Quitclaim Deed from Corporation to LLC South Carolina Form

What is the Quitclaim Deed From Corporation To LLC South Carolina

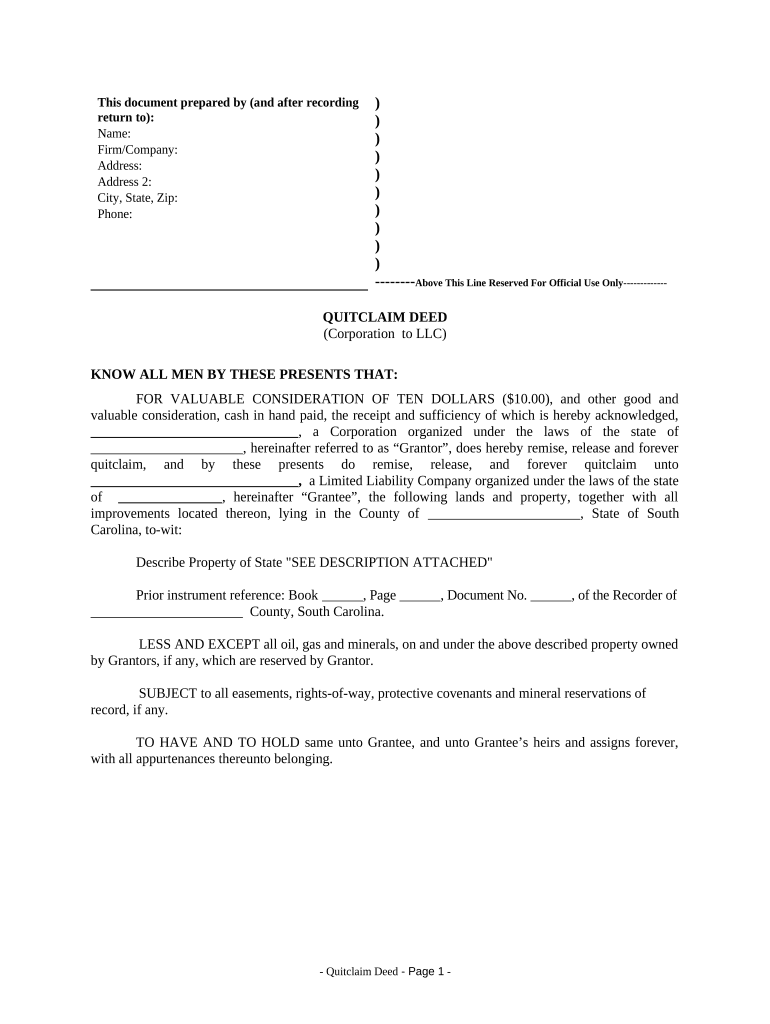

A quitclaim deed from corporation to LLC in South Carolina is a legal document used to transfer ownership of real property from a corporation to a limited liability company (LLC). This type of deed conveys whatever interest the corporation has in the property without guaranteeing that the title is clear. It is often utilized in business transactions where the property ownership needs to be restructured or transferred to a different business entity for operational or financial reasons.

Key Elements of the Quitclaim Deed From Corporation To LLC South Carolina

Several key elements must be included in a quitclaim deed to ensure its validity in South Carolina:

- Grantor and Grantee Information: The full legal names and addresses of both the corporation (grantor) and the LLC (grantee) must be clearly stated.

- Property Description: A detailed description of the property being transferred, including the legal description, must be included to avoid ambiguity.

- Consideration: The deed should specify any consideration exchanged for the property, although a nominal amount is often sufficient.

- Execution and Notarization: The deed must be signed by an authorized representative of the corporation and notarized to be legally binding.

Steps to Complete the Quitclaim Deed From Corporation To LLC South Carolina

Completing a quitclaim deed involves several important steps:

- Gather Necessary Information: Collect all relevant details about the property and the parties involved.

- Draft the Deed: Use a template or legal counsel to draft the quitclaim deed, ensuring all key elements are included.

- Sign the Deed: Have the authorized representative of the corporation sign the document in the presence of a notary public.

- File the Deed: Submit the executed deed to the appropriate county office for recording.

Legal Use of the Quitclaim Deed From Corporation To LLC South Carolina

The quitclaim deed is legally recognized in South Carolina for transferring property ownership. It is particularly useful in scenarios where the grantor does not wish to make any warranties about the title. However, it is important to note that while this deed transfers the interest in the property, it does not protect the grantee against any liens or encumbrances that may exist on the property.

State-Specific Rules for the Quitclaim Deed From Corporation To LLC South Carolina

In South Carolina, specific rules govern the execution and recording of quitclaim deeds:

- Recording Requirements: The deed must be recorded in the county where the property is located to provide public notice of the transfer.

- Notarization: The signature of the grantor must be notarized for the deed to be valid.

- Transfer Taxes: Depending on the transaction, transfer taxes may apply, and it is essential to check local regulations.

How to Use the Quitclaim Deed From Corporation To LLC South Carolina

Using a quitclaim deed involves understanding its purpose and implications. Once the deed is completed and recorded, it effectively transfers ownership of the property from the corporation to the LLC. This method is often used for internal restructuring or to simplify property management under a single entity. However, it is advisable to consult with legal professionals to ensure compliance with all applicable laws and to understand the potential risks involved.

Quick guide on how to complete quitclaim deed from corporation to llc south carolina

Effortlessly prepare Quitclaim Deed From Corporation To LLC South Carolina on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, enabling you to obtain the right form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Quitclaim Deed From Corporation To LLC South Carolina on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Quitclaim Deed From Corporation To LLC South Carolina without stress

- Obtain Quitclaim Deed From Corporation To LLC South Carolina and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Quitclaim Deed From Corporation To LLC South Carolina and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To LLC in South Carolina?

A Quitclaim Deed From Corporation To LLC in South Carolina is a legal document that allows a corporation to transfer its property rights to a Limited Liability Company (LLC) without guaranteeing the title. This type of deed is often used when organizations undergo restructuring or changes in ownership. It simplifies the process of property transfer by removing the need for extensive title searches.

-

How much does it cost to prepare a Quitclaim Deed From Corporation To LLC in South Carolina?

The cost for preparing a Quitclaim Deed From Corporation To LLC in South Carolina can vary depending on the service provider you choose. Generally, the process is affordable and can range from $50 to $200 when using professional document preparation services like airSlate SignNow. Utilizing our service provides added value through user-friendly templates and guidance on the legalities involved.

-

What are the benefits of using airSlate SignNow for a Quitclaim Deed From Corporation To LLC in South Carolina?

Using airSlate SignNow for a Quitclaim Deed From Corporation To LLC in South Carolina allows for a streamlined, cost-effective document preparation and eSigning process. Our platform simplifies the submission experience, saves time, and enhances security. Additionally, users benefit from real-time tracking and notifications once documents are signed.

-

Is it legal to use an online service for a Quitclaim Deed From Corporation To LLC in South Carolina?

Yes, it is legal to use an online service like airSlate SignNow for a Quitclaim Deed From Corporation To LLC in South Carolina. As long as the document complies with South Carolina state laws and is properly executed and signNowd, it holds legal validity. Our platform ensures that all legal requirements are met to facilitate a smooth transaction.

-

What features does airSlate SignNow offer for managing Quitclaim Deeds From Corporation To LLC in South Carolina?

airSlate SignNow provides a range of features for managing Quitclaim Deeds From Corporation To LLC in South Carolina, including customizable templates, electronic signatures, and document storage. Users can easily edit, send, and track documents within the platform. Additionally, our collaboration tools enhance communication among parties involved in the property transfer.

-

How can I ensure that my Quitclaim Deed From Corporation To LLC in South Carolina is valid?

To ensure that your Quitclaim Deed From Corporation To LLC in South Carolina is valid, it must be properly completed, dated, and signed by the grantor. The document may also need to be signNowd and recorded with the county's register of deeds to provide public notice. Using airSlate SignNow helps ensure that you include all necessary information and signatures for validity.

-

Does airSlate SignNow integrate with other software for handling Quitclaim Deeds?

Yes, airSlate SignNow integrates with various business tools and software that enhance workflow efficiency when managing Quitclaim Deeds From Corporation To LLC in South Carolina. You can connect with platforms like Google Drive, Dropbox, and CRM systems to streamline document management and storage. This allows for a more seamless transition between different tools.

Get more for Quitclaim Deed From Corporation To LLC South Carolina

Find out other Quitclaim Deed From Corporation To LLC South Carolina

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document