Living Trust for Individual Who is Single, Divorced or Widow or Wwidower with No Children Oregon Form

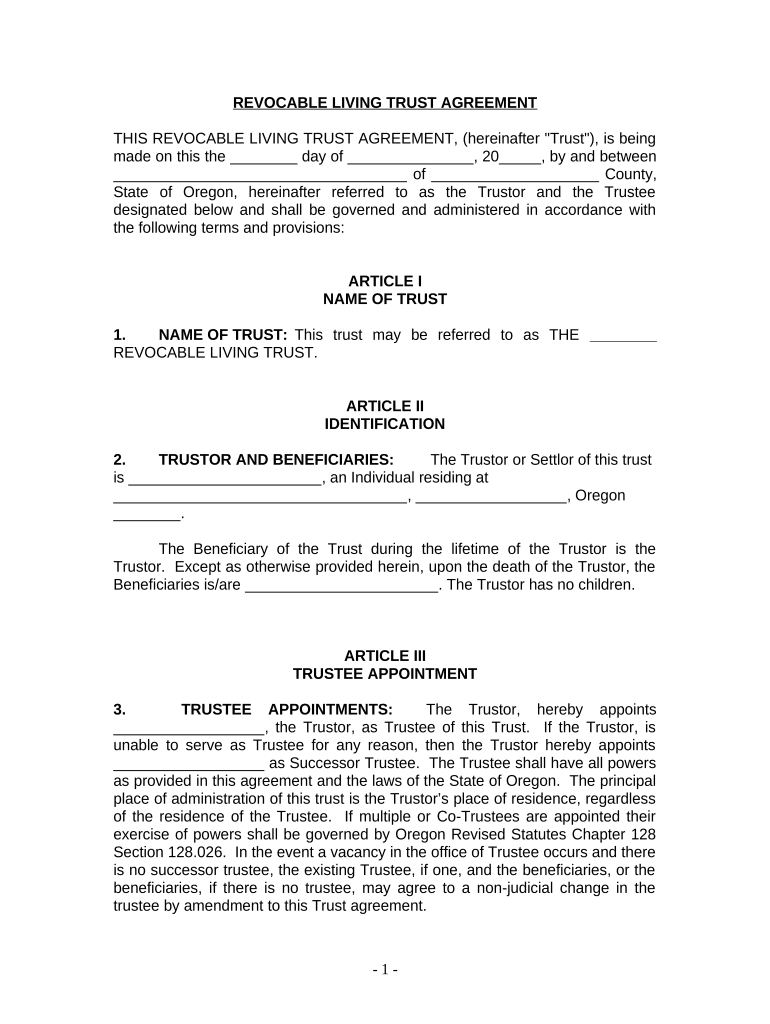

What is the Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon

A living trust is a legal document that allows an individual to manage their assets during their lifetime and specify how those assets will be distributed after their death. For individuals who are single, divorced, or widowed with no children in Oregon, a living trust can provide a way to ensure that their wishes are honored without the complexities of probate. This type of trust is particularly beneficial for those who want to maintain control over their assets and simplify the transfer process to their chosen beneficiaries.

Steps to Complete the Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon

Completing a living trust involves several important steps:

- Identify your assets: List all assets you wish to include in the trust, such as real estate, bank accounts, and investments.

- Select a trustee: Choose an individual or institution to manage the trust. This person will be responsible for carrying out your wishes.

- Draft the trust document: Create a legal document that outlines the terms of the trust, including how assets will be managed and distributed.

- Sign the document: Execute the trust in accordance with Oregon laws, which may require notarization or witness signatures.

- Fund the trust: Transfer ownership of your identified assets into the trust to ensure they are managed according to your wishes.

Legal Use of the Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon

The living trust is recognized as a valid legal instrument in Oregon, provided it meets state requirements. It allows individuals to avoid probate, which can be a lengthy and costly process. The trust document must clearly outline the terms and conditions for asset distribution, and the trustee must adhere to these instructions. Additionally, the trust can be amended or revoked by the grantor at any time during their lifetime, offering flexibility in estate planning.

State-Specific Rules for the Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon

In Oregon, specific rules govern the creation and management of living trusts. These include:

- Trustee requirements: The trustee must be a competent adult or a qualified institution.

- Notarization: While notarization is not always required, it is recommended to enhance the trust's validity.

- Asset funding: Assets must be properly transferred into the trust to be effective.

- Tax considerations: Living trusts do not provide tax benefits; however, they can simplify the tax process for beneficiaries.

Key Elements of the Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon

Several key elements are essential when creating a living trust:

- Grantor: The individual creating the trust.

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or organizations designated to receive assets from the trust.

- Instructions: Clear directives on how the assets should be managed and distributed upon the grantor's passing.

How to Use the Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon

Using a living trust effectively involves understanding its terms and ensuring compliance with legal requirements. Once established, the grantor can manage their assets as usual, retaining control over the trust during their lifetime. Upon the grantor's death, the trustee will follow the instructions outlined in the trust document, distributing assets to the beneficiaries without going through probate. This streamlined process can help reduce stress during a difficult time and ensure that the grantor's wishes are honored.

Quick guide on how to complete living trust for individual who is single divorced or widow or wwidower with no children oregon

Complete Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With No Children Oregon effortlessly on any device

Online document administration has gained popularity among organizations and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Manage Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With No Children Oregon on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With No Children Oregon with ease

- Obtain Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With No Children Oregon and then click Get Form to begin.

- Utilize the tools we offer to submit your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Adjust and eSign Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With No Children Oregon and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon?

A Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon is a legal tool that helps manage your assets and ensures they are distributed according to your wishes. This type of trust can simplify the process of transferring your property upon death and can provide privacy and control over your estate.

-

How much does it cost to set up a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon?

The cost of setting up a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon varies based on the complexity of your estate and the professional fees involved. Typically, you can expect to pay between $1,000 and $3,000 for setting up a comprehensive trust with legal assistance.

-

What are the main benefits of a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon?

The main benefits of a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon include avoiding probate, maintaining privacy, and allowing for greater control over asset distribution. Additionally, it can provide clarity on your wishes, ensuring your affairs are handled according to your preferences.

-

Can I create a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon without an attorney?

Yes, you can create a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon without an attorney using online resources or templates. However, consulting with a legal professional is recommended to ensure all legal requirements are met and your trust is appropriately structured.

-

How does a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon affect taxes?

A Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon generally does not impact your taxes during your lifetime. However, after your death, the assets in the trust may be subject to estate taxes, depending on your overall estate value and current tax laws.

-

What assets can be included in a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon?

You can include various types of assets in a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon, such as real estate, bank accounts, investments, and personal property. It is important to properly transfer ownership of these assets into the trust to ensure they are managed effectively.

-

How can airSlate SignNow help with my Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon?

airSlate SignNow provides a user-friendly platform to create, sign, and manage documents related to your Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Oregon. With easy-to-use eSigning features, you can ensure your trust documents are executed efficiently and securely.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With No Children Oregon

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With No Children Oregon

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF