Uscis I 9 Form 2016

What is the Uscis I 9 Form

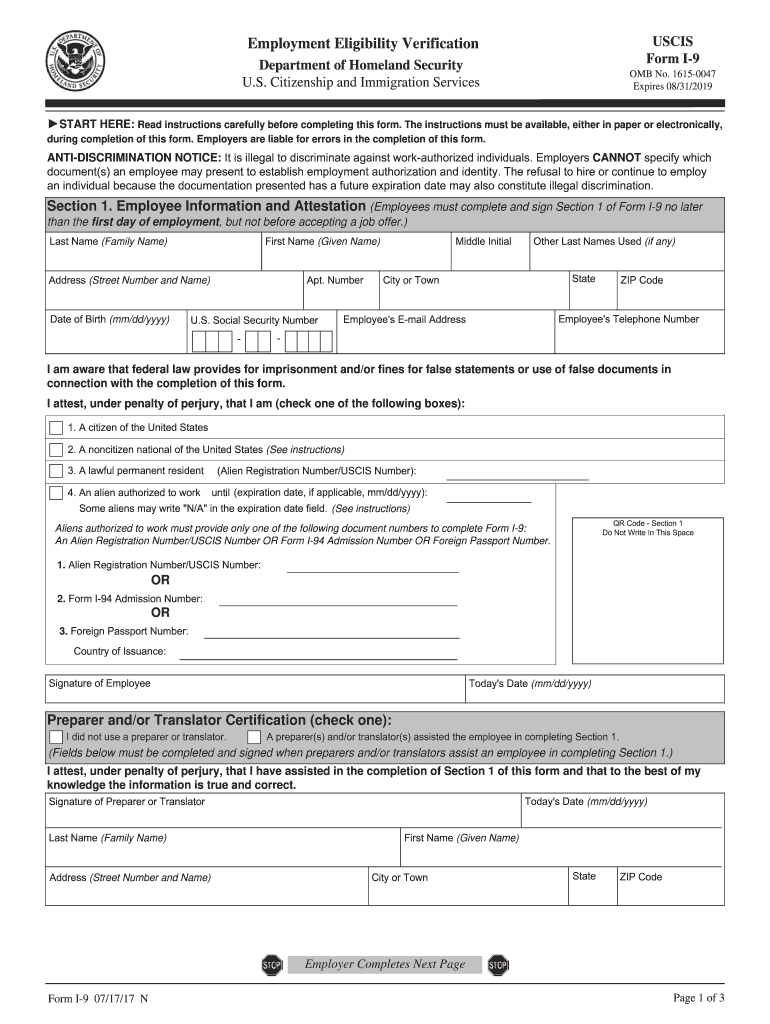

The Uscis I-9 Form, officially known as the Employment Eligibility Verification form, is a crucial document required by the United States government. It is used by employers to verify the identity and employment authorization of individuals hired for employment in the U.S. This form is essential for ensuring compliance with immigration laws and helps prevent unauthorized employment.

Steps to complete the Uscis I 9 Form

Completing the Uscis I-9 Form involves several key steps:

- Section One: The employee must fill out their personal information, including name, address, date of birth, and Social Security number. This section must be completed by the employee on or before their first day of work.

- Section Two: The employer is responsible for completing this section, which involves reviewing the employee's documentation to verify their identity and work eligibility. This must be done within three business days of the employee's start date.

- Section Three: This section is used for reverifying employment eligibility if the employee's work authorization has expired. It is completed by the employer when necessary.

How to obtain the Uscis I 9 Form

The Uscis I-9 Form can be easily obtained online through the U.S. Citizenship and Immigration Services (USCIS) website. It is available as a free downloadable PDF, ensuring that employers and employees can access the most current version. It is important to ensure that you are using the latest version of the form to remain compliant with legal requirements.

Legal use of the Uscis I 9 Form

The Uscis I-9 Form must be used in accordance with federal regulations. Employers are required to retain completed forms for a specific period, typically three years after the date of hire or one year after the employee's termination, whichever is later. Failure to comply with these regulations can result in penalties, including fines and legal consequences.

Required Documents

When completing the Uscis I-9 Form, employees must provide documentation that establishes their identity and employment authorization. This can include:

- U.S. passport or passport card

- Permanent resident card (Green Card)

- Driver's license along with a Social Security card

- Other government-issued identification documents

Employers must review these documents to ensure they are valid and not expired.

Form Submission Methods (Online / Mail / In-Person)

The Uscis I-9 Form does not require submission to the government; however, it must be retained by the employer. Employers can choose to keep the completed form in paper format or electronically. If stored electronically, it must comply with the guidelines set forth by USCIS regarding electronic storage and retrieval.

