South Dakota Installments Fixed Rate Promissory Note Secured by Commercial Real Estate South Dakota Form

What is the South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota

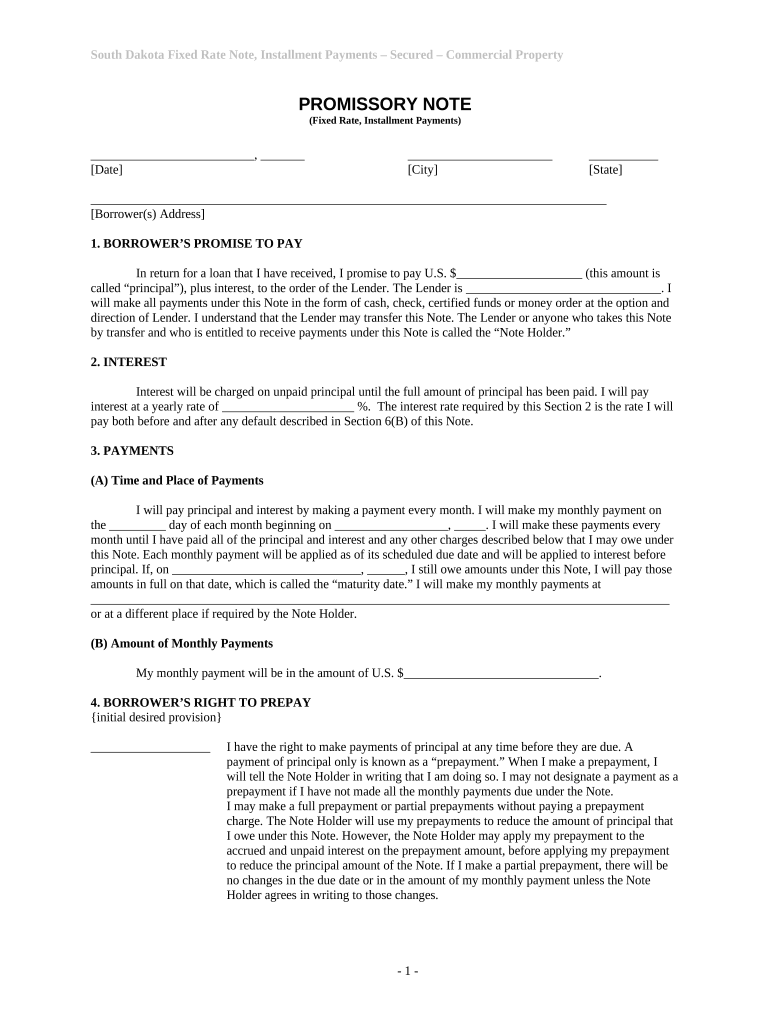

The South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate is a legal document that outlines a loan agreement where the borrower promises to repay the lender in fixed installments over a specified period. This note is secured by commercial real estate, meaning that the property serves as collateral for the loan. The fixed rate ensures that the interest remains constant throughout the term, providing predictability for both parties involved. This type of promissory note is commonly used in real estate transactions to facilitate financing for property purchases or improvements.

How to use the South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota

To use the South Dakota Installments Fixed Rate Promissory Note, both the borrower and lender should carefully review the terms outlined in the document. The borrower must provide accurate information regarding the loan amount, interest rate, repayment schedule, and property details. Once both parties agree on the terms, they can sign the document. It is advisable to keep a copy of the signed note for record-keeping purposes. Utilizing digital tools for signing can streamline the process, ensuring that the document is executed efficiently and securely.

Steps to complete the South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota

Completing the South Dakota Installments Fixed Rate Promissory Note involves several key steps:

- Gather necessary information, including the loan amount, interest rate, repayment terms, and details of the property being used as collateral.

- Fill out the promissory note form accurately, ensuring all information is correct and complete.

- Review the terms with the lender to confirm mutual understanding and agreement.

- Sign the document in the presence of a witness or notary, if required.

- Keep copies of the signed note for both the borrower and lender for future reference.

Legal use of the South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota

The legal use of the South Dakota Installments Fixed Rate Promissory Note is governed by state laws and regulations. For the note to be enforceable, it must meet specific legal requirements, including clear identification of the parties involved, a defined loan amount, and a specified repayment schedule. The document should also be signed by both parties, demonstrating their agreement to the terms. Compliance with eSignature laws ensures that the digital execution of the note holds legal weight, making it a valid instrument in financial transactions.

Key elements of the South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota

Several key elements are essential in the South Dakota Installments Fixed Rate Promissory Note:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the loan.

- Repayment Schedule: The timeline for repayment, including the frequency of payments (monthly, quarterly, etc.).

- Collateral Description: Details about the commercial real estate securing the loan.

- Signatures: Signatures of both the borrower and lender, indicating their agreement to the terms.

State-specific rules for the South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota

In South Dakota, specific rules govern the execution and enforcement of promissory notes. It is crucial for both parties to understand state laws regarding interest rates, foreclosure processes, and the rights of lenders in case of default. Additionally, the note must comply with the Uniform Commercial Code (UCC) as adopted in South Dakota, which outlines the legal framework for secured transactions. Familiarity with these regulations ensures that the promissory note is valid and enforceable in the state.

Quick guide on how to complete south dakota installments fixed rate promissory note secured by commercial real estate south dakota

Prepare South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and safely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without holdups. Manage South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest method to amend and eSign South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota effortlessly

- Locate South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which requires seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota ensuring outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota?

A South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota is a legal document that outlines a loan agreement where the borrower agrees to repay the lender in fixed installments over a specified period. This type of note is secured by real estate, providing additional assurance to the lender. It’s a useful tool for financing business operations or real estate investments.

-

How does a South Dakota Installments Fixed Rate Promissory Note work?

This type of note functions by detailing the amount borrowed, interest rate, and repayment schedule. The borrower makes periodic payments that consist of principal and interest until the total amount is repaid. The property serves as collateral, which can be claimed by the lender in case of default.

-

What are the benefits of using a South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota?

Utilizing a South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota offers several benefits, including predictable monthly payments due to the fixed interest rate and improved access to financing for business ventures. Additionally, securing the note with commercial real estate can result in lower interest rates due to reduced risk for lenders.

-

What is the pricing structure for creating a South Dakota Installments Fixed Rate Promissory Note?

The pricing for creating a South Dakota Installments Fixed Rate Promissory Note may vary depending on the provider and the complexity of the agreement. Typically, it involves a one-time fee for drafting the document, which can be more cost-effective when using platforms like airSlate SignNow. It's essential to consider both the initial costs and ongoing fees associated with the secured loan.

-

Are there specific requirements for a South Dakota Installments Fixed Rate Promissory Note?

Yes, there are certain requirements for a South Dakota Installments Fixed Rate Promissory Note to be legally binding. These include clear terms of the loan, identification of the parties involved, and a signature of all parties. It’s also advisable to have the note signNowd to ensure its enforceability in a court of law.

-

Can companies integrate airSlate SignNow with their existing systems for managing South Dakota Installments Fixed Rate Promissory Notes?

Yes, airSlate SignNow offers integration capabilities that allow companies to seamlessly incorporate its eSigning features with their current management systems. This provides a streamlined way to create, sign, and manage South Dakota Installments Fixed Rate Promissory Notes securely and efficiently. This integration can help improve workflow and reduce administrative burdens.

-

What makes airSlate SignNow a good choice for handling South Dakota Installments Fixed Rate Promissory Notes?

airSlate SignNow is a robust solution that empowers businesses to easily create and manage South Dakota Installments Fixed Rate Promissory Notes. Its user-friendly interface, cost-effectiveness, and secure eSigning capabilities make it an attractive choice for businesses looking to streamline their documentation processes. Additionally, it ensures compliance and provides a legally binding solution for all parties involved.

Get more for South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota

- Summons free divorce papers and divorce forms

- Free app ocp dc form

- Great adventure parent letterpermission form 20102011doc rosaweb chclc

- Bleadb bbased paintb operations and maintenance program form

- Uscis i 9 form 2016

- White marsh park amp ride parking pass form

- Issued by warrant ebt no1 no 2 wk1 wk2 tularehhsaorg form

- Childrens product certificate form

Find out other South Dakota Installments Fixed Rate Promissory Note Secured By Commercial Real Estate South Dakota

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed