Acumen Fiscal Agent W2 2011-2026

What is the Acumen Fiscal Agent W-2?

The Acumen Fiscal Agent W-2 is an important tax document that reports an employee's annual wages and the amount of taxes withheld from their paycheck. This form is issued by the Acumen Fiscal Agent in Louisiana and is essential for employees to accurately file their income tax returns. It includes key information such as the employee's name, Social Security number, and the total wages earned during the tax year, along with federal and state tax withholdings.

How to Obtain the Acumen Fiscal Agent W-2

To obtain the Acumen Fiscal Agent W-2, employees can follow a few straightforward steps. First, check with the payroll department or human resources at your organization to confirm the availability of the W-2 form. Many employers provide electronic access to W-2 forms through their employee portals. If the form is not available online, employees may request a physical copy to be mailed to their address. It is important to ensure that the employer has the correct mailing address on file to avoid delays.

Steps to Complete the Acumen Fiscal Agent W-2

Completing the Acumen Fiscal Agent W-2 involves several important steps:

- Gather necessary information, including your Social Security number and total earnings for the year.

- Ensure that all personal details, such as your name and address, are accurately entered on the form.

- Review the amounts reported in the various boxes, including wages, tips, and other compensation.

- Check the federal and state tax withholding amounts to ensure they match your pay stubs.

- Sign and date the form if required, and keep a copy for your records.

Legal Use of the Acumen Fiscal Agent W-2

The Acumen Fiscal Agent W-2 is legally recognized by the Internal Revenue Service (IRS) and is essential for tax compliance. Employees must use this form to report their income accurately when filing their federal and state tax returns. Failure to use the correct W-2 form can lead to discrepancies in reported income, which may result in penalties or audits. It is crucial to retain the W-2 for at least three years in case of any inquiries from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Acumen Fiscal Agent W-2 are crucial for both employers and employees. Employers must provide W-2 forms to employees by January 31 of each year. Employees should file their tax returns by April 15 to avoid penalties. It is advisable to keep track of these deadlines to ensure timely compliance with tax regulations.

Who Issues the Form

The Acumen Fiscal Agent W-2 is issued by the Acumen Fiscal Agent in Louisiana. This organization is responsible for managing payroll and tax reporting for its employees. It is important for employees to verify that their W-2 forms are issued by this entity to ensure they are using the correct documentation for tax filing.

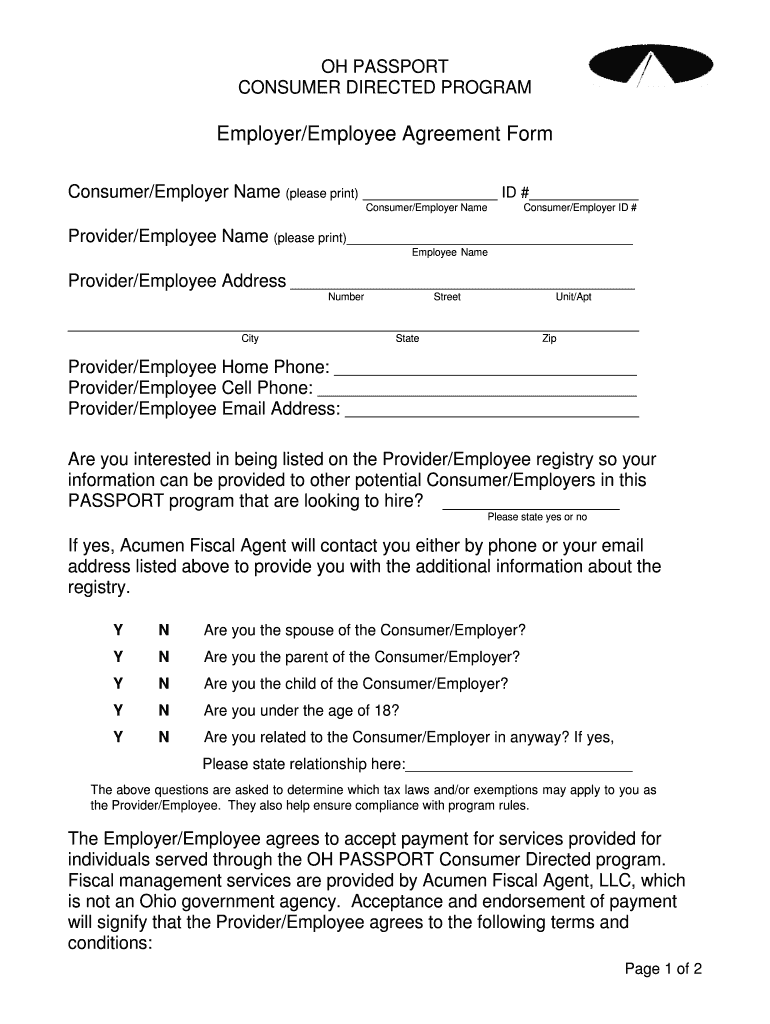

Quick guide on how to complete employeremployee agreement form acumen fiscal agent

Optimize your HR workflows with Acumen Fiscal Agent W2 Template

Every HR professional understands the significance of keeping employee records neat and organized. With airSlate SignNow, you gain access to a vast collection of state-specific employment documents that greatly enhance the organization, management, and storage of all job-related paperwork in one location. airSlate SignNow can assist you in overseeing Acumen Fiscal Agent W2 administration from beginning to end, with robust editing and eSignature tools available whenever you require them. Enhance your precision, document protection, and reduce minor manual errors in just a few clicks.

How to modify and eSign Acumen Fiscal Agent W2:

- Locate the relevant state and search for the document you need.

- Access the document page and click Get Form to start working on it.

- Allow Acumen Fiscal Agent W2 to load in the editor and follow the prompts that highlight required fields.

- Input your information or add additional fillable fields to the document.

- Utilize our tools and functionalities to customize your document as necessary: annotate, obscure sensitive data, and create an eSignature.

- Review your document for any mistakes before proceeding with its submission.

- Click Done to save changes and download your document.

- Alternatively, send your document directly to your recipients and collect signatures and information.

- Securely store completed documents in your airSlate SignNow account and access them whenever you wish.

Employing a flexible eSignature solution is essential when handling Acumen Fiscal Agent W2. Simplify even the most intricate workflows with airSlate SignNow. Start your free trial today to discover what you can achieve within your department.

Create this form in 5 minutes or less

FAQs

-

As an employer, what legal and tax forms am I required to have a new employee to fill out?

I-9, W-4, state W-4, and some sort of state new hire form. The New hire form is for dead beat parents. Don’t inform the state in time and guess what? You become personally liable for what should have been garnished from their wages.From the sound of your question I infer that you are trying to make this a DIY project. DO NOT. There are just too many things that you can F up. Seek yea a CPA or at least a payroll service YESTERDAY.

-

How much paperwork does an employer have to fill out if an employee quits without putting their two weeks in?

Generally an exit interview is required to return company's items including but not limited to software. Hardware, passwords, company cars and more. The Dept head should sign as well as all the way up the ladder until human resources is satisfied with a clean break of employment

-

Is it legal for companies to charge a previous employee a fee for filling out an employment verification form?

I’m not a lawyer, but I’d say you don’t have to pay. The law, as I know it, requires former employers to confirm your dates of employment and title. If your former employer demands you pay a fee for this, ask for the demand in writing (say you need it for financial records), then send a copy of that demand to the company you applied to, and your state’s Office of the Attorney General or Labor Department. The demand on email would also work, as would a voicemail you can attach to an email.

-

I'm the founder of a new startup and recently I heard that when I employ someone, I need to fill out form I-9 for them. The employee needs to fill it out, but I also need to check their identity and status. Is it true that I am required to do that? Is it true that all companies, even big companies that employ thousands of people, do this?

In addition to both you and the employee filling out the form, you need to do it within a certain time period, usually the first day of work for the employee. And as mentioned, you do need to keep them on file in case of an audit. You need to examine their eligibility documents (most often their passport, or their driver's license and social security card, and the list of acceptable documents is included on the form). You just need to make sure it looks like it's the same person and that they aren't obvious fakes.You can find the forms as well as instructions on how to fill them out here: Employment Eligibility Verification | USCIS On the plus side, I-9's aren't hard or time-consuming to do. Once you get the hang of it, it only takes a few minutes.

-

I'm filling out the employment verification form online for KPMG and realized that it's not asking me for phone numbers to my previous employers. Just curious as to how they verify employment without me providing a contact number to call?

Many US employers today won’t allow individuals (coworkers, supervisors) at a company respond to any questions or write recommendations. Everything must go through HR and they will often only confirm dates of employment.I know this, so I’m not going to waste time contacting phone numbers/email lists of supposed former coworkers or managers. Fact is, if anyone answered and started responding to my questions, I’d be very suspicious. Instead, I just ask for the main number of the company — which I can look up on line and verify to be the actual number of the claimed company.Same deal with academic credentials. I’m not going to use your address for “Harvard” … the one with a PO Box in Laurel, KS. I’m going to look up the address for the registrar myself.Sorry to say, there’s far too much lying on resumes today, combined with the liability possible for a company to say anything about you. A common tactic is to lie about academic back ground while giving friends as your “former supervisor at XYZ.”

Create this form in 5 minutes!

How to create an eSignature for the employeremployee agreement form acumen fiscal agent

How to generate an eSignature for your Employeremployee Agreement Form Acumen Fiscal Agent in the online mode

How to generate an eSignature for the Employeremployee Agreement Form Acumen Fiscal Agent in Chrome

How to create an electronic signature for signing the Employeremployee Agreement Form Acumen Fiscal Agent in Gmail

How to generate an electronic signature for the Employeremployee Agreement Form Acumen Fiscal Agent straight from your smartphone

How to create an electronic signature for the Employeremployee Agreement Form Acumen Fiscal Agent on iOS devices

How to make an eSignature for the Employeremployee Agreement Form Acumen Fiscal Agent on Android

People also ask

-

What is Acumen fiscal agent Louisiana and how does it work?

Acumen fiscal agent Louisiana is a service that helps organizations manage their financial transactions and compliance. It facilitates accurate reporting and ensures that funds are used effectively for various projects. By using an acumen fiscal agent, businesses can streamline their financial processes and focus on their core activities.

-

What are the benefits of using acumen fiscal agent Louisiana?

Using an acumen fiscal agent Louisiana provides several advantages including improved financial oversight, compliance with state regulations, and enhanced reporting capabilities. This service allows organizations to maximize their funding opportunities and minimize administrative burdens, ultimately contributing to better program outcomes.

-

How much does an acumen fiscal agent Louisiana cost?

The cost of an acumen fiscal agent Louisiana can vary based on the services provided and the size of the organization. Generally, fees are structured to be cost-effective, ensuring that even small businesses can access essential fiscal management services without breaking the bank. It’s best to request a custom quote based on specific needs.

-

What features should I look for in an acumen fiscal agent Louisiana?

Key features to look for in an acumen fiscal agent Louisiana include comprehensive financial reporting, compliance management, and efficient transaction handling. Additionally, a good agent should offer support for grant management and provide transparency in all financial dealings, ensuring that your organization is well-informed and compliant.

-

How does an acumen fiscal agent Louisiana integrate with existing systems?

An acumen fiscal agent Louisiana typically offers integration capabilities with a variety of financial and management systems. This ensures seamless data transfer and minimizes duplication of efforts, allowing your organization to maintain efficiency. It’s important to discuss integration needs with your agent to ensure compatibility with your current systems.

-

Can an acumen fiscal agent Louisiana help with grant management?

Yes, an acumen fiscal agent Louisiana can signNowly assist with grant management. They provide expertise in tracking expenditures, reporting on progress, and ensuring compliance with grant requirements. This allows organizations to maximize the use of their financial resources and successfully manage their funded programs.

-

Is consulting with an acumen fiscal agent Louisiana necessary for small businesses?

Consulting with an acumen fiscal agent Louisiana can be highly beneficial for small businesses. Even with limited resources, having professional financial oversight can enhance compliance, funding management, and overall efficiency. It’s a strategic investment that can lead to better financial health and operational success.

Get more for Acumen Fiscal Agent W2

- Quitclaim deed from an individual to a trust illinois form

- Deed trust form 497306079

- Illinois fiduciary form

- Illinois deed trust form

- Contractors notice to owner about disclosure of labor and materials mechanic liens corporation or llc illinois form

- Illinois deed 497306083 form

- Illinois succession form

- Illinois 60 day notice form

Find out other Acumen Fiscal Agent W2

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors