Warranty Deed from Husband and Wife to Corporation Oklahoma Form

What is the Warranty Deed From Husband And Wife To Corporation Oklahoma

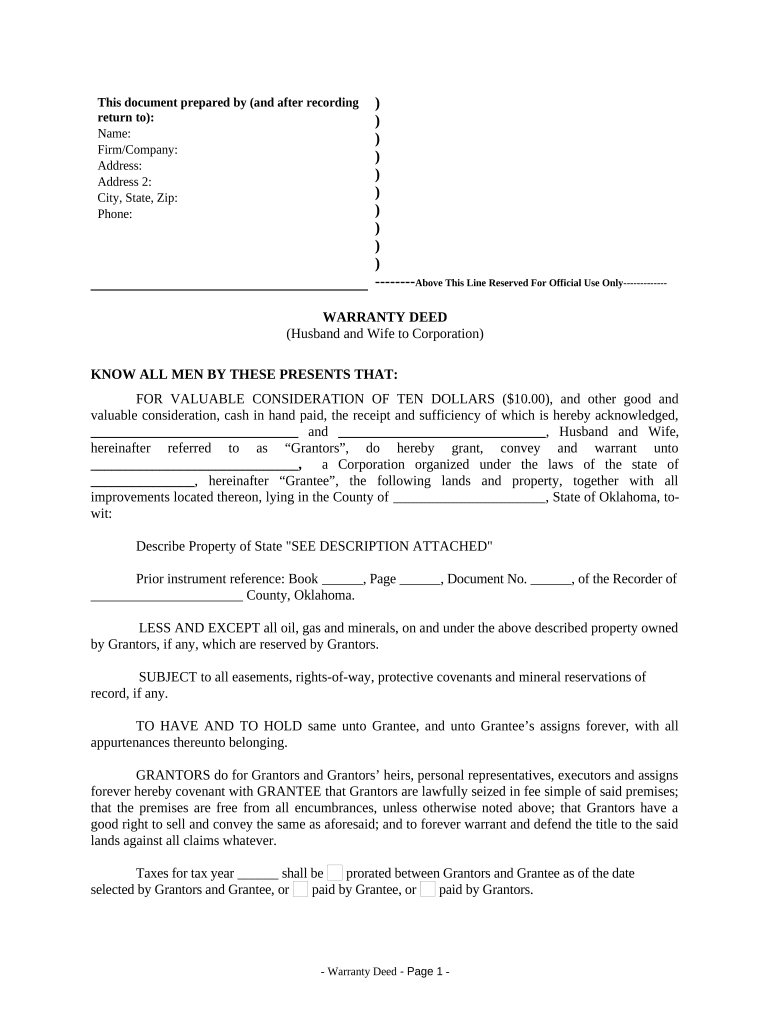

A warranty deed from husband and wife to a corporation in Oklahoma is a legal document that transfers ownership of property from a married couple to a corporate entity. This type of deed guarantees that the property is free from any liens or encumbrances, except those explicitly stated in the deed. It provides assurance to the corporation that the transfer is legitimate and that the couple holds clear title to the property. This document is essential in real estate transactions, ensuring that all parties involved have a clear understanding of ownership rights.

Key elements of the Warranty Deed From Husband And Wife To Corporation Oklahoma

Several key elements must be included in a warranty deed to ensure its validity in Oklahoma:

- Grantors: The names of the husband and wife transferring the property.

- Grantee: The name of the corporation receiving the property.

- Legal Description: A detailed description of the property being transferred, including boundaries and location.

- Consideration: The amount paid for the property, which may be nominal or a specific dollar amount.

- Signatures: The signatures of both the husband and wife, along with a notary acknowledgment to validate the deed.

Steps to complete the Warranty Deed From Husband And Wife To Corporation Oklahoma

Completing a warranty deed involves several steps to ensure that the document is legally binding:

- Gather necessary information about the property, including its legal description and the names of the parties involved.

- Draft the warranty deed, ensuring all required elements are included.

- Both the husband and wife must review and sign the document in the presence of a notary public.

- File the completed warranty deed with the county clerk's office where the property is located.

- Retain a copy of the filed deed for personal records.

Legal use of the Warranty Deed From Husband And Wife To Corporation Oklahoma

The warranty deed is legally used to transfer property ownership and is recognized by Oklahoma law. It serves as proof of ownership and protects the interests of the grantee, the corporation. This type of deed is particularly important in real estate transactions as it provides a level of security regarding the title of the property. Ensuring that the deed is properly executed and filed is crucial for it to be enforceable in legal matters.

State-specific rules for the Warranty Deed From Husband And Wife To Corporation Oklahoma

Oklahoma has specific rules governing the execution and recording of warranty deeds. These include:

- The requirement for both spouses to sign the deed if the property is jointly owned.

- Notarization of the signatures to validate the transfer.

- Filing the deed with the county clerk's office within a specified timeframe to ensure public record.

- Compliance with local regulations regarding property transfers and disclosures.

How to use the Warranty Deed From Husband And Wife To Corporation Oklahoma

Using the warranty deed involves understanding its purpose and ensuring it is filled out correctly. After drafting the deed, the husband and wife must sign it in front of a notary. Once signed, the deed should be filed with the appropriate county office to make the transfer official. This process helps protect the rights of both the grantors and the grantee, ensuring that the transaction is legally recognized.

Quick guide on how to complete warranty deed from husband and wife to corporation oklahoma

Easily prepare Warranty Deed From Husband And Wife To Corporation Oklahoma on any device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any delays. Handle Warranty Deed From Husband And Wife To Corporation Oklahoma on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Warranty Deed From Husband And Wife To Corporation Oklahoma effortlessly

- Locate Warranty Deed From Husband And Wife To Corporation Oklahoma and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or hide sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Forge your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it directly to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Warranty Deed From Husband And Wife To Corporation Oklahoma to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Warranty Deed From Husband And Wife To Corporation in Oklahoma?

A Warranty Deed From Husband And Wife To Corporation in Oklahoma is a legal document that transfers property ownership from a married couple to a corporation. This deed ensures that the corporation receives full legal rights to the property and that the title is free from additional claims. This type of deed provides security and assurance to the new owner regarding the property's integrity.

-

What are the key benefits of using a Warranty Deed From Husband And Wife To Corporation in Oklahoma?

Using a Warranty Deed From Husband And Wife To Corporation in Oklahoma provides several benefits, including clear title transfer, legal protection against future claims, and improved property security for the corporation. This document can also facilitate smoother transactions in real estate, making it easier for businesses to manage their assets. Ensuring proper documentation can prevent potential disputes down the line.

-

How much does it cost to create a Warranty Deed From Husband And Wife To Corporation in Oklahoma?

The cost to create a Warranty Deed From Husband And Wife To Corporation in Oklahoma can vary depending on the legal services you choose, the complexity of the property transfer, and any additional fees. Typically, legal assistance may range from a few hundred to over a thousand dollars. It's important to compare options and ensure that the price reflects the quality of service provided.

-

What information do I need to provide for a Warranty Deed From Husband And Wife To Corporation in Oklahoma?

To create a Warranty Deed From Husband And Wife To Corporation in Oklahoma, you will need to provide details such as the legal names of the husband and wife, the name of the corporation, a description of the property, and any relevant tax identification numbers. Accurate information is crucial to ensure a smooth transfer and to avoid future legal issues.

-

How long does it take to process a Warranty Deed From Husband And Wife To Corporation in Oklahoma?

The processing time for a Warranty Deed From Husband And Wife To Corporation in Oklahoma can vary based on local filing requirements and the efficiency of your legal representation. Generally, once the deed is signed and signNowd, it can take a few days to weeks for it to be recorded officially. Factors such as workload at the county office may also impact this timeline.

-

Can I handle the Warranty Deed From Husband And Wife To Corporation in Oklahoma without a lawyer?

While it is possible to create a Warranty Deed From Husband And Wife To Corporation in Oklahoma without an attorney, it is advisable to seek legal guidance. An attorney can help ensure that all legal requirements are met, reducing the risk of errors that could jeopardize the transfer. Proper legal assistance can save time and potential issues in the future.

-

What happens if I do not register my Warranty Deed From Husband And Wife To Corporation in Oklahoma?

Failing to register your Warranty Deed From Husband And Wife To Corporation in Oklahoma can lead to legal complications, such as disputes over property ownership. Without proper registration, the deed may not hold up in court, and rights to the property could be challenged. It's vital to complete this step to secure ownership rights fully.

Get more for Warranty Deed From Husband And Wife To Corporation Oklahoma

Find out other Warranty Deed From Husband And Wife To Corporation Oklahoma

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors