Affidavit Tod Form

What is the Affidavit Tod

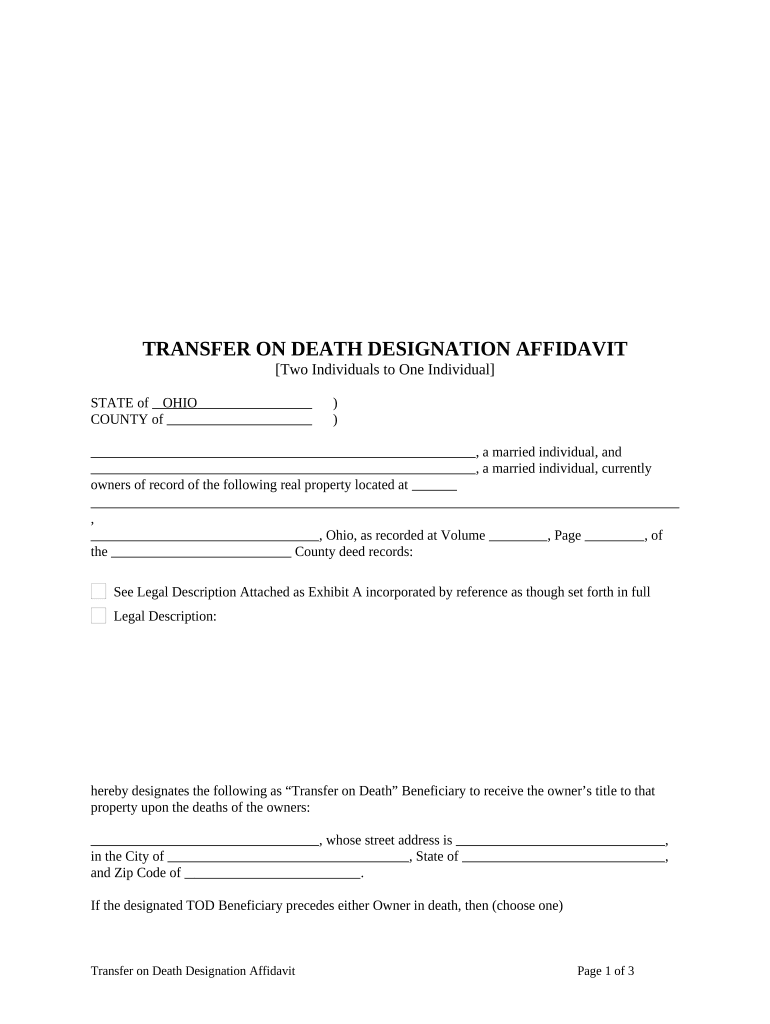

The Affidavit for Transfer on Death (TOD) is a legal document that allows an individual to designate beneficiaries for their property upon their death. This affidavit ensures that the specified assets transfer directly to the beneficiaries without the need for probate. By using this document, property owners in Ohio can simplify the process of transferring real estate, making it more efficient and less costly for their heirs.

How to use the Affidavit Tod

To effectively use the Affidavit Tod, property owners must complete the form accurately, providing necessary details such as the property description and the names of the beneficiaries. Once filled out, the affidavit must be signed in the presence of a notary public. After notarization, it should be filed with the county recorder's office in the county where the property is located. This filing ensures that the transfer is legally recognized and enforceable upon the owner's death.

Steps to complete the Affidavit Tod

Completing the Affidavit Tod involves several key steps:

- Gather necessary information, including property details and beneficiary names.

- Obtain the Affidavit Tod form from a reliable source or legal professional.

- Fill out the form, ensuring all fields are completed accurately.

- Sign the affidavit in front of a notary public to validate the document.

- File the notarized affidavit with the county recorder's office.

Legal use of the Affidavit Tod

The legal use of the Affidavit Tod is governed by Ohio state law, which allows property owners to designate beneficiaries for real estate. This document must comply with specific legal requirements, including proper notarization and filing with the county recorder. When executed correctly, the Affidavit Tod serves as a legally binding instrument that facilitates the transfer of property outside of probate, ensuring a smoother transition for beneficiaries.

Key elements of the Affidavit Tod

Key elements of the Affidavit Tod include:

- Property Description: A detailed description of the property being transferred.

- Beneficiary Information: Names and addresses of the designated beneficiaries.

- Signatures: The property owner's signature and the signature of a notary public.

- Filing Information: Details regarding where and how to file the affidavit.

State-specific rules for the Affidavit Tod

Ohio has specific rules governing the use of the Affidavit Tod. These include requirements for notarization, the necessity of filing with the county recorder, and the stipulation that the document must be executed while the property owner is alive and competent. Additionally, property owners should be aware of the implications of the TOD designation on their estate and any potential tax consequences for the beneficiaries.

Quick guide on how to complete affidavit tod

Effortlessly Prepare Affidavit Tod on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an exceptional eco-friendly alternative to conventional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the functionalities required to create, edit, and eSign your documents quickly and efficiently. Manage Affidavit Tod on any device using the airSlate SignNow apps for Android or iOS, and streamline your document-based tasks today.

Steps to Edit and eSign Affidavit Tod Effortlessly

- Find Affidavit Tod and press Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact sensitive information with the tools available from airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Affidavit Tod and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a transfer death designation form?

A transfer death designation form is a legal document that allows an individual to specify how their assets will be transferred upon their death. This form helps in avoiding probate, ensuring that your beneficiaries receive the designated assets directly. It is an essential tool for estate planning and can provide peace of mind regarding your wishes.

-

How can airSlate SignNow help me with a transfer death designation form?

airSlate SignNow offers a user-friendly platform that enables you to create, customize, and eSign your transfer death designation form quickly and efficiently. Our document management features simplify the process, allowing you to securely store and share your form with beneficiaries. Additionally, eSigning eliminates the need for printing and mailing, making the entire process faster.

-

Is there a cost associated with creating a transfer death designation form using airSlate SignNow?

Yes, airSlate SignNow provides various pricing plans tailored to different needs. However, creating a transfer death designation form is typically included in our plan. We offer a cost-effective solution, ensuring that you can manage and eSign your important documents without breaking the bank.

-

What features does airSlate SignNow offer for managing transfer death designation forms?

airSlate SignNow includes features such as template creation, document tracking, and secure cloud storage for your transfer death designation form. You can also integrate our solution with other platforms, ensuring a seamless workflow for your document needs. Our platform guarantees a smooth signing process, facilitating collaboration with your beneficiaries or legal advisors.

-

Can I integrate airSlate SignNow with other applications for my transfer death designation form?

Absolutely! airSlate SignNow supports integration with various applications such as Google Drive, Salesforce, and Zapier, allowing you to streamline the management of your transfer death designation form. These integrations enhance functionality and enable efficient document handling across platforms you already use. This means you can access your forms and maintain organization effortlessly.

-

What are the benefits of using airSlate SignNow for my transfer death designation form?

Using airSlate SignNow for your transfer death designation form offers several benefits, including legal compliance, time savings, and enhanced security. Our platform ensures that your document is legally binding while providing an intuitive interface for ease of use. Plus, with electronic signing, you avoid delays associated with traditional paper methods, ensuring your wishes are executed without hassle.

-

Is my information safe when using airSlate SignNow for transfer death designation forms?

Yes, your information is highly secure when using airSlate SignNow. We utilize advanced encryption and follow strict compliance protocols to protect your personal data. This ensures that your transfer death designation form and all related documents are safeguarded against unauthorized access, giving you confidence in our service.

Get more for Affidavit Tod

Find out other Affidavit Tod

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed