Company Name or Logo Here Customer Refund and Credit Request Form

Understanding the Customer Refund and Credit Request Form

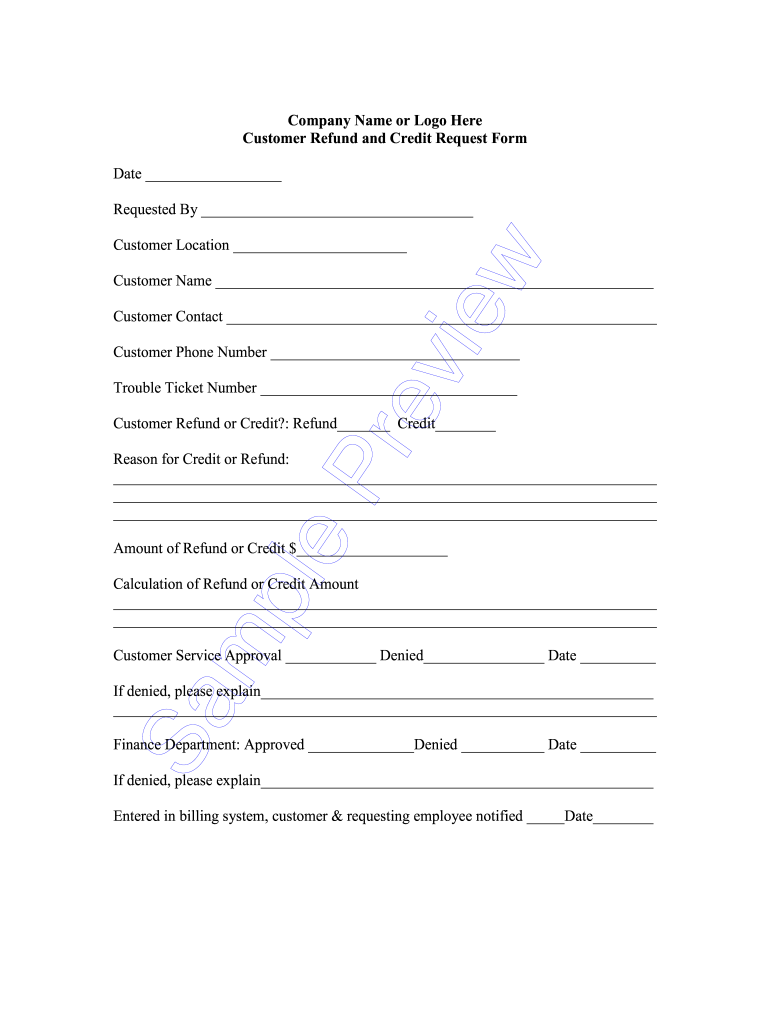

The Customer Refund and Credit Request Form is a crucial document for individuals seeking to initiate a refund process with a business. This form typically includes essential information such as the customer's name, contact details, purchase date, and the reason for the refund request. It serves as a formal request to the company, ensuring that all necessary details are documented for processing. By using this form, customers can clearly communicate their needs, facilitating a smoother transaction and improving the chances of a timely resolution.

Steps to Complete the Customer Refund and Credit Request Form

Filling out the Customer Refund and Credit Request Form involves several straightforward steps:

- Gather necessary information: Before starting, collect all relevant details, including your order number, purchase date, and payment method.

- Fill in personal details: Provide your full name, address, and contact information to ensure the company can reach you regarding your request.

- Specify the refund reason: Clearly state why you are requesting a refund, whether it’s due to a defective product, dissatisfaction, or another reason.

- Attach supporting documents: If applicable, include receipts, photos, or any other documentation that supports your claim.

- Review and submit: Double-check all information for accuracy before submitting the form through the designated method.

Legal Use of the Customer Refund and Credit Request Form

The Customer Refund and Credit Request Form is legally recognized as a formal request for reimbursement. For it to be valid, it must comply with relevant consumer protection laws, which vary by state. These laws often require businesses to process refund requests within a specific timeframe. By using this form, customers can ensure they are following the proper legal channels, which can help protect their rights and facilitate a smoother refund process.

Required Documents for Submitting the Customer Refund and Credit Request Form

When submitting the Customer Refund and Credit Request Form, certain documents may be required to support your request. These typically include:

- Proof of purchase: This can be a receipt or an order confirmation email.

- Identification: A copy of your ID may be necessary to verify your identity.

- Photos or evidence: If relevant, include images of the product or any issues encountered.

Having these documents ready can expedite the review process and increase the likelihood of a successful refund.

Form Submission Methods

The Customer Refund and Credit Request Form can typically be submitted through various methods, depending on the company's policies. Common submission methods include:

- Online submission: Many businesses offer a digital platform where you can fill out and submit the form directly.

- Mail: You may also have the option to print the form, fill it out, and send it via postal service.

- In-person: Some companies allow customers to submit the form in person at their physical locations.

Choosing the right submission method can help ensure that your request is received and processed efficiently.

Examples of Using the Customer Refund and Credit Request Form

Understanding how to effectively use the Customer Refund and Credit Request Form can be illustrated through various scenarios:

- Defective product: A customer who receives a damaged item can use the form to request a refund or replacement.

- Service dissatisfaction: If a service does not meet expectations, the customer can outline their concerns in the form to seek a refund.

- Order cancellation: In cases where an order is canceled, the form can be used to formally request a refund of the payment made.

These examples highlight the versatility of the form in addressing different refund situations, ensuring customers have a clear path to recourse.

Quick guide on how to complete company name or logo here customer refund and credit request form

Effortlessly Prepare Company Name Or Logo Here Customer Refund And Credit Request Form on Any Device

Digital document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed papers, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without hindrances. Manage Company Name Or Logo Here Customer Refund And Credit Request Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Company Name Or Logo Here Customer Refund And Credit Request Form with Ease

- Obtain Company Name Or Logo Here Customer Refund And Credit Request Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that task.

- Create your electronic signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Company Name Or Logo Here Customer Refund And Credit Request Form and ensure outstanding communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I had a hard inquiry to a credit reporting agency that I did not generate in anyway shape or form. How do I contact the credit reporting agency and company where credit was requested to find out what was applied for and who applied?

You challenge the hard inquiry in writing with the agencies that are reporting it.Your credit report will show the name of the firms that placed the hard inquiry and the date of the inquiry. Most of the time that is sufficient to jog your memory but if it isn't, the credit reporting agencies will provide additional information about inquiry in response to your challenge.

-

When is it too late to return a customer’s call or email? On my website customers can fill out a quote request form and leave their number. If someone sends one at 9 pm should I wait until the morning or should I call immediately?

The longer you leave it, the lower the response rate is.If you look at the advertising for Hubspot, one of the things they do is trigger pop-ups when people open your emails so that you can contact the customer. They cite some research on the effectiveness of doing this rather than contacting the customer the next day.Personally I find this a bit creepy, but I have to acknowledge that it is true. I have a ‘request a free demo’ link on my website. Clicking it triggers an email to my team asking them to create a demo system, which takes about an hour to do. I had the site reviewed a while back and one of the strongest pieces of feedback was that I had to automate the creation of a demo. Everybody who clicks that button will be distracted by something else in an hour.That said, I would not phone a customer at 9PM because I’d be worried about disturbing them at home, I’d email back straight away instead and include in that email a line requesting permission to call. If they reply saying “sure, give me a call now” then you’re all good, and if they don’t reply then I’d wait until regular business hours.

-

How do I mail a regular letter to Venezuela? Do I need to fill out a customs form for a regular letter or do I just need to add an international mail stamp and send it?

You do not need to fill out a customs form for a regular letter sent from the US to any other country. Postage for an international letter under 1 ounce is currently $1.15. You may apply any stamp - or combination of stamps - which equals that amount.

-

How do people with just one name get around this fact when filling out forms and stuff? Also hypothetically could I change my name to just one name if I wanted or something crazy like Disco Stu or something?

In the US you may absolutely change your name to pretty much anything you want to including single names such as Prince or Madonna. I don’t know what fact you’re referring to that people need to get around when filling out forms, but if a for requires both first and last name to be filled in then someone could be creative and fill in anything they choose, but whatever they fill in will go into the system as part of their name. I see that someone else indicated a common solution is to use the same name twice. That makes me think of the character Jimmy James (actually James James, but goes by Jimmy) from News Radio. Thanks for asking.

-

I'm a very shy guy, aged 19. I've never had a girlfriend. There is this pretty girl in my class at college. I want to introduce myself to her, but I don't want to come off creepy. How do I approach her? After class? Before class?

I am a 21 year old girl in college. Even though all girls are different, I think that makes me pretty qualified to answer.If she doesn't have a lot of friends in class, and if you don't have assigned seats (or self appointed seats that will cause someone to be upset if you take his or her seat), start sitting next to her. Get to class after her, but make sure the room is not entirely and completely empty or it might look strange if you take the seat directly next to her. Once you're next to her, just make a comment about something said in the lecture, something about the topic, something about the textbook, etc. during class. I'm sure you get some interesting or entertaining thoughts about these things in your head during class. Just say one out loud to her. Don't try too hard. Just do it casually. Do this a few days, and eventually she'll get used to having you sit there and talk to her. She might start to say hi and make small talk when you get to class. If she doesn't, you should initiate it after a couple days. That is the easiest and most natural way I've met people (guys and girls) in college classes. If you're too shy to sit next to her, sit a seat or two over and casually say or ask something before too many people are in the room. Once there's too many people, she might wonder why you're specifically singling out her, which might you feel self conscious, or she might not hear you. Just ask something about the homework, her opinion of the professor, etc. This can work particularly well if there's something about the class that everyone seems to agree upon and dislike.Walking up to her and simply saying hi or catching her as you're walking out after class are not bad pieces of advice at all. You, however, specifically stated that you are shy, and I think those things take more guts to do. Complimenting her is also very good advice, and that advice can easily be combined with this one.

-

Is PayUMoney a fraud payment gateway?

Fraudsters are finding innovative ways to cheat you via e-commerce and banking transactions as well as mobile calls and mail. Find out how to prevent these.If a stranger you met for the first time on a metro asked you to give him Rs 10,000, would you do it? You don't have his contact details. You don't have his identity proof. And, no, you don't know if the money will be returned.If you are shaking your head in disdain at the sheer naivety of the person who would give out his hard-earned money, take a look in the mirror. It could be you. Or, perhaps, it is you, if you were among the 36% of people who have been cheated in Internet scams, according to a survey by Telenor (see 'Rising incidence...') early this year.The easy access to victims is the reason they are readily stalked by fraudsters—whether you use a smartphone or a computer, are logged into social media or pay online bills, buy gadgets from an ecommerce website, or withdraw money from an ATM, you are a sitting duck. It helps if you have poor tech skills, trust freely and are lured by easy money.As per the RBI data, 11,997 cases related to ATM, credit and debit cards as well as Net banking frauds were reported by banks in 2015-16. This, besides the 49,455 cyber security incidents, including phishing, scanning, malicious code, website intrusion, etc, (see 'Scam terms') that were reported by the Indian Computer Emergency Response Team (CERT-In), in 2015. If, however, you take into account the unreported cases, these figures are a fraction of the frauds being unleashed in the country.A new breed of scamsters is coming up with ingenious ways to circumvent security measures. "Earlier, an individual was hacking while sitting in a garage. Today, it is a more organised market, with syndicates all over the world using sophisticated ways to indulge in identity theft," says Mohan Jayaraman, Managing Director, Experian Credit Bureau (India), a global analytics firm that has just launched a tool to measure the probability of fraud in banking and insurance.So rampant is fraud that RBI Deputy Governor S.S. Mundra has reiterated the need to provide relief to customers. "The RBI is examining whether to issue regulatory direction with regard to limiting the liability of customers on fraudulent transactions arising out of frauds and electronic banking transactions," he said at an event organised by the Banking Codes and Standards Board of India, in May this year.But prevention being the better option, you need to protect yourself from the omnipresent scamsters. In the following pages, we shall tell you not only about the various modus operandi being used by scamsters but, more importantly, the ways in which to secure your finances and seek redressal if you are cheated.Also Read: Are you likely to fall prey to online frauds? Find outONLINE SHOPPING Ensure that the website, seller and payment modes are secure before you binge on e-commerce sites.There is no doubting the convenience of online shopping, be it for electronic gadgets or household appliances, clothes or furniture. Sadly, this has also led to new cheating techniques and sale/delivery loopholes.Modus operandi When you order online, it's possible that the product may not be delivered at all, or that you land a fake or damaged product. You may even get an empty package or, worse, one filled with stones. Ask Ghaziabad-based Santosh Kushwaha, 32, who ordered an iPhone6 worth Rs 46,000 in 2015. "The packaging was flawless. It was laminated, the weight was right and it wasn't tampered with. But when I opened it, I found the box filled with stones," he says.The problem can occur at any stage, for which you need to understand the sale and delivery process. There are sites that sell and deliver their own products like Fabindia. There are others that serve as a platform for various sellers. These are marketplaces, like Flipkart, Amazon or Snapdeal, which host products by different brands and sellers. These products may be delivered either by the site itself or the seller. In most cases, it's the seller who delivers. Some sites also provide special services, wherein product quality and delivery are guaranteed, for a premium. Here the site sources products from other sellers but conducts quality checks and delivers them itself. For instance, Flipkart is set to launch FAssured, promising improved delivery service and stricter quality checks, while Amazon Prime is the paid service that offers similar advantages to its members. Here are the various points at which fraud can occur:Fake website: Tech-savvy scamsters set up sites that look like genuine ones with similar logos and domain names. Some may create a dummy site with a product line-up that only exists online. The purpose is to extract money from vulnerable buyers and disappear.Genuine site, fake seller: If you have not received a product, or it's damaged or fake, the scam could be by the seller or courier company, not the site itself. Though such sites scan the sellers hosted by them, weeding out frauds by checking themselves or going by buyers' ratings, it is not possible to identify all scamsters.Courier company: Here, both the site and seller may not be to blame. If they fail to choose a reputed courier and go for cheaper fly-by-night operators, you could land a dummy package. A specific errant employee of the courier firm may also be responsible for the fake delivery.Preventive stepsCheck the site: If you want to try out new sites, make sure to check the domain name. Ensure the URL has 'https' (not just 'http') and a lock icon, and check the site's spelling. To find out who owns a particular domain name and if it's genuine, log in to https://registry. in/WHOIS, which is a searchable list of every domain currently registered in the world. If the site does not offer any contact details or has a vague exchange or return policy, abandon the site. You could also check the company's trust rating on http://www. http://www.scamadviser.com which will give you all the details about the firm and how safe it is to shop from the site. "Make sure the company has the right infrastruc ture, wherein you are able to track delivery and payment informa tion," says Jayaraman of Experian.Check seller's rating: If you have picked an established site, opt for product assurance services, if any. If you don't wish to pay extra, go through the buyer reviews and ratings for the seller to find out if he has a good reputation for delivery. "We take strict action against sellers who attract negative feedback about their service or are found to be engaged in selling products that are fake, in violation of copyright or any other applicable laws," says the Flipkart spokesperson.Secure payment: As for payment, avoid direct payment to sellers. Opt for payment services like PaisaPay in eBay, which ensures that the seller is not paid by the site till the product is delivered, safeguarding your money. Also, do not pay via electronic bank transfers because it is difficult to retrieve the money once it has left the bank. Opt for payment via credit card that has a low credit limit and is used exclusively for online shopping, or for cash on delivery, to minimise risk. "An important safeguard is to make a video recording of the delivery, starting when the courier arrives till the package is opened, in a single loop without breaks," says Kushwaha. This is what served as proof and helped him get his money back, he says.If you are cheated.. The first step is to get in touch with the website or the seller. If it's a fake site, it's impossible to seek redressal. Consider your money lost.If you have opted for a safe site with a guaranteed exchange or money-back policy, you could write to the site, detailing the fraud, product details and mode of payment without giving sensitive information like your bank account number, etc. The site will conduct its verification within a specified time and revert. If the site doesn't respond, you could escalate it by registering a complaint with the district or state consumer redressal forum.A good option is to put up the grievance on consumer complaint boards/sites. You could also upload your complaint or video on micro-blogging sites like Twitter with the company's handle. "The site was taking its time to resolve my issue, but when I posted my video on Twitter with its handle, the site responded immediately and my money was refunded in four days," says Kushwaha.Also Read: Online fraud jargons that you must knowSOCIAL MEDIA Be cautious while interacting on such sites and conduct background checks before giving away money for a good cause.The popularity of social media like Facebook, micro-blogging sites like Twitter, dating sites, online consumer compaint forums, charity and crowdfunding sites have spawned a fresh set of scamsters that preys on the personal information posted unwittingly by members.Modus operandi There are various online shopping sites that require you to log in through Facebook or mail and this can be an easy entry point for fraudsters, who can misuse your bank details, phone numbers or mail login and password to clean out your account.Social media: Beware also of friends' friends who ask you for money. They could have hacked your friend's account, created a duplicate one, sent requests to the friend's friends and asked for money. "One of my relatives, who is a scamster, asked several of my Facebook friends for money and two of them even ended up paying her," says Vidya Nagraj, a Chennai-based consultant.Complaint forums: Be careful what information you volunteer on such sites. "I had put up my complaint regarding a wrong bank account number I had provided to an online shopping site for a refund," says Varun Kapila from Bengaluru. "I got a call from a person claiming to be from the site, who requested the correct account number. I didn't suspect anything and gave it to him. My account was soon wiped out, but thankfully it did not have too much money," he adds.Crowdfunding and charities: Despite the noble sentiment involved, be wary about giving money without verifying the claims of the backers. On 26 February 2016, an Indian American, Manisha Nagrani, was arrested in the US for raising thousands of dollars via crowdfunding to help cover the cost of treating her blood cancer. She had been perfectly healthy all along.Dating scams: Though this is more common abroad, it's not completely unknown in India. If you befriend someone on a dating site and the person starts demanding money for travelling to meet you or other emergencies, medical or otherwise, know it to be a fraud.Preventive steps You may not be able to seek redressal or have legal rights to claim the money lost because you either volunteered the money or information yourself. So the best you can do is avoid these. "Expose yourself only to the people you know on social media," says Jayaraman. Don't give money without knowing how it is going to be used and make sure to use secure payment channels while giving money to charities or for crowdfunding.BANK TRANSACTIONS Banking fraud may be among the top online scams, but the RBI is in the process of reducing the liability of the customer.According to the RBI, incidents of bankrelated fraud, including cards, ATMs and Net banking, have risen from 8,765 in 2012-13 to 11,997 in 2015-16. "With the introduction of 'Chip and PIN' security feature, we have noticed a signNow reduction in incidents of fraud in credit cards," says Vijay Jasuja, CEO, SBI Card. But the sheer volume of online and offline transactions makes it a fecund ground for fraud.Modus operandi Essentially, the only way to cheat when it comes to banking transactions is through identity theft, wherein your credit/debit card details or your bank account information is stolen. It is this theft that is carried out in a variety of ingenious ways by scamsters.Online stealing: During e-shopping or bill payment, if you do not choose a safe site or payment channel, it is easy to steal your card information by intercepting the data. You can be routed to a fake site or the data can be copied through keystroke logging. Pharming ensures that the fraudster has your bank account or credit card number and CVV, which can be used for online transactions. Malware or virus can also be introduced in your computer which provides access to all the details stored in your e-mail. If you have saved your passwords and login details, these can be easily stolen. "Besides phishing and vishing, malware and bsignNow incidents are the emerging threats when it comes to frauds," says Sanjay Silas, Head, Branch Banking, Axis Bank.SIM swipe fraud: This is a relatively new technique, wherein the scamster contacts the mobile operator with fake identity proof and gets a duplicate SIM card. Your original SIM is deactivated by the operator. The fraudster generates one time password (OTP), which appears on his phone, and he carries out online transactions.Fake calls and mails: "Vishing has become popular in the past few years and is done via a phone call. Customers, unknowingly, share their CVV number or OTP which is used for identity theft," says Jasuja. Hyderabad-based Bharat Naidu (see picture) knew better. "Last year, I got a call allegedly from Citibank, saying my points were about to expire and that they would transfer it to a new card, for which I would need to give the old card's CVV. I knew what was happening and gave them the wrong number," he says. Frustrated after a few attempts to get the details, the caller gave up. A month later he got a similar call. At that point he called up the bank and asked them to replace the card. You should also be suspicious of any mails that ask you to give sensitive information.Mobile phone apps: There are some apps that seek access to the data on your phone. Ensure that the app is safe because it is an easy way for fraudsters to seek critical information stored on your phone.Public terminals or Wi-Fi: If you use laptops in public areas or conduct mobile transactions over public Wi-Fi, it can be intercepted and your card details stolen.ATM withdrawals: This is another hot spot for fraudsters to gain access to your card data and PIN. Scamsters use hidden cameras and skimmers to gain information (see Are you likely to be conned?) from ATMs. Mumbai's Girish Nair (see picture) knows it well. "When I went to withdraw money from an ATM, the machine stalled. Later, I realised that the money had been withdrawn shortly after I had left," he says. He believes that the three men in the booth at the time had rigged the ATM and taken the cash.Preventive steps Be alert, install protective features on your phone and computer, and educate yourself. Here are some steps you can take to avoid fraud:Register for SMS and e-mail alerts: This will help detect a transaction you haven't made. In such a case, call up the bank's customer care number (see Call your bank...). Also, if your mobile stops working for unusual reasons, check with your mobile operator.Don't disclose details: "Never give Net banking password, ATM or phone PIN to anyone or respond to unknown mails or calls asking for account details," says Silas. Adds Jasuja: "No bank or credit card firm personnel is authorised to ask a cardholder for his card details."Hide CVV, go virtual: "While entering the CVV on a site, ensure it is masked by asterisks and the number is not visible on screen. This is especially important when shopping on foreign websites where the CVV number is the only point of verification and approval," says Jasuja. Also, while transacting on websites, use a virtual keyboard to avoid keystroke logging and while using an ATM, cover the keypad with your hand.Don't save details on sites: Many websites ask to save credit card details for future purchases. "But one should never ever save this information," says Naidu. Neither should you do it on any server, desktop, or mobile to avoid skimming and other frauds.If you are cheated.. The moment you fear your credit card or bank account details have been compromised or a fraudulent transaction has taken place, call the bank and have the card blocked. Follow it up with a written complaint and declaration. The bank should respond in 30 days, and if it doesn't, lodge a complaint with the ombudsman (https://www. http://rbi.org.in/commonman/Engl...).If this doesn't help, complain to the district consumer redressal forum and then to the court of law.PHONE CALLS, E-MAILS Phishing and vishing are among the most prevalent of frauds to have emerged in the past couple of years.One would assume cheating someone over the phone or mail would be difficult, but it's probably one of the easiest ways. All it takes is confidence and smooth-talking on the part of the fraudster. Besides vishing and other attempts to snare credit card information over the phone, there are other ploys to not only draw out sensitive information, but also make you pay money. This happens not only via phone but also mails. The Nigerian advance fee and lottery scams have given way to new excuses to steal your money, almost all of them demanding some sort of payment for bigger rewards.Modus operandi Insurance plans: If you get a call or mail, saying some of your forgotten policies are due for maturity and that you need to pay some money to secure this amount, know it to be a fraud.Work-from-home offers: According to the Telenor survey, this is the most common form of Internet scams accounting for 39% of frauds. This will typically entail an enticing job offer that requires you to first pay some fees and charges to be able to entitle you for the job. You are asked to deposit the money in a bank account and will never hear from the caller again.Free gifts and loans: This scam involves securing basic information from any forms you have filled in any of the offline shops. You are then offered a free gift for being a valued customer, but of course, you have to pay a small charge. Similarly offers of interest-free loans that require paying a processing fee should be ignored.Banking calls: If you get an urgent call saying your PIN is going to be deactivated, or account closed, and that you need to share your bank or card details to continue operating it, ignore it. Similarly offers for new credit cards or redemption of points that require divulging details should be avoided.Preventive steps "Avoid sharing personal details at public places like malls or shopping complexes on the pretext of holiday packages or gifts," says Silas. Do not reveal your financial or personal details on application forms, phone or mails. Similarly, avoid responding to SMSes or mails received from unknown senders or ones that urge immediate action or attention (see How to identify junk mail). Remember that there is no legal recourse if you lose your money in this fashion. So stay alert and secure your hard-earned money.

Create this form in 5 minutes!

How to create an eSignature for the company name or logo here customer refund and credit request form

How to make an eSignature for the Company Name Or Logo Here Customer Refund And Credit Request Form in the online mode

How to generate an electronic signature for your Company Name Or Logo Here Customer Refund And Credit Request Form in Google Chrome

How to generate an eSignature for signing the Company Name Or Logo Here Customer Refund And Credit Request Form in Gmail

How to create an eSignature for the Company Name Or Logo Here Customer Refund And Credit Request Form straight from your mobile device

How to make an electronic signature for the Company Name Or Logo Here Customer Refund And Credit Request Form on iOS

How to make an electronic signature for the Company Name Or Logo Here Customer Refund And Credit Request Form on Android

People also ask

-

What is a refund form in airSlate SignNow?

A refund form in airSlate SignNow is a digital document used to process refund requests easily and efficiently. It allows both customers and businesses to create, sign, and manage refund transactions seamlessly. This ensures a streamlined process that reduces delays and enhances customer satisfaction.

-

How can I create a refund form using airSlate SignNow?

Creating a refund form in airSlate SignNow is straightforward. Simply log into your account, select 'Create Document,' and choose a refund form template or create one from scratch. You can customize the fields and add signatures, making the process quick and tailored to your needs.

-

Is there a charge for using the refund form feature?

The refund form feature is included in various pricing plans of airSlate SignNow, which are designed to be cost-effective for businesses of all sizes. You can choose a plan that fits your needs, whether you're a small startup or a large corporation. Plus, you can take advantage of a free trial to explore all features, including the refund form.

-

Can I integrate the refund form with other applications?

Yes, airSlate SignNow allows you to integrate the refund form with various applications such as CRM systems, payment processors, and project management tools. This enhances your workflow and ensures that refund processes are aligned with your existing systems. Integrations are designed to be user-friendly, making the setup process simple.

-

What are the benefits of using a refund form in airSlate SignNow?

Using a refund form in airSlate SignNow provides numerous benefits, including improved efficiency and faster turnaround times for refund requests. With digital signatures and automated workflows, you can ensure that refunds are processed quickly. Additionally, it enhances record-keeping and provides a complete audit trail for your transactions.

-

Is it secure to submit a refund form through airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and ensures that all refund forms are encrypted during transmission. The platform complies with industry standards, providing a secure environment for sensitive information. You can have peace of mind knowing your data is protected.

-

Can customers fill out the refund form on mobile devices?

Yes, customers can easily fill out the refund form using mobile devices. airSlate SignNow is mobile-responsive, allowing users to complete and sign documents on-the-go. This flexibility ensures that your customers can submit refund requests conveniently, increasing overall customer satisfaction.

Get more for Company Name Or Logo Here Customer Refund And Credit Request Form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession florida form

- Fl illegal form

- Letter from landlord to tenant about time of intent to enter premises florida form

- Florida notice rent form

- Letter from tenant to landlord about sexual harassment florida form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children florida form

- Letter landlord form 497302964

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497302965 form

Find out other Company Name Or Logo Here Customer Refund And Credit Request Form

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free