Living Trust for Husband and Wife with One Child Pennsylvania Form

What is the Living Trust For Husband And Wife With One Child Pennsylvania

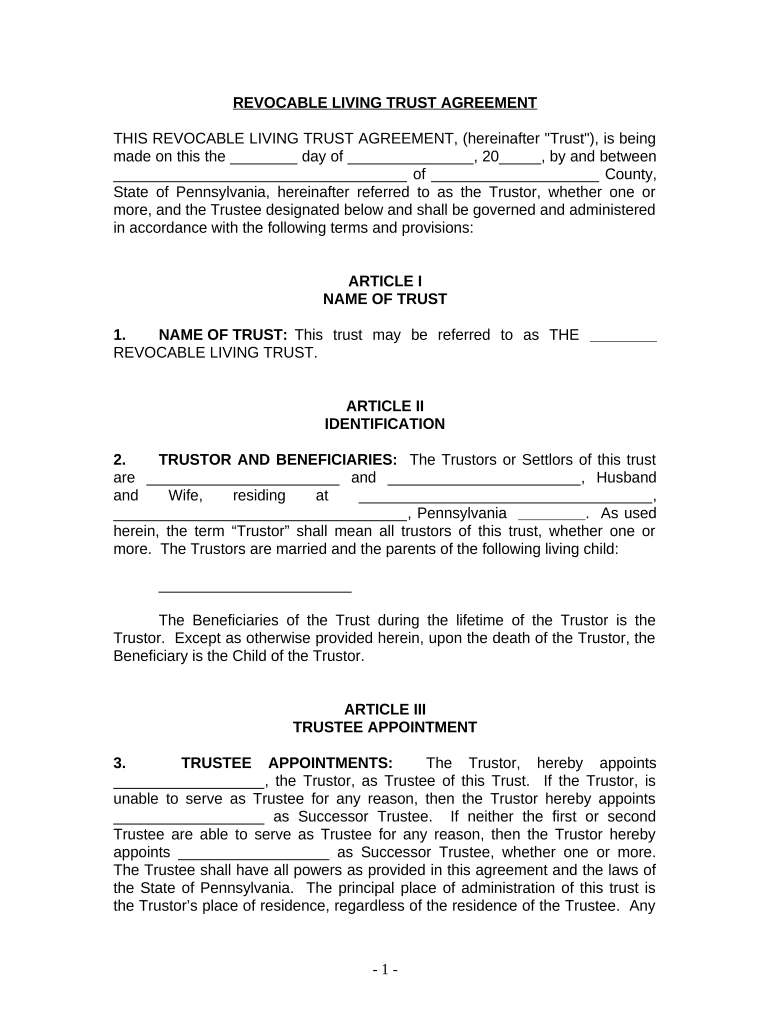

A living trust for husband and wife with one child in Pennsylvania is a legal document that allows couples to manage their assets during their lifetime and specify how those assets will be distributed after their passing. This type of trust can help avoid probate, ensuring a smoother transition of assets to the surviving spouse and child. It provides flexibility in managing assets and can be altered or revoked as circumstances change.

Key Elements of the Living Trust For Husband And Wife With One Child Pennsylvania

Several key elements define this type of living trust:

- Grantors: The husband and wife who create the trust.

- Trustee: Typically, one or both spouses act as trustees, managing the trust during their lifetime.

- Beneficiaries: The couple's child is usually the primary beneficiary, receiving assets upon the death of the surviving spouse.

- Assets: The trust can hold various assets, including real estate, bank accounts, and investments.

- Instructions: Detailed instructions on how assets should be managed and distributed after death.

Steps to Complete the Living Trust For Husband And Wife With One Child Pennsylvania

Completing a living trust involves several important steps:

- Determine the assets to be included in the trust.

- Choose a trustee, typically one or both spouses.

- Draft the trust document, outlining the terms and conditions.

- Sign the document in the presence of a notary public to ensure its legal validity.

- Transfer ownership of the chosen assets into the trust.

Legal Use of the Living Trust For Husband And Wife With One Child Pennsylvania

The legal use of a living trust in Pennsylvania allows couples to manage their estate planning effectively. It provides a way to dictate how assets are handled during their lifetime and after death, ensuring that the surviving spouse and child receive their intended inheritance without the delays associated with probate. This legal structure can also help minimize estate taxes and protect assets from creditors.

State-Specific Rules for the Living Trust For Husband And Wife With One Child Pennsylvania

Pennsylvania has specific rules governing living trusts, including:

- The trust must be in writing and signed by the grantors.

- Assets must be properly transferred to the trust to be protected from probate.

- Trustees have a fiduciary duty to manage the trust in the best interest of the beneficiaries.

- Trusts can be revocable or irrevocable, depending on the couple's needs and preferences.

Quick guide on how to complete living trust for husband and wife with one child pennsylvania

Complete Living Trust For Husband And Wife With One Child Pennsylvania effortlessly on any device

Online document management has gained traction among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Living Trust For Husband And Wife With One Child Pennsylvania on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Living Trust For Husband And Wife With One Child Pennsylvania without stress

- Obtain Living Trust For Husband And Wife With One Child Pennsylvania and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and eSign Living Trust For Husband And Wife With One Child Pennsylvania and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with One Child in Pennsylvania?

A Living Trust for Husband and Wife with One Child in Pennsylvania is a legal arrangement that allows parents to manage and distribute their assets for the benefit of their child. It provides a way to ensure that assets are transferred smoothly and efficiently after one or both spouses pass away, avoiding probate. This type of trust can be tailored to fit the specific needs of the family, providing peace of mind.

-

How does a Living Trust for Husband and Wife with One Child differ from a will?

Unlike a will, a Living Trust for Husband and Wife with One Child in Pennsylvania avoids probate, allowing for faster distribution of assets. Additionally, a trust offers greater privacy since it does not become public record after death. While a will takes effect only after death, a living trust can be used during the lifetime of the individuals involved.

-

What are the benefits of creating a Living Trust for Husband and Wife with One Child in Pennsylvania?

The primary benefits of a Living Trust for Husband and Wife with One Child in Pennsylvania include avoiding probate, maintaining privacy, and ensuring more direct control over asset distribution. It can also help manage assets if one spouse becomes incapacitated. Overall, a living trust provides a more flexible and efficient estate planning solution.

-

How much does it cost to set up a Living Trust for Husband and Wife with One Child in Pennsylvania?

The cost to create a Living Trust for Husband and Wife with One Child in Pennsylvania can vary based on the complexity and the service provider. Generally, the setup fees can range from a few hundred to a few thousand dollars. It's important to consult with legal professionals who specialize in estate planning to get an accurate estimate based on your specific needs.

-

Can I modify my Living Trust for Husband and Wife with One Child after it is created?

Yes, you can modify your Living Trust for Husband and Wife with One Child in Pennsylvania at any time as long as you are alive and competent. Making changes might include adding or removing beneficiaries or altering terms related to asset distribution. It's advisable to work with an estate planning attorney to ensure that modifications are executed correctly.

-

What should I include in my Living Trust for Husband and Wife with One Child?

Key elements to include in your Living Trust for Husband and Wife with One Child in Pennsylvania are the names of the trustees, beneficiaries, and a detailed list of assets to be managed. Additionally, consider outlining specific provisions for the care and education of your child. It's essential to be thorough to ensure your wishes are followed.

-

How does airSlate SignNow help in the management of a Living Trust for Husband and Wife with One Child?

airSlate SignNow offers an easy-to-use platform for eSigning and managing documents related to a Living Trust for Husband and Wife with One Child in Pennsylvania. With secure storage and seamless collaboration, it simplifies the process of sharing and maintaining vital estate planning documents. This can save time and enhance efficiency in managing your trust.

Get more for Living Trust For Husband And Wife With One Child Pennsylvania

- Ecitizen kenya special pass form

- Ben leeds properties application form

- Pdf application co signer form uw housing

- Printable rental application pdf rcg llccom form

- Conscreditappl bmw new singlep65 form

- Old dominion freight claim form

- Form dr100

- A standardization review and a separate audit is required by opspec paragraph a031 and must be accomplished to ensure that form

Find out other Living Trust For Husband And Wife With One Child Pennsylvania

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors