Oregon Lien Form

What is the Oregon Lien?

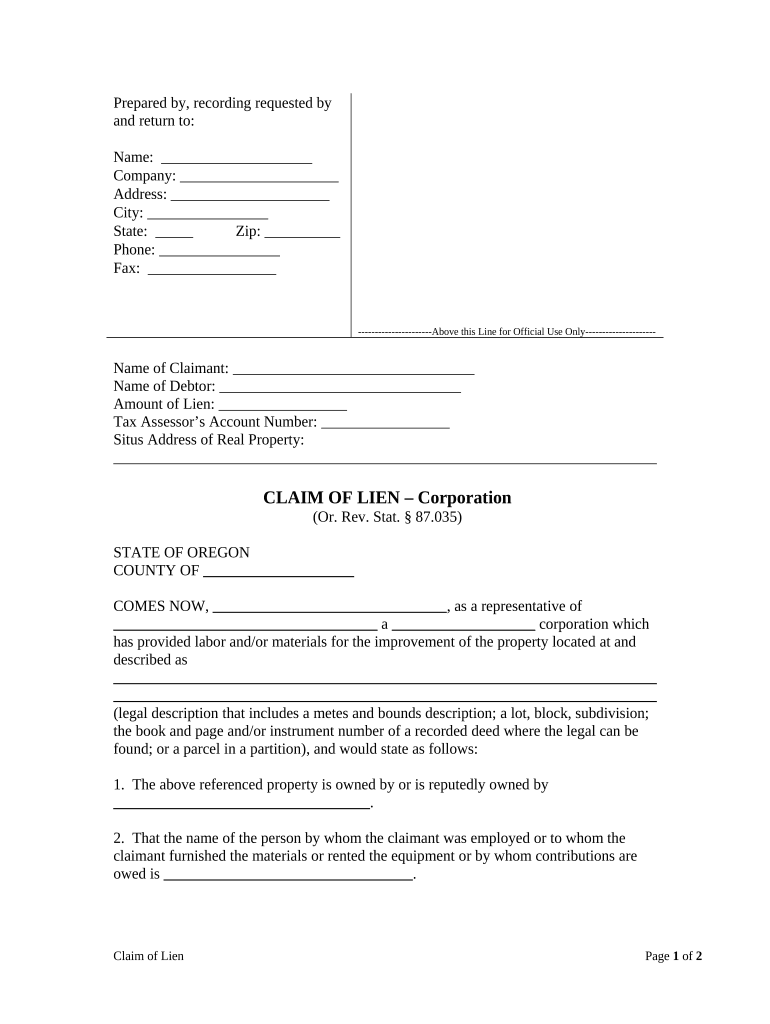

The Oregon lien is a legal claim against property, typically used to secure the payment of a debt or obligation. This form is essential for creditors to protect their interests in a debtor's property. In Oregon, liens can be placed on various types of property, including real estate and personal property. Understanding the nature of the lien is crucial for both creditors and debtors, as it can affect property ownership and transfer. It is important to comply with state laws and regulations when filing a lien to ensure its enforceability.

Key Elements of the Oregon Lien

Several key elements define the Oregon lien, making it a legally binding instrument. These include:

- Identification of the Debtor: The lien must clearly identify the individual or entity that owes the debt.

- Description of the Debt: The document should specify the amount owed and the nature of the obligation.

- Property Description: A precise description of the property subject to the lien is necessary to establish a claim.

- Filing Requirements: The lien must be filed with the appropriate state office to be enforceable.

- Compliance with State Laws: Adhering to Oregon's specific legal requirements is essential for the lien's validity.

Steps to Complete the Oregon Lien

Completing the Oregon lien involves several important steps to ensure it is properly filed and enforceable. These steps include:

- Gather Necessary Information: Collect all relevant details about the debtor, the debt, and the property.

- Prepare the Lien Document: Draft the lien document, ensuring all key elements are included.

- File the Lien: Submit the completed lien to the appropriate state office, adhering to filing guidelines.

- Notify the Debtor: Provide notice to the debtor regarding the lien placement, as required by law.

- Maintain Records: Keep copies of the filed lien and any correspondence related to it for future reference.

Legal Use of the Oregon Lien

The legal use of the Oregon lien is governed by state laws that outline how and when a lien can be placed. Creditors must ensure they have a valid claim and follow the appropriate legal procedures to avoid disputes. The lien serves as a powerful tool for creditors to secure payment and can be enforced through legal action if necessary. Understanding the legal framework surrounding liens in Oregon is essential for effective debt recovery.

Form Submission Methods for the Oregon Lien

Submitting the Oregon lien can be done through various methods, each with its own considerations:

- Online Submission: Many state offices offer online filing options, making it convenient to submit the lien electronically.

- Mail Submission: Creditors can also choose to send the lien via traditional mail, ensuring all documents are properly signed and dated.

- In-Person Submission: For those who prefer direct interaction, submitting the lien in person at the appropriate office is an option.

Eligibility Criteria for Filing an Oregon Lien

To file an Oregon lien, certain eligibility criteria must be met. Typically, creditors must have a legitimate claim against the debtor, supported by documentation of the debt. Additionally, the property subject to the lien must be located within Oregon, and the creditor must follow the state's filing procedures. Understanding these criteria is vital for ensuring that the lien can be enforced if necessary.

Quick guide on how to complete oregon lien 497323627

Complete Oregon Lien effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Oregon Lien on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Oregon Lien with minimal effort

- Obtain Oregon Lien and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your edits.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Modify and eSign Oregon Lien and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Oregon lien form?

An Oregon lien form is a legal document used to secure a debt by placing a claim against a property in the state of Oregon. This form is essential for creditors seeking to protect their interests and ensure they are paid. Using airSlate SignNow, you can easily create, send, and eSign these forms for a smooth process.

-

How much does it cost to use the Oregon lien form features on airSlate SignNow?

airSlate SignNow offers a range of pricing plans to accommodate different business needs for using the Oregon lien form. The plans start at a competitive rate, which is designed to be cost-effective for small to large businesses. Visit our pricing page to view detailed plans that fit your requirements.

-

Can I customize the Oregon lien form using airSlate SignNow?

Yes, airSlate SignNow allows you to customize the Oregon lien form to suit your specific needs. You can add your company logo, change text fields, and include additional clauses as necessary. This level of customization ensures that your document aligns perfectly with your branding and requirements.

-

What are the benefits of using airSlate SignNow for Oregon lien forms?

Using airSlate SignNow for Oregon lien forms provides numerous benefits, including enhanced efficiency through electronic signing, reduced paper usage, and faster processing times. The platform ensures compliance with legal standards, making it a trustworthy solution for securing debts. Additionally, you can track the status of your documents in real time.

-

Are there any integrations available for Oregon lien forms on airSlate SignNow?

Yes, airSlate SignNow offers several integrations that enhance the functionality of your Oregon lien form process. You can connect with popular platforms like Google Drive, Dropbox, and others for seamless document sharing and storage. This integration enhances workflow efficiency and keeps your documents organized.

-

Is it legally binding to eSign an Oregon lien form?

Absolutely! An eSigned Oregon lien form through airSlate SignNow is legally binding, just like a traditional handwritten signature. Our platform complies with the Electronic Signature in Global and National Commerce (ESIGN) Act, ensuring your documents hold up in court. This means you can sign important documents with confidence.

-

How do I track the status of my Oregon lien form on airSlate SignNow?

Tracking your Oregon lien form is easy with airSlate SignNow. Our platform provides real-time status updates, so you can see when your document is viewed, signed, or completed. This feature allows for efficient follow-ups and communication between parties, ensuring that nothing falls through the cracks.

Get more for Oregon Lien

Find out other Oregon Lien

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement