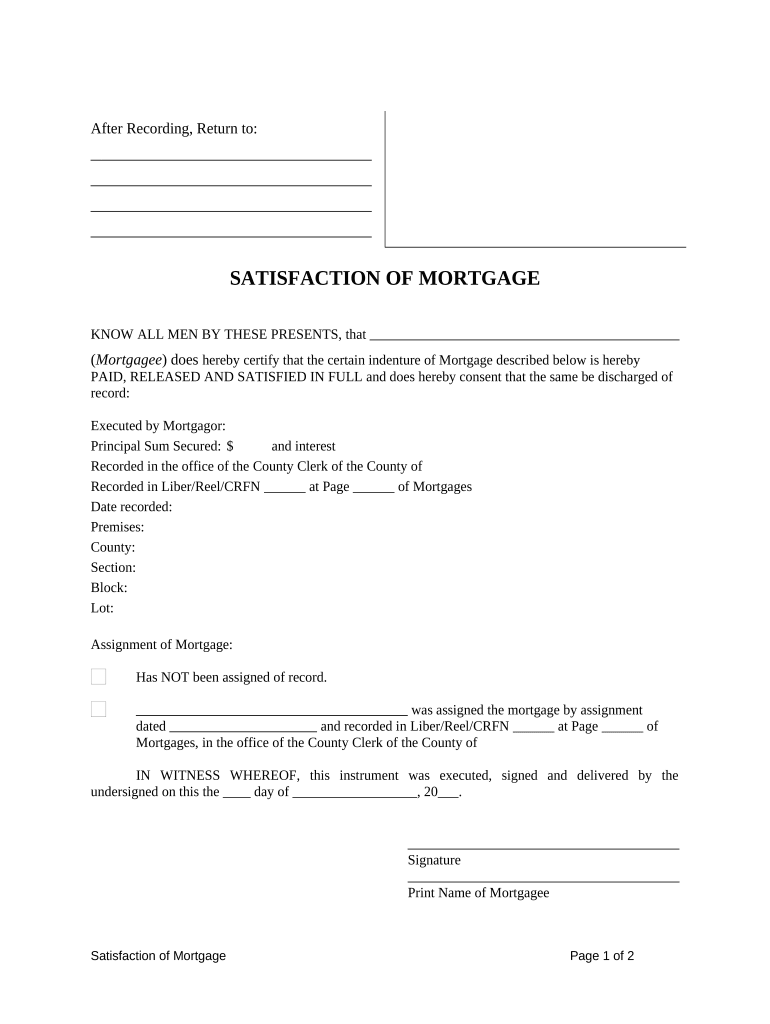

Mortgage Holder Form

What is the mortgage holder?

The term "mortgage holder" refers to the individual or entity that owns the mortgage loan secured by a property. This can include banks, credit unions, or private lenders. The mortgage holder has the legal right to collect payments and enforce the terms of the mortgage agreement. Understanding who the mortgage holder is crucial for homeowners, as it determines where payments are sent and who to contact for any inquiries regarding the loan.

How to use the mortgage holder

Using the mortgage holder involves understanding the responsibilities and rights associated with the mortgage. Homeowners should keep track of their payments, understand the terms of their mortgage agreement, and communicate with the mortgage holder regarding any changes in financial status or potential difficulties in making payments. Additionally, homeowners may need to provide documentation or information to the mortgage holder for refinancing or loan modifications.

Steps to complete the mortgage holder

Completing the mortgage holder process typically involves several key steps:

- Gather necessary documentation, including income statements, tax returns, and identification.

- Fill out the mortgage application accurately, providing all required information.

- Submit the application to the mortgage holder for review.

- Respond to any requests for additional information from the mortgage holder.

- Review and sign the mortgage agreement once approved.

Legal use of the mortgage holder

The legal use of the mortgage holder is governed by state and federal laws, which dictate the terms of the mortgage agreement and the rights of both the borrower and the lender. It is important for borrowers to understand their legal obligations, including timely payments and compliance with the terms outlined in the mortgage contract. Failure to adhere to these legal requirements can result in penalties, including foreclosure.

Key elements of the mortgage holder

Key elements of the mortgage holder include:

- The loan amount, which is the total borrowed from the mortgage holder.

- The interest rate, which determines the cost of borrowing.

- The repayment schedule, outlining when payments are due and how much is owed.

- The term of the loan, which specifies how long the borrower has to repay the mortgage.

- Any fees associated with the mortgage, such as closing costs or late payment penalties.

Required documents

When dealing with the mortgage holder, several documents are typically required to process a mortgage application or modification. These may include:

- Proof of income, such as pay stubs or tax returns.

- Bank statements to verify financial stability.

- Identification documents, like a driver's license or Social Security number.

- Property-related documents, including the purchase agreement or current mortgage statements.

Form submission methods

Submitting documents to the mortgage holder can be done through various methods, including:

- Online submission via the mortgage holder's secure portal.

- Mailing physical copies of documents to the mortgage holder's office.

- In-person delivery at the mortgage holder's local branch or office.

Quick guide on how to complete mortgage holder 497321895

Complete Mortgage Holder with ease on any device

Managing documents online has gained traction with businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly without interruptions. Handle Mortgage Holder on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and electronically sign Mortgage Holder effortlessly

- Find Mortgage Holder and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing out new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Mortgage Holder while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of a mortgage holder?

A mortgage holder is the individual or entity that owns the mortgage loan, usually the lender or bank. They have the legal rights to the property and can foreclose if the borrower fails to meet repayment obligations. Understanding the role of a mortgage holder is crucial for borrowers to navigate their financing options effectively.

-

How can airSlate SignNow benefit mortgage holders?

airSlate SignNow offers mortgage holders a streamlined process for managing important documents, including mortgage agreements. It eliminates paperwork bottlenecks by allowing users to sign and send documents electronically. This enhances efficiency and ensures that mortgage holders can access and manage their documents anytime, anywhere.

-

Are there any costs associated with using airSlate SignNow for mortgage holders?

Yes, airSlate SignNow provides various pricing plans tailored for different needs, including options suitable for mortgage holders. The plans are designed to be cost-effective, ensuring that mortgage holders can access essential eSigning features without breaking the bank. You can find detailed pricing information on the airSlate SignNow website.

-

What features does airSlate SignNow offer for mortgage holders?

airSlate SignNow provides a variety of features ideal for mortgage holders, such as document templates, secure eSigning, and real-time tracking. These tools help mortgage holders manage their documents easily and ensure compliance with legal requirements. Additionally, users can access reports and analytics to improve their document workflows.

-

Can mortgage holders integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with numerous applications used by mortgage holders, such as CRM systems, document management solutions, and cloud storage services. This flexibility allows mortgage holders to incorporate eSigning into their existing workflows seamlessly. Integrations enhance productivity and provide a unified approach to document management.

-

Is airSlate SignNow compliant with mortgage regulations?

Absolutely! airSlate SignNow is compliant with various regulations that govern mortgage documentation, including eSignature laws. This compliance gives mortgage holders peace of mind that their electronically signed documents are legally valid and enforceable. Staying compliant is essential for mortgage holders to reduce risks and ensure smooth transactions.

-

How does airSlate SignNow ensure the security of documents for mortgage holders?

airSlate SignNow prioritizes security through advanced encryption and multi-factor authentication, ensuring documents are protected for mortgage holders. The platform adheres to industry standards to safeguard sensitive information during the signing process. Mortgage holders can trust that their data is secure from unauthorized access.

Get more for Mortgage Holder

- This water quality assurance plan wqap guidance note with the associated wqap template will facilitate the completion of wqaps form

- Direct care worker retainer payment attestation and acknowledgment form

- Sample format invitational travel authorization ita

- Fl 021 form

- Temporary judge applicationsuperior court of california form

- How to write your uc activities list form

- Notice of filing petition for certificate of rehabilitation and pardon form

- Tuo cr 500 form

Find out other Mortgage Holder

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile