Business Credit Application Oregon Form

What is the Business Credit Application Oregon

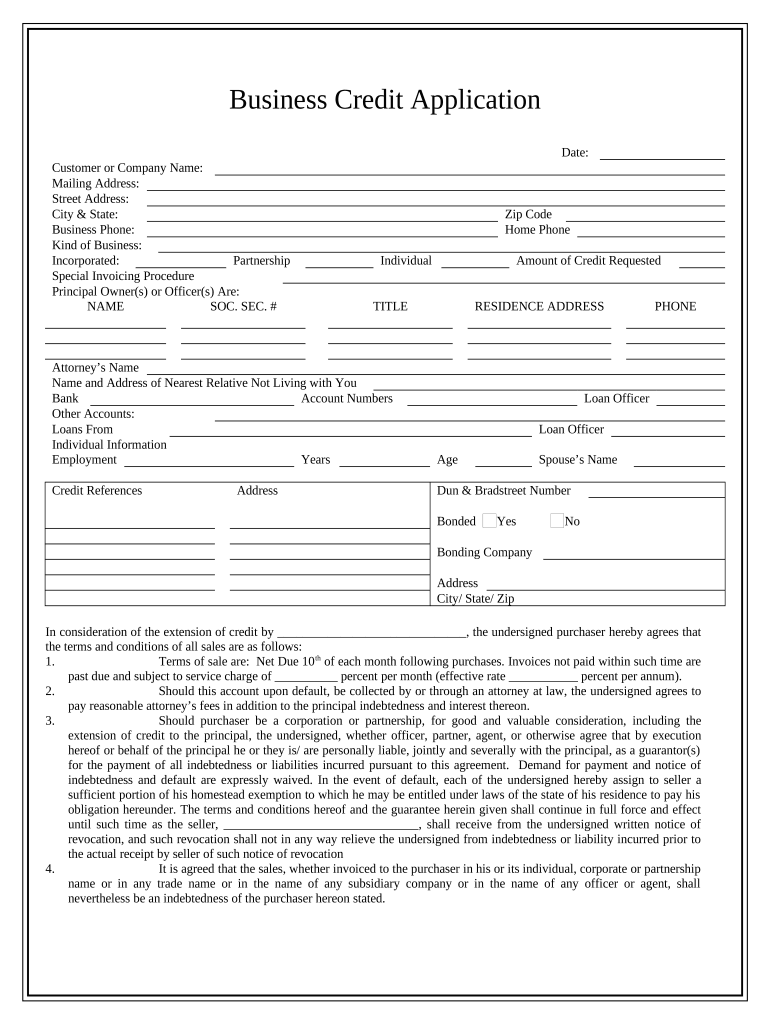

The Business Credit Application Oregon is a formal document that businesses in Oregon use to apply for credit from lenders or suppliers. This application typically requires essential information about the business, including its legal structure, financial history, and creditworthiness. By providing this information, businesses can secure the necessary funding or credit lines to support their operations and growth.

Key Elements of the Business Credit Application Oregon

When filling out the Business Credit Application Oregon, several key elements must be included to ensure its effectiveness. These elements typically consist of:

- Business Information: This includes the legal name, address, and contact details of the business.

- Ownership Details: Information about the owners or partners, including their names and ownership percentages.

- Financial Statements: Recent financial statements or projections that demonstrate the business's financial health.

- Credit History: A summary of the business's credit history, including any past loans or credit lines.

- Purpose of Credit: A brief explanation of how the credit will be used to benefit the business.

Steps to Complete the Business Credit Application Oregon

Completing the Business Credit Application Oregon involves several steps to ensure that all necessary information is accurately provided. Here are the steps to follow:

- Gather Required Information: Collect all necessary documents and information, including financial statements and ownership details.

- Fill Out the Application: Complete the application form, ensuring that all fields are filled out accurately.

- Review the Application: Double-check the application for any errors or missing information.

- Submit the Application: Send the completed application to the lender or supplier, either electronically or via mail.

Legal Use of the Business Credit Application Oregon

The Business Credit Application Oregon must comply with various legal requirements to be considered valid. This includes adhering to state and federal laws regarding credit applications and ensuring that all information provided is truthful and accurate. Misrepresentation or failure to disclose necessary information can lead to legal consequences, including denial of credit or potential legal action.

How to Obtain the Business Credit Application Oregon

Businesses can obtain the Business Credit Application Oregon through various means. Typically, lenders or suppliers provide their own versions of the application, which can be accessed on their websites or requested directly. Additionally, templates may be available online for businesses to customize according to their needs. It is essential to ensure that the application form used is up-to-date and complies with current regulations.

Form Submission Methods

The Business Credit Application Oregon can be submitted through multiple methods, depending on the lender or supplier's preferences. Common submission methods include:

- Online Submission: Many lenders allow businesses to submit applications electronically through their websites.

- Mail Submission: Businesses can print the completed application and send it via postal mail.

- In-Person Submission: Some lenders may allow businesses to submit their applications in person at a local branch.

Quick guide on how to complete business credit application oregon

Effortlessly Prepare Business Credit Application Oregon on Any Device

Digital document management has gained traction among businesses and individuals. It offers a fantastic environmentally friendly substitute for conventional printed and signed papers, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Business Credit Application Oregon on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign Business Credit Application Oregon Without Stress

- Find Business Credit Application Oregon and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, slow form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Business Credit Application Oregon and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Business Credit Application Oregon process?

The Business Credit Application Oregon process involves submitting an online form that captures essential information about your business. This streamlined application can be easily completed using airSlate SignNow's eSigning capabilities, ensuring it's both efficient and secure.

-

How much does it cost to use the Business Credit Application Oregon template?

Using the Business Credit Application Oregon template with airSlate SignNow is cost-effective, with pricing plans that fit various business sizes and needs. By leveraging our service, you can save time and resources while maintaining compliance and security in your transactions.

-

What features does the Business Credit Application Oregon provide?

The Business Credit Application Oregon available through airSlate SignNow includes essential features such as customizable templates, electronic signatures, and secure document sharing. These features enable businesses to create and manage their applications efficiently.

-

How can the Business Credit Application Oregon benefit my business?

Implementing the Business Credit Application Oregon through airSlate SignNow can signNowly streamline your application process, reducing paperwork and improving efficiency. With automated workflows and real-time tracking, you ensure your applications are processed quickly and accurately.

-

Is the Business Credit Application Oregon template customizable?

Yes, the Business Credit Application Oregon template offered by airSlate SignNow is fully customizable. You can adjust it to meet your business's unique requirements, making it easier to gather the necessary information while maintaining your branding.

-

Can the Business Credit Application Oregon integrate with other software?

Absolutely! The Business Credit Application Oregon can seamlessly integrate with various business applications to facilitate better data management. airSlate SignNow supports multiple integrations, promoting a more efficient workflow for your team's document handling.

-

Is the Business Credit Application Oregon secure?

Security is our top priority at airSlate SignNow. The Business Credit Application Oregon is protected with state-of-the-art encryption and compliance measures, ensuring that all submitted information remains confidential and secure throughout the process.

Get more for Business Credit Application Oregon

Find out other Business Credit Application Oregon

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation