433 B Oic 2025-2026

What is the 433 B OIC

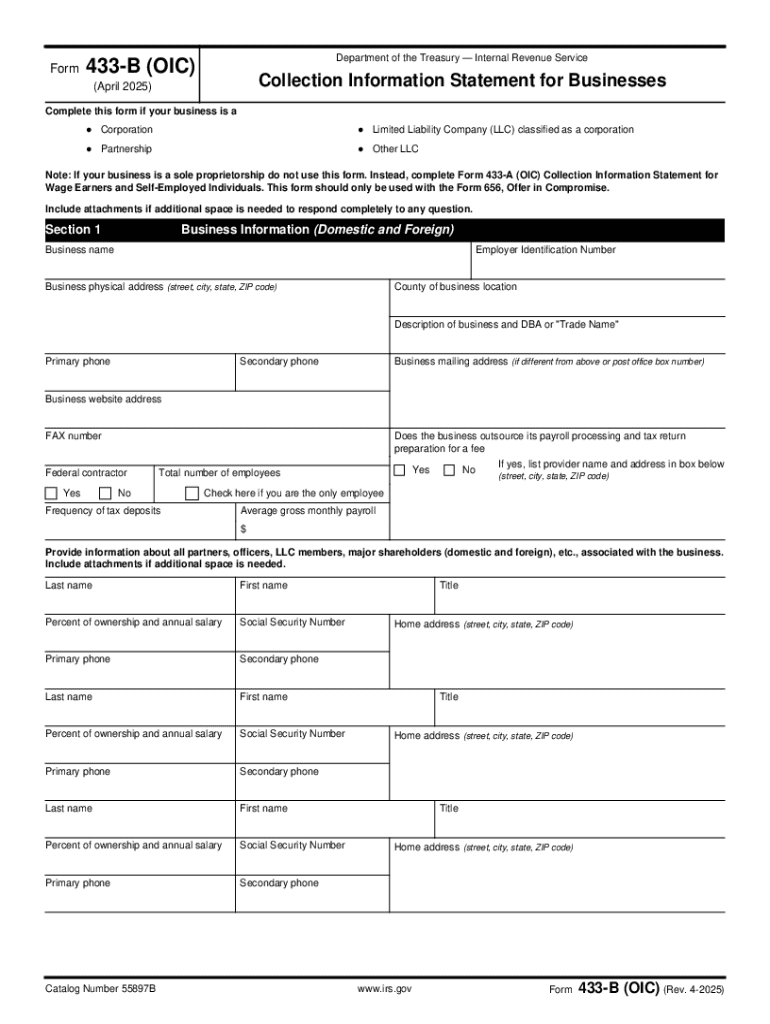

The 433 B OIC, or Form 433-B (OIC), is a financial disclosure form used by the Internal Revenue Service (IRS) in the United States. It is specifically designed for businesses seeking to settle their tax debts through an Offer in Compromise (OIC). This form allows the IRS to evaluate a taxpayer's financial situation, including assets, income, and expenses, to determine whether the proposed settlement amount is reasonable. The 433 B OIC is essential for businesses that wish to negotiate their tax liabilities and potentially reduce the amount owed to the IRS.

How to Use the 433 B OIC

To effectively use the 433 B OIC, businesses must accurately complete the form to reflect their financial status. This involves providing detailed information about assets, liabilities, income, and expenses. The IRS uses this information to assess the taxpayer's ability to pay. It is crucial to ensure that all figures are correct and that the form is submitted along with the appropriate Offer in Compromise application. Proper completion increases the likelihood of acceptance by the IRS.

Steps to Complete the 433 B OIC

Completing the 433 B OIC involves several key steps:

- Gather financial documents, including income statements, bank statements, and expense reports.

- Fill out the form with accurate information regarding your business's financial situation.

- Detail all assets, including real estate, vehicles, and business equipment.

- List all liabilities, such as loans, credit debts, and other financial obligations.

- Calculate your monthly income and expenses to determine your disposable income.

- Review the form for accuracy and completeness before submission.

Legal Use of the 433 B OIC

The 433 B OIC is legally binding once submitted to the IRS. It is important for businesses to understand that providing false information can lead to penalties or legal consequences. The form is used during the negotiation process for settling tax debts, and it must be filled out truthfully to ensure compliance with IRS regulations. Legal counsel or tax professionals can provide guidance to ensure that the form is used correctly and in accordance with the law.

Required Documents for the 433 B OIC

When submitting the 433 B OIC, businesses must include several supporting documents to validate their financial situation. These documents typically include:

- Recent bank statements.

- Profit and loss statements for the past few months.

- Asset valuations, such as appraisals for real estate.

- Documentation of liabilities, including loan agreements and credit statements.

- Any other relevant financial information that supports the claim.

Filing Deadlines for the 433 B OIC

Understanding the filing deadlines for the 433 B OIC is crucial for businesses seeking to settle their tax debts. The IRS typically requires that the form be submitted within a specific timeframe, which may vary based on individual circumstances. It is advisable to check the IRS guidelines for the most current deadlines and ensure timely submission to avoid penalties or complications in the negotiation process.

Handy tips for filling out 433 b oic online

Quick steps to complete and e-sign 433 b oic online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents could be. Obtain access to a HIPAA and GDPR compliant platform for maximum simplicity. Use signNow to electronically sign and send out 433 b oic for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct 433 b oic

Create this form in 5 minutes!

How to create an eSignature for the 433 b oic

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 433 b oic and how does it relate to airSlate SignNow?

The 433 b oic refers to a specific regulatory framework that can impact how businesses manage their document workflows. airSlate SignNow provides a compliant solution that helps organizations navigate these regulations effectively while ensuring secure eSigning and document management.

-

How does airSlate SignNow support compliance with 433 b oic?

airSlate SignNow is designed to meet various compliance standards, including those outlined in the 433 b oic. Our platform offers features such as secure storage, audit trails, and customizable workflows to ensure that your document processes adhere to regulatory requirements.

-

What are the pricing options for airSlate SignNow related to 433 b oic?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, ensuring that you can find a solution that fits your budget while complying with 433 b oic. Our plans include various features that enhance document management and eSigning capabilities.

-

What features does airSlate SignNow offer for managing documents under 433 b oic?

With airSlate SignNow, you can utilize features such as customizable templates, automated workflows, and real-time tracking to manage documents effectively under 433 b oic. These tools streamline the eSigning process and enhance overall efficiency.

-

Can airSlate SignNow integrate with other tools to support 433 b oic compliance?

Yes, airSlate SignNow offers integrations with various third-party applications that can help streamline your document processes while ensuring compliance with 433 b oic. This allows you to maintain a cohesive workflow across different platforms.

-

What are the benefits of using airSlate SignNow for 433 b oic compliance?

Using airSlate SignNow for 433 b oic compliance provides several benefits, including enhanced security, improved efficiency, and reduced turnaround times for document approvals. Our platform simplifies the eSigning process, making it easier for businesses to stay compliant.

-

Is airSlate SignNow suitable for small businesses dealing with 433 b oic?

Absolutely! airSlate SignNow is an ideal solution for small businesses navigating the complexities of 433 b oic. Our user-friendly interface and cost-effective pricing make it accessible for organizations looking to streamline their document management processes.

Get more for 433 b oic

- Real estate residential lot contract questionnaire form

- Consolidated financial statements otc markets form

- The words you type form

- Us9767513b1 card registry systems and methods google patents form

- Field 12 form

- Field 18 form

- Welcome to the city of clovis application process form

- Using fba for diagnostic assessment in behavior using fba for diagnostic assessment in behavior form

Find out other 433 b oic

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement