SBA Loans Greater Than $50,000 Business Credit Application Redfcu 2014-2026

Understanding the SBA Loans Greater Than $50,000 Business Credit Application Redfcu

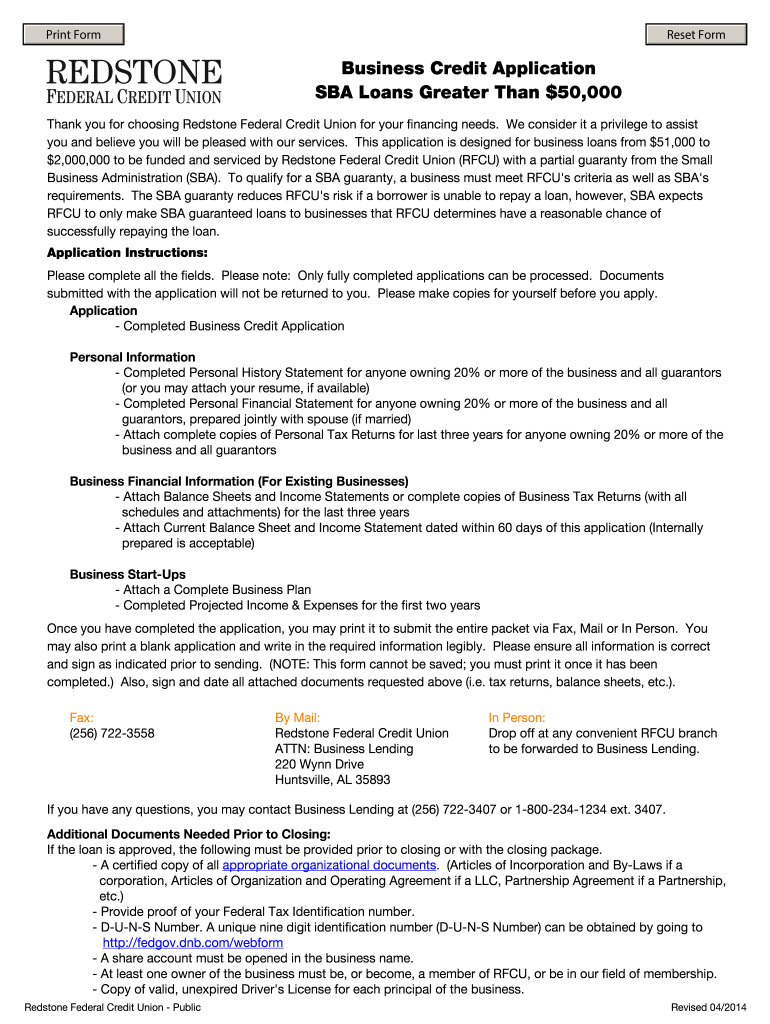

The SBA Loans Greater Than $50,000 Business Credit Application is designed for businesses seeking funding to support growth and operational needs. This application is specifically tailored for loans exceeding fifty thousand dollars, providing a structured approach to secure financial assistance. It requires detailed information about the business, including financial statements, business plans, and personal financial information of the owners. Understanding the components of this application is essential for a successful submission.

Steps to Complete the SBA Loans Greater Than $50,000 Business Credit Application Redfcu

Completing the SBA Loans Greater Than $50,000 Business Credit Application involves several key steps:

- Gather necessary documentation, including financial statements, tax returns, and business plans.

- Fill out the application form accurately, ensuring all sections are completed.

- Review the application for any errors or missing information.

- Submit the application through the preferred method, ensuring compliance with any specific submission guidelines.

Taking these steps carefully can enhance the chances of approval and streamline the application process.

Eligibility Criteria for the SBA Loans Greater Than $50,000 Business Credit Application Redfcu

Eligibility for the SBA Loans Greater Than $50,000 Business Credit Application typically includes several criteria:

- The business must be a for-profit entity operating in the United States.

- The business should meet the SBA's size standards, which vary by industry.

- The owner must have a reasonable credit history.

- The business must demonstrate a need for the loan proceeds.

Meeting these criteria is crucial for a successful application process.

Required Documents for the SBA Loans Greater Than $50,000 Business Credit Application Redfcu

When applying for the SBA Loans Greater Than $50,000, several documents are required to support your application:

- Personal and business tax returns for the past three years.

- Financial statements, including balance sheets and income statements.

- A detailed business plan outlining the purpose of the loan and how it will benefit the business.

- Personal financial statements from all owners with a stake in the business.

Having these documents ready can facilitate a smoother application process.

Application Process & Approval Time for the SBA Loans Greater Than $50,000 Business Credit Application Redfcu

The application process for the SBA Loans Greater Than $50,000 typically involves submitting the completed application along with all required documentation. Once submitted, the review process can take anywhere from a few weeks to several months, depending on the complexity of the application and the lender's workload. It is essential to follow up with the lender to ensure all documents are received and to inquire about the status of the application.

Legal Use of the SBA Loans Greater Than $50,000 Business Credit Application Redfcu

Using the SBA Loans Greater Than $50,000 Business Credit Application legally entails adhering to all federal and state regulations governing business loans. This includes providing truthful information in the application, using the loan proceeds for legitimate business purposes, and complying with the terms of the loan agreement. Failure to comply with these legal requirements can result in penalties or loan default.

Quick guide on how to complete sba loans greater than 50000 business credit application redfcu

The optimal method to locate and endorse SBA Loans Greater Than $50,000 Business Credit Application Redfcu

On the scale of your entire organization, ineffective workflows related to document approval can drain a signNow amount of productive time. Endorsing documents such as SBA Loans Greater Than $50,000 Business Credit Application Redfcu is an inherent element of operations in any enterprise, which is why the effectiveness of each contract’s lifecycle signNowly impacts the overall productivity of the company. With airSlate SignNow, endorsing your SBA Loans Greater Than $50,000 Business Credit Application Redfcu is as straightforward and quick as possible. This platform provides you access to the latest version of virtually any document. Even better, you can endorse it immediately without needing to install additional software on your device or print anything as physical copies.

Steps to acquire and endorse your SBA Loans Greater Than $50,000 Business Credit Application Redfcu

- Browse our catalog by category or utilize the search bar to locate the document you require.

- View the document preview by selecting Learn more to confirm it’s the correct one.

- Select Get form to begin editing immediately.

- Fill in your document and insert any required details using the toolbar.

- Once completed, click on the Sign tool to endorse your SBA Loans Greater Than $50,000 Business Credit Application Redfcu.

- Choose the signing method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finish editing and move on to document-sharing options as necessary.

With airSlate SignNow, you have everything necessary to handle your documentation efficiently. You can find, complete, modify, and even send your SBA Loans Greater Than $50,000 Business Credit Application Redfcu all in one tab without any difficulties. Enhance your workflows with a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba loans greater than 50000 business credit application redfcu

How to create an eSignature for the Sba Loans Greater Than 50000 Business Credit Application Redfcu in the online mode

How to generate an electronic signature for the Sba Loans Greater Than 50000 Business Credit Application Redfcu in Chrome

How to create an electronic signature for signing the Sba Loans Greater Than 50000 Business Credit Application Redfcu in Gmail

How to generate an eSignature for the Sba Loans Greater Than 50000 Business Credit Application Redfcu straight from your smartphone

How to generate an eSignature for the Sba Loans Greater Than 50000 Business Credit Application Redfcu on iOS

How to generate an electronic signature for the Sba Loans Greater Than 50000 Business Credit Application Redfcu on Android devices

People also ask

-

What are the benefits of using airSlate SignNow for my SBA Loans Greater Than $50,000 Business Credit Application Redfcu?

Using airSlate SignNow for your SBA Loans Greater Than $50,000 Business Credit Application Redfcu streamlines the eSigning process, making it quick and efficient. With a user-friendly interface, you can send and receive documents seamlessly, reducing paperwork and saving time. Additionally, our secure platform ensures that your sensitive information is protected throughout the entire application process.

-

How much does airSlate SignNow cost for managing SBA Loans Greater Than $50,000 Business Credit Application Redfcu?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. For managing your SBA Loans Greater Than $50,000 Business Credit Application Redfcu, you can choose from our various subscription options, ensuring you get the best value for your needs. Plus, with our cost-effective solution, you can reduce operational costs associated with traditional document signing.

-

Can I integrate airSlate SignNow with other software for my SBA Loans Greater Than $50,000 Business Credit Application Redfcu?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms that can enhance your SBA Loans Greater Than $50,000 Business Credit Application Redfcu process. Whether you use CRM systems, cloud storage, or project management tools, our integrations help streamline your workflow and improve efficiency.

-

How secure is airSlate SignNow for handling SBA Loans Greater Than $50,000 Business Credit Application Redfcu?

Security is a top priority at airSlate SignNow. For your SBA Loans Greater Than $50,000 Business Credit Application Redfcu, we use advanced encryption protocols and comply with industry standards to protect your documents. You can rest assured that your sensitive information remains confidential and secure during the signing process.

-

Is there a mobile app for airSlate SignNow to manage my SBA Loans Greater Than $50,000 Business Credit Application Redfcu?

Yes, airSlate SignNow offers a mobile app that allows you to manage your SBA Loans Greater Than $50,000 Business Credit Application Redfcu on the go. With the app, you can easily send, sign, and manage documents from your smartphone or tablet, ensuring that you never miss an opportunity to expedite your business credit application.

-

How quickly can I send out my SBA Loans Greater Than $50,000 Business Credit Application Redfcu using airSlate SignNow?

With airSlate SignNow, you can send out your SBA Loans Greater Than $50,000 Business Credit Application Redfcu in just a few clicks. Our intuitive platform allows you to upload documents, add signers, and send them out for eSignature almost instantly. This efficiency helps you speed up your application process and get the funding you need faster.

-

What types of documents can I use with airSlate SignNow for my SBA Loans Greater Than $50,000 Business Credit Application Redfcu?

airSlate SignNow supports a wide variety of document types that you can use for your SBA Loans Greater Than $50,000 Business Credit Application Redfcu. Whether it's PDF forms, Word documents, or images, our platform can handle them all, making it easy to manage your application submissions regardless of the format.

Get more for SBA Loans Greater Than $50,000 Business Credit Application Redfcu

- Type street address form

- Field 4 9 form

- This article is for you to leave your homestead if you have one on the date of form

- Field 23 form

- Illinois will formcreate your own willus legal forms

- Organizations and other like entities 11 employer 12 will contracts form

- This letter is to notify you that letters testamentary have been issued by the chancery form

- Medical case file template form

Find out other SBA Loans Greater Than $50,000 Business Credit Application Redfcu

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online