Llc Open Form

What is the LLC Open?

The LLC Open refers to the process of establishing a Limited Liability Company (LLC) in the United States. This business structure combines the flexibility of a partnership with the liability protection of a corporation. LLCs are favored by many entrepreneurs because they shield personal assets from business debts and liabilities while allowing for pass-through taxation. This means that profits and losses can be reported on the personal tax returns of the LLC members, avoiding double taxation.

Steps to Complete the LLC Open

To successfully open an LLC, several steps must be undertaken:

- Select a name: Choose a unique name that complies with state regulations and includes "LLC" or "Limited Liability Company."

- Designate a registered agent: Appoint an individual or business entity authorized to receive legal documents on behalf of the LLC.

- File Articles of Organization: Submit the necessary formation documents to the appropriate state agency, typically the Secretary of State.

- Create an Operating Agreement: Draft a document outlining the management structure and operating procedures of the LLC, though not always required by law.

- Obtain an EIN: Apply for an Employer Identification Number from the IRS for tax purposes and to open a business bank account.

- Comply with state regulations: Ensure adherence to any additional state-specific requirements, such as business licenses or permits.

Legal Use of the LLC Open

The legal use of the LLC Open involves adhering to state-specific laws and regulations governing the formation and operation of an LLC. This includes maintaining compliance with annual reporting requirements, paying necessary fees, and ensuring that the LLC operates within the scope of its stated purpose. Properly executed, an LLC provides legal protection for its members, shielding personal assets from business-related liabilities.

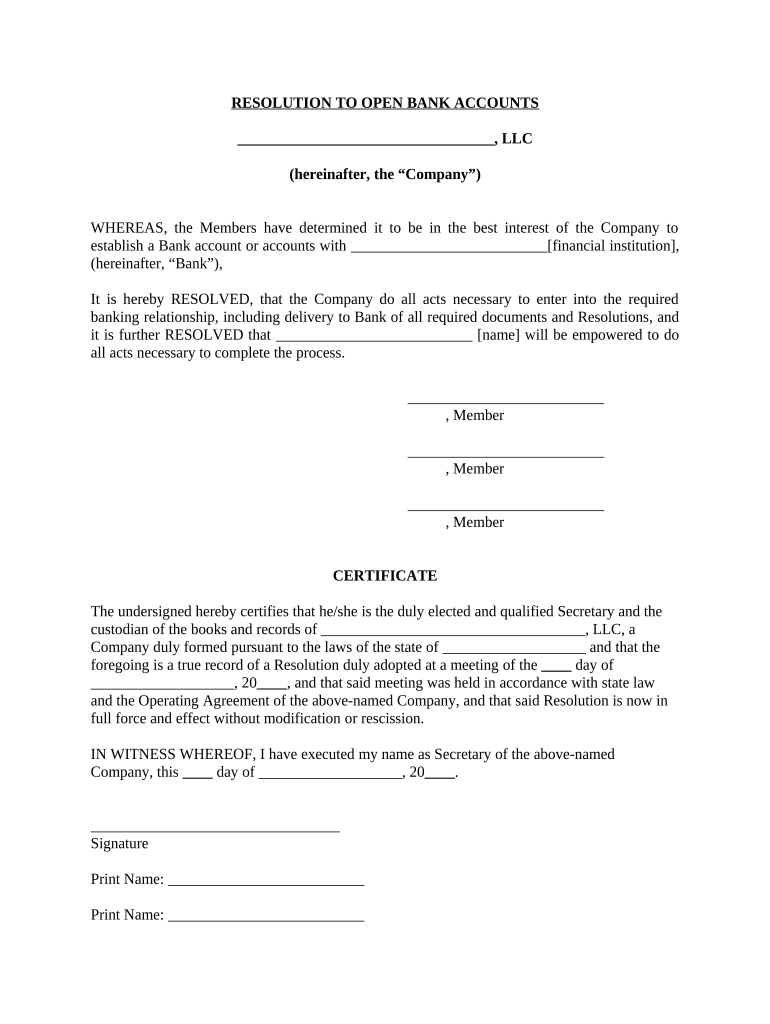

Required Documents

When opening an LLC, several documents are typically required:

- Articles of Organization: This foundational document outlines the LLC's basic information, including its name, address, and registered agent.

- Operating Agreement: While not always mandatory, this document details the management structure and operational guidelines of the LLC.

- Employer Identification Number (EIN): This number is essential for tax purposes and is required to open a business bank account.

- State-specific licenses and permits: Depending on the nature of the business, additional documentation may be necessary to comply with local regulations.

Examples of Using the LLC Open

LLCs can be utilized in various business scenarios, such as:

- Small businesses: Many entrepreneurs choose the LLC structure for retail shops, restaurants, and service providers due to its liability protection and tax benefits.

- Professional services: Professionals such as consultants, accountants, and lawyers often form LLCs to protect their personal assets while providing services.

- Real estate investments: Investors may create LLCs to hold properties, offering liability protection and simplifying tax reporting.

Eligibility Criteria

To form an LLC, certain eligibility criteria must be met, including:

- Being at least eighteen years old.

- Having a valid identification, such as a driver's license or passport.

- Choosing a unique name that complies with state laws.

- Designating a registered agent with a physical address in the state of formation.

Quick guide on how to complete llc open

Effortlessly Prepare Llc Open on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Llc Open on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign Llc Open with Ease

- Find Llc Open and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Llc Open to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it benefit LLC members from my business?

airSlate SignNow is an eSignature solution that allows businesses to easily send and sign documents online. For LLC members from your business, this means streamlined document management, faster turnaround times, and improved collaboration without the hassles of paper-based processes.

-

How does airSlate SignNow ensure the security of documents shared by LLC members from?

Security is a top priority at airSlate SignNow, which employs advanced encryption and robust security protocols. LLC members from your business can trust that their sensitive documents are protected, as we ensure compliance with leading security standards and regulations.

-

Are there any pricing plans specifically designed for LLC members from businesses?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, including those with LLC members from. Our pricing is competitive, and you can choose a plan based on the number of users and features needed, ensuring cost-effectiveness for your LLC.

-

What features does airSlate SignNow offer for LLC members from to enhance productivity?

airSlate SignNow includes features like template creation, document tracking, and automated reminders that enhance productivity for LLC members from your business. These tools help in managing documents efficiently and keeping all members informed throughout the signing process.

-

Can LLC members from integrate airSlate SignNow with other software tools?

Absolutely! airSlate SignNow offers integrations with popular business applications such as Google Workspace, Salesforce, and Zapier, enabling LLC members from to seamlessly connect their existing tools. This facilitates a smoother workflow and enhances overall operational efficiency.

-

How does airSlate SignNow simplify the document signing process for LLC members from?

airSlate SignNow simplifies the document signing process by allowing LLC members from your business to sign documents electronically, anytime and anywhere. This eliminates the need for printing, scanning, and mailing, making it a fast and eco-friendly solution for document management.

-

What customer support options are available for LLC members from using airSlate SignNow?

For LLC members from using airSlate SignNow, we provide comprehensive customer support through various channels, including live chat, email, and an extensive knowledge base. This ensures that all questions and concerns are promptly addressed, helping your LLC run smoothly.

Get more for Llc Open

- Fall 2018 bachelor of science in microbiology form

- Associate degree nursing program student handbook 2019 2020 academic year form

- Student name student id b0 form

- 2018 2019 verification work sheet v1 form

- New preferred first name policycal lutheran registrar form

- Please complete sign and return this form via mail fax or e mail at least 4 business days before the date of the

- Employee tuition waiver request radford university form

- Policy motor vehicle record form

Find out other Llc Open

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile