Illinois Deed Form

What is the Illinois Deed

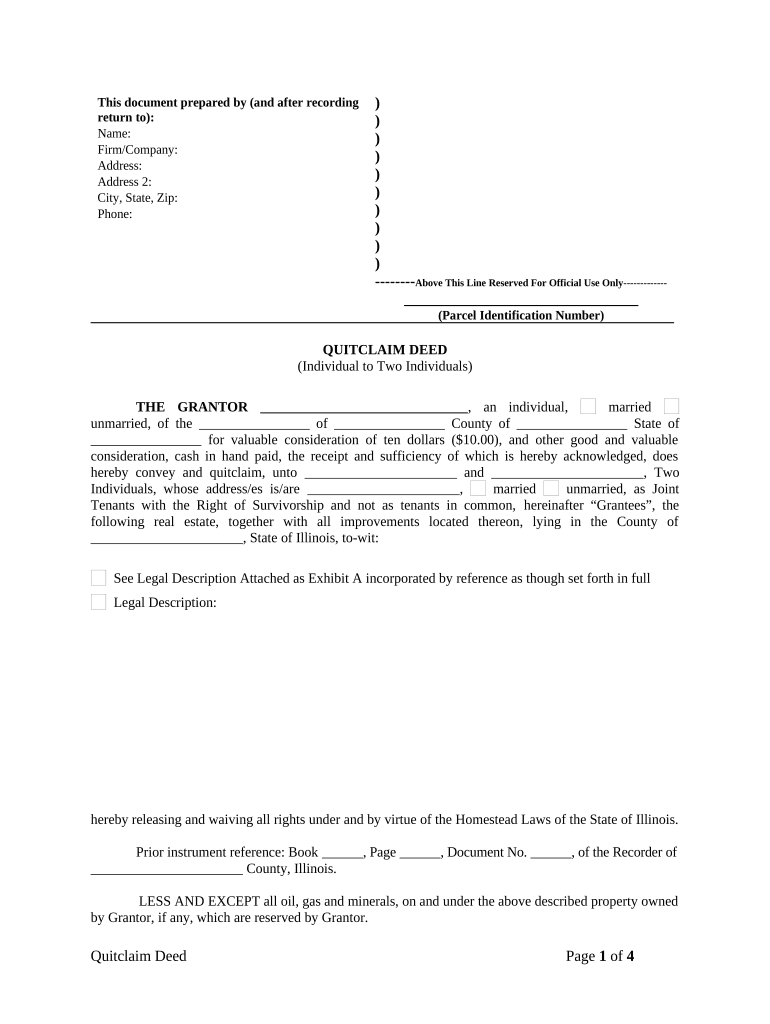

The Illinois Deed is a legal document used to transfer ownership of real property within the state of Illinois. This form serves as a record of the transaction and is essential for establishing the new owner's rights to the property. Various types of deeds exist, including warranty deeds, quitclaim deeds, and special warranty deeds, each serving different purposes and providing varying levels of protection for the grantee. Understanding the specific type of deed required for a transaction is crucial for ensuring compliance with state laws and the protection of property rights.

How to use the Illinois Deed

Using the Illinois Deed involves several steps to ensure that the transfer of property is executed legally and effectively. First, the grantor (the current owner) must accurately complete the deed form, including the names of the parties involved, a legal description of the property, and any necessary terms of the transfer. Next, the deed must be signed in the presence of a notary public to verify the identities of the signers. Once notarized, the deed should be filed with the appropriate county recorder's office to make the transfer official and public. This process protects the rights of the new owner and provides a public record of ownership.

Steps to complete the Illinois Deed

Completing the Illinois Deed requires attention to detail and adherence to specific legal requirements. Here are the key steps involved:

- Obtain the correct Illinois Deed form based on the type of transfer.

- Fill out the form with accurate information, including the grantor's and grantee's names and the property's legal description.

- Sign the deed in front of a notary public to ensure its validity.

- File the completed and notarized deed with the county recorder's office where the property is located.

- Pay any applicable recording fees to finalize the process.

Key elements of the Illinois Deed

The Illinois Deed must contain several key elements to be legally valid. These include:

- Grantor and Grantee Information: Full names and addresses of both parties involved in the transfer.

- Legal Description of the Property: A precise description that identifies the property being transferred.

- Consideration: The amount of money or value exchanged for the property, though this may not always be required.

- Signature of the Grantor: The grantor must sign the deed in the presence of a notary.

- Notary Acknowledgment: A notary public must verify the grantor's identity and witness the signing.

Legal use of the Illinois Deed

The legal use of the Illinois Deed is governed by state laws that outline how property transfers should occur. Proper execution of the deed ensures that the transfer is recognized by the state and protects the rights of the new owner. It is important to follow all legal requirements, including notarization and filing, to avoid potential disputes over property ownership. Additionally, understanding the implications of different types of deeds can help parties choose the most appropriate option for their specific situation.

State-specific rules for the Illinois Deed

Illinois has specific rules governing the execution and filing of deeds. These include requirements for notarization, the necessity of including a legal property description, and the obligation to file the deed with the county recorder's office. Additionally, Illinois law mandates that certain disclosures may be necessary, such as property tax information and any existing liens. Familiarity with these state-specific rules is essential for anyone involved in real estate transactions in Illinois to ensure compliance and protect their interests.

Quick guide on how to complete illinois deed 497306083

Effortlessly Prepare Illinois Deed on Any Device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and without delays. Manage Illinois Deed on any device using airSlate SignNow's Android or iOS apps and simplify any document-based procedure today.

The easiest way to modify and eSign Illinois Deed with ease

- Find Illinois Deed and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your adjustments.

- Choose your preferred delivery method for your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Illinois Deed to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois deed?

An Illinois deed is a legal document that conveys property ownership in the state of Illinois. It is crucial for real estate transactions, ensuring the legal transfer of property rights. Understanding the specifics of Illinois deeds can help you navigate property transfers smoothly.

-

How can airSlate SignNow assist with Illinois deeds?

airSlate SignNow simplifies the process of signing and managing Illinois deeds electronically. Our platform allows you to prepare, send, and secure your Illinois deed documents quickly and efficiently. With customizable templates, you can ensure compliance with state laws while saving time.

-

What are the costs associated with using airSlate SignNow for Illinois deeds?

airSlate SignNow offers competitive pricing that accommodates different business needs when handling Illinois deeds. With flexible subscription plans, you can choose a tier that best fits your volume of transactions and features. We provide a cost-effective solution to manage your eSignatures efficiently.

-

Can I integrate airSlate SignNow with other software for Illinois deeds?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing how you manage Illinois deeds. Whether it's CRMs or cloud storage services, our integrations streamline workflows and improve efficiency. You can connect your favorite tools without hassle.

-

What features does airSlate SignNow offer for managing Illinois deeds?

airSlate SignNow provides features tailored for managing Illinois deeds, including customizable templates, electronic signatures, and real-time tracking of document status. These features enhance collaboration and ensure that all signers can complete the process quickly. You can easily manage multiple Illinois deeds simultaneously.

-

Are online signatures valid for Illinois deeds?

Yes, electronic signatures through airSlate SignNow are legally valid for Illinois deeds, complying with state regulations. The platform provides a secure environment for signing, ensuring that your documents meet all legal requirements. This legitimacy allows for a smooth transaction process.

-

What benefits does airSlate SignNow provide for businesses dealing with Illinois deeds?

Using airSlate SignNow for Illinois deeds offers signNow benefits, such as increased efficiency, reduced paperwork, and faster turnaround times. Businesses can save time and resources, allowing them to focus on more critical tasks. The security features also ensure that your sensitive information is protected.

Get more for Illinois Deed

Find out other Illinois Deed

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed