New York offers numerous benefits, including improved speed, reduced paperwork, and enhanced security. Our solution allows you to access documents from anywhere, streamlining your credit application process.

-

Can I integrate airSlate SignNow with other software for my Business Credit Application New York?

Yes, airSlate SignNow allows for easy integration with various CRM and productivity tools. This way, you can seamlessly incorporate your Business Credit Application New York into your existing workflows, enhancing overall efficiency.

-

Is eSigning a Business Credit Application New York legally binding?

Absolutely! eSigning a Business Credit Application New York through airSlate SignNow is legally binding and compliant with E-Sign and UETA laws. This ensures that your electronically signed documents hold the same legal weight as traditional handwritten signatures.

Get more for Business Credit Application New York

- Meningococcal meningitis vaccination response form pdf berkeleycollege

- Contract information sheet

- Member reimbursement claim form allways health partnersmember reimbursement claim form allways health partnersmember

- Nutrition assessment form

- National grid medical protection form massachusetts 576208333

- Form 705 beneficiary application for pension benefits

- Enrollment form for drop in care oocities geocities oocities

- Department of pharmacy pgy1 pharmacy residency form

Find out other Business Credit Application New York

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe