Attc 1 2013

What is the Attc 1?

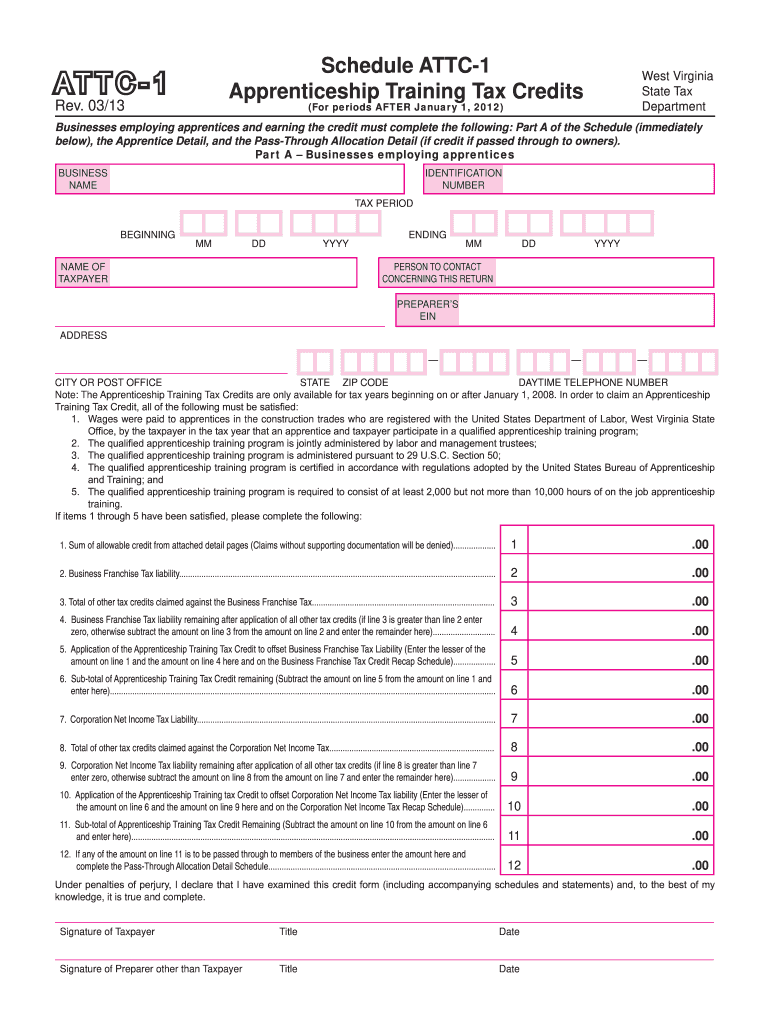

The Attc 1, also known as the apprenticeship training tax credits form, is a specific document used in the United States for claiming tax credits related to apprenticeship programs. This form is designed to assist businesses in reporting their eligible apprenticeship training expenses to the IRS. By utilizing the Attc 1, employers can potentially reduce their tax liability while promoting workforce development through training initiatives.

How to use the Attc 1

Using the Attc 1 involves several steps to ensure accurate completion and submission. First, gather all relevant information about the apprenticeship programs, including the names of apprentices, training hours, and associated costs. Next, fill out the form with precise details, ensuring that all fields are completed as required. After completing the form, review it thoroughly for accuracy before submitting it to the appropriate tax authority, either electronically or by mail.

Steps to complete the Attc 1

Completing the Attc 1 involves a systematic approach:

- Collect necessary documentation, such as proof of apprenticeship training expenses and participant details.

- Fill out the form accurately, ensuring that all required fields are completed.

- Double-check the information for any errors or omissions.

- Submit the completed form to the IRS, adhering to any specified deadlines.

Eligibility Criteria

To qualify for the benefits associated with the Attc 1, businesses must meet specific eligibility criteria. These typically include having registered apprenticeship programs that comply with federal and state regulations. Additionally, the apprentices must meet certain age and educational requirements. Employers should ensure that they understand these criteria fully to maximize their potential tax credits.

Filing Deadlines / Important Dates

Filing deadlines for the Attc 1 are crucial for ensuring that businesses can take advantage of the available tax credits. Typically, the form must be submitted by the tax filing deadline for the corresponding tax year. It is important for businesses to stay informed about any changes to these deadlines, which can vary from year to year.

Legal use of the Attc 1

The Attc 1 must be used in accordance with IRS guidelines to ensure its legal validity. This includes adhering to the requirements for documentation and submission methods. Employers should maintain accurate records of all apprenticeship training activities and expenses, as these may be subject to review by tax authorities. Proper use of the form can help businesses avoid penalties and ensure compliance with tax laws.

Quick guide on how to complete schedule attc 1 attc 1 apprenticeship training tax credits

Your assistance manual on preparing your Attc 1

If you wish to learn how to fill out and submit your Attc 1, here are a few straightforward guidelines to make tax filing easier.

To commence, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly intuitive and powerful document solution that enables you to edit, draft, and finalize your tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify details as necessary. Streamline your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Execute the following steps to finalize your Attc 1 in just a few minutes:

- Create your account and start editing PDFs in moments.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Select Get form to access your Attc 1 in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and rectify any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can increase mistakes and delay refunds. Certainly, prior to e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct schedule attc 1 attc 1 apprenticeship training tax credits

FAQs

-

According to instructions, if you earn less than $1,500, say $15 in interest, you don't have to fill out a Schedule B--if it's ordinary income, where do you put it on the new forms? (I know the government won't give up a penny in tax.)

If you have less than $1500 in interest income, and do not attach Schedule B, you should report your total taxable interest directly on Form 1040, Line 2b.

-

My company pays the TDS for the current financial year and the amount of tax was Rs. 0 because I am in the first slab. Do I still need to fill out an ITR-1 if I have Form 16 from my employer?

Receiving a Form 16 from your employer does not directly imply that you need to file an Income Tax Return. A Return has to be filed if your total income (including salary and any income from say savings bank account interest, interest income on fixed deposits, rental income) is more than the minimum income which is exempt from tax. This minimum exempt income is Rs 2,00,000 for FY 2013-14 and Rs 2,50,000 for FY 2014-15 and FY 2015-16.So you need to sum up the total income earned by you in a financial year and see if you are required to pay tax and file a Return.Return filing has several advantages too -Need a Refund – In case excess TDS has been deducted on your income and you need to claim a refund - in this situation you must file a return to claim the tax refund. For example, even though your total income is below the taxable limit, a bank deducted TDS on your FD interest - to get the refund of this TDS you'll have to file a Return.Need a Loan – When you signNow out to a bank or a financial institution for a loan a house loan or a personal loan - they usually require copies of your IT returns to check your credit worthiness. And therefore, it makes sense to keep your finances in order and file an IT return.Visas - Some countries require copies of your IT returns when they provide you a travel or a work visa.You can read more in detail here Are You required to file an IT Return in India?You'll find a lot of helpful topics here which have been addressed in very simple and easy format ClearTax's Series on Salary Income. Understand Salary Income, Deductions, Form-16Do note that if you file with http://www.cleartax.in you never have to choose which form to file since we do that for you automatically.signNow out to us support@cleartax.in if you need help!

-

I can't figure out if I should claim 1 dependent or 2 dependents on my W-4 tax form. When and how do you make changes to your W-4 tax form after having children?

OK, first off I’m going to say *IGNORE* the instructions on the updated W-4 form. It’s not worth anything. And yes, I’ve seen and followed the directions, which are wildly inaccurate and misleading.Here’s how exemptions and the W-4 work.As of last year, per the Tax Cuts and Job Act, you can NO LONGER, claim yourself as a dependent/exemption. You can, if you are married, no longer claim your spouse as a dependent/exemption.IF you have minor children (Age 19 and under) you *MAY* claim one exemption per child. IF you have a child, enrolled ‘full time in school’ who is age 24 or under, and that schooling is College, Trade School, Vo-Tech, etc and NOT primary education (IE High School education, GED classes, etc) you may claim an exemption for them.So simple example. Jack and Jane Darling are married. They have one child born June 1st.From January to June, Jack and Jane can *ONLY* claim ZERO EXEMPTIONS on their W-4. From June 1st, when the child is born, on wards, they can each claim ONE Exemption on their W-4.Hopefully that helps and simplifies it down. And yes, I’m a tax preparer as well. I spent all of last year warning various clients and I’m doing the same this year, along with explaining how many you can *legally* claim on your W-4.

-

What is the correct way to get a federal job as a photographer? I have two agencies that help me fill out the forms, train me, and help in the process, but one charges me $1,290.00 and the other $2,900.00. Is this the only way?

This is almost certainly a scam. No paid intermediaries, at least paid by you, are necessary to apply for employment at any federal agency.If you’re not already an experienced photographer, it’s unlikely the government is going to hire and train you, outside of perhaps, the military.

Create this form in 5 minutes!

How to create an eSignature for the schedule attc 1 attc 1 apprenticeship training tax credits

How to make an eSignature for the Schedule Attc 1 Attc 1 Apprenticeship Training Tax Credits online

How to create an eSignature for your Schedule Attc 1 Attc 1 Apprenticeship Training Tax Credits in Google Chrome

How to create an electronic signature for putting it on the Schedule Attc 1 Attc 1 Apprenticeship Training Tax Credits in Gmail

How to generate an electronic signature for the Schedule Attc 1 Attc 1 Apprenticeship Training Tax Credits straight from your mobile device

How to generate an eSignature for the Schedule Attc 1 Attc 1 Apprenticeship Training Tax Credits on iOS

How to make an electronic signature for the Schedule Attc 1 Attc 1 Apprenticeship Training Tax Credits on Android devices

People also ask

-

What is attc 1 and how does it relate to airSlate SignNow?

attc 1 refers to an advanced feature of airSlate SignNow that enhances document management and eSigning capabilities. It streamlines the signing process, making it simpler and faster for users to handle multiple transactions.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Each plan includes access to features like attc 1, ensuring you get the best value for your investment in document management.

-

What key features does airSlate SignNow provide?

airSlate SignNow includes several powerful features such as document templates, automated workflows, and document tracking. With features like attc 1, users can efficiently manage their eSigning tasks with ease.

-

How can attc 1 benefit my business?

The attc 1 feature signNowly enhances productivity by allowing users to send and eSign documents quickly and securely. This capability reduces turnaround times and improves overall efficiency in document handling.

-

Does airSlate SignNow integrate with other applications?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, making it easier for users to manage documents across different platforms. The integration capabilities of attc 1 allow for streamlined workflows regardless of the software used.

-

Is there a mobile app for airSlate SignNow?

Absolutely! airSlate SignNow offers a user-friendly mobile app that provides access to all its features, including attc 1. This means you can manage your eSigning needs from anywhere, at any time.

-

Can I try airSlate SignNow before committing to a plan?

Yes, airSlate SignNow provides a free trial that allows potential customers to explore all features, including attc 1. This trial is an excellent opportunity to assess how the platform can meet your document management needs.

Get more for Attc 1

- Quitclaim deed husband and wife to trust florida form

- Florida warranty deed 497302731 form

- Quitclaim deed individual to individual with reserved life estate florida form

- Special warranty deed florida form

- Quitclaim deed from individual to two individuals in joint tenancy florida form

- Quitclaim deed by two individuals to husband and wife florida form

- Warranty deed from two individuals to husband and wife florida form

- Enhanced life estate or lady bird deed quitclaim two individual or husband and wife to individual florida form

Find out other Attc 1

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation