Individual Credit Application South Dakota Form

What is the Individual Credit Application South Dakota

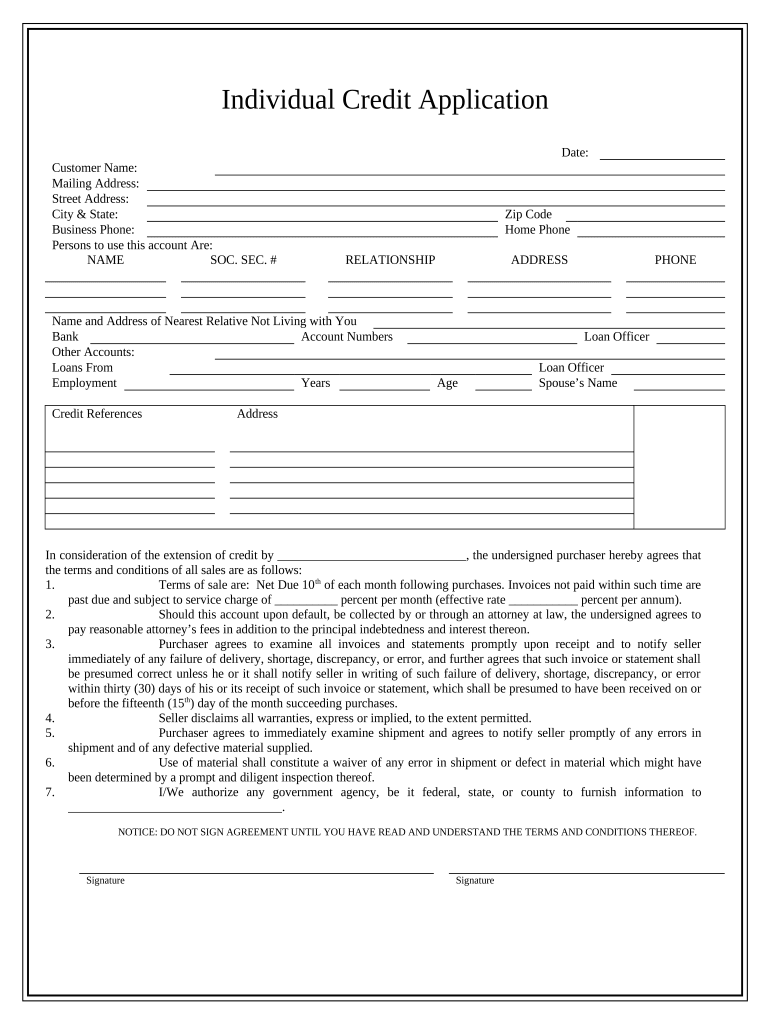

The Individual Credit Application South Dakota is a formal document used by individuals seeking credit from financial institutions. This application collects essential information about the applicant's financial status, including income, employment history, and credit history. By submitting this form, individuals allow lenders to assess their creditworthiness and make informed lending decisions. Understanding the purpose and components of this application is crucial for anyone looking to secure financing in South Dakota.

How to use the Individual Credit Application South Dakota

Using the Individual Credit Application South Dakota involves several straightforward steps. First, gather all necessary personal and financial information, such as Social Security number, employment details, and income sources. Next, fill out the application accurately, ensuring that all information is complete and truthful. After completing the form, review it for any errors before submitting it to the lender. This process can often be done online, making it convenient for applicants to submit their information securely.

Steps to complete the Individual Credit Application South Dakota

Completing the Individual Credit Application South Dakota requires careful attention to detail. Follow these steps for a smooth application process:

- Gather Information: Collect personal identification, income statements, and employment records.

- Fill Out the Form: Provide accurate details in each section, including your financial history and current obligations.

- Review Your Application: Double-check all entries for accuracy to avoid delays in processing.

- Submit the Application: Send the completed form to the lender, ensuring you follow their submission guidelines.

Legal use of the Individual Credit Application South Dakota

The Individual Credit Application South Dakota is legally binding once submitted. To ensure its legality, it must comply with state and federal regulations regarding credit applications. This includes adhering to the Fair Credit Reporting Act, which governs how lenders can use the information provided. Additionally, using a secure electronic signature solution can enhance the legal standing of the application, ensuring that all parties involved recognize the document's validity.

Key elements of the Individual Credit Application South Dakota

Several key elements are essential for the Individual Credit Application South Dakota. These include:

- Personal Information: Name, address, date of birth, and Social Security number.

- Employment Details: Current employer, job title, and duration of employment.

- Financial Information: Monthly income, existing debts, and assets.

- Credit History: Previous loans, credit cards, and payment history.

Eligibility Criteria

Eligibility for the Individual Credit Application South Dakota typically depends on several factors. Applicants must be at least eighteen years old and possess a valid Social Security number. Lenders may also consider the applicant's credit score, income level, and employment stability. Meeting these criteria is essential for a successful application and can influence the terms of the credit offered.

Quick guide on how to complete individual credit application south dakota

Complete Individual Credit Application South Dakota seamlessly on any device

Web-based document management has become increasingly popular with organizations and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to easily find the right form and securely save it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly and efficiently. Manage Individual Credit Application South Dakota on any device with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The simplest way to edit and eSign Individual Credit Application South Dakota effortlessly

- Find Individual Credit Application South Dakota and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Edit and eSign Individual Credit Application South Dakota and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Individual Credit Application in South Dakota?

An Individual Credit Application in South Dakota is a form that allows individuals to apply for credit by providing their personal and financial information. This application is essential for lenders to evaluate creditworthiness and facilitate the lending process. By using an eSigning solution like airSlate SignNow, users can complete and submit this application quickly and efficiently.

-

How does airSlate SignNow help with the Individual Credit Application in South Dakota?

airSlate SignNow streamlines the Individual Credit Application process in South Dakota by enabling users to electronically sign and manage their applications online. This not only saves time but also ensures that all documents are secure and easily accessible. The platform's user-friendly interface simplifies the entire application process, making it a go-to choice for applicants.

-

What are the pricing options for using airSlate SignNow for Individual Credit Applications in South Dakota?

airSlate SignNow offers various pricing plans to suit different needs for processing Individual Credit Applications in South Dakota. These plans are designed to be cost-effective, catering to both individuals and businesses. Users can choose from monthly or annual subscriptions, ensuring they only pay for what they need.

-

Are there any specific features in airSlate SignNow that benefit Individual Credit Applications in South Dakota?

Yes, airSlate SignNow includes features such as customizable templates, multi-party signing, and real-time tracking, which are particularly beneficial for Individual Credit Applications in South Dakota. These features enhance the efficiency of document management and ensure smooth interactions between applicants and lenders. Additionally, the platform keeps applications organized and compliant with relevant regulations.

-

What are the benefits of using airSlate SignNow for an Individual Credit Application in South Dakota?

Using airSlate SignNow for your Individual Credit Application in South Dakota offers several benefits, including faster processing times, reduced paperwork, and enhanced security. The electronic signing capabilities allow for quick approvals, which can help applicants receive credit decisions sooner. Furthermore, the platform's compliance features ensure that all submissions meet legal requirements.

-

Can airSlate SignNow integrate with other software for Individual Credit Applications in South Dakota?

Yes, airSlate SignNow supports integrations with various software applications, which can facilitate the processing of Individual Credit Applications in South Dakota. Whether it's customer relationship management (CRM) systems or financial software, these integrations help streamline workflows and improve data accuracy. Users can easily connect their existing tools to enhance their application processes.

-

What security measures does airSlate SignNow implement for Individual Credit Applications in South Dakota?

airSlate SignNow employs robust security measures to protect Individual Credit Applications in South Dakota, including data encryption and secure cloud storage. All signed documents are stored securely, ensuring that sensitive information remains confidential. This commitment to security gives users peace of mind when submitting their credit applications.

Get more for Individual Credit Application South Dakota

- Impact resource family evaluation questionnaire division of dfcs dhs georgia form

- Beneficiary claimant statement gotobennet form

- Next of kin form

- Register of wills of sussex county 1 file form 600 rw sussexcountyde

- Eglin access form

- Ga vaccine form

- Lack of probate affidavit washington state form

- How do you fill out a financial affidavit for iowa form

Find out other Individual Credit Application South Dakota

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online