Quick guide on how to complete uscis i 9 form 2016

Uncover the most efficient approach to complete and authorize your Uscis I 9 Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior method to complete and authorize your Uscis I 9 Form and associated forms for public services. Our advanced eSignature service gives you all the tools to handle documentation swiftly and according to legal standards - powerful PDF editing, managing, safeguarding, signing, and sharing capabilities all available within a user-friendly interface.

There are just a few steps required to complete and authorize your Uscis I 9 Form:

- Upload the editable template to the editor using the Get Form button.

- Review what information needs to be included in your Uscis I 9 Form.

- Navigate between the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the fields with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Obscure sections that are no longer relevant.

- Click on Sign to create a legally binding eSignature using any method of your choice.

- Add the Date next to your signature and finalize your process with the Done button.

Store your completed Uscis I 9 Form in the Documents section of your profile, download it, or export it to your favored cloud storage. Our solution also allows for flexible form sharing. There’s no need to print your forms when you need to submit them to the appropriate public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct uscis i 9 form 2016

FAQs

-

Where can you get help filling out USCIS Form 1-90?

Firstly it probably helps to realize that the form is called I-90 (as in capital i).Then one could read the instructions for the form on the relevant USCIS webpage Application to Replace Permanent Resident Card and google a bit to find some sites & forums that offer additional help in filling out the form Google If it's a very unique/complicated case it might be necessary to employ the services of an immigration lawyer Google

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

What do I fill out as the "current USCIS status" on form i-485?

The I-485 form was updated in June 2017!Here is a guide on how to fill out the latest I-485.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

Create this form in 5 minutes!

How to create an eSignature for the uscis i 9 form 2016

How to generate an eSignature for the Uscis I 9 Form 2016 in the online mode

How to make an eSignature for your Uscis I 9 Form 2016 in Chrome

How to make an eSignature for signing the Uscis I 9 Form 2016 in Gmail

How to generate an electronic signature for the Uscis I 9 Form 2016 straight from your smart phone

How to make an electronic signature for the Uscis I 9 Form 2016 on iOS devices

How to create an electronic signature for the Uscis I 9 Form 2016 on Android devices

People also ask

-

What is the USCIS I 9 Form, and why is it important?

The USCIS I 9 Form is a crucial document used by employers to verify the identity and employment authorization of individuals hired for employment in the United States. Completing the USCIS I 9 Form correctly is essential for compliance with federal regulations, helping employers avoid penalties. Utilizing tools like airSlate SignNow can streamline this process and ensure that the form is filled out accurately.

-

How can airSlate SignNow help with the USCIS I 9 Form process?

airSlate SignNow simplifies the USCIS I 9 Form process by providing an intuitive platform for electronic signatures and document management. With our solution, employers can easily send, sign, and store the USCIS I 9 Form securely, ensuring that all records are organized and accessible. This efficiency saves time and reduces the risk of errors in form completion.

-

Is airSlate SignNow compliant with USCIS I 9 Form requirements?

Yes, airSlate SignNow is designed to comply with USCIS I 9 Form requirements, ensuring that your eSignatures and document handling meet legal standards. Our platform maintains compliance with federal regulations, providing peace of mind for employers. By using airSlate SignNow, you can confidently manage your USCIS I 9 Form submissions while adhering to necessary guidelines.

-

What features does airSlate SignNow offer for managing the USCIS I 9 Form?

airSlate SignNow offers several robust features for managing the USCIS I 9 Form, including customizable templates, secure eSigning, and automated reminders. These features enhance the efficiency of the hiring process, allowing employers to track status and ensure timely completion of the USCIS I 9 Form. Additionally, our platform supports multiple integrations for a seamless workflow.

-

What is the pricing structure for using airSlate SignNow for the USCIS I 9 Form?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a small startup or a large enterprise, you can choose a plan that fits your budget while providing access to essential features for managing the USCIS I 9 Form. We also offer a free trial, allowing you to experience the benefits of our platform before committing.

-

Can I integrate airSlate SignNow with other HR software for the USCIS I 9 Form?

Absolutely! airSlate SignNow seamlessly integrates with various HR software and tools, making it easier to manage the USCIS I 9 Form alongside your existing systems. This integration ensures a smooth flow of information and helps maintain accurate records, enhancing your overall HR processes. You can connect with popular platforms to streamline your workflow.

-

How does airSlate SignNow ensure the security of the USCIS I 9 Form?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the USCIS I 9 Form. Our platform employs advanced encryption, secure data storage, and strict access controls to protect your information. You can trust that your USCIS I 9 Form and other documents are safe while using our solution.

Get more for Uscis I 9 Form

Find out other Uscis I 9 Form

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed