Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children Ohio Form

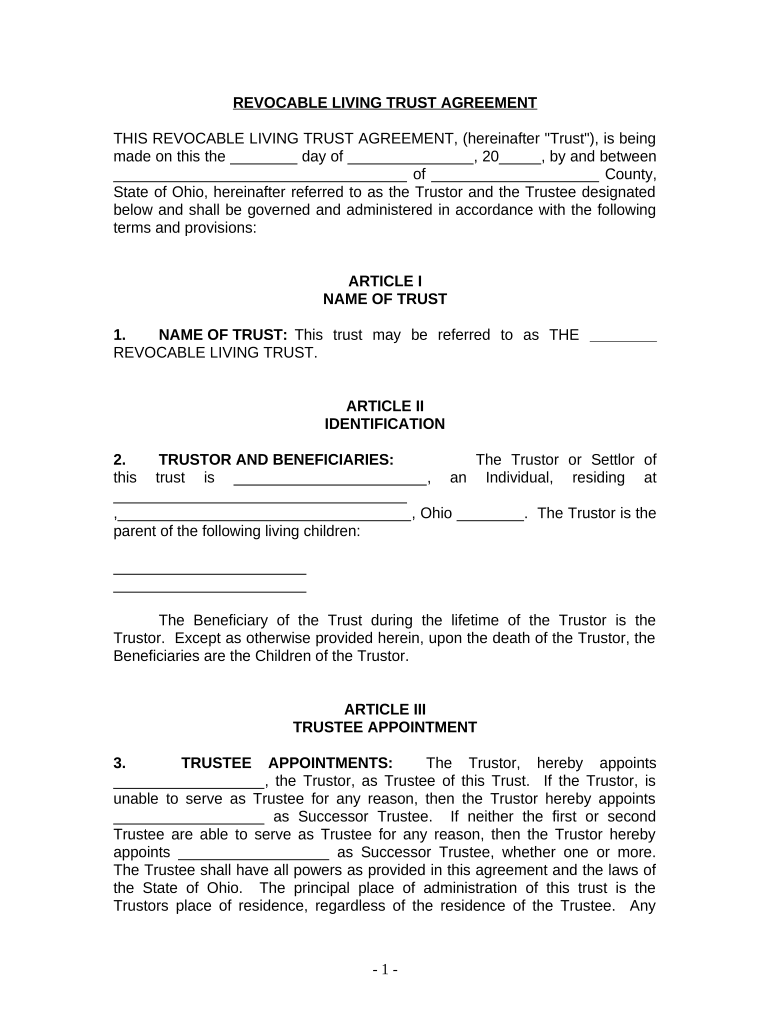

What is the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in Ohio

A living trust is a legal arrangement that allows an individual to place their assets into a trust during their lifetime. For those who are single, divorced, or widowed with children in Ohio, a living trust can be especially beneficial. It helps ensure that assets are managed and distributed according to the individual's wishes after their passing. Unlike a will, a living trust can bypass the probate process, allowing for a quicker and more private transfer of assets to beneficiaries.

How to Use the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in Ohio

Using a living trust involves several steps. First, individuals must determine what assets they want to include in the trust. This can include real estate, bank accounts, investments, and personal property. Next, they need to create the trust document, which outlines how the assets will be managed and distributed. It is advisable to work with a legal professional to ensure that the trust complies with Ohio laws and accurately reflects the individual's intentions. Once established, the individual must transfer ownership of the assets into the trust, a process known as "funding" the trust.

Steps to Complete the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in Ohio

Completing a living trust involves a series of clear steps:

- Identify and list all assets to be included in the trust.

- Draft the trust document, specifying the terms and conditions.

- Choose a trustee to manage the trust, which can be the individual or another trusted person.

- Fund the trust by transferring ownership of the identified assets.

- Review and update the trust periodically, especially after significant life changes.

Legal Use of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in Ohio

The legal use of a living trust in Ohio requires adherence to specific state laws. The trust must be created in writing and signed by the individual establishing the trust. It is important to ensure that the trust document complies with Ohio Revised Code provisions regarding trusts. Additionally, the trust should be properly funded to be legally effective. This means that all designated assets must be transferred into the trust's name to ensure they are managed according to the trust's terms.

Key Elements of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in Ohio

Key elements of a living trust include:

- Trustee: The individual or entity responsible for managing the trust.

- Beneficiaries: Individuals or entities that will receive assets from the trust.

- Terms of Distribution: Instructions on how and when assets will be distributed to beneficiaries.

- Revocability: The ability to modify or revoke the trust during the individual's lifetime.

State-Specific Rules for the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in Ohio

Ohio has specific rules governing the creation and administration of living trusts. For instance, the trust must be signed by the grantor and can be revoked at any time unless it is designated as irrevocable. Additionally, Ohio law requires that the trust be funded properly to ensure that the assets are legally recognized as part of the trust. Consulting with an attorney familiar with Ohio trust law can help navigate these requirements effectively.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children ohio

Complete Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the resources you need to generate, amend, and electronically sign your documents quickly without hold-ups. Handle Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric workflow today.

How to edit and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio with ease

- Locate Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether via email, SMS, invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. It helps ensure your children are taken care of and can simplify the estate settlement process. This type of trust is particularly beneficial for individuals navigating changes in family dynamics.

-

How does a Living Trust benefit someone who is Single, Divorced, or a Widow/Widower with Children in Ohio?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio provides peace of mind by clearly outlining how your assets will be managed and distributed to your children. It can avoid the lengthy and costly probate process, ensuring that your loved ones receive their inheritance more quickly. Additionally, this trust allows you to retain control over your assets while you're alive.

-

What are the costs associated with creating a Living Trust in Ohio?

The costs to establish a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio can vary depending on several factors, including legal fees and the complexity of your estate. Generally, you may expect to pay anywhere from $1,000 to $3,000 for professional assistance. Investing in a trust ensures that your assets are distributed according to your wishes, which can save money in the long run.

-

Can I modify my Living Trust if my situation changes?

Yes, a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio is revocable, meaning you can modify it as your circumstances change. Whether you get remarried, have more children, or wish to change beneficiaries, adjustments can easily be made. This flexibility ensures that your estate plan stays current and effective.

-

What assets can I include in a Living Trust?

You can include various assets in a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio, such as real estate, bank accounts, investments, and personal property. However, it's essential to title the assets in the name of the trust properly. By doing this, you can ensure these assets are managed according to your wishes after your passing.

-

How long does it take to set up a Living Trust?

Setting up a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio can take anywhere from a few days to several weeks, depending on the complexity of your assets and whether you choose to work with an attorney. Typically, it involves drafting the trust document, transferring assets, and signing in front of a notary. Prompt action can help ensure your estate plan is in place when needed.

-

Is a Living Trust necessary if I have a Will?

While a Will can outline how your assets should be distributed, a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio can help avoid probate and provide a quicker distribution of your assets. Many individuals find having both documents beneficial as the trust covers specific aspects of asset management during your lifetime. This dual approach can ensure a more comprehensive estate plan.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio

- Tompkins county proof of residence form

- Building permit application form village of south barrington southbarrington

- Ny ambulance call form

- Data intake form pdf hauser clinic amp associates

- Hope fund application for assistance hca hope fund form

- Umr fillable forms

- New equipment request form herberger institute for design and herbergerinstitute asu

- Bird checklist pdf form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Ohio

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure