Oregon Unsecured Installment Payment Promissory Note for Fixed Rate Oregon Form

What is the Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon

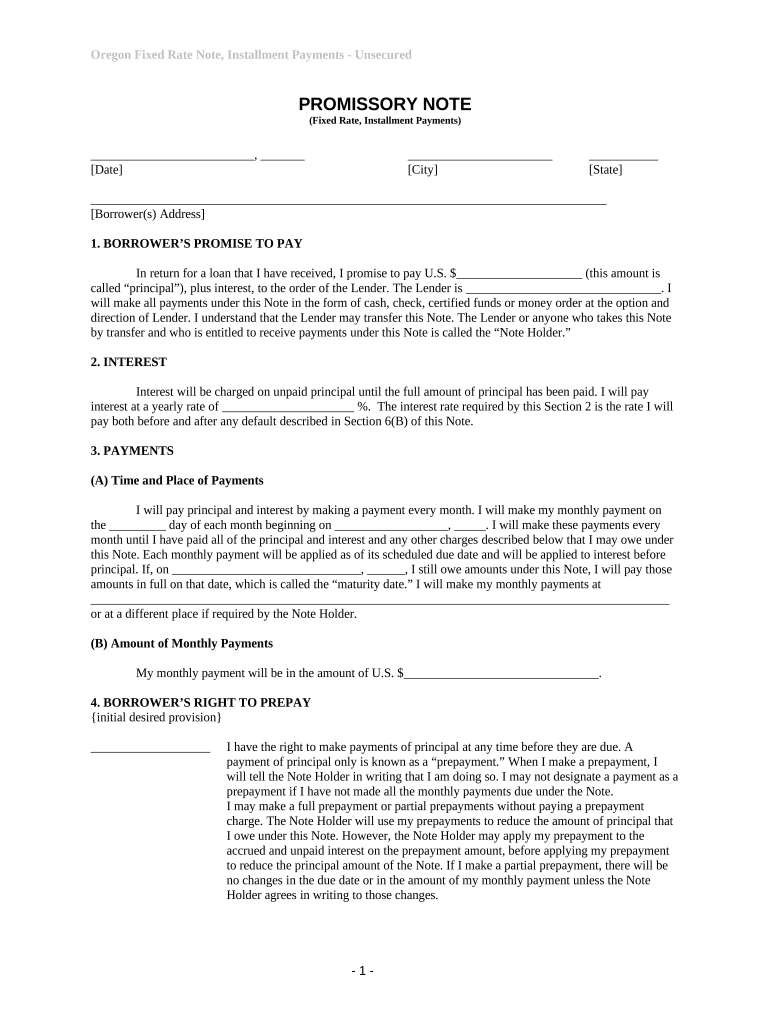

The Oregon Unsecured Installment Payment Promissory Note for Fixed Rate Oregon is a legal document used to outline the terms of a loan agreement between a lender and a borrower. This note specifies the amount borrowed, the interest rate, the repayment schedule, and the obligations of both parties. Unlike secured loans, this note does not require collateral, making it essential for borrowers to understand their repayment responsibilities fully. The document is designed to protect the interests of both the lender and the borrower by clearly stating the terms of the agreement.

How to use the Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon

This promissory note is utilized when an individual or business seeks to borrow money without providing collateral. To use the note, both parties must agree on the loan terms, including the loan amount, interest rate, and repayment schedule. Once agreed upon, the borrower fills out the necessary information in the document, and both parties sign it to make it legally binding. It is advisable to keep a copy of the signed document for personal records, as it serves as proof of the loan agreement.

Key elements of the Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon

Several key elements must be included in the Oregon Unsecured Installment Payment Promissory Note to ensure its validity. These elements include:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the borrowed amount.

- Repayment Schedule: The timeline for repayments, including the frequency and due dates.

- Borrower and Lender Information: Names and contact details of both parties involved in the agreement.

- Signatures: Signatures of both the borrower and the lender to validate the agreement.

Steps to complete the Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon

Completing the Oregon Unsecured Installment Payment Promissory Note involves several straightforward steps:

- Gather all necessary information, including the loan amount and interest rate.

- Fill out the document with the required details, ensuring accuracy.

- Review the terms with the lender to confirm mutual understanding.

- Both parties should sign the document in the presence of a witness, if possible.

- Make copies of the signed document for both the borrower and the lender.

Legal use of the Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon

The Oregon Unsecured Installment Payment Promissory Note is legally recognized in the state of Oregon, provided it meets certain criteria. For the note to be enforceable, it must be signed by both parties, clearly outline the loan terms, and comply with state laws regarding lending practices. It is crucial for both parties to understand their rights and obligations under the agreement, as failure to adhere to the terms can lead to legal disputes.

State-specific rules for the Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon

In Oregon, specific regulations govern the use of unsecured installment payment promissory notes. These rules include maximum interest rates, disclosure requirements, and the necessity for clear communication of loan terms. Lenders must ensure compliance with the Oregon Uniform Commercial Code and any other relevant state laws to avoid potential legal issues. It is advisable for both parties to consult legal professionals to ensure that the note conforms to all applicable regulations.

Quick guide on how to complete oregon unsecured installment payment promissory note for fixed rate oregon

Finish Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, since you can access the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon on any device with airSlate SignNow Android or iOS applications and simplify any document-related operation today.

The easiest way to modify and eSign Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon with ease

- Locate Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon and ensure exceptional communication at any point in the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon?

An Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon is a legal document that outlines the terms of repayment for a loan without securing it against any collateral. This type of note is ideal for lenders looking to ensure predictable repayment schedules, as it specifies fixed interest rates and payment dates.

-

How can I create an Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon?

You can easily create an Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon using airSlate SignNow's user-friendly document builder. Our platform allows you to customize the note according to your specific needs, ensuring all important information is included for both parties.

-

What are the benefits of using an Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon?

Using an Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon provides numerous benefits. It offers a clear repayment structure, helps establish trust between the lender and borrower, and protects the interests of both parties by outlining penalties for late payments and default.

-

Is an Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon legally binding?

Yes, an Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon is legally binding once both parties sign it. This ensures that the terms agreed upon are enforceable in a court of law, providing security and accountability to both the lender and the borrower.

-

Can I use airSlate SignNow to eSign my Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon?

Absolutely! airSlate SignNow allows you to securely eSign your Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon. Our platform simplifies the signing process, enabling you and your counterpart to sign documents from anywhere, anytime.

-

What features does airSlate SignNow offer for Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon?

airSlate SignNow offers essential features for Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon, including customizable templates, automated reminders for payment schedules, and real-time tracking of document status. These features enhance efficiency and organization for both lenders and borrowers.

-

How much does it cost to use airSlate SignNow for an Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon?

airSlate SignNow offers competitive pricing plans based on your needs, starting with a free tier for basic document creation. For more advanced features related to Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon, consider our subscription plans which provide additional functionalities.

Get more for Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon

- Form 50 bidder certification los angeles city ethics commission ethics lacity

- Lac4 upforms3

- Wla transcripts form

- Fax volunteer application los robles form

- Form ct 1120 ext 2011

- Pdpm calculation worksheet for snfs cms form

- Assumed name application for certificate of ownership form

- Write neatly and legibly in blue pen form

Find out other Oregon Unsecured Installment Payment Promissory Note For Fixed Rate Oregon

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe