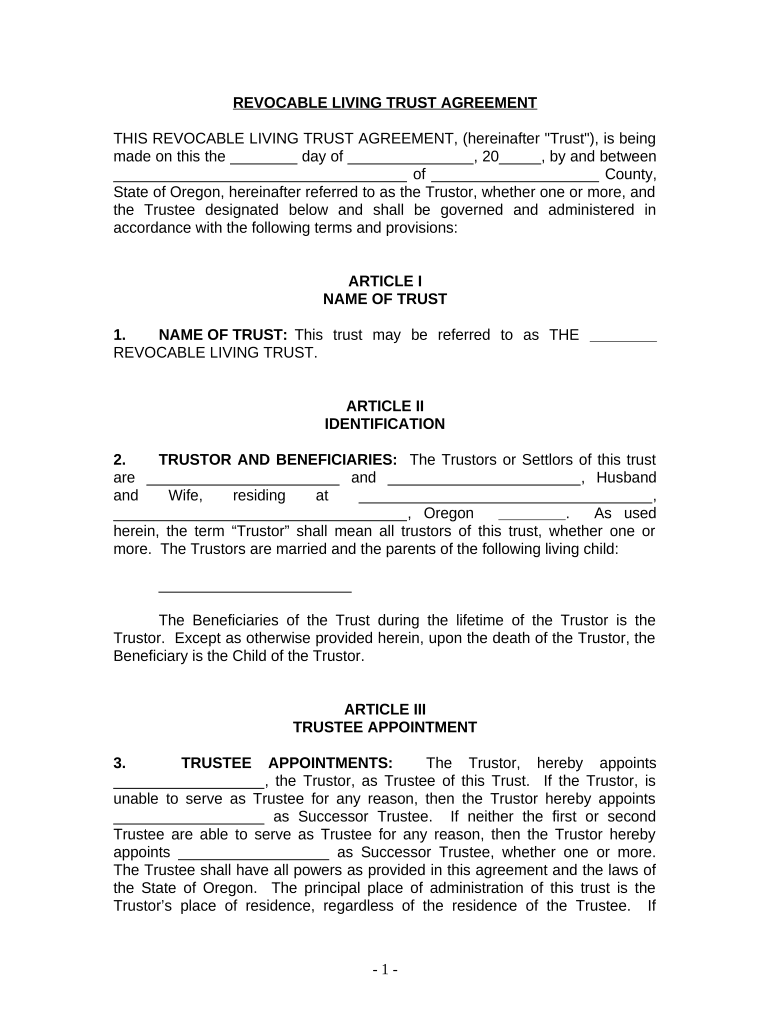

Living Trust for Husband and Wife with One Child Oregon Form

What is the Living Trust For Husband And Wife With One Child Oregon

A living trust for husband and wife with one child in Oregon is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed upon their passing. This type of trust is particularly beneficial for ensuring that the couple's child receives their inheritance without the need for probate, which can be a lengthy and costly process. The trust can hold various assets, including real estate, bank accounts, and investments, providing a streamlined way to transfer ownership while minimizing taxes and legal complications.

How to use the Living Trust For Husband And Wife With One Child Oregon

Using a living trust for husband and wife with one child in Oregon involves several steps. First, the couple must decide which assets to include in the trust. Next, they should work with a qualified attorney to draft the trust document, ensuring it complies with Oregon laws. Once the trust is created, the couple needs to transfer ownership of their assets into the trust. This may involve changing titles or designating the trust as the beneficiary of certain accounts. Finally, it is essential to review and update the trust periodically to reflect any changes in circumstances or wishes.

Steps to complete the Living Trust For Husband And Wife With One Child Oregon

Completing a living trust for husband and wife with one child in Oregon typically involves the following steps:

- Identify the assets to be included in the trust.

- Consult with an estate planning attorney to draft the trust document.

- Review the trust provisions, ensuring they align with your wishes.

- Sign the trust document in the presence of a notary public.

- Transfer ownership of assets into the trust by changing titles or designating the trust as a beneficiary.

- Store the trust document in a safe place and inform relevant parties of its existence.

Legal use of the Living Trust For Husband And Wife With One Child Oregon

The legal use of a living trust for husband and wife with one child in Oregon is governed by state laws that outline how trusts must be created and administered. To be legally valid, the trust must be signed by the grantors (the couple creating the trust) and may require notarization. The trust should clearly specify the terms of asset distribution, the responsibilities of the trustee, and any conditions that must be met for the trust to be executed. Adhering to these legal requirements ensures that the trust will be recognized by courts and can effectively manage the couple's estate.

State-specific rules for the Living Trust For Husband And Wife With One Child Oregon

In Oregon, specific rules govern the creation and administration of living trusts. These include requirements for the trust document to be in writing, the need for the grantors to have the legal capacity to create a trust, and the necessity of clearly defining beneficiaries. Additionally, Oregon law allows for revocable trusts, meaning the couple can modify or revoke the trust during their lifetime. It's important to consult with an attorney familiar with Oregon estate law to ensure compliance with all state-specific regulations.

Key elements of the Living Trust For Husband And Wife With One Child Oregon

Key elements of a living trust for husband and wife with one child in Oregon include:

- Grantors: The couple creating the trust.

- Trustee: The individual or institution responsible for managing the trust assets.

- Beneficiaries: The child and any other individuals or entities designated to receive assets from the trust.

- Assets: Property and financial accounts included in the trust.

- Distribution terms: Instructions on how and when the assets will be distributed to beneficiaries.

Quick guide on how to complete living trust for husband and wife with one child oregon

Effortlessly Prepare Living Trust For Husband And Wife With One Child Oregon on any device

Digital document management has gained traction among companies and individuals alike. It offers an excellent environmentally friendly option to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly and without issues. Manage Living Trust For Husband And Wife With One Child Oregon on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Living Trust For Husband And Wife With One Child Oregon effortlessly

- Obtain Living Trust For Husband And Wife With One Child Oregon and then click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Forge your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Living Trust For Husband And Wife With One Child Oregon to ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child Oregon?

A Living Trust For Husband And Wife With One Child Oregon is a legal document that allows couples to manage their assets effectively during their lifetime and specify how their assets will be distributed after death. It helps avoid the lengthy probate process, ensuring that your child receives their inheritance promptly and efficiently.

-

What are the benefits of setting up a Living Trust For Husband And Wife With One Child Oregon?

Setting up a Living Trust For Husband And Wife With One Child Oregon provides privacy, as trust assets do not go through probate and remain confidential. It also allows for flexible asset management, helping you ensure your child’s needs are met as they grow, while providing for your spouse in the event of your passing.

-

How much does it cost to create a Living Trust For Husband And Wife With One Child Oregon?

The cost to create a Living Trust For Husband And Wife With One Child Oregon can vary depending on the complexity of your estate and whether you choose to work with an attorney or use a DIY solution. Generally, prices can range from a few hundred to several thousand dollars, making it important to consider your specific needs and budget.

-

Can I modify my Living Trust For Husband And Wife With One Child Oregon?

Yes, you can modify your Living Trust For Husband And Wife With One Child Oregon at any time while you are alive and mentally competent. This flexibility allows you to make adjustments as your circumstances change, such as the birth of additional children or changes in marital status.

-

Does a Living Trust For Husband And Wife With One Child Oregon protect my assets from creditors?

While a Living Trust For Husband And Wife With One Child Oregon can help manage asset distribution, it generally does not protect your assets from creditors. However, certain types of assets, such as retirement accounts and life insurance, may have built-in protections which can work in conjunction with your trust.

-

How does a Living Trust For Husband And Wife With One Child Oregon compare to a will?

A Living Trust For Husband And Wife With One Child Oregon offers advantages over a will, primarily by avoiding probate, which can be time-consuming and costly. While a will only takes effect after death, a living trust can be used to manage assets during your lifetime and provide for your spouse and child as needed.

-

What documents do I need to set up a Living Trust For Husband And Wife With One Child Oregon?

To set up a Living Trust For Husband And Wife With One Child Oregon, you typically need personal identification, a list of your assets, beneficiary information, and possibly financial statements. Working with a professional can help ensure you have all necessary documentation in place.

Get more for Living Trust For Husband And Wife With One Child Oregon

- Tuberculosis tb surveillance form visionqwest healthcare group

- Camp lohikan medical forms

- Chlic hospital supplement claim form capital insurance agency

- Okla tax commission what is an event permit form

- United healthcare dental claim form

- Special event ems plan bucks county emergency health services form

- Maryland continuation election form

- Employment application mcpherson oil products form

Find out other Living Trust For Husband And Wife With One Child Oregon

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter