South Carolina Annual Form

What is the South Carolina Annual

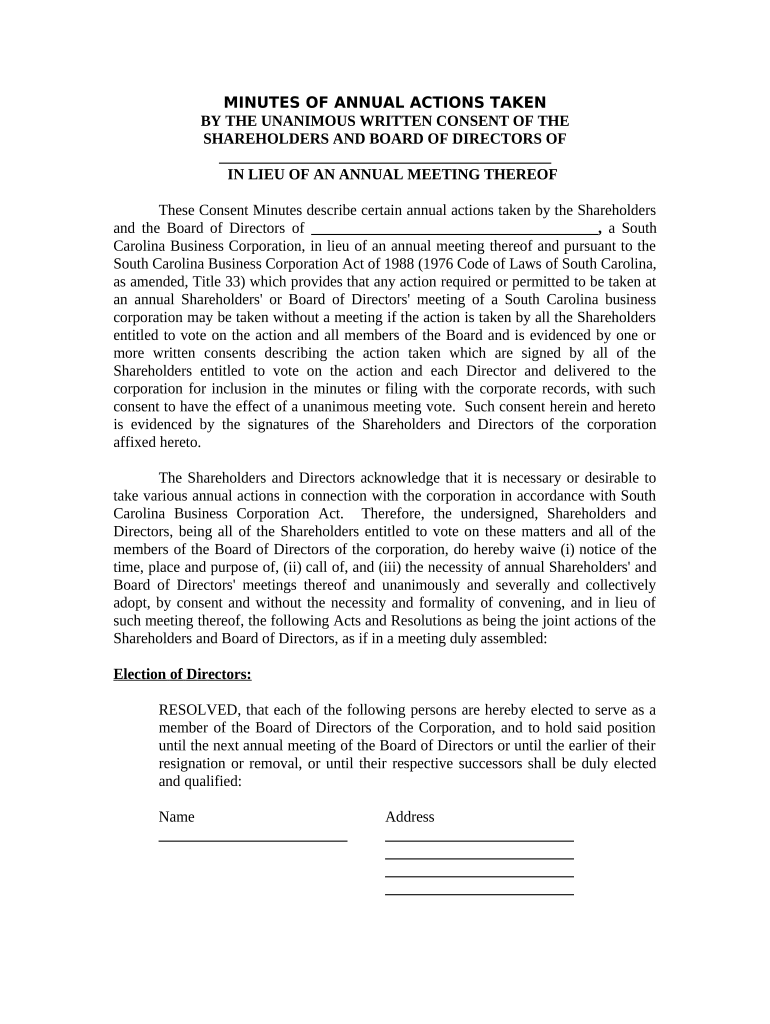

The South Carolina Annual refers to a specific form required for businesses operating within the state of South Carolina. This form is essential for various types of entities, including corporations and limited liability companies (LLCs), to report their annual activities and maintain compliance with state regulations. It typically includes information about the business's financial performance, ownership structure, and operational status over the past year.

How to use the South Carolina Annual

Using the South Carolina Annual involves several steps to ensure accurate completion and submission. Businesses must gather necessary financial data, including revenue, expenses, and any changes in ownership or structure. Once the required information is compiled, it can be entered into the form. Electronic submission is encouraged for efficiency and tracking purposes, ensuring that all data is securely transmitted to the appropriate state department.

Steps to complete the South Carolina Annual

Completing the South Carolina Annual requires careful attention to detail. Follow these steps for successful submission:

- Gather financial records from the past year, including profit and loss statements.

- Review any changes in business structure or ownership that need to be reported.

- Access the official South Carolina Annual form through the state’s business portal.

- Fill in the required fields with accurate information.

- Review the form for any errors or omissions.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the South Carolina Annual

The legal use of the South Carolina Annual is crucial for maintaining good standing with the state. Filing this form ensures compliance with state laws, which can help avoid penalties or legal issues. It serves as a formal declaration of a business's operational status and financial health, which can be important for tax purposes and when applying for loans or other financial assistance.

Filing Deadlines / Important Dates

Filing deadlines for the South Carolina Annual vary based on the type of business entity. Generally, the form must be submitted by the anniversary date of the business's formation. It is advisable to check the specific deadlines for your entity type to avoid late fees or penalties. Keeping track of these important dates can help ensure timely compliance and maintain the business's good standing.

Penalties for Non-Compliance

Failure to file the South Carolina Annual can result in various penalties. Businesses may face fines, late fees, or even administrative dissolution if they do not comply with the filing requirements. It is essential to be aware of these potential consequences and prioritize timely submission to avoid complications that could affect the business's operations.

Quick guide on how to complete south carolina annual 497325831

Complete South Carolina Annual effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an excellent eco-conscious substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage South Carolina Annual on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest method to edit and eSign South Carolina Annual with minimal effort

- Locate South Carolina Annual and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign South Carolina Annual to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the pricing structure for airSlate SignNow in South Carolina?

The pricing for airSlate SignNow's services in South Carolina is designed to be affordable and transparent. We offer various plans that cater to different business sizes and needs, including an annual subscription that can lead to cost savings. Our South Carolina annual pricing is competitive, giving you access to advanced features without straining your budget.

-

What features does airSlate SignNow offer for South Carolina businesses?

airSlate SignNow provides a comprehensive suite of features perfect for South Carolina businesses. You can easily send, sign, and manage documents from anywhere, with options for templates, in-person signing, and mobile access. Our platform is designed to streamline your documentation processes, making it an essential tool for any South Carolina annual workflow.

-

How can airSlate SignNow benefit my South Carolina-based business?

Using airSlate SignNow can signNowly enhance operational efficiency for your South Carolina-based business. The platform reduces paperwork, saves time with instant document signing, and ensures that your contracts are legally binding. By adopting our solution, you can focus more on your core business activities while managing your South Carolina annual documentation digitally.

-

What types of integrations does airSlate SignNow support?

airSlate SignNow seamlessly integrates with various software platforms that South Carolina businesses commonly use, including CRM and project management tools. This ensures that your document workflow fits perfectly within your existing tech ecosystem. With our South Carolina annual plans, you gain access to priority integration support to enhance your operational capabilities.

-

Is airSlate SignNow compliant with South Carolina legal standards?

Yes, airSlate SignNow is compliant with all relevant legal standards in South Carolina regarding electronic signatures. Our platform meets the requirements of the ESIGN Act and UETA, ensuring that your signed documents hold up in court. This regulatory compliance is crucial for businesses in South Carolina that rely on secure and legally-binding agreements.

-

Can I customize templates for my South Carolina annual contracts?

Absolutely! One of the standout features of airSlate SignNow is the ability to create and customize templates for your South Carolina annual contracts. You can tailor these templates to meet specific business needs and ensure that all necessary legal language is included. This flexibility allows for a more efficient and standardized contract creation process.

-

What kind of customer support does airSlate SignNow provide in South Carolina?

airSlate SignNow offers exceptional customer support dedicated to South Carolina users. You can signNow out via multiple channels, including live chat, email, and phone support, ensuring that any issues are resolved promptly. Our South Carolina annual clients receive priority assistance to maximize their experience with our platform.

Get more for South Carolina Annual

- Mcc 15 1 form

- Metro mobility standing order change form metro mobility standing order change form metrocouncil

- Phillip s junior college transcript request form ihl state ms

- Mississippi statewide teacher appraisal rubric pre mde k12 ms form

- Lodgers tax report city of hobbs hobbsnm form

- Right of entry requestnew mexico state land office form

- Sterile compounding inspection form board of pharmacy pharmacy ohio

- Addendum multidocsig pa supervision agreementdoc med ohio form

Find out other South Carolina Annual

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free