Non Foreign Affidavit under IRC 1445 Rhode Island Form

What is the Non Foreign Affidavit Under IRC 1445 Rhode Island

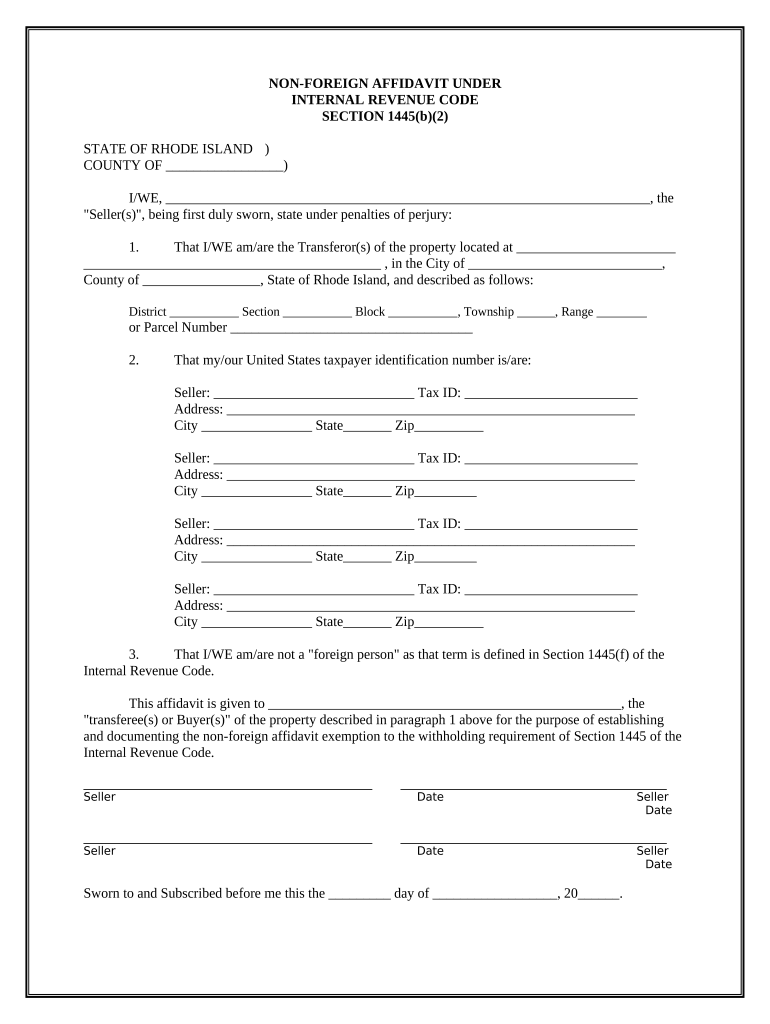

The Non Foreign Affidavit under IRC 1445 in Rhode Island is a legal document used primarily in real estate transactions. It serves to certify that the seller of a property is not a foreign person, as defined by the Internal Revenue Code. This affidavit helps ensure that the buyer does not incur withholding tax obligations associated with foreign sellers. By completing this form, sellers affirm their status, which is crucial for compliance with U.S. tax regulations.

Steps to complete the Non Foreign Affidavit Under IRC 1445 Rhode Island

Completing the Non Foreign Affidavit involves several key steps:

- Gather necessary information, including the seller's full name, address, and taxpayer identification number.

- Fill out the affidavit accurately, ensuring all personal details are correct.

- Sign the affidavit in the presence of a notary public to validate the document.

- Submit the completed affidavit to the relevant parties involved in the real estate transaction.

Legal use of the Non Foreign Affidavit Under IRC 1445 Rhode Island

The Non Foreign Affidavit is legally binding and must be executed according to the guidelines set forth by the IRS. It is essential for buyers to obtain this affidavit from sellers to avoid potential tax liabilities. If a seller falsely claims non-foreign status, they may face penalties, including tax withholding and legal repercussions. Therefore, ensuring the accuracy and authenticity of the affidavit is critical for all parties involved.

Key elements of the Non Foreign Affidavit Under IRC 1445 Rhode Island

Several key elements must be included in the Non Foreign Affidavit to ensure its validity:

- The seller's full legal name and address.

- The seller's taxpayer identification number, such as a Social Security number or Employer Identification Number.

- A declaration stating that the seller is not a foreign person as defined by the IRC.

- The seller's signature, along with the date of signing.

How to obtain the Non Foreign Affidavit Under IRC 1445 Rhode Island

The Non Foreign Affidavit can typically be obtained through real estate professionals, such as realtors or attorneys, who are familiar with the closing process. Additionally, templates for the affidavit may be available online or through legal document services. It is crucial to ensure that the version used complies with current IRS regulations and Rhode Island state laws.

Filing Deadlines / Important Dates

While the Non Foreign Affidavit does not have a specific filing deadline, it is essential to complete and submit it during the closing process of a real estate transaction. Delaying the submission may lead to complications, such as tax withholding issues. Buyers should ensure that the affidavit is obtained and executed prior to the closing date to facilitate a smooth transaction.

Quick guide on how to complete non foreign affidavit under irc 1445 rhode island

Effortlessly Complete Non Foreign Affidavit Under IRC 1445 Rhode Island on Any Device

Digital document management has gained traction among businesses and individuals. It offers a superb environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Non Foreign Affidavit Under IRC 1445 Rhode Island on any platform using airSlate SignNow's Android or iOS applications and streamline any document-oriented process today.

How to Modify and Electronically Sign Non Foreign Affidavit Under IRC 1445 Rhode Island Smoothly

- Find Non Foreign Affidavit Under IRC 1445 Rhode Island and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically supplies for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Non Foreign Affidavit Under IRC 1445 Rhode Island and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Non Foreign Affidavit Under IRC 1445 in Rhode Island?

The Non Foreign Affidavit Under IRC 1445 in Rhode Island is a document utilized in real estate transactions to confirm that the seller is not a foreign person. This affidavit helps buyers avoid withholding taxes on proceeds from the sale. It’s essential for compliance with federal tax laws and to ensure a smooth transaction.

-

How can airSlate SignNow help with the Non Foreign Affidavit Under IRC 1445 in Rhode Island?

airSlate SignNow provides a seamless platform for businesses to create, send, and eSign Non Foreign Affidavits Under IRC 1445 in Rhode Island. Our user-friendly interface simplifies document management and ensures compliance with all legal requirements. With airSlate SignNow, you can streamline your transaction process while maintaining full legal integrity.

-

What features does airSlate SignNow offer for managing the Non Foreign Affidavit Under IRC 1445 in Rhode Island?

airSlate SignNow offers robust features including template creation, eSigning, and document storage specifically for the Non Foreign Affidavit Under IRC 1445 in Rhode Island. You can customize the affidavit to meet your needs, automate workflows, and track document status in real-time. These features enhance efficiency and reduce the chances of errors.

-

Is there a specific pricing model for using airSlate SignNow for the Non Foreign Affidavit Under IRC 1445 in Rhode Island?

Yes, airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes looking to manage the Non Foreign Affidavit Under IRC 1445 in Rhode Island. We offer competitively priced plans based on user needs, including discounts for annual subscriptions. Contact our sales team to find a plan that works for you.

-

What are the benefits of using airSlate SignNow for the Non Foreign Affidavit Under IRC 1445 in Rhode Island?

Using airSlate SignNow for your Non Foreign Affidavit Under IRC 1445 in Rhode Island simplifies the entire signing process. Businesses benefit from increased efficiency, reduced paper waste, and real-time tracking of document statuses. Moreover, our secure platform ensures that sensitive information is protected throughout the transaction.

-

Can I integrate airSlate SignNow with other tools for managing the Non Foreign Affidavit Under IRC 1445 in Rhode Island?

Absolutely! airSlate SignNow supports integrations with a variety of tools and applications to help streamline the process of managing the Non Foreign Affidavit Under IRC 1445 in Rhode Island. This means you can connect our platform with CRM systems, cloud storage services, and other essential business applications for a more cohesive workflow.

-

How do I ensure compliance when filling out a Non Foreign Affidavit Under IRC 1445 in Rhode Island using airSlate SignNow?

With airSlate SignNow, you can ensure compliance when completing the Non Foreign Affidavit Under IRC 1445 in Rhode Island by using our templates designed specifically for this purpose. Our platform includes guidance on filling out documents correctly and tracks completion to meet legal requirements. Additionally, you can consult legal resources available through our support.

Get more for Non Foreign Affidavit Under IRC 1445 Rhode Island

Find out other Non Foreign Affidavit Under IRC 1445 Rhode Island

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure