Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children Ohio Form

What is the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Ohio

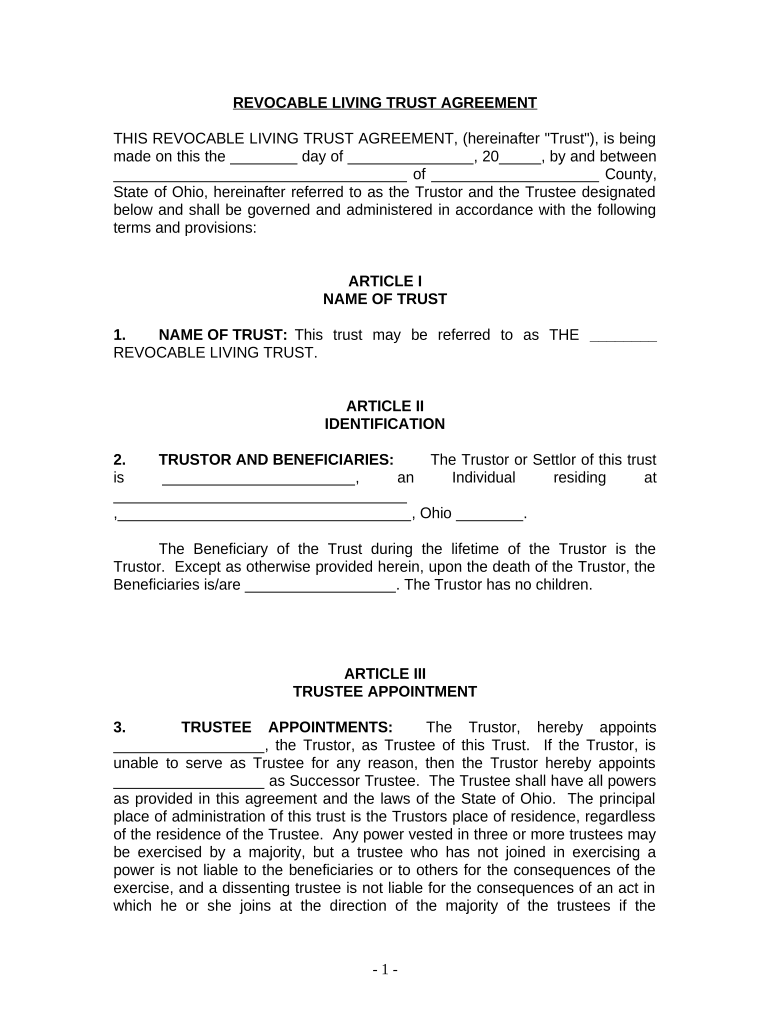

A living trust is a legal arrangement that allows an individual to manage their assets during their lifetime and specify how those assets should be distributed upon their death. For individuals who are single, divorced, or widowed and have no children, a living trust can provide a straightforward way to ensure that their wishes are honored. This type of trust can help avoid probate, maintain privacy, and provide flexibility in asset management.

How to Use the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Ohio

Using a living trust involves several steps. First, the individual must create the trust document, which outlines the terms and conditions of the trust. Next, they need to transfer ownership of their assets into the trust. This may include real estate, bank accounts, and other valuable items. Once the trust is established and funded, the individual can manage their assets as usual, with the trust serving as the legal entity that holds those assets.

Steps to Complete the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Ohio

Completing a living trust involves a series of steps:

- Determine the assets to include in the trust.

- Draft the trust document, specifying the terms and beneficiaries.

- Sign the document in accordance with Ohio state laws.

- Transfer assets into the trust, ensuring proper title changes.

- Review and update the trust as necessary over time.

Legal Use of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Ohio

The legal use of a living trust in Ohio allows individuals to outline their wishes regarding asset distribution without going through probate. This can be particularly beneficial for those who want to ensure a smooth transition of their estate after their passing. It is important to comply with Ohio laws when creating and executing a living trust to ensure its validity and enforceability.

State-Specific Rules for the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Ohio

Ohio has specific regulations governing living trusts. These include requirements for the trust document to be signed and witnessed according to state law. Additionally, Ohio law allows for the revocation of a living trust at any time, providing flexibility for the trust creator. Understanding these rules is crucial for ensuring that the trust is legally binding and effective.

Key Elements of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Ohio

Key elements of a living trust include:

- The name of the trust and the trust creator.

- A detailed description of the assets included in the trust.

- The name of the trustee, who will manage the trust.

- Instructions for asset distribution upon the creator's death.

- Provisions for revocation or amendment of the trust.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with no children ohio

Complete Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Ohio effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Ohio on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Ohio without hassle

- Locate Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Ohio and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Ohio and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Ohio?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Ohio is a legal document that allows you to manage your assets during your lifetime and distribute them after your death without going through probate. It provides control over your assets and can simplify the process for your heirs.

-

How does a Living Trust benefit someone who is single, divorced, or a widow/widower in Ohio?

A Living Trust For Individuals Who Are Single, Divorced Or Widow or Widower With No Children in Ohio offers several benefits, including avoiding probate, maintaining privacy, and having flexibility in asset management. This can be particularly valuable for individuals with unique estate planning needs or those looking for a streamlined approach.

-

What are the costs associated with setting up a Living Trust for single, divorced, or widowed individuals in Ohio?

The costs of establishing a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Ohio can vary depending on the complexity of your estate and the fees charged by legal professionals. Generally, costs can range from a few hundred to a couple of thousand dollars, including attorney fees and filing fees.

-

Can I manage my Living Trust myself if I'm single, divorced, or a widow/widower in Ohio?

Absolutely! A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Ohio can be self-managed, allowing you to retain control over your assets. However, it’s beneficial to consult with a legal professional to ensure it's set up correctly and meets your needs.

-

What assets can be included in a Living Trust for single or divorced individuals in Ohio?

You can include various assets in a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Ohio, such as real estate, bank accounts, investments, and personal property. It’s important to properly transfer these assets into the trust to ensure they are managed according to your wishes.

-

How does a Living Trust impact estate taxes for single or divorced individuals in Ohio?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Ohio does not directly affect estate taxes; however, it can provide strategic ways to manage your assets to minimize tax liabilities. Consulting with a tax advisor is advisable to ensure optimal tax planning.

-

Can I modify my Living Trust if my circumstances change in Ohio?

Yes, one of the key advantages of a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Ohio is that it is revocable, meaning you can change its terms or revoke it entirely as your situation changes. This flexibility makes it a versatile estate planning tool.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Ohio

- Cffa application fillable form

- Adirondack tire corp form

- Columbia community transcript form

- Home health aide training program application new york state health ny form

- Tompkins county health department septic form

- Instructions for form cg 213 cigarette stamping tax ny gov

- 1 business registration lists master pending yearly form

- Cancellation claim form claim number csal co

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Ohio

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation