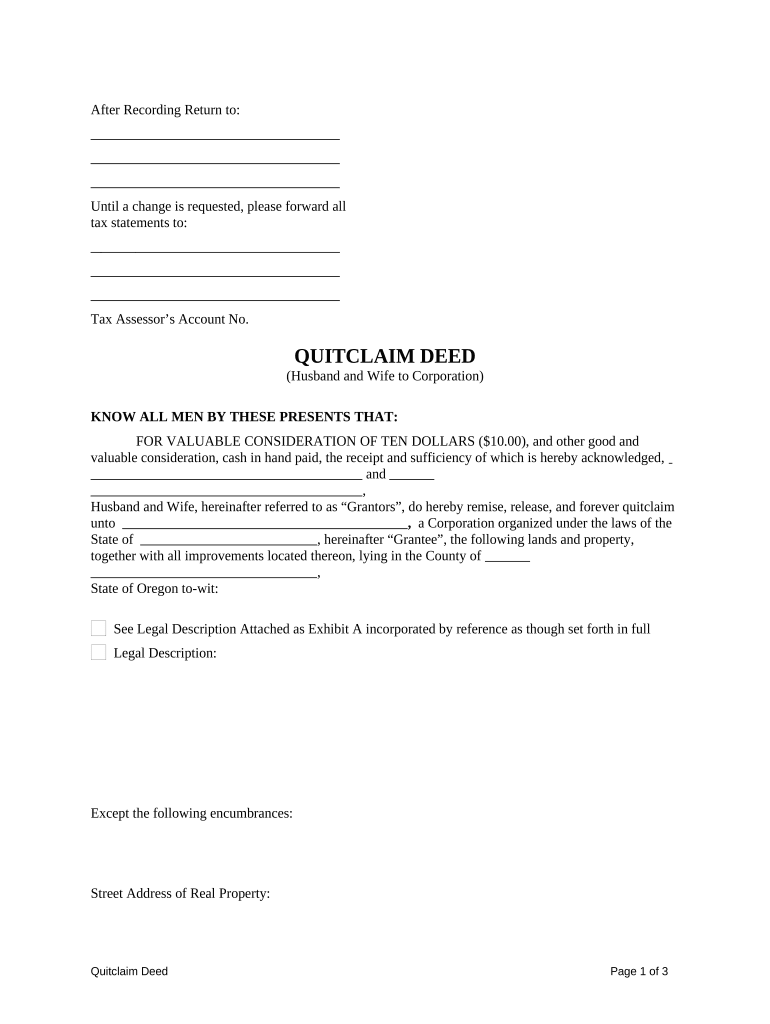

Husband Wife Corporation Form

What is the Husband Wife Corporation

The husband wife corporation is a unique business structure designed specifically for married couples who wish to operate a business together. This type of corporation allows both spouses to be actively involved in the management and decision-making processes while providing certain tax benefits and legal protections. By forming a husband wife corporation, couples can simplify their business operations and potentially reduce their overall tax liability. This structure is recognized under U.S. tax law, allowing couples to file taxes jointly, which can lead to favorable tax rates and deductions.

How to use the Husband Wife Corporation

Utilizing a husband wife corporation involves several key steps. First, couples must decide on the type of business they want to establish, whether it be a corporation or limited liability company (LLC). Next, they should choose a business name and ensure it complies with state regulations. After that, couples need to file the necessary formation documents with their state’s Secretary of State office. Once the corporation is established, they can begin operating their business, keeping in mind the importance of maintaining proper records and compliance with tax obligations.

Steps to complete the Husband Wife Corporation

Completing the formation of a husband wife corporation requires careful attention to detail. Here are the essential steps:

- Choose a business name that reflects the nature of the business and is not already in use.

- Determine the state in which the corporation will be formed and review its specific requirements.

- Prepare and file the Articles of Incorporation or Organization with the state.

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

- Draft corporate bylaws that outline the management structure and operational procedures.

- Open a business bank account to separate personal and business finances.

Legal use of the Husband Wife Corporation

The legal use of a husband wife corporation is governed by both federal and state laws. This structure allows couples to enjoy limited liability protection, meaning personal assets are generally protected from business debts and liabilities. It is crucial for couples to adhere to all legal requirements, including maintaining proper corporate formalities, filing annual reports, and paying applicable taxes. Additionally, couples should ensure that they comply with IRS guidelines regarding the taxation of their corporation, as improper handling can lead to penalties.

IRS Guidelines

The IRS has specific guidelines for husband wife corporations, particularly regarding taxation and filing requirements. Couples must report their business income and expenses on their personal tax returns, typically using Form 1040 and Schedule C. It's important to keep accurate records of all business transactions to support deductions and credits. Additionally, the IRS allows certain tax benefits for married couples operating a business together, such as the ability to file jointly, which can lead to lower tax rates.

Eligibility Criteria

To qualify for a husband wife corporation, couples must meet certain eligibility criteria. Both spouses must be actively involved in the business operations, and the business must be a legitimate entity recognized by the state. Additionally, the couple must be legally married at the time of formation. It is essential to ensure that the business complies with state-specific regulations and that both spouses agree on the management and operational structure of the corporation.

Quick guide on how to complete husband wife corporation 497323641

Complete Husband Wife Corporation effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Husband Wife Corporation on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Husband Wife Corporation seamlessly

- Locate Husband Wife Corporation and click Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and eSign Husband Wife Corporation to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a husband wife corporation?

A husband wife corporation is a unique business structure where both spouses own and operate a company together. This type of corporation enables couples to combine their resources and expertise, maximizing tax benefits and operational efficiency. Understanding how a husband wife corporation works can enhance your business strategy.

-

How does airSlate SignNow benefit a husband wife corporation?

airSlate SignNow provides a seamless eSignature solution tailored for husband wife corporations. With features like document templates, secure signing, and real-time collaboration, it helps streamline your operations. This can signNowly reduce the time spent on paperwork, allowing both partners to focus on growing the business.

-

What pricing options are available for husband wife corporations using airSlate SignNow?

airSlate SignNow offers flexible pricing plans suitable for husband wife corporations, ensuring affordability for small businesses. Whether you need a basic plan or advanced features, there are options to fit every budget. Exploring pricing tiers can help you choose the best solution for your corporation's needs.

-

Can airSlate SignNow integrate with accounting software for a husband wife corporation?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making it ideal for a husband wife corporation. Integrating eSignature capabilities with your financial tools enhances operational efficiency and accuracy. This means you can manage contracts and finances in one centralized location.

-

What features are most beneficial for husband wife corporations?

Key features of airSlate SignNow that benefit husband wife corporations include easy document sharing, cloud storage, and customizable workflows. The user-friendly interface allows both partners to collaborate on documents instantly. These features ensure that your corporation runs smoothly and efficiently.

-

Is airSlate SignNow secure for sensitive documents in a husband wife corporation?

Absolutely, airSlate SignNow employs advanced security protocols to protect sensitive documents utilized by husband wife corporations. With features like encryption, two-factor authentication, and secure cloud storage, you can trust that your business data is safeguarded. This gives peace of mind as you focus on your business.

-

How can a husband wife corporation ensure compliance using airSlate SignNow?

A husband wife corporation can ensure compliance by utilizing airSlate SignNow's legally binding eSignatures, which meet regulatory requirements. The platform also provides audit trails and signing workflows that help maintain compliance. This is crucial for any business looking to establish credibility and trust with clients.

Get more for Husband Wife Corporation

Find out other Husband Wife Corporation

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